Best Air Miles Credit Cards in India

Last Updated : Sept. 26, 2024, 4:38 p.m.

If you are a frequent flier, then airline miles or Air miles can help you cut costs. Air miles are the currency in which the airlines reward you. You can redeem these air miles for flights, hotel stays, tickets, etc. Credit cards help you to earn plenty of air miles. Usually credit cards which have tie ups with airlines will provide air miles for that airline. But, there are also some cards that will offer air miles or rewards in general, and these can be redeemed across multiple airline programs. For instance, using the Axis Bank Atlas Credit Card, cardholders can accumulate EDGE Miles with every spend and later redeem them across 20 plus travel partners. Let us now read about some of the top Air Miles credit cards in India for 2025.

Top Air Miles Credit Cards in India 2025

Here’s a list of top air mile credit cards in India.

Credit Card | Air Miles Rate | Accelerated Air Miles |

|---|---|---|

2 EDGE Miles per Rs 100 spent on all purchases | 5 EDGE Miles per Rs. 100 spent on airline, travel, and hotels up to a monthly cap of Rs. 2,00,000. | |

Axis Bank Miles and More World Credit Card | Rs. 3500 | Rs. 3500 |

Axis Bank Miles and More Select Credit Card | Rs. 10,000 | Rs. 4500 |

8 InterMiles per Rs. 150 on retail spends. Only retail purchases above 150 Rs. are eligible for intermiles | Get 16 InterMiles on each spends of Rs. 150 on every flight ticket booked on intermiles.com | |

4 reward points per Rs. 100 | Earn 30 reward points per Rs. 100 spent on Air India tickets | |

2 Etihad Guest Miles per Rs. 100 spent | 6 Etihad Guest Miles per Rs. 100 spent on Etihad.com | |

Standard Chartered Emirates World Credit Card | Get 3 Skyward Miles per Rs. 150 spent | Get 6 Skyward Miles per Rs. 150 spent on Emirates |

Air Miles Credit Cards in India 2025 - Key highlights

Axis Bank Atlas Credit Card

This airline travel credit card has numerous benefits on travel like lounge access, dining rewards, etc. On the whole, it has been designed to make travel comfortable and exciting.

Key Features

- Enjoy 2,500 bonus EDGE Miles as a welcome benefit on making the first transaction within 37 days of card issuance.

- Earn 5 EDGE miles per Rs.100 spent on travel.

- You get upgraded to gold tiered membership on reaching milestone spends of Rs. 7.5 lakhs and to the platinum tier on reaching spends over 15 lakhs.

- Unlock 10,000 EDGE miles on spending more than Rs.15 lakh in a year.

- Enjoy 25% off up to a maximum of Rs. 800 in partner dining restaurants via EazyDiner.

Terms and conditions: The dining benefit is valid only on ordering for a minimum of Rs. 2000, twice per month per card

Axis Bank Miles and More Credit Cards (Axis Bank Miles and More World Credit Card and Axis Bank Miles and More Select Credit Card)

Key features

- Get a welcome benefit of 15,000 award miles

- Earn 6 award miles for every Rs. 200 spent

- There is no expiry for the miles

- Get up to 8 complimentary visits to select airport lounges every quarter.

- Get preferred rates on Axis Bank loans

- Get up to 4 free priority pass lounge visits per annum

- Get a minimum of 15% off at select restaurants

- Use the concierge service facility to make flight bookings, table reservations, gift deliveries, and more.

JetPrivilege HDFC Bank Diners Club Credit Card

This credit card comes with great benefits for lifestyle. You can get abundant intermiles, interest free credit facility for up to 50 days, fuel surcharge waiver, and other attractive perks for travel.

Key features:

- Get welcome benefits of up to 25,000 intermiles - 10,000 InterMiles on spending Rs. 20,000 within the first 30 days of issuing the card and 15,000 InterMiles on total retail spends of Rs. 1.5 lakhs and more within the first 90 days.

- Accrue 8 InterMiles per Rs. 150 spent across all categories and 16 InterMiles per Rs. 150 spent on flight and hotel bookings.

- Earn discounts of 10% and 5% on Etihad Airways Business Class tickets and Economy class tickets respectively.

- Get 2.5X bonus InterMiles on Etihad Airways tickets.

- Get 10,000 Intermiles on spends of Rs. 20,000 within the first 30 days of card issuance.

- Avail discount vouchers worth Rs. 1000 and Rs. 2000 on flights and hotels respectively.

- Get unrestricted access to 1,000+ domestic and international airport lounges .

- Get a waiver of renewal fee on reaching milestone spends of Rs. 8 lakhs in a year.

SBI Air India Signature Credit Card

This card helps you travel in great style and luxury with its stand out feature of complimentary access to more than 600 luxury airport lounges through the priority pass program. Other benefits include plenty of airmiles, fuel benefits, annual bonus, etc. Enjoy the enhanced features of the card by becoming a proud cardholder of the same.

- Enjoy receiving 20,000 reward points as a welcome gift on paying the joining fee.

- Get 4 reward points for each Rs. 100 spent

- Get up to 100,000 bonus reward points annually.

- Earn up to 30 reward points per Rs. 100 spent on Air India tickets booked through Air India.com and the Air India mobile app.

- Enjoy up to 30 reward points when booked for self and 10 reward points when booked for others.

- Get a coverage of Rs. 1 lakh for lost card liability.

- You can use the balance transfer facility on EMI for saving money while paying your dues.

- Reward points can be converted into Air India Miles @ of 1 reward point = 1 Air India Mile

- Enjoy access to more than 600 international airport lounges with complimentary priority pass program

- 8 complimentary visits annually to domestic VISA lounges in India (With a maximum of 2 visits per quarter).

- Get an anniversary bonus of 5,000 reward points every year.

- Avail a fuel surcharge waiver of 1% across all petrol pumps for transactions between Rs. 500 and Rs. 4,000, up to Rs. 250 in a month.

Etihad Guest SBI Premier Credit Card

The card welcomes you with ample air miles and also allows you to earn it in plenty on your spends. Get access to a world of air miles with this card curated for frequent travellers.

- Get a welcome gift of 5,000 Etihad Guest Miles within 30 days of paying the annual fee.

- Secure complimentary Etihad Guest Gold Tier Status after the first transaction.

- Earn 6 Etihad Guest miles per Rs. 100 spent on Etihad.com

- Get a discount of up to 10% on select business class and economy class flights on direct Etihad Airways booking.

- Get 1,500 Etihad Guest Miles on reaching milestone spends of Rs. 1.5 lakhs in a calendar quarter.

- Get 1 companion voucher on reaching annual milestone spends of Rs. 8 lakhs

- Get complimentary membership to international priority pass program

- Complimentary membership to the International Priority Pass program worth $99.

- Get access to more than 1000 airport lounges globally.

- Get 4 complimentary airport lounge visits per year, outside India (With a maximum of 2 visits per quarter).

- Get access to more than 1000 airport lounges worldwide

- Get a fuel surcharge waiver of 1% at petrol pumps across the country.

Standard Chartered Emirates World Credit Card

This is one of the best travel cards for the frequent traveler. Get access to skyward miles, cashback, complimentary lounge access, and so on with this card. Apply for this card and indulge in enhanced travel features.

- Get 6 skyward miles per Rs. 150 spent on Emirates transactions. On each Rs. 150 spent on other transactions, card holders will earn 3 skyward miles.

- Get a cashback of 5% on reaching threshold spends of Rs. 1000 per month on duty free shopping.

- Under the Mastercard lounge program, enjoy complimentary access to 25 domestic lounges.

- Using priority pass, enjoy 2 complimentary accesses to domestic and international airport lounges every month.

- Spend over Rs. 10,000 in a month and avail 2 free complimentary visits to priority pass lounges in the subsequent month.

- Get complimentary golf access three times a year at 14 premium courses in India and unlimited games at 50% discount on green fees.

- Get an overseas accident cover of Rs. 1 crore inclusive of the insurance on the loss of baggage and flight delay.

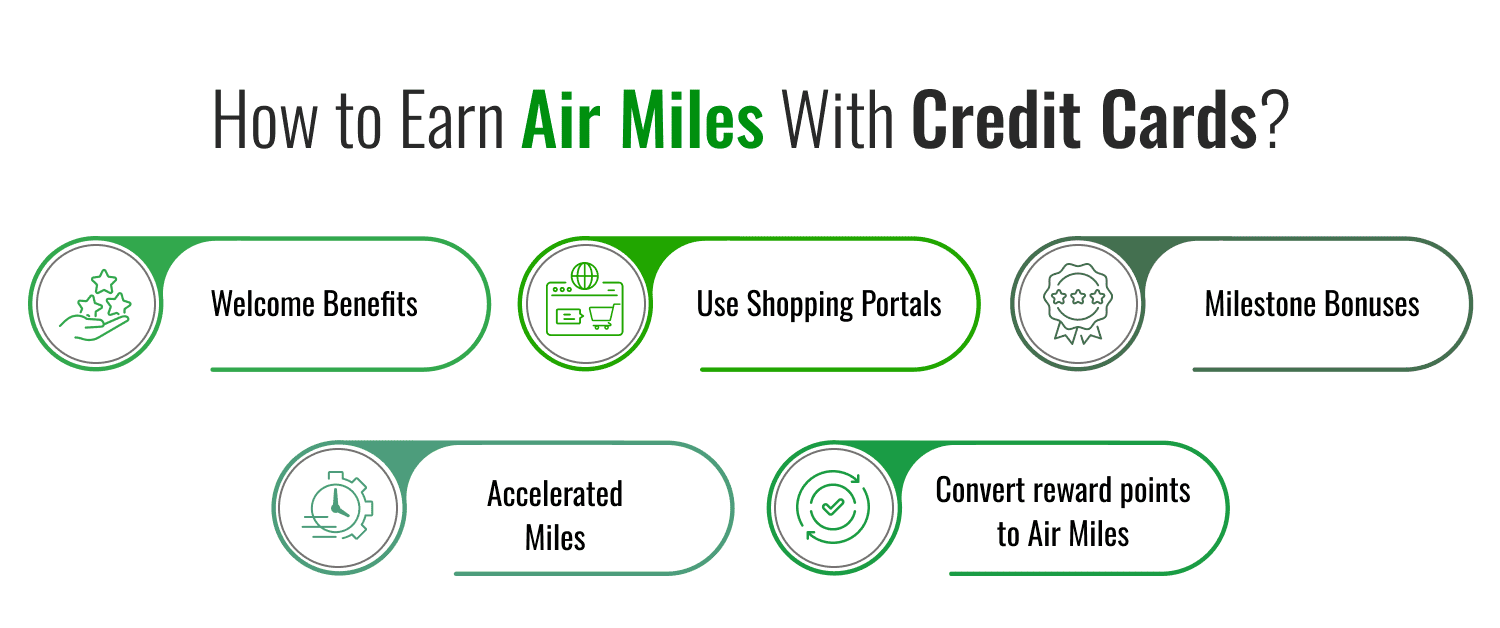

How to Earn Air Miles With Credit Cards?

Welcome Benefits

Many card issuers such as banks and co-branded partners offer huge reward points for card holders who receive their credit card and spend more than or equal to a certain threshold value within a few days or months. So, this is one of the best and quickest ways to accumulate air miles. Huge joining benefits exceeding the first year annual fee are generally given to individuals who apply for premium cards with an annual fee. For example: Get 15,000 air miles as welcome gift on the Axis Bank Miles and More Credit Card.

Use Shopping Portals

Many airlines have shopping portals on their frequent flyer websites. Navigate to the first page of these portals and click on a merchant to earn points. However, be careful when you accumulate points on your purchases since card balance increases on buying and this could cause you to pay more interest. As a result, the value of reward points will be nullified.

Milestone Bonuses

Credit card issuers give rewards to cardholders on reaching and crossing milestone spends. This is a great way to earn air miles. For example, the Etihad Guest Premier card offers 1,500 Etihad Guest Miles on reaching milestone spends of Rs. 1.5 lakhs in a calendar quarter.

Accelerated Miles

Accelerated miles are those bonus air miles which you earn for booking flight tickets directly on affiliated platforms. You can also earn these miles by booking tickets through the partner airline’s portal. For instance, HDFC Infinia credit card holders can earn 10,000 points on booking travel worth Rs. 30,000 on an affiliated platform SmartBuy. Flights booked through the Air India website using SBI credit cards will earn you those extra miles.

Convert reward points to Air Miles

In some cases, issuers enable you to convert the accumulated reward points earned into air miles. For example: The Air India SBI Signature Credit Card offers 1 lakh reward points as an annual milestone benefit. These can then be converted into Air India miles at the ratio of 1:1. Cards that are curated to offer rewards would be more flexible with the earning and redemption rate. You can use these cards across multiple categories to earn bonus points. For instance, the HDFC Diners Club Miles Credit Card offers 4 reward points for every Rs. 100. These rewards can be converted into air miles of British Airways, Jet Airways, Vistara, and Singapore Airlines in the ratio of 1:1.

What are the Types of Air Miles that can be Availed?

There are two distinct types of Air miles that can be availed:

Co-branded Air Miles

Co branded air miles are rewards given by those credit card issuers which have partnered with specific airlines. By using such credit cards, you will automatically become a participant in the respective airline’s frequent flyer program free of cost. If not, then you can enroll for the airline’s frequent flyer program voluntarily. Co-branded credit card users can directly redeem the rewards on the lender’s website, so redeeming or converting the credit card reward points and air miles is much easier.

General Air miles

These air miles are provided by card issuers which have not tied up with any specific airlines. So, individual card users can choose whichever airline they want to for redeeming the air miles.

Things to Consider When You Apply for an Air Miles Credit Card?

- If you are a frequent traveler who is loyal to a specific airline, then you should apply for a co-branded air mile credit card. Otherwise, using a general air miles credit card that allows you to redeem rewards across multiple airlines is better.

- You must be aware of your spending capability. Many cards reward you on spending within a specific time frame. Also, you must be confident of meeting a minimum spend requirement and regularly use your credit card for purchases on which the credit card rewards you.

- You can benefit maximum from your air miles credit card when you are able to get rewards on milestone spends, from welcome perks that require you to spend within a particular duration.

- When you are looking for an air miles credit card, also look at other benefits offered by the card such as hotel benefits, low foreign currency mark up fee, airport lounge access, priority pass program, travel insurance coverage, baggage allowance, etc.

- Check if the interest rate is low enough to enable you to save money if you carry a balance.

- You have to evaluate if the annual fee is justified by the benefits it offers.

How to Redeem Air Miles?

Co-branded and common air miles are redeemed in different ways.

Co-branded Air Miles

When you use a co-branded credit card, you automatically become a member of the airline’s frequent flyer program. So, you can redeem the air miles directly while booking your tickets on that airline’s website or mobile app. You can do them instantly. But, if the card does not offer a free membership, you will have to register for the membership. Once you receive it, you will have to link it with your credit card for air miles redemption.

Common Air Miles

If you are using a credit card that offers air miles that can be redeemed across multiple airlines, you will have to transfer the accrued reward points or air miles to the airline of your choice from the list of select airlines the card issuer has partnered with. To do this, you will have to login to the online portal of the card issuer and navigate to the section which contains the option to transfer points. This is usually contained in the rewards redemption or rewards section of the website. You can follow the same method for air miles conversion.

Conclusion

Air miles help a lot in saving money for frequent travelers. They help you get free air tickets or bring the cost to the barest minimum. However, before choosing a credit card that offers air miles, compare and opt for the one most suited for your position. You can compare and apply for credit cards here at Wishfin.

Frequently Asked Questions (FAQs)