Best Credit Cards for NRIs

Last Updated : Oct. 18, 2024, 11:47 a.m.

Many non-resident Indians prioritize maintaining financial ties with India. They can do so via several ways. NRI credit cards are one of the best financial tools through which people can achieve this. These credit cards are curated to fulfill the specific demands of non-resident Indians. They offer benefits such as nil foreign transaction fees and other exclusive features. They operate like regular credit cards and are more helpful in booking travels, dining, online shopping, and more. Even though NRIs reside overseas, they may still have properties, investments, or family expenses in India. Credit cards for NRIs help in simplifying the complexities associated with these dealings and ensure that the transactions are seamless.

Top NRI Credit Cards in India for 2025

If you are an NRI and you are looking for a credit card then you are at the right place. We have a list of all credit cards that can be useful for an NRI. You must explore all these cards and then choose the card as per the usage.

Credit Card | Best Feature | Joining fee/annual fee or renewal fee |

|---|---|---|

Receive Complimentary Swiggy One and MMT Black Gold membership as welcome benefit. | Rs. 2500 plus applicable taxes | |

Get complimentary annual memberships - MakeMyTrip, Double Black, Club Marriott, Zomato Gold, Amazon Prime, Forbes & Times Prime | Rs. 10,000 plus applicable taxes | |

Customers can get 2 reward points per Rs. 200 spent overseas. The reward point is earned on transactions made in India. | Nil/Rs. 1000 | |

ICICI Bank NRI Sapphiro Credit Card | Get up to 20,000 ICICI Bank reward points on this card every anniversary year. | Rs. 6500/3500 |

ICICI Bank NRI Coral Credit Card | Every anniversary year, earn up to 10,000 Points from ICICI Bank Rewards. | 500 plus GST |

HDFC Bank Regalia First Card | You accrue 3 reward points on Rs. 150, on all retail spends. | Rs. 1000 plus applicable taxes |

Get a gift voucher worth Rs. 500 on spending Rs. 50,000 every quarter. Earn Earn up to Rs. 2,000 worth gift vouchers in a year | Rs. 500 plus applicable taxes | |

HDFC Bank Diners ClubMiles Card | Earn 4 reward points per Rs. 150 spent. | Rs. 1000 plus applicable taxes |

Earn 1 reward point on every 200 Rs. spent with the Neo credit card | Rs. 250 | |

Enjoy complimentary Club Vistara Silver membership and Trident Privilege membership | Rs. 4,999 plus taxes | |

Get 10,000 InterMiles on spends of Rs. 20,000 within the first 30 days of the anniversary date. | Rs. 5000 plus applicable taxes | |

Get a complimentary annual times prime membership | Rs. 1000 plus applicable taxes |

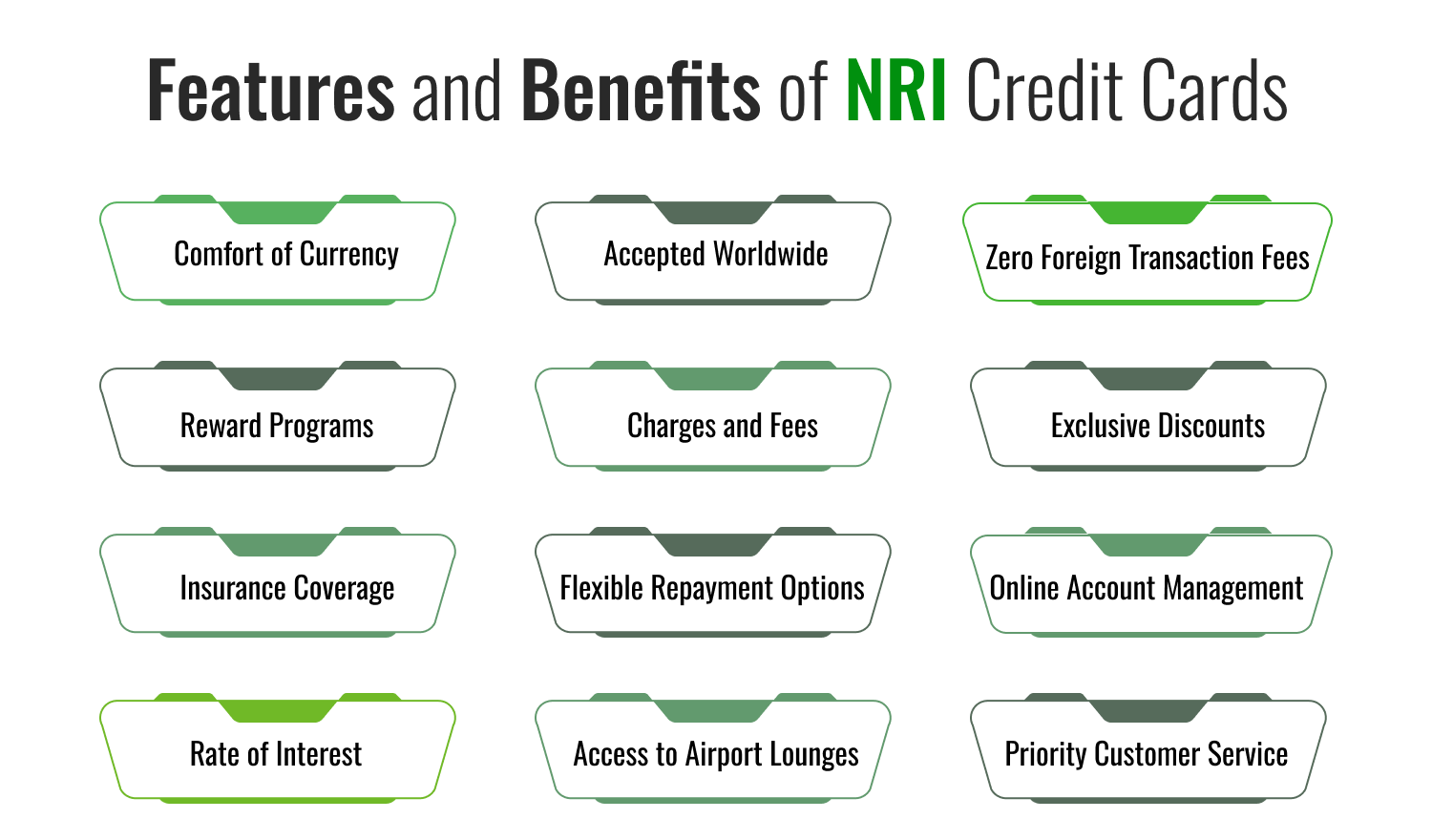

Features and Benefits of NRI Credit Cards

NRI credit cards come with various features:

- Comfort of Currency: NRI credit cards help users to transact in Indian rupees. You don’t have to worry about currency conversion. This is especially beneficial to NRIs who often travel to India or have financial expenditures to meet in the home country. NRIs can spend across various categories like travel, lifestyle, shopping etc. either in India or abroad with these specialized credit cards.

- Accepted Worldwide: Since NRI credit cards are accepted worldwide, they can be used to make transactions anywhere in the world without any issues. Thus, they are highly useful for NRIs when they are undertaking global travel.

- Zero Foreign Transaction fFees: Many NRI credit cards have nil foreign transaction fees. This enables users to save money by avoiding forex fees, which is an additional charge incurred when transacting in foreign currency.

- Reward Programs: NRI credit cards offer attractive reward programs in the form of discounts, rewards, and loyalty points. These points accrued on various transactions can be redeemed against different categories. Some NRI credit cards offer two times the rewards accrued for transactions done overseas. They also give rewards on transactions made in India. But, banks set their own spending criteria to credit reward points.

- Charges and Fees: NRI credit cards come with basic charges and fees such as tax fee, annual fee, joining fee, withdrawal fees, etc. The fee may vary depending on the bank. The rules of the credit card will be provided by the bank at the time of issuing the card. Also, individuals must have an NRE/NRO account to be eligible for the NRI credit card. Some banks will also require you to maintain a minimum balance in the account to qualify for an NRI credit card.

- Exclusive Discounts: Some NRI credit cards give exclusive benefits on a comprehensive range of services including travel bookings, online shopping, and dining.

- Insurance Coverage: Some NRI credit cards provide complimentary travel insurance,which provides coverage for travel related emergencies, medical expenses, and other unpredictable events. This feature contributes an extra layer of security for NRIs during their travels .

- Flexible Repayment Options: NRI credit cards offer flexible repayment options. Thus, users can manage their finances with comfort according to their preferences. This includes options for minimum or full payments, or tailor made payment plans.

- Online Account Management Facilities: Individuals using NRI credit cards can manage their online accounts efficiently. These cards provide facilities to individuals to monitor their transactions, make payments safely through online platforms, and track expenses

- Priority Customer Service: Many NRI credit cards provide dedicated customer service for priority assistance. This provides NRIs with support to address and resolve their queries and concerns.

- Access to Airport Lounges: Some ultra premium NRI credit cards offer free visits to airport lounges, thus making the NRI travels through flights a comfortable, luxurious, and entertaining experience.

- Rate of Interest: Credit cards are more like loans offered by banks. So, interest is charged on the transactions done. This interest will vary depending on the bank. The interest charges are computed from the date of withdrawal.

Top NRI Credit Cards for 2025 - Key Highlights

HDFC Bank Regalia Credit Card

- Get 2500 bonus points on paying the joining fee

- The card becomes lifetime free on completing 4 transactions of Rs. 500 plus in a month for the first 3 consecutive months.

- Get 5x reward points on spends at Marks & Spencer, Myntra, Nykaa & Reliance Digital.

- Get flight vouchers of value Rs. 5000 on annual spends of Rs. 5 lakhs and an additional voucher of value Rs. 5000 on spends of Rs. 7.5 lakhs.

- Complimentary lounge access at more than 1000 airports.

- Get 4 reward points per Rs. 150 spent

- Redeem the reward points @ 1 point = Rs. 0.5

HDFC Diners Club Black Card

- Get 10,000 points on paying the joining fee

- Get 10x points at select partners

- Get 5 reward points on making retail spends of Rs. 500

- You can redeem the reward points @ 1 point = Re 1 worth travel voucher.

Kotak NRI Royale Signature Credit Card

- Get 2 rewards points per Rs. 200 spent outside India.

- Get 1 reward point per Rs. 200 spent within India

- A fuel surcharge waiver is applicable on transactions between Rs. 500 and Rs. 3000

- Redeem your reward points across categories such as movie tickets, air tickets, cash, and more.

- 1 reward point = Re 1

ICICI Bank NRI Sapphiro Credit Card

- Get 4 free domestic airport lounge visits per quarter.

- Get 4 complimentary rounds of golf every month

- Get 2 PAYBACK points per Rs.100 spent on all domestic purchases.

- Save a minimum of 15% on dining bills at 2,500+ restaurants across India through the ICICI Bank Culinary Treats Programme.

- Get 1 PAYBACK Points on every ₹100 spent on utilities and insurance categories.

- Enjoy air accident insurance cover of Rs. 3 crores through this credit card.

- Waive off the Annual Fee by spending ₹6 Lacs in a Year.

ICICI Bank NRI Coral Credit Card

- Get 2 complimentary lounge visits per quarter

- Buy 1 ticket and get another free any day of the week on BookMyShow.

- Get 15% off on your dining bill at more than 2,500 participating restaurants.

HDFC Bank Regalia First Card

- Get welcome benefit of 1000 points on paying the joining fee

- The card becomes lifetime free on making 4 transactions in a month for the first 3 consecutive months (The minimum transaction value is Rs. 500).

- Get 4 reward points on all spends.

HDFC Bank Moneyback Card

- Get 500 reward points as welcome bonus on paying the joining fee

- The APR - 40.8% per annum

- Get 4 points per Rs. 150 spent on online shopping.

- Get 2 points per Rs. 150 across other categories.

HDFC Bank Diners ClubMiles Card

- Get an APR of 40.8% per annum

- You can earn 4 reward points per Rs.150 spent via the card.

- Reward points can be redeemed for air miles @ 1 reward point = 1 air mile with partner airlines and hotels including Trident hotels, Club Vistara, Singapore Airlines, and British Airways.

- You can also redeem reward points for gifts and vouchers from HDFC’s exclusive rewards redemption catalogue.

- Reward points can also be exchanged for an air ticket or hotel bookings on the HDFC Bank Diners Club website @ 1 reward point = Re.0.50.

Axis Neo Credit Card

- Enjoy 10% off on a minimum purchase of ₹500 at Myntra.

- Get a 10% discount every time you purchase movie tickets at BookMyShow.

- Enjoy a welcome gift voucher of ₹500 while shopping at Jabong.

- Get a 10% cashback offer on mobile recharge at the Freecharge mobile app.

- Spend ₹2500 within 45 days of card issuance and waive off the renewal fee.

- The age of the applicant must be between 18-70 years.

SBI Card Elite

- Multiply your rewards 5 times on grocery, departmental stores and dining spend.

- Enjoy concierge services such as holiday packages, hotel reservations, gift delivery.

- Enjoy 6 complimentary visits per year to Airport Lounges outside India through Priority Pass.

- Get a 1% fuel surcharge waiver on this card.

- Get a complimentary fraud liability cover of ₹1 Lac.

- Enjoy a 50% discount on golf games and get 4 complimentary rounds.

- The age of the applicant must be at least 21 years but not more than 70 years.

- Spend ₹10 lakhs and waive off the annual fee for the next year and you can check it after making the SBI Credit Card Login .

Jet Privilege HDFC Bank Diners Club Credit Card

- Enjoy 24×7 concierge assistance services on this credit card.

- Enjoy dining privileges through this card.

- Spend ₹8 lacs in a year to waive off the renewal fee from the next year.

- Multiply JPMiles 3 times by spending on Jet Airways’ website.

- Get 8 JPMiles on every ₹150 spent from the card.

- The minimum age of the applicant must be 21 years and a maximum of 65 years.

HDFC Bank Platinum Times Credit Card

- Get Welcome Gift gift vouchers for dining, shopping, apparel, and much more.

- Get exciting discount offers throughout the year on movie tickets.

- Enjoy 3 Reward Points on spending ₹150 from your card.

- Enjoy a 50 day interest-free period from the date of purchase on this credit card.

- The age of the applicant must be between 18-65 years.

Eligibility Criteria for NRI Credit Cards

The eligibility criteria are as follows:

- Most banks require NRI individuals to have a Non Resident Ordinary (NRO) or Non-Resident External Rupees (NRE) account.

- Some banks need a minimum balance to be held in the account. This is for the bank to analyze the capability of the individual to repay the money.

Documents Required for NRI Credit Cards

The following documents have to be submitted to get an NRI credit card. The person can either upload it online or submit it by visiting the bank.

- Copy of the passport

- The application form consists of information such as income, bank account, office address, and residential address. It must be filled and submitted.

- An official document which contains a signature.

How to Apply for an NRI Credit Card?

Online application process:

Step 1: Visit the official portal of the chosen bank and start the application process.

Step 2: Fill in the application form providing the necessary information such as name, email ID, contact number, income, and address.

Step 3: After submitting the application, wait for a call from the bank representative. The representative will help you through the rest of the process.

Step 4: Arrange a bank representative to collect the necessary documents at your doorstep, making the process convenient.

Offline application process:

Step 1: Go to the nearest bank branch and enquire about the NRI credit card variants available.

Step 2: Speak to a bank representative who will provide details on the various cards. You can then choose one most suitable to your needs.

Step 3: Completely fill the application form given by the bank and submit the required documents, including identity proof, address proof, and any other necessary paperwork.

Step 4: Submit supplementary documents such as income proof and passport-sized photographs along with the application form.

Things to Consider Before Choosing an NRI credit card

It is crucial to consider the following when opting for an NRI credit card.

- Currency flexibility: The process of conversion between foreign currency and INR must be simple.

- Global Usage: Check if the cards can be used both in India and abroad.

- Rewards and cashbacks: Choose cards which offer rewards on international spends.

- Low foreign transaction fees: This is most important for NRIs who conduct transactions in foreign currencies.

- Joining fees, annual fees, and processing fees

- Rate of interest

- Check if protection is provided by the bank if the card is stolen.

- Check the custom duty that is charged if the card is used in a different country.

- Check if the process to make payments is easy in case it is made from another bank.

Conclusion

NRI credit cards help bridge the gap between NRIs who are staying abroad and India. Choose the most suitable credit card and use it wisely. In this way, you can ensure that your financial dealings in India are safe.

Frequently Asked Questions (FAQs)