Bank of Baroda Credit Card Bill Payment through Net Banking

Last Updated : May 15, 2025, 2:59 p.m.

Making your Bank of Baroda Credit Card payments through netbanking is the most convenient way to pay your credit card bills online without visiting a branch. This step-by-step guide covers the entire process, from logging in to confirming your payment, along with tips to maintain your CIBIL score through timely payments. We also cover alternative payment methods and troubleshooting steps if you encounter any issues.

Did you know? According to Bank of Baroda data, customers who pay their credit card bills through netbanking are 78% less likely to miss payment deadlines compared to those who use offline methods.

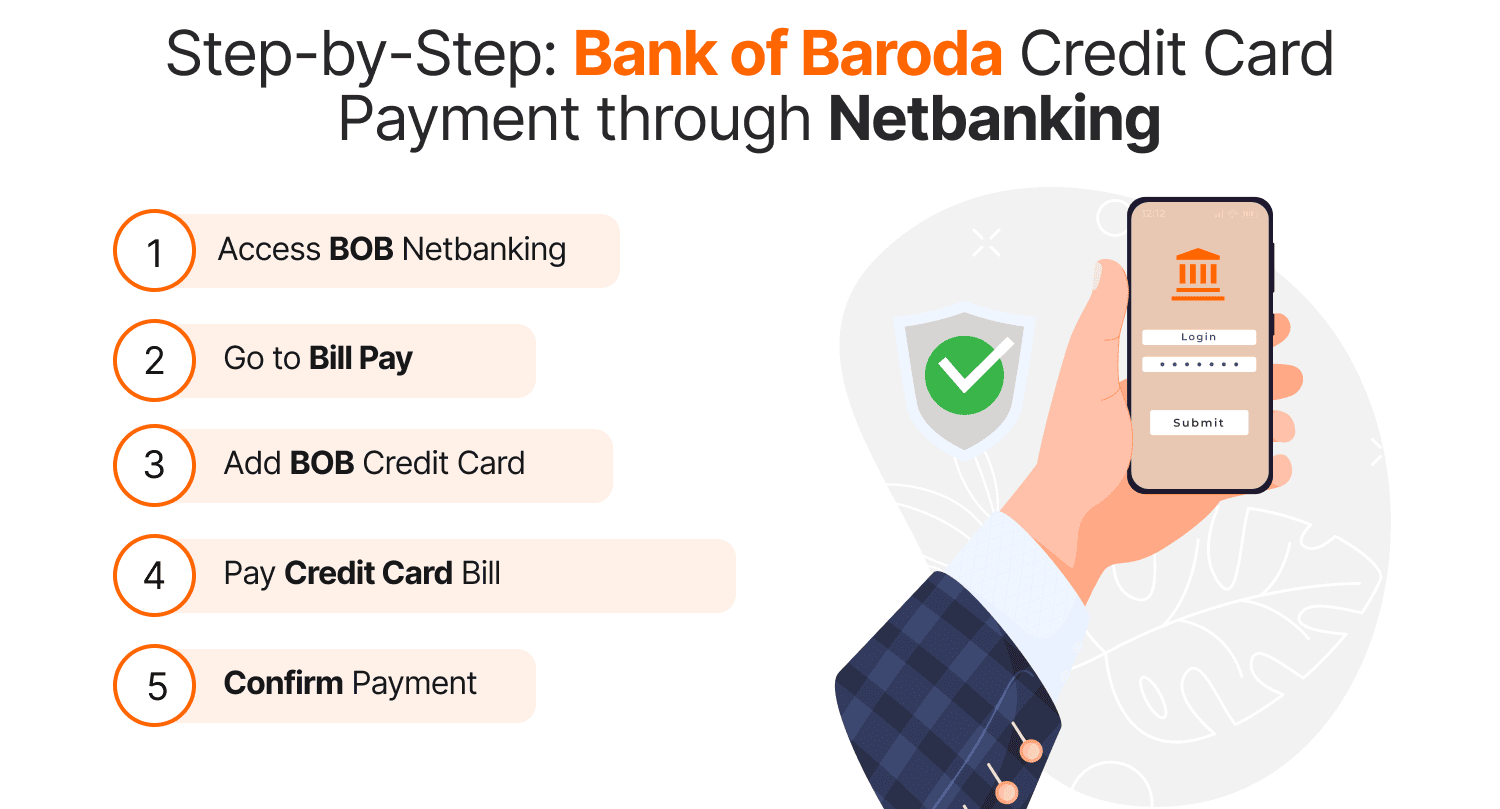

Step-by-Step: Bank of Baroda Credit Card Payment through Netbanking

Step 1: Access Bank of Baroda Netbanking

- Visit the official Bank of Baroda netbanking portal

- Enter your User ID in the login section

- Input your password in the secure field

- Complete the captcha verification if prompted

- Click on “Login” to access your account

New User? If you haven’t registered for netbanking yet, click on “New User Registration” and follow the on-screen instructions using your account details and registered mobile number.

Step 2: Navigate to Bill Payment Section

Once logged in to your Bank of Baroda netbanking account:

- Search and click on the option, “Bill Payments” in the main menu

- Pick the option “Credit Card” from the list of payment categories

- You’ll be directed to the credit card payment interface

Step 3: Add Your Bank of Baroda Credit Card

First-time users must add their credit card as a payee:

- Click on “Add a Payee” or “Register Biller”

- From the biller category, select “ Credit Cards ”

- Choose “Bank of Baroda” from the provider list

- Input your full 16-digit Bank of Baroda credit card number

- Create a nickname for easy identification (e.g., “My BoB Card”)

- Verify all details and click “Submit” or “Add”

- Input the OTP dispatched to your registered mobile number

- Wait for confirmation that your card has been added successfully

Pro Tip: Adding a distinctive nickname helps quickly identify your card when you have multiple billers registered.

Step 4: Make Your Credit Card Payment

Now that your credit card is registered, follow these steps to make a payment:

- Choose your registered Bank of Baroda credit card from the list

- Your current outstanding balance will be displayed automatically

- Choose your payment amount:

- Minimum Due Amount: Pay this to avoid late fees (not recommended for maintaining a good CIBIL score)

- Total Outstanding Amount: Best option to steer clear of interest charges and maintain your CIBIL score

- Custom Amount: Specify any amount above the minimum amount outstanding

- Choose the account from which you want the payment to be debited

- Review all payment details carefully

- Click “Continue” or “Proceed” to move to confirmation

Step 5: Verify and Confirm Payment

- Check all payment details on the confirmation screen

- Enter your transaction password or OTP for authentication

- Click “Confirm” to process your payment

- Wait for the success message and note the transaction reference number

- Save or download the payment receipt for your records

Payment Processing Time: Your Bank of Baroda credit card payment typically reflects within 24-48 hours, but it’s advisable to pay at least 3 days before your due date.

Setting Up Auto-Pay for Never Missing a Payment

Maintaining a good CIBIL score requires consistent timely payments. Schedule auto-pay to make sure that you never miss a deadline:

- In the credit card payment section, look for “Standing Instructions” or “Auto Debit”

- Select your Bank of Baroda credit card from the list

- Choose your payment preference:

- Minimum Amount Due: The minimum amount will be automatically paid

- Total Amount Due: The full balance will be paid (recommended)

- Fixed Amount: Specify a fixed amount to be paid each month

- Select the payment date (typically 2-3 days before your due date)

- Choose the account to be debited

- Set the validity period (you can choose “Until Cancelled”)

- Confirm the setup with your transaction password or OTP.

CIBIL Score Impact: Setting up auto-pay for the total amount due can improve your credit utilization ratio, which accounts for 30% of your CIBIL score calculation.

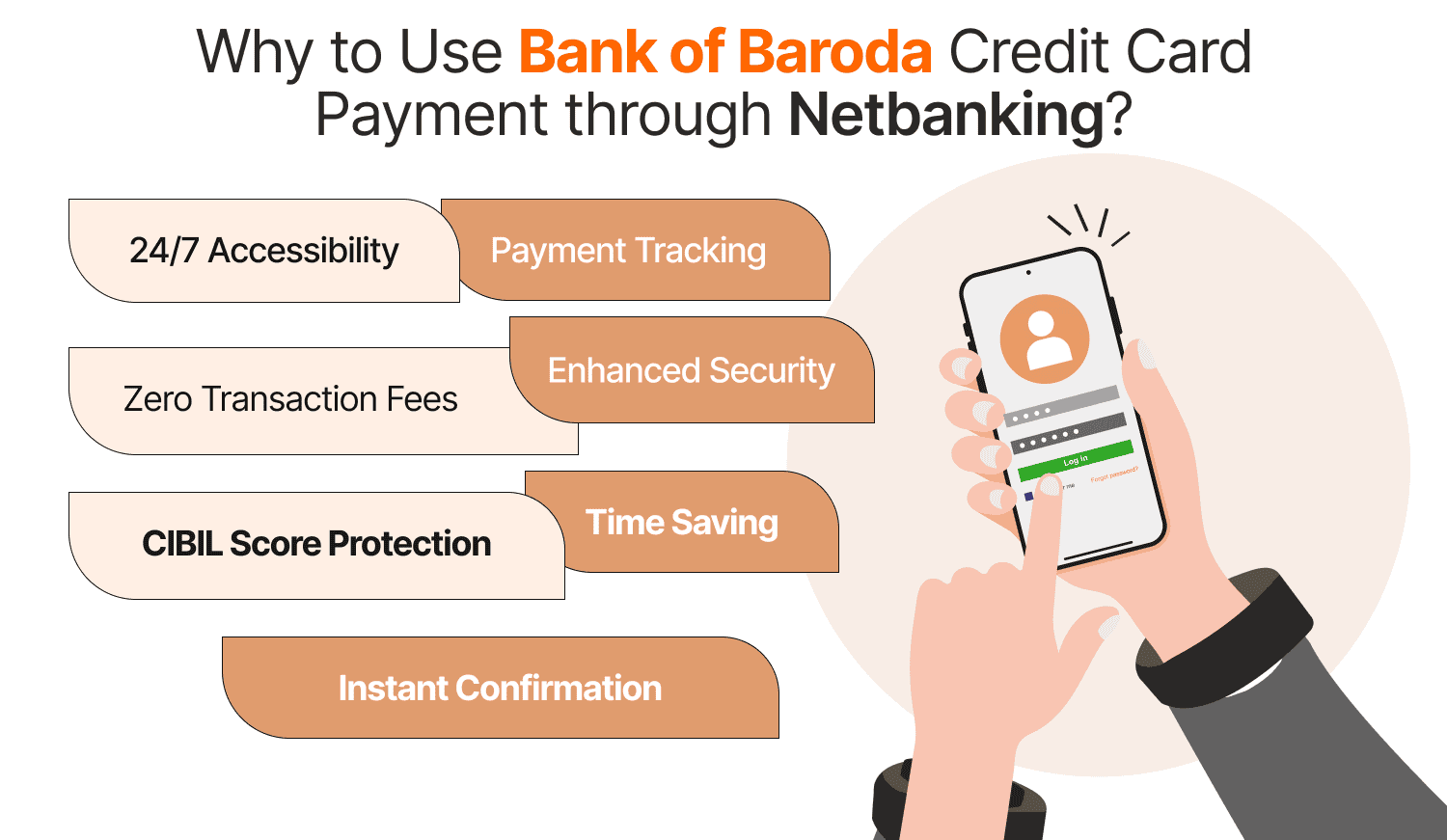

Why to Use Bank of Baroda Credit Card Payment through netbanking?

Using Bank of Baroda netbanking for your credit card payments offers significant advantages:

| Benefit | Description |

|---|---|

24/7 Accessibility | Make payments anytime, even on holidays and weekends |

Instant Confirmation | Receive immediate transaction receipts and SMS alerts |

CIBIL Score Protection | Timely payments help maintain and improve your credit score |

Zero Transaction Fees | No extra charges for paying online, unlike some other methods |

Payment Tracking | View complete payment history and upcoming dues |

Enhanced Security | Multi-factor authentication protects your transactions |

Time Saving | Complete the entire process in under 2 minutes |

Security Features for Safe Netbanking Transactions

Bank of Baroda implements several security measures to protect your online credit card payments:

1)Multi-Layer Authentication

- Username and password protection

- Transaction password requirement for financial transactions

- OTP verification for all critical activities

- Virtual keyboard to prevent keylogger threats

2)Advanced Encryption

- 256-bit SSL encryption for all data transmission

- Secure session management with automatic timeouts

- End-to-end encryption for payment information

3)Account Protection

- Automatic account locking after multiple failed attempts

- Real-time transaction monitoring for suspicious activity

- Instant alerts for all account activities

4)Important Security Practices:

- Never share your OTP, password, or attributes about your card with anyone

- Always log out completely after completing transactions

- Regularly update your netbanking password

- Verify the website has “https://” and a lock icon before logging in.

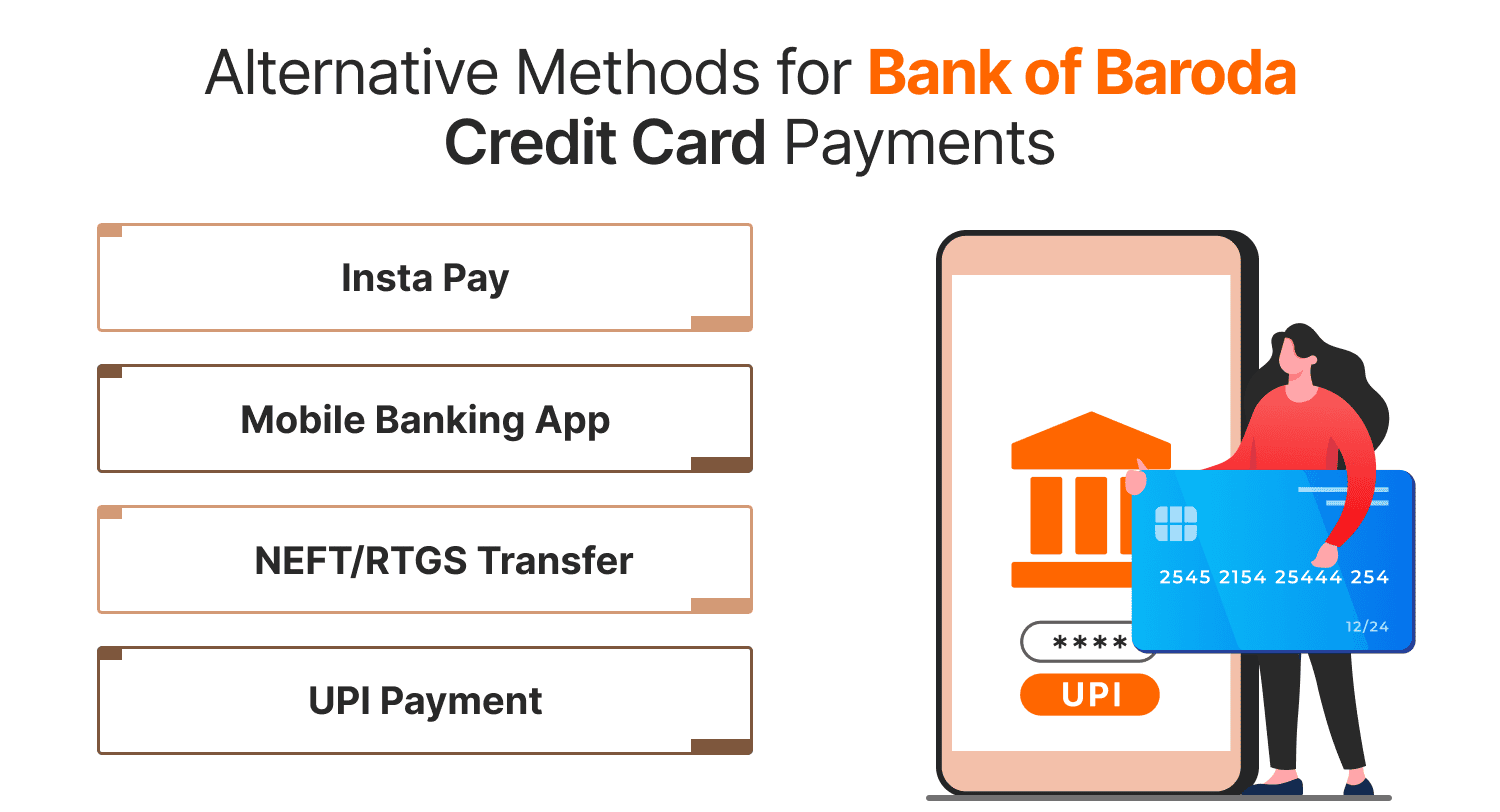

Alternative Methods for Bank of Baroda Credit Card Payments

While netbanking is the most efficient method, Bank of Baroda offers multiple ways to pay your credit card bills:

1. Insta Pay (Without Login)

Perfect for quick payments without logging into netbanking:

- Visit the Bank of Baroda website

- Click “Pay Your Credit Card Bill” or “Insta Pay”

- Enter your 16-digit credit card number

- Provide the CVV and expiry date

- Select your payment amount

- Complete the transaction using any bank’s debit card or net banking

Processing Time: 24-48 hours for payment reflection

2. Mobile Banking App

For on-the-go payments:

- Download the Bob World app from App Store or Google Play

- Log in using your credentials

- Navigate to “Bill Payments” > “Credit Card”

- Select your card and payment amount

- Complete the transaction

Advantage: Same-day processing for payments made before 8 PM

3. NEFT/RTGS Transfer

From other bank accounts:

- Add your Bank of Baroda credit card as a beneficiary

- Use IFSC Code: BARB0COLABA

- In the account number field, key in your 16-digit card number.

- Transfer the payment amount

Note: Under remarks, specify your card number. This will help in quicker processing.

4. UPI Payment

Quick digital payments:

- Open any UPI app (Google Pay, PhonePe, etc.)

- Select “Credit Card Bill Payment”

- Choose “Bank of Baroda” as the biller

- Enter your card details and payment amount

- Complete the UPI transaction

Processing Time: Usually same-day if completed before 8 PM.

What must be done for Issues with Bank of Baroda Credit Card Payments through netbanking?

If you encounter problems while making Bank of Baroda credit card payments through netbanking, here are solutions to common issues:

Payment Not Reflecting

Solution:

- Allow 24-48 hours for processing

- Verify your transaction history to authenticate the payment status

- Keep your payment receipt handy for reference

- Contact customer care if payment doesn’t reflect after 48 hours

Transaction Failure

Solution:

- Verify you have sufficient balance in your account

- Check your internet connection and try again

- Ensure you’re entering the correct transaction password/OTP

- Either use a different browser or empty your cache.

Unable to Add Credit Card as Payee

Solution:

- Double-check the card number for accuracy

- Ensure the card is active and not blocked

- Try adding the card during banking hours (10 AM - 6 PM)

- Contact customer support if issues persist

Customer Support for Bank of Baroda Credit Card Users

If you need assistance with Bank of Baroda credit card payments or netbanking:

24/7 Helpline Numbers

- General Banking: 1800 5700 (Toll-Free)

- Particular to credit cards: 1800 258 4455 / 1800 102 4455

- International/NRI Customers: +9179 6629 6629

Digital Support

- Email: crm@bobcards.com (Level 1) or escalations@bobfinancial.com (Level 2)

- Chat Support: Available on the official Bank of Baroda website

- Social Media: @bankofbaroda on Twitter for quick responses

Branch Support

Visit any Bank of Baroda branch with your credit card and identity proof for in-person assistance.

Conclusion: Start Managing Your Credit Card Payments Online Today

Bank of Baroda credit card payments through netbanking offer the perfect combination of convenience, security, and efficiency. By following this step-by-step guide, you can easily manage your payments, avoid late fees, and maintain a healthy CIBIL score.

The digital payment process takes less than 2 minutes once set up and provides instant confirmation for your peace of mind. For maximum convenience, consider setting up auto-pay to ensure you never miss a payment deadline again.

Start using Bank of Baroda netbanking for your credit card payments today and experience hassle-free financial management.

Frequently Asked Questions (FAQs)