Bank of Baroda Credit Card Payment through BillDesk

Last Updated : May 15, 2025, 3:40 p.m.

Managing your credit card bill payments efficiently is crucial for maintaining financial health and a strong Credit score. For Bank of Baroda credit card holders, using BillDesk offers a seamless and secure way to pay bills online. This article explores the process, benefits, and considerations of making Bank of Baroda credit card payment through BillDesk, including the advantages of using a debit card for payments and the potential impact on your credit score.

What is BillDesk?

BillDesk is one of India’s leading online payment gateway platforms, enabling users to pay utility bills, credit card bills, and other financial obligations securely. It partners with numerous banks, including the Bank of Baroda, to facilitate hassle-free credit card bill payments . With its user-friendly interface and strong protective measures, BillDesk is a trusted option for millions of users looking to manage their Bank of Baroda credit cards efficiently.

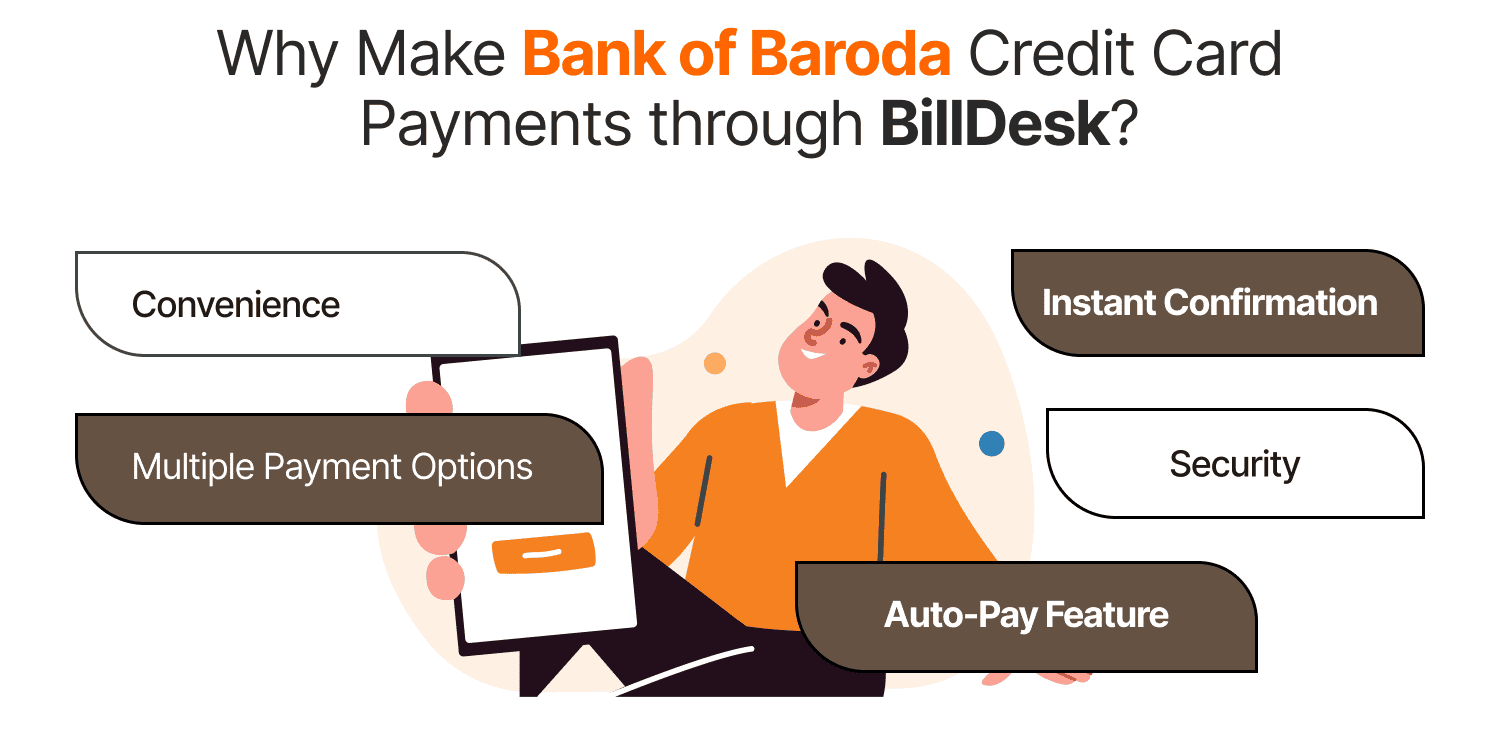

Why Make Bank of Baroda Credit Card Payments through BillDesk?

Using BillDesk for Bank of Baroda credit card payments offers several advantages:

- Convenience: Pay your credit card bill from anywhere, anytime, using your computer or mobile device.

- Multiple Payment Options: BillDesk supports payments via debit cards, net banking, UPI, and mobile wallets, providing flexibility for Bank of Baroda credit card holders.

- Security: BillDesk employs advanced encryption and security protocols to protect your financial information.

- Instant Confirmation: Payments are processed quickly, with instant confirmation, ensuring your credit card bill payments are recorded promptly.

- Auto-Pay Feature: Set up recurring payments to prevent missing due dates, which can positively affect your Credit score.

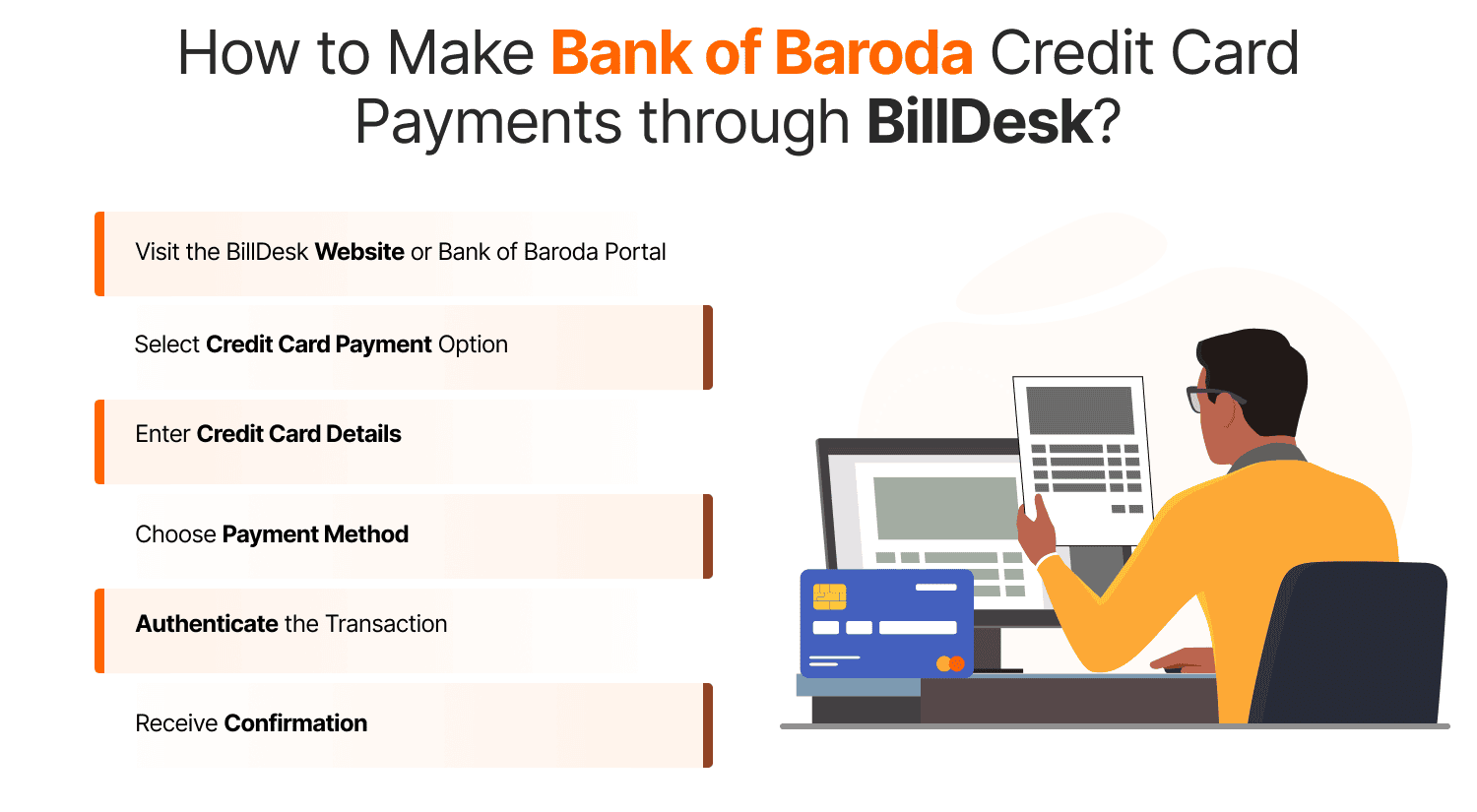

How to Make Bank of Baroda Credit Card Payments through BillDesk?

Making Bank of Baroda credit card payments through BillDesk is straightforward. Follow these steps to ensure a smooth transaction:

Step-by-Step Process

- Visit the BillDesk Website or Bank of Baroda Portal

Login to the official BillDesk website or visit the Bank of Baroda credit card payment section. Alternatively, you can use the Bank of Baroda’s mobile banking app, which may redirect you to BillDesk for payment processing. - Select Credit Card Payment Option

Pick the option to pay your credit card bill. You’ll need to select Bank of Baroda from the list of supported banks. - Enter Credit Card Details

Key in your Bank of Baroda credit card number and the bill amount. Verify the details to avoid errors. - Choose Payment Method

BillDesk offers multiple payment methods, including:- Debit Card : Ideal for those who want to use available funds directly from their bank account.

- Net Banking : Link your Bank of Baroda or other bank account for direct payment.

- UPI : Use apps like Google Pay or PhonePe for speedy transactions.

- Mobile Wallets : Options like Paytm or Amazon Pay are also supported.

- Authenticate the Transaction

Depending on your chosen payment method, you may need to authenticate the transaction using an OTP (One-Time Password) sent to your registered mobile number or email. - Receive Confirmation

Post processing the payment, you’ll get a confirmation via SMS or email. The payment will reflect in your Bank of Baroda credit card account within 1-2 working days.

Using a Debit Card for Credit Card Payments

Using a debit card to pay your Bank of Baroda credit card bill through BillDesk is a popular choice for many users. Here’s why:

- Direct Fund Usage : A debit card draws funds directly from your bank account, helping you avoid accumulating additional debt.

- No Interest Charges : Unlike using a credit card to pay another credit card (which is generally not allowed), debit card payments incur no interest.

- Budget Control : Paying with a debit card ensures you only spend what you have, promoting financial discipline.

- Wide Acceptance: Most banks’ debit cards, including those from Bank of Baroda, are accepted on BillDesk.

To use a debit card, select the debit card option on BillDesk, enter your card details (card number, expiry date, and CVV), and authenticate the transaction with an OTP or 3D Secure PIN.

Impact of Timely Payments on Your Credit Score

Your Credit score , a three-digit number, is in the range of 300 to 900, and it reflects your creditworthiness. Timely credit card bill payments are critical for maintaining or improving your score. Here’s how using BillDesk for Bank of Baroda credit card payments can impact your CIBIL score:

- Positive Impact of Timely Payments : Paying your Bank of Baroda credit card bill on or before the due date through BillDesk ensures your payment history remains positive. Payment history makes up approximately 35% of your CIBIL score.

- Avoiding Late Payment Penalties : Missing a payment deadline can result in late fees and a negative mark on your credit report. BillDesk’s auto-pay feature can help you schedule payments to avoid this.

- Credit Utilization Ratio : Paying your bill in full each month keeps your credit utilization ratio low, which is another key factor in your CIBIL score (around 30% weightage).

- Building Credit History : Consistent payments through BillDesk demonstrate responsible credit behavior, strengthening your credit profile over time.

Note : Using a debit card to pay your credit card bill does not directly affect your CIBIL score , as debit card transactions are not reported to credit bureaus. However, ensuring timely payments with any method (including debit cards) indirectly supports a healthy credit score.

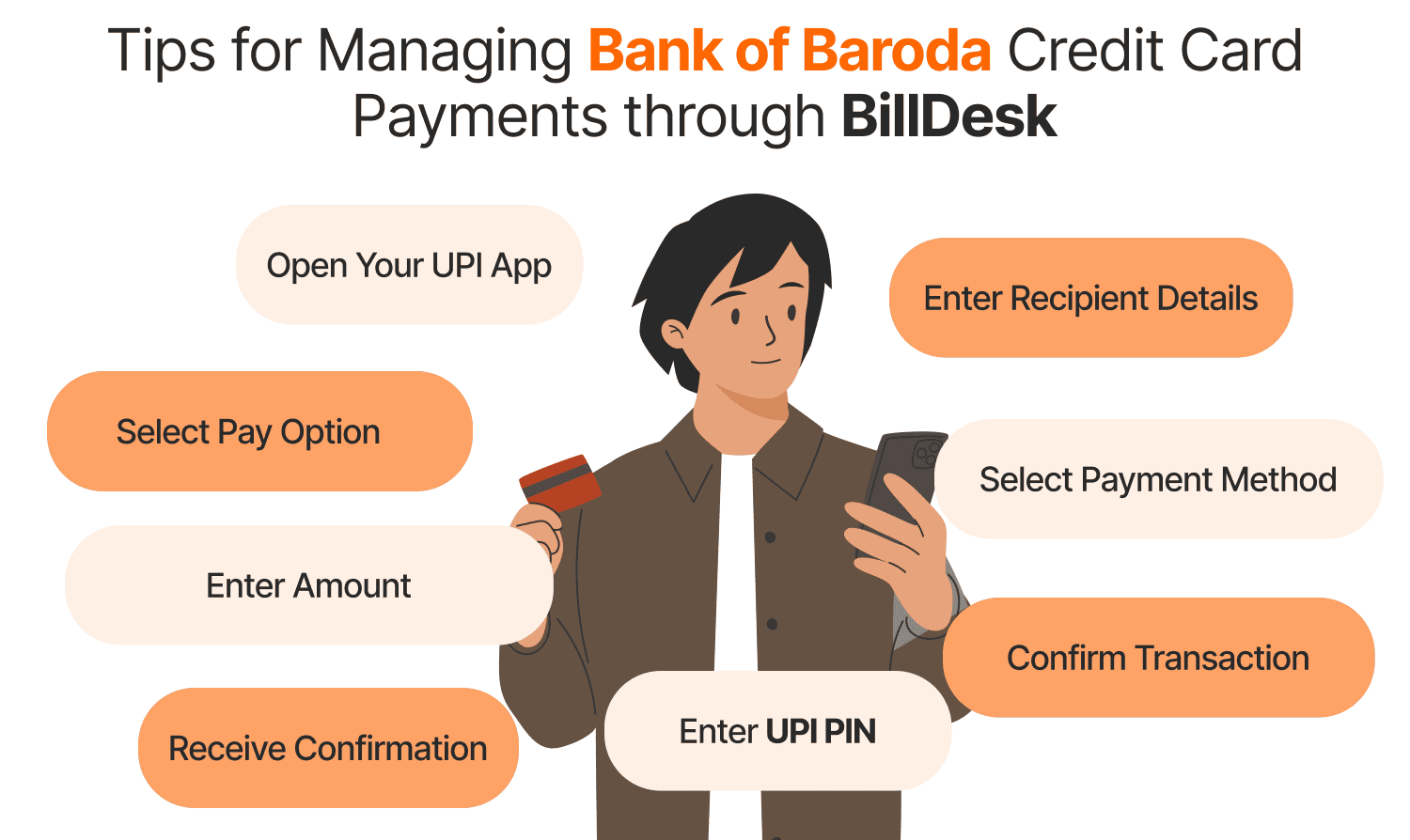

Tips for Managing Bank of Baroda Credit Card Payments through BillDesk

To maximize the benefits of using Bank of Baroda credit cards and BillDesk, consider these tips:

- Set Payment Reminders : Use BillDesk’s auto-pay or calendar reminders to avoid missing due dates.

- Monitor Your Statements : Regularly check your Bank of Baroda credit card statements to ensure all transactions are accurate.

- Pay More Than the Minimum : Paying the full outstanding amount rather than the minimum due helps avoid interest charges and keeps your CIBIL score healthy.

- Secure Your Transactions : Use a secure internet connection and avoid public Wi-Fi when making payments through BillDesk.

- Contact Customer Support : If you face issues with BillDesk or your Bank of Baroda credit card, reach out to Bank of Baroda’s customer care or BillDesk support for assistance.

Comparing BillDesk with Other Payment Platforms

While BillDesk is a preferred choice for Bank of Baroda credit card payments, other platforms like Paytm, Razorpay, and bank-specific apps also offer similar services. Here’s a quick comparison:

- BillDesk : Known for its dependability, wide bank partnerships, and robust security. Ideal for users prioritizing a trusted platform.

- Paytm : Offers a broader range of services, including bill payments, shopping, and investments, but may have higher transaction fees for certain methods.

- Razorpay : Popular for business transactions but also supports personal bill payments with a modern interface.

- Bank of Baroda’s M-Connect Plus App : Provides a direct payment option for Bank of Baroda credit cards but may have fewer payment method options compared to BillDesk.

BillDesk stands out for its focus on bill payments and seamless integration with Bank of Baroda systems, making it a top choice for credit card bill payments.

Potential Challenges and Solutions

While BillDesk is user-friendly, you may encounter occasional issues. Here are common challenges and how to address them:

- Transaction Failures : If a payment fails, check your internet connection and ensure sufficient funds in your account. Retry or contact BillDesk support.

- Delayed Payment Reflection : Payments may take 1-2 working days to reflect. If it takes longer, verify with Bank of Baroda’s customer service.

- Incorrect Details : Double-check your Bank of Baroda credit card number and amount before confirming the payment to avoid errors.

Conclusion

Making Bank of Baroda credit card payments through BillDesk is a convenient, secure, and efficient way to manage your credit card bill payments. By using a debit card, you can maintain financial discipline. With its user-friendly interface, multiple payment options, and robust security, BillDesk is an excellent choice for Bank of Baroda credit card holders. Follow the steps outlined, set up auto-pay, and monitor your statements to ensure a hassle-free experience and a healthy credit profile.

For the latest updates on Bank of Baroda credit cards or BillDesk services, visit the official Bank of Baroda website or contact their customer support. Stay on top of your credit card bill payments to enjoy the benefits of your Bank of Baroda credit card.

Frequently Asked Questions (FAQs)