Bank of Baroda Credit Card Payment through Debit Card

Last Updated : May 15, 2025, 3:19 p.m.

Making timely payments on your Bank of Baroda credit card is crucial for maintaining financial health and a strong credit profile. Among the various payment methods available, Bank of Baroda credit card payments through debit card offers a convenient and immediate way to settle your credit card bills. This comprehensive guide explores everything you need to know about Bank of Baroda credit card payment through debit card, including the process, benefits, and impact on your CIBIL score .

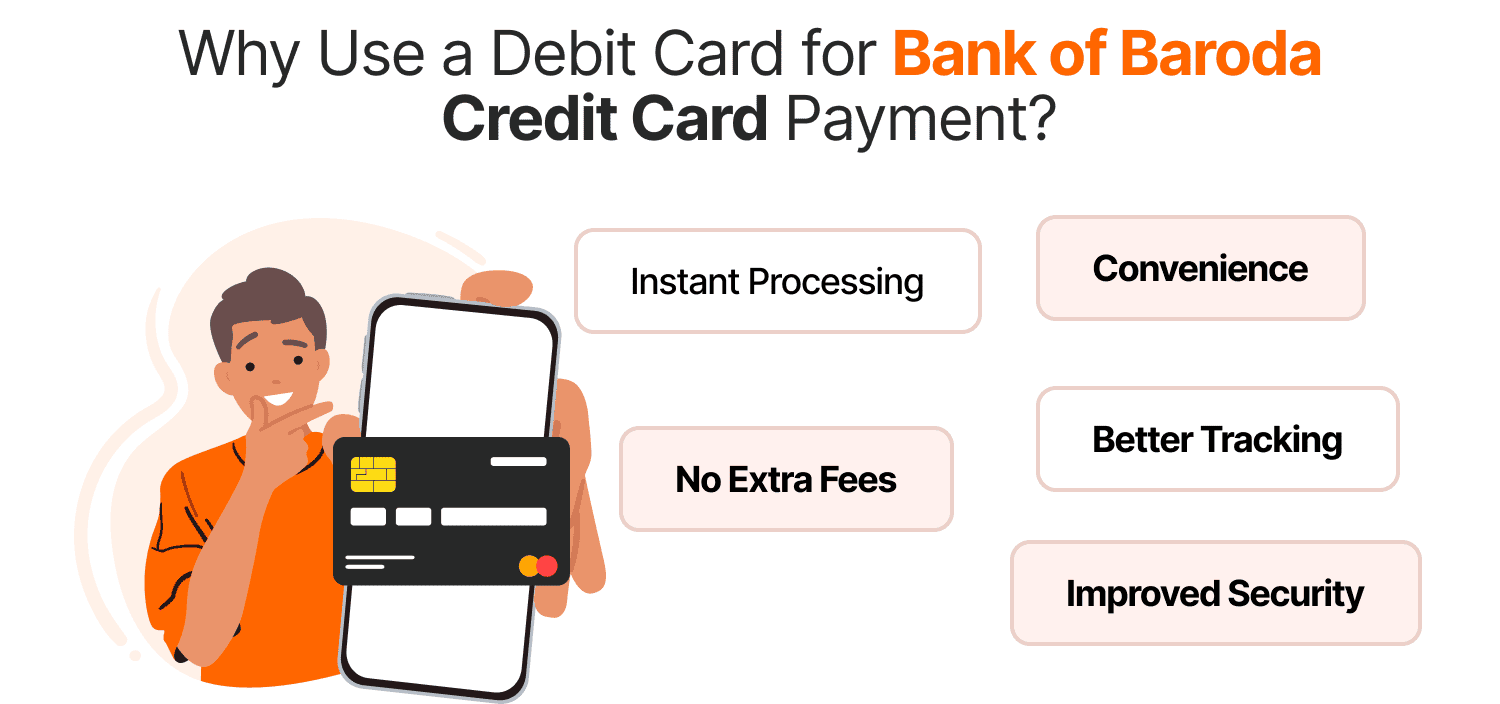

Why Use a Debit Card for Bank of Baroda Credit Card Payment?

Using your debit card to pay your Bank of Baroda credit card bill offers several distinct advantages:

- Instant Processing : Payments made via debit card are processed much faster compared to traditional methods like cheques.

- Convenience : You can make payments anytime, anywhere without visiting a bank branch.

- No Extra Fees : Unlike some payment methods, debit card payments typically don’t incur additional processing charges.

- Better Tracking : Digital payments are easier to track and maintain records of for future reference.

- Improved Security : Debit card transactions offer enhanced security features compared to cash payments.

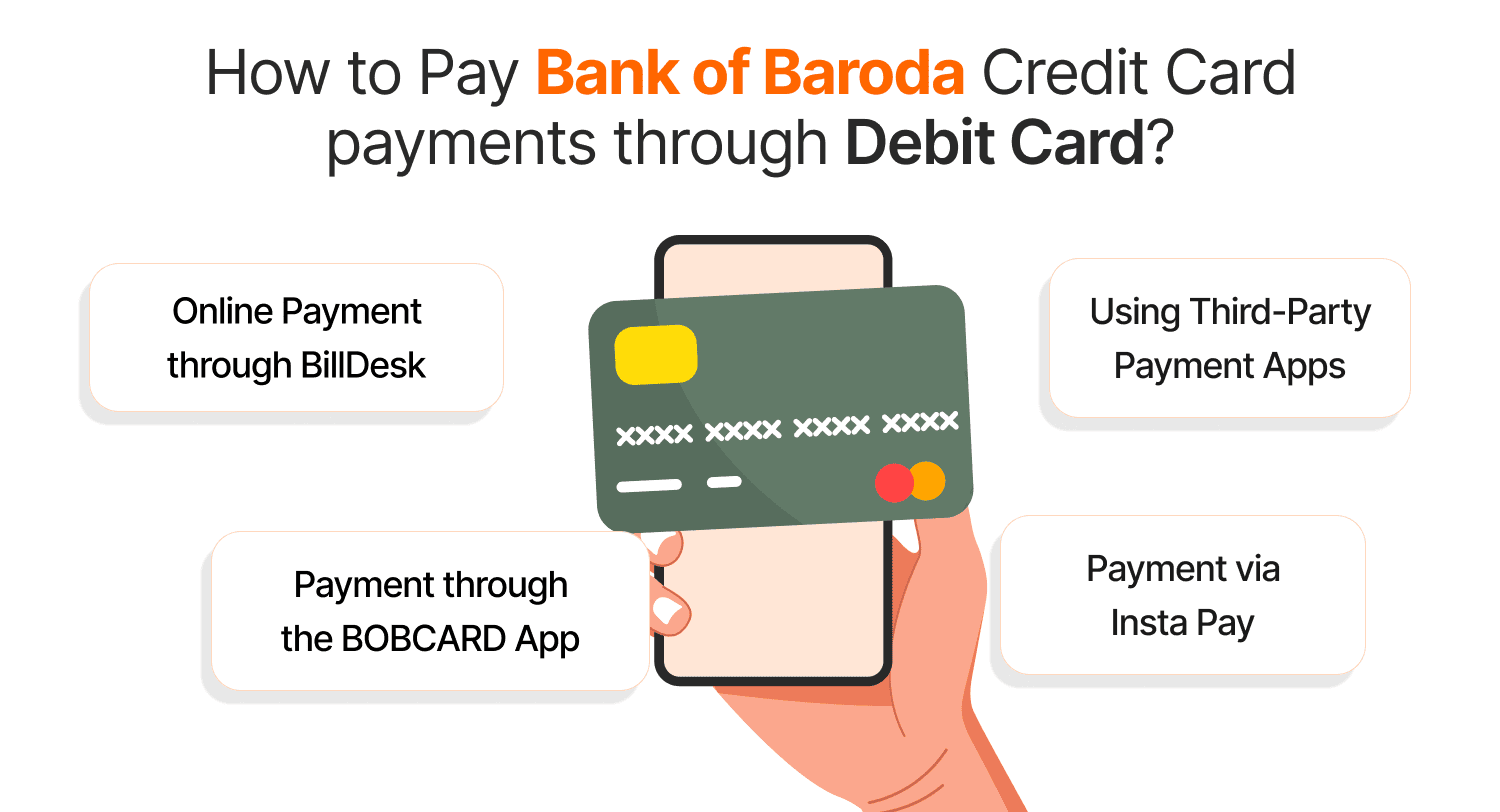

How to Pay Bank of Baroda Credit Card payments through Debit Card?

1. Online Payment through BillDesk

The BillDesk portal provides a secure platform for making credit card payments using your debit card:

- Visit the official BOB BillDesk portal

- Select Bank of Baroda Credit Card

- Enter your credit card details and payment amount

- Choose the debit card option for payment

- Enter your debit card details and complete the transaction

2. Payment through the BOBCARD App

You will get a seamless user experience for managing your credit card payments through the BOBCARD mobile app.

- Log in to the BOBCARD app

- Navigate to the “Pay Card Bills” section

- Enter the payment amount

- Select debit card as your payment method

- Enter your debit card details and complete the payment

3. Payment via Insta Pay

Bank of Baroda’s Insta Pay service allows you to make quick payments without logging into the BOB portal:

- Visit the Insta Pay page

- Enter your 16-digit credit card number and verification code

- Confirm your name as it shows up on the card

- Enter the payment amount, mobile number, and email address

- Choose your preferred bank

- Choose debit card as the payment mode and complete the transaction

4. Using Third-Party Payment Apps

You can also use third-party payment apps like Paytm to pay your Bank of Baroda credit card bill:

- Log in to your payment app

- Navigate to the “Credit Card Bill Payment” section

- Select Bank of Baroda as the card issuer

- Enter your credit card number and payment amount

- Choose debit card as your payment method

- Complete the transaction.

Processing Times for Debit Card Payments

When paying your Bank of Baroda credit card bill using a debit card, processing times vary depending on the platform used:

| Payment Method | Processing Time |

|---|---|

BillDesk | Up to 3 days |

BOBCARD App | Up to 2 days |

Insta Pay | Up to 2 days |

Razor Pay (UPI) | Same day |

Razor Pay (Debit Card) | Within 3 working days |

How do Timely Credit Card Payments Affect Your CIBIL Score?

Making your Bank of Baroda credit card payments on or before the due date with your debit card can significantly impact your CIBIL score:

Positive Impacts:

- Improved Payment History : Timely payments contribute to a positive payment history, which accounts for 35% of your CIBIL score.

- Lower Credit Utilization Ratio : Paying your bills on time helps maintain a lower credit utilization ratio, which is another important factor in determining your credit score.

- Better Credit Report : Regular payments through debit card create a consistent digital trail of responsible credit behavior.

Negative Impacts of Late Payments:

- Reduced CIBIL Score : Late payments can negatively impact your CIBIL score, making it difficult to secure loans in the future.

- Higher Interest Rates : Financial institutions may charge higher interest rates on future credit products if you have a history of late payments.

- Limited Credit Opportunities : A poor credit score due to late payments may limit your ability to access premium credit cards and favorable loan terms.

Tips for Effective Credit Card Management

To maximize the benefits of using your debit card for Bank of Baroda credit card payments:

- Set Up Payment Reminders : Mark your calendar or set up digital reminders for your payment due dates.

- Pay More Than the Minimum : Whenever possible, pay more than the minimum amount due to reduce interest charges.

- Verify Transaction Success : Always check if your payment has been successfully processed by logging into the BOBCARD App or Customer website.

- Keep Track of Payment Processing Times : Be aware of the processing times for different payment methods to avoid late fees.

- Maintain Sufficient Balance : Ensure that the account linked to your debit card has enough balance to make the credit card bill payment.

Auto-Debit Facility for Future Payments

For even greater convenience, consider setting up an auto-debit facility for your Bank of Baroda credit card payments:

- Download the Auto Debit form from the Bank of Baroda website

- Fill in the required details

- Furnish the form at the nearest branch of Bank of Baroda

- Choose either option- Minimum amount due or full payment

Troubleshooting Common Issues for Bank of Baroda credit card payments through debit card

Payment Failure

If your debit card payment fails:

- Check if you have sufficient balance in your account

- Verify if your debit card is active and not expired

- Ensure you’ve entered the correct card details

- Contact your bank if the issue persists

Payment Verification

To verify if your payment has been processed:

- Log in to the BOBCARD App or Customer website

- Go to the “TRANSACTIONS” tab

- In the top right corner, Click on “VIEW ALL”

- Check the “UNSETTLED” tab for recent transactions.

Conclusion

Making your Bank of Baroda credit card payments through debit card offers a convenient, secure, and efficient way to manage your credit card payments . By understanding the various payment options, processing times, and the impact on your CIBIL score, you can make informed decisions about your credit card management strategy.

Regular and timely payments not only help you avoid late fees and interest charges but also contribute significantly to building a strong credit profile. Make the most of the digital payment infrastructure offered by Bank of Baroda to simplify your credit card payment process and maintain excellent financial health.

Remember, a good credit score opens doors to better financial opportunities in the future, and proper management of your Bank of Baroda credit card payments through debit card is a step in the right direction.

Frequently Asked Questions (FAQs)