How to Link Aadhaar with Bank of Maharashtra?

Last Updated : Sept. 4, 2024, 11:08 a.m.

Just as your name is essential for your identity, your Aadhaar is crucial for your bank account. Seeding your Aadhaar brings several benefits, such as receiving government subsidiaries directly into your bank account. Also, to ensure ongoing activity in your account, the Bank of Maharashtra has made it easy for customers to update their Aadhaar details.

This requirement follows a government directive dated June 1, 2017. It mandates Seeding your Aadhaar number with your bank account. This is in accordance with amendments under the Prevention of Money-laundering (Maintenance of Records) Rules, 2005. Let's look at the benefits and the methods available to link Aadhaar with the Bank of Maharashtra account.

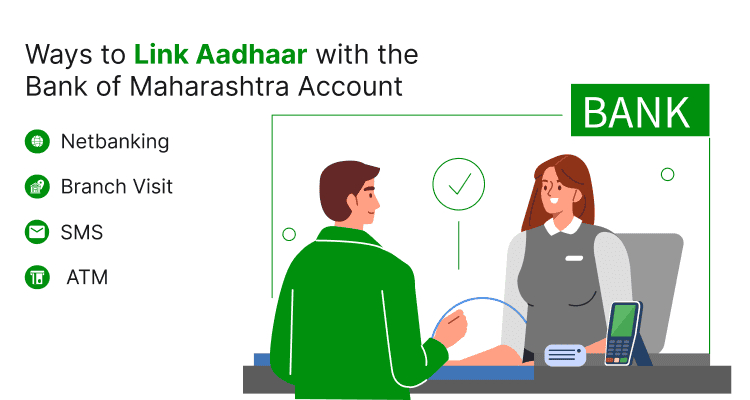

Ways to Link Aadhaar with the Bank of Maharashtra Account

If you have a Bank of Maharashtra account and are unsure how to link it with your 12-digit Aadhaar number, there's no need to worry. You can update your Aadhaar credentials by following one of the methods below:

- Internet Banking

- Branch Visit

- SMS

- ATM

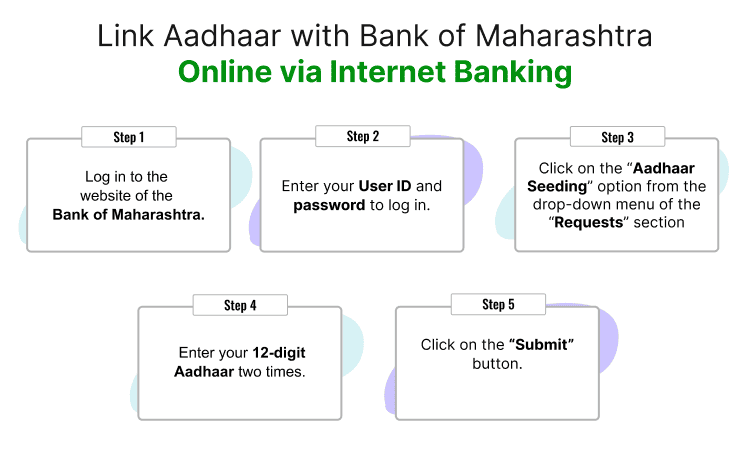

Link Aadhaar with Bank of Maharashtra Online Via Internet Banking

Bank of Maharashtra offers a way to link Aadhaar with Bank of Maharashtra accounts using net banking. To link your account with Aadhaar online, account holders just need to follow these simple steps:

- Log in to the website of the Bank of Maharashtra.

- Enter your User ID and password to log in.

- Click on the “Aadhaar Seeding” option from the drop-down menu of the “Requests” section.

- Enter your 12-digit Aadhaar two times.

- Click on the “Submit” button.

Once you submit the details, it will take 48 hours to verify and update your bank account with Aadhaar.

Link Aadhaar Card with Bank of Maharashtra Via Branch Visit

Bank of Maharashtra allows people to link their bank accounts with Aadhaar by visiting the bank as well. Here are the steps you can follow:

- Walk into your nearest Bank of Maharashtra branch where you have your account.

- Carry the “Aadhaar Seeding Consent form” downloaded from the website or ask your bank representative once you reach the bank.

- Complete your filled-in details in the form. Keep your Aadhaar Card (in hard copy) and bank account statement (passbook) ready to be asked for verification purposes.

- After verification, you will be provided with a receipt.

- Your bank account will be mapped to Aadhaar within three working days.

- Later on, get the confirmation message on your registered mobile number.

Link Aadhaar with the Bank of Maharashtra Via SMS

Sending an SMS is a quick way to link your Aadhaar. Simply type the following syntax:

SEED

Send to 9223181818 from your registered mobile number.

For example,

if your Aadhaar number is 895637224734 and the bank account number is

124343485986056

Type the message as :

SEED 895637224734 124343485986056 and send to 9223181818

It's important to note that only account holders with mobile numbers registered with the bank can use this facility.

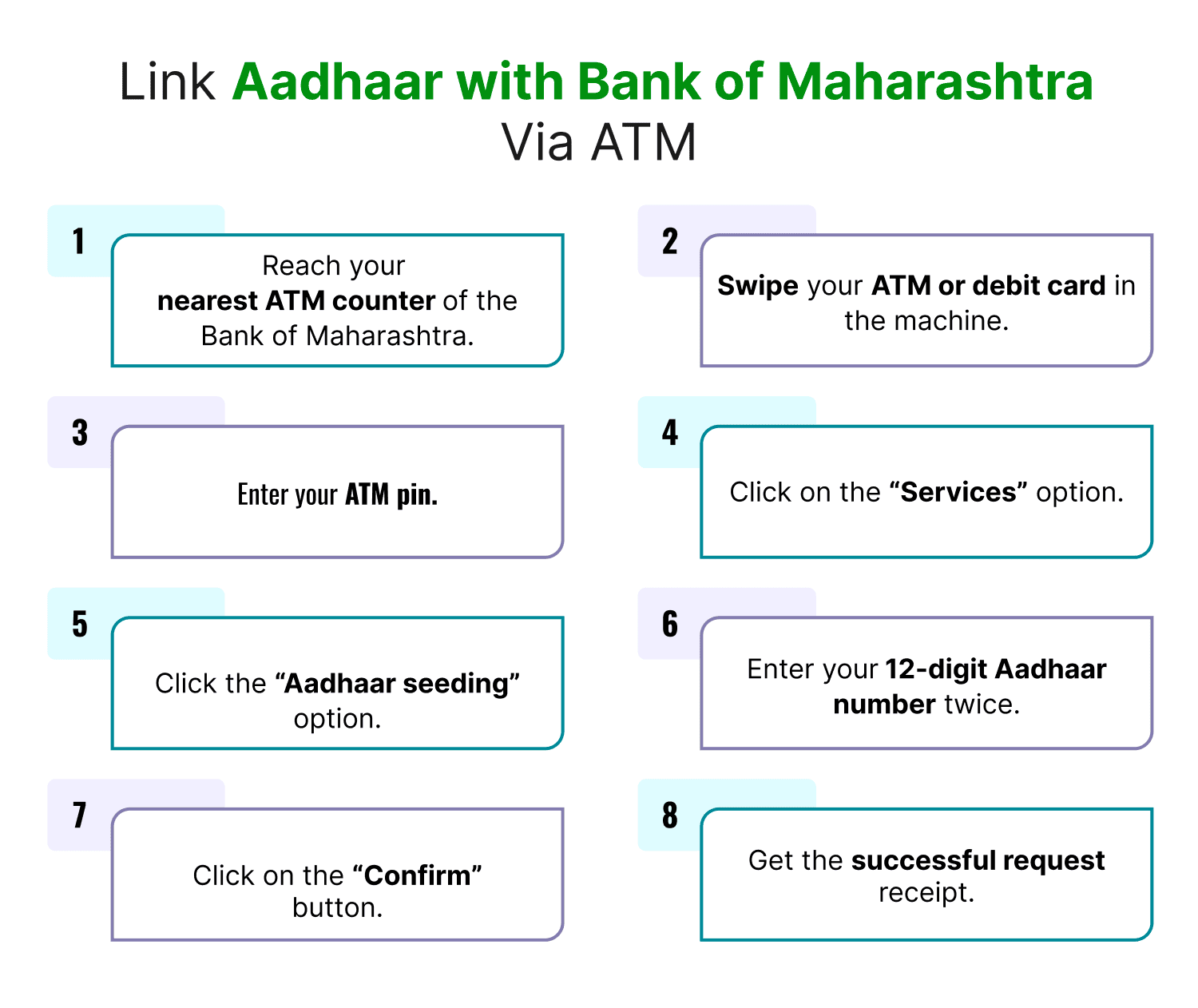

Link Aadhaar with Bank of Maharashtra Via ATM

Bank of Maharashtra also allows customers to link their bank accounts with Aadhaar at ATMs. Here’s how you can update your account with Aadhaar by visiting a Bank of Maharashtra ATM:

- Reach your nearest ATM counter of the Bank of Maharashtra.

- Swipe your ATM or debit card in the machine.

- Enter your ATM pin.

- Click on the “Services” option.

- Click the “Aadhaar seeding” option.

- Enter your 12-digit Aadhaar number twice.

- Click on the “Confirm” button.

- Get the successful request receipt.

Within a couple of days, a confirmation message will be delivered to your registered mobile number after successfully linking with your bank account.

How to Check the Aadhaar Card Link Status with the Bank of Maharashtra?

To check the Aadhaar card link status with the Bank of Maharashtra, you can use the following steps:

- Check-in to the website of UIDAI(Unique Identification Authority of India).

- From the drop-down list under '’Aadhaar Services,'’ select '’Check Aadhaar & Bank Account Linking Status.'’

- Enter your 12-digit Aadhaar number.

- Enter the security code(or Captcha code)in the relative field as mentioned on the screen.

- Click the “Send OTP” button.

- Get direct delivery of your One-time password(OTP)on your registered mobile number.

- Enter the OTP details in the related box.

- Click “Login”

Once your details are successfully processed, a status message will appear that says, “Congratulations! Your Bank Aadhaar Linking has been updated successfully”. It will also display your bank name along with the last updated date.

OR

How to Know Your Aadhaar Link Status With Bank of Maharashtra Via Mobile?

Here are the steps you can use to link Aadhaar with the Bank of Maharashtra account using the SMS facility on your mobile:

- Dial *99*99*1# from your mobile number(which is registered with Maharashtra Bank).

- Enter your Aadhaar number in the box.

- Confirm your details.

When choosing either of the above two options, the Bank of Maharashtra will only appear on the UIDAI screen if it was recently linked to your Aadhaar. UIDAI displays only the last bank account linked with Aadhaar, not a list of all accounts linked. Remember, your mobile number must already be registered with the Aadhaar database to use this service.

Benefits of Aadhaar link with Bank of Maharashtra

Linking your Aadhaar with your Bank of Maharashtra account offers several benefits that can enhance your banking experience and ensure compliance with regulatory requirements. Here are some key advantages:

- Get LPG subsidy directly into your account.

- Obtain items like kerosene and sugar at subsidized rates directly through your account.

- Avail government benefits like pensions, welfare funds, scholarships, MNREGA, etc.

- Receive tax refunds directly into your linked bank account.

- Reduce paperwork and time in completing Know Your Customer (KYC) requirements.

How to Link Aadhaar with Bank of Maharashtra Credit Card?

If you are having a Bank of Maharashtra Credit Card and are still confused how to link the same with your 12-digit Aadhaar number, nothing to worry. There are many ways with the help of which you can update your aadhaar credentials with your BOM Credit Card. The bank allows you to link your aadhaar via SMS Banking Service, Customer Care and Branch Visit. You can easily link your aadhaar by using any medium. However, those who are already having an account in BOM, simply need to link their respective bank account with Aadhaar only as doing so will automatically link their aadhaar with credit card.

Frequently Asked Questions (FAQs)

Is it mandatory to link my Aadhaar card with my Bank of Maharashtra account?

How does linking Aadhaar with my Bank of Maharashtra account help if I receive government subsidies?

How often should I update my Aadhaar details linked to my Bank of Maharashtra account?

Can I link my Aadhaar with multiple accounts?

How can I check if my Aadhaar is linked to my Bank of Maharashtra account?

Aadhaar

- Check Aadhaar Update History

- Aadhaar Card Services

- Aadhaar Services on SMS

- Documents Required for Aadhaar Card

- Aadhaar Card Status

- E-Aadhaar Card Digital Signature

- Aadhaar Card Authentication

- Aadhaar Card Online Verification

- Lost Aadhaar Card

- Aadhaar Card Not Received Yet

- Aadhaar Virtual ID

- Retrieve Forgotten & Lost Aadhaar Card UID/EID

- Aadhaar Card Address Validation Letter

- Get Aadhaar Card for Non-Resident Indians

- Get Aadhaar e-KYC Verification

- Aadhaar Card Seva Kendra

- Aadhaar Card Features

- Aadhaar Card Online Corrections

- Change Photo in Aadhaar Card

Link Aadhaar Card

- Link Aadhaar Card to Bank Account

- Link Aadhaar Card to IRCTC Account

- Link Aadhaar Card to Income Tax Return

- Link Aadhaar Card with EPF

- Link Aadhaar Card with Driving Licence

- LInk Aadhaar to Caste Certificate

- Link Aadhaar with BPCL

- Link Aadhaar Card with LPG Gas

- Link Aadhaar Card with Ration Card

- Link Aadhaar Card with HP Gas

- Link Aadhaar Card with NPS Account

- Link Aadhaar Card with Mutual Funds

- Link Aadhaar Card with Demat Account

- Link Aadhaar Card with HDFC Life Insurance

- Link Aadhaar Card with SBI Life Insurance

Link Aadhaar to Mobile Number

Aadhaar Enrollment Centers

- Aadhaar Card Enrollment Centres

- Aadhaar Card Enrolment Centers in Delhi

- Aadhaar Card Enrolment Centers in Bangalore

- Aadhaar Card Enrolment Centers in Mumbai

- Aadhaar Card Enrolment Centers in Ahmedabad

- Aadhaar Card Enrolment Centers in Hyderabad

- Aadhaar Card Enrolment Centers in Ranchi

- Aadhaar Card Enrolment Centers in Indore

- Aadhaar Card Enrolment Centers in Kanpur

- Aadhaar Card Enrolment Centers in Patna

- Aadhaar Card Enrolment Centers in Surat

- Aadhaar Card Enrolment Centers in Lucknow

- Aadhaar Card Enrolment Centers in Bhopal

- Aadhaar Card Enrolment Centers in Jaipur

- Aadhaar Card Enrolment Centers in Ghaziabad

- Aadhaar Card Enrolment Centers in Faridabad

- Aadhaar Card Enrolment Centers in Noida

- Aadhaar Card Enrolment Centers in Gurgaon

- Aadhaar Card Enrolment Centers in Kolkata

- Aadhaar Card Enrolment Centers in Pune

- Aadhaar Card Enrolment Centers in Chennai

- Aadhaar Card Enrolment Centers in Chandigarh