Axis Bank Credit Card Late Payment Charges

Last Updated : June 14, 2025, 2:55 p.m.

If you’re an Axis Bank credit cardholder, avoiding late payment charges is important for keeping your finances in check. Late payments not only lead to hefty fees but also impact your CIBIL score and future credit eligibility. This guide breaks down Axis Bank Credit Card Late Payment Charges & Fees, other related charges, and how you can stay free of penalties while managing your credit card efficiently.

What Are Axis Bank Credit Card Late Payment Charges?

Late payment fees apply when you do not pay the Minimum Amount Due (MAD) by the due date. Charges are based on your bill amount:

- ₹0 – ₹500: Nil

- ₹501 – ₹5,000: ₹500

- ₹5,001 – ₹10,000: ₹750

- Above ₹10,000: ₹1,200

When Are Axis Credit Card Late Fees Charged?

Axis Bank credit card late payment charges are levied if the minimum due is not credited by the due date. Even if payment is made a day late or gets delayed in processing, the fee applies. Always ensure credited payment, not just initiated payment.

Axis Credit Card Cash Withdrawal Charges

Using your Axis Bank credit card to withdraw cash from ATMs can be expensive. These withdrawals attract both a cash advance fee and high interest from the day of the transaction. Since there's no interest-free period, it’s advisable to avoid cash withdrawals unless absolutely necessary.

| Component | Charge |

|---|---|

Cash Advance Fee | 2.5% of the withdrawn amount or Rs. 500 (Whichever is higher) |

Interest Rate | ~3.5% per month (charged from the withdrawal date) |

Interest-Free Period | Not applicable |

Axis Forex Currency Charges

When using Axis Bank credit cards for international transactions, forex markup fees are applied based on your card type. Premium cards attract lower charges than standard ones.

| Card Type | Forex Markup Fee | |

|---|---|---|

Standard Axis Credit Cards | 3.5% of the transaction amount | |

Premium Cards (e.g., Atlas, Burgundy) | 2% – 3% depending on the variant |

Other Fees and Charges of Axis Bank Credit Card

Below is a summary table of the most common Axis Bank credit card charges you should know about. From late payment fees to forex markup, here’s a complete breakdown:

| Charge Type | Details |

|---|---|

Late Payment Fee | ₹0 – ₹1,200 based on outstanding amount |

Cash Advance Fee | 2.5% of amount withdrawn (Min ₹500) |

Cash Advance Interest | ~3.5% per month (charged from withdrawal date) |

Forex Markup (Standard Cards) | 3.5% of international transaction value |

Forex Markup (Premium Cards) | 2% – 3% based on card type |

Overlimit Charges | ₹500 or 2.5% of overlimit amount |

Card Replacement Fee | ₹100 – ₹300 (varies by card variant) |

Duplicate Statement Fee | ₹100 per statement |

EMI Foreclosure Charges | 3% of outstanding principal |

Cash Payment at Branch | ₹100 per transaction |

Tip: Always review your statement for exact fee amounts based on usage.

What Happens If You Keep Missing Axis Credit Card Payments?

Ignoring due dates can have long-term financial consequences:

- Penalty and interest charges compound month after month

- Axis Bank may block your card or reduce your credit limit

- Your CIBIL score drops significantly, impacting future loans

- You could lose eligibility for offers and limit enhancements.

Tips to Prevent Axis Credit Card Late Payment Charges

- Enable auto-debit for full or minimum payment

- Set SMS/email reminders a few days before due date

- Use UPI or net banking for swift, last-minute payments

- Schedule payments 2–3 days early to avoid bank processing delays

- Check due date via Axis Mobile App or net banking dashboard.

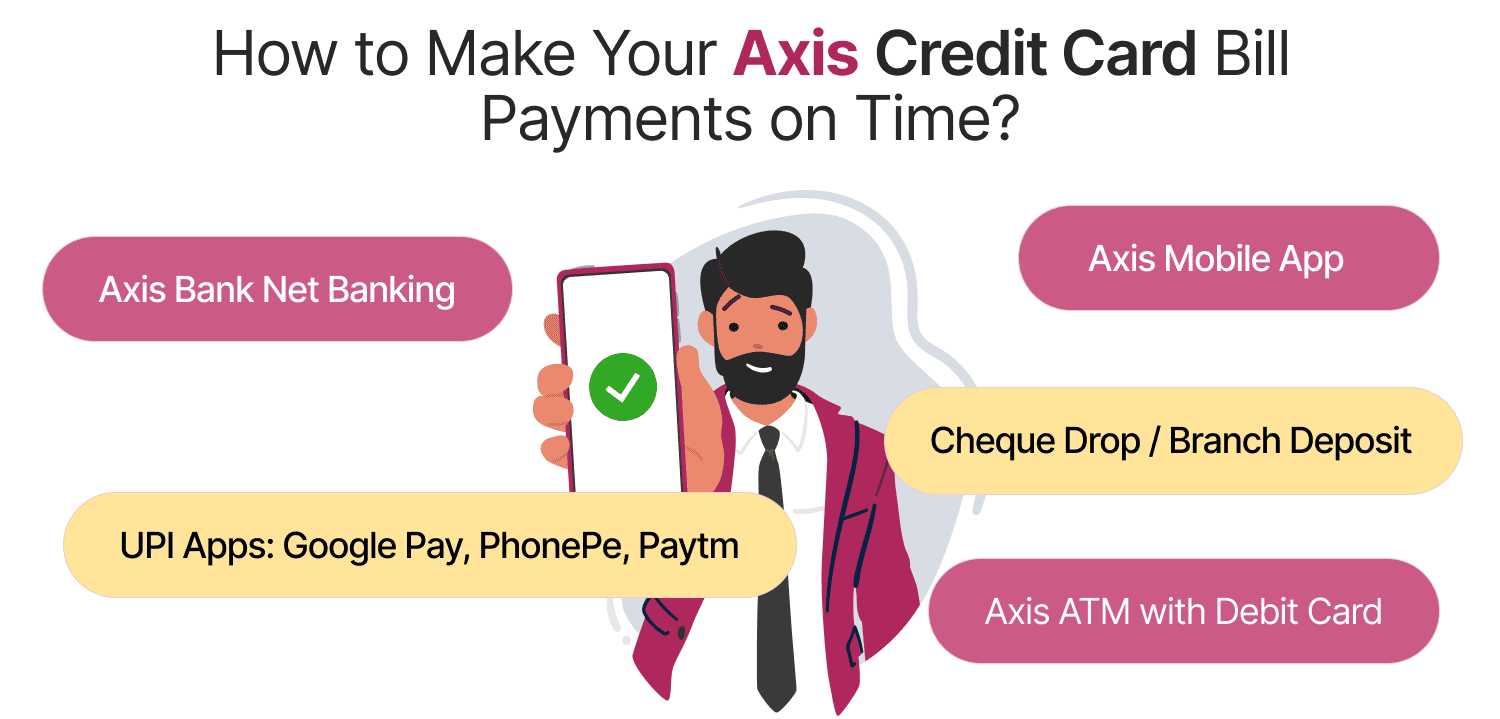

How to Make Your Axis Credit Card Bill Payments on Time?

Choose from these safe and fast Axis Bank credit card payment methods:

- Axis Bank Net Banking

- Axis Mobile App

- UPI Apps: Google Pay, PhonePe, Paytm

- Axis ATM with Debit Card

- Cheque Drop / Branch Deposit (use well before the due date)

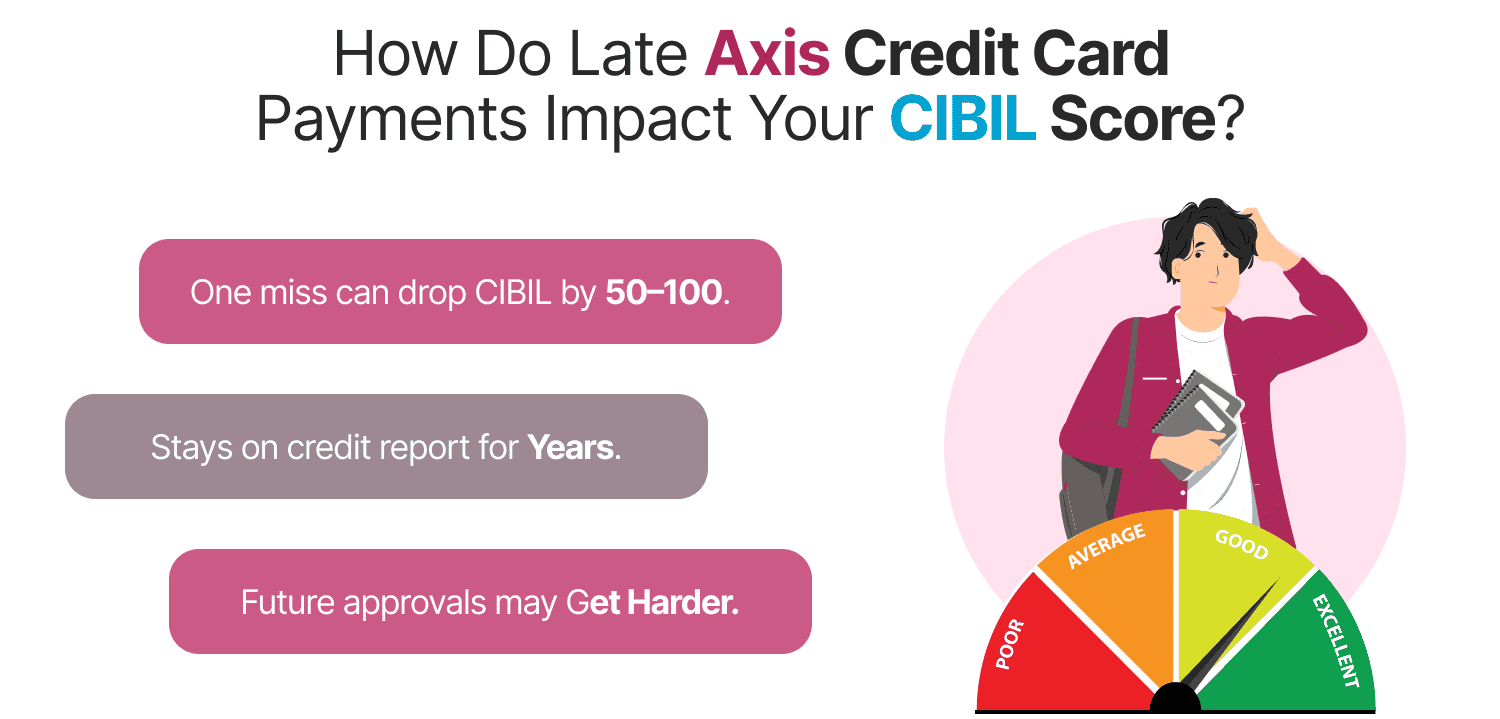

How Do Late Axis Credit Card Payments Impact Your CIBIL Score?

A delayed payment reflects poorly on your credit profile:

- CIBIL score can drop 50–100 points for one missed payment

- Reports stay on your credit history for years

- Future loan and credit card approvals may become difficult.

Comparison: Axis Bank vs HDFC vs ICICI Late Fees

| Outstanding Balance (₹) | Axis Bank | HDFC Bank | ICICI Bank |

|---|---|---|---|

Up to ₹500 | Nil | ₹100 | Nil |

₹501 – ₹5,000 | ₹500 | ₹500 | ₹500 |

₹5,001 – ₹10,000 | ₹750 | ₹750 | ₹750 |

Above ₹10,000 | ₹1,200 | ₹900–1,300 | ₹900–1,200 |

Conclusion

Avoiding Axis Bank Credit Card Late Payment Charges & Fees is simple if you pay on time, choose the right payment method, and monitor your CIBIL score. Use digital tools, set reminders, and always verify your credit card statement.

Disclaimer: The charges given above are as of when this page was written. To ensure accuracy, always refer to Axis Bank’s site for the latest fee schedule or contact the bank.

Frequently Asked Questions (FAQs)