Bank of Baroda Credit Card Payments through NEFT

Last Updated : May 20, 2025, 1:19 p.m.

In today’s digital banking landscape, managing credit card payments efficiently is crucial for maintaining financial discipline and a healthy credit profile. Bank of Baroda (BoB) offers multiple convenient methods for credit card bill payments, with National Electronic Funds Transfer (NEFT) emerging as one of the most reliable options for customers who prefer to pay from accounts in other banks. This comprehensive guide explores everything you need to know about making Bank of Baroda Credit Card payments through NEFT, along with valuable insights on improving your CIBIL score through responsible credit card usage.

Understanding NEFT for Credit Card Payments

What is NEFT?

National Electronic Funds Transfer (NEFT) is a countrywide payment system that allows for one-to-one transfer of funds. Unlike UPI which has transaction limits, NEFT allows for larger transaction amounts, making it ideal for credit card payments of any size. The system operates in hourly batches, ensuring your payment reaches your credit card account in a timely manner.

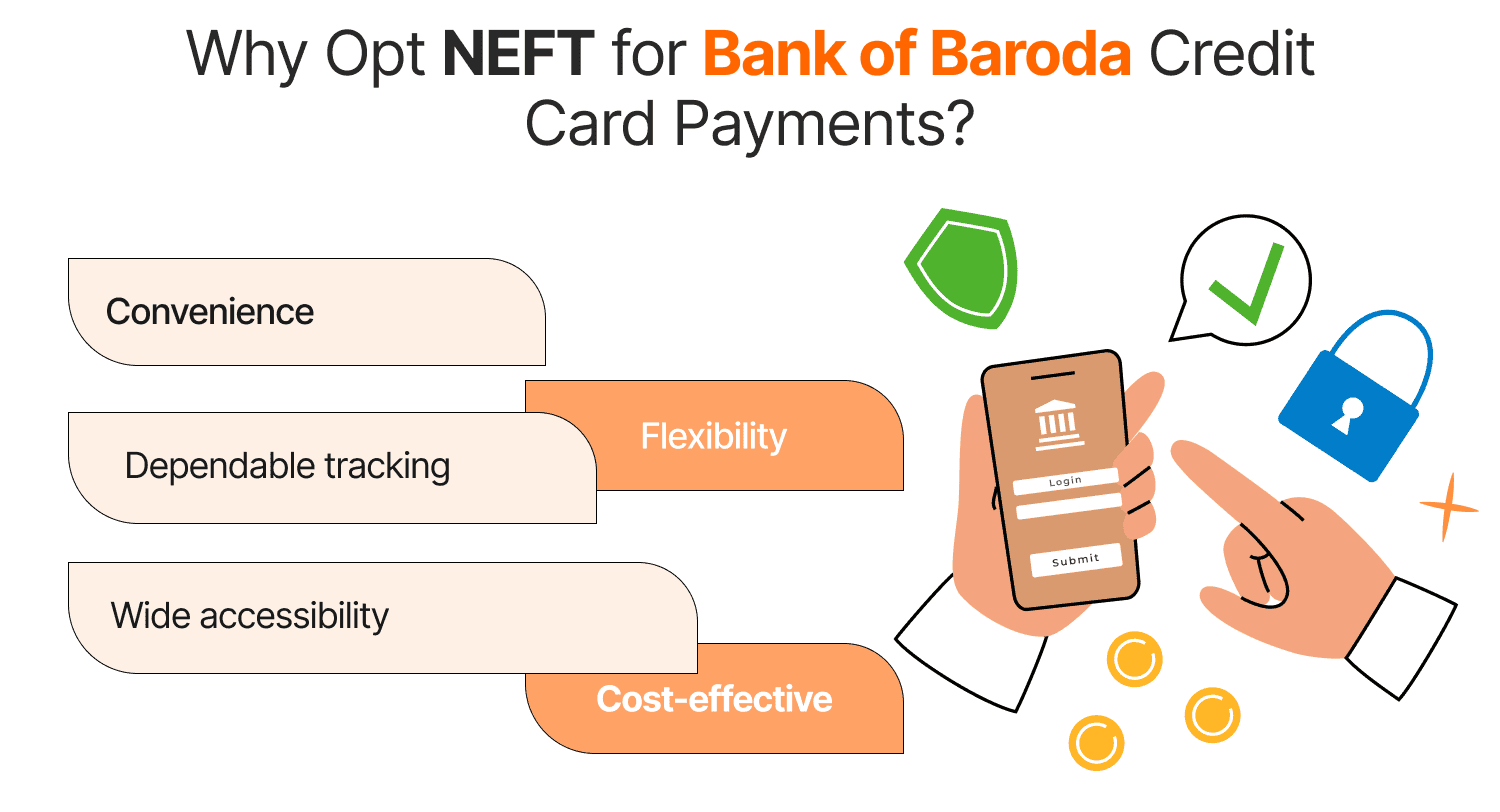

Why Opt NEFT for Bank of Baroda Credit Card Payments?

- Convenience : Make payments from any bank account without visiting a branch

- Flexibility : Transfer any amount based on your repayment capacity

- Wide accessibility : Almost all banks in India offer NEFT services

- Dependable tracking : Each transaction has a unique reference number for easy tracking

- Cost-effective : Minimal or zero charges for NEFT transactions (varies by bank)

Step-by-Step Guide to Bank of Baroda Credit Card Payments through NEFT

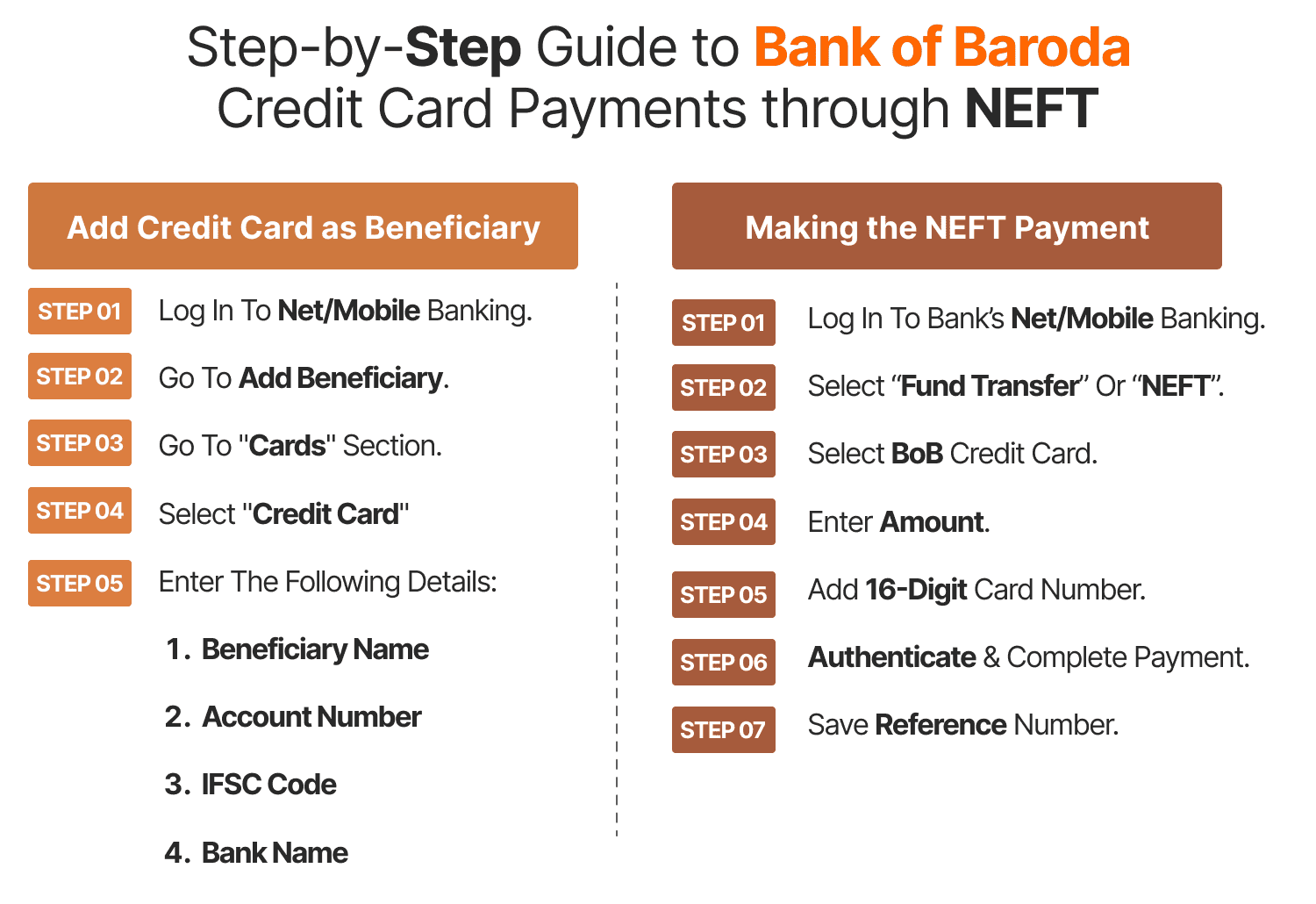

Adding Your Credit Card as a Beneficiary

- Log in to your bank’s netbanking portal or mobile banking using your credentials (Any bank Excluding BoB)

- Go to the section named “Add Beneficiary” or “Manage Payees”

- Select “Credit Card Payment” or “Other Bank Accounts” as the beneficiary type

- Enter the following details:

- Beneficiary Name : Your full name as it appears on the credit card

- Account Number : Your 16-digit Bank of Baroda credit card number

- IFSC Code : BARB0COLABA (note: the fifth character is zero, not the letter O)

- Bank Name : Bank of Baroda

- Save the beneficiary and complete any confirmation process needed by your bank

Making the NEFT Payment

- Log in to your bank’s internet banking portal or mobile banking

- Select “Fund Transfer” or “NEFT”

- From the beneficiary list, pick your saved Bank of Baroda credit card

- Key in the payment amount you want to pay (Minimum due, complete amount, or tailor made amount)

- In the remarks section, mention your 16-digit credit card number for faster processing

- Complete the transaction using your bank’s authentication method (OTP, transaction password)

- Save the confirmation/reference number for future reference

Processing Time for NEFT Payments

According to Bank of Baroda’s latest guidelines (2025), Bank of Baroda credit card payments through NEFT typically reflect within 24-48 hours. However, processing times may vary based on:

- Time of transaction (payments made before 8 PM usually process faster)

- Working days vs. holidays

- System maintenance schedules.

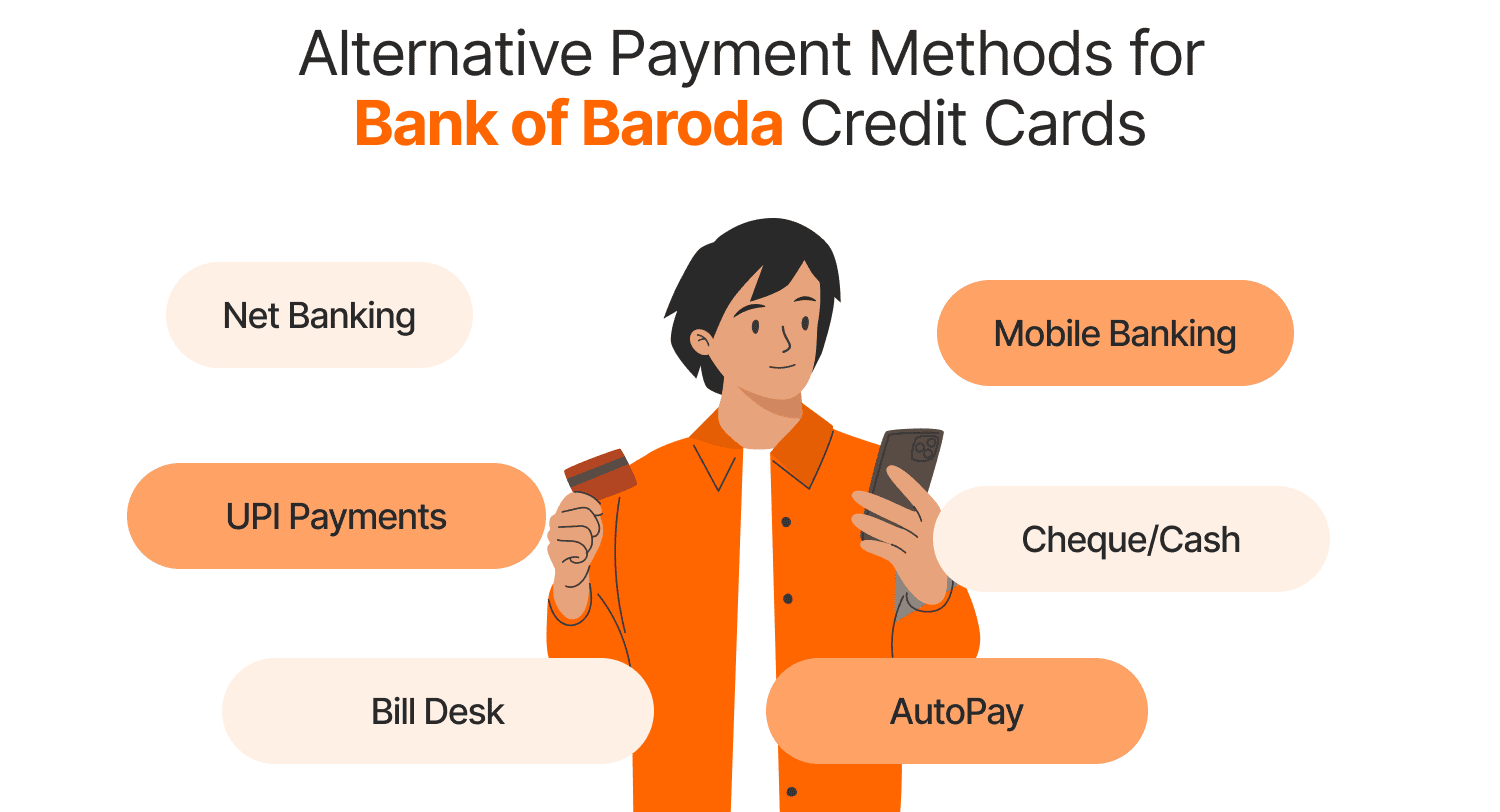

Alternative Payment Methods for Bank of Baroda Credit Cards

While NEFT is highly efficient, Bank of Baroda offers multiple payment channels to suit different customer preferences:

- Net Banking : Direct payment through Bank of Baroda’s net banking portal

- Mobile Banking : Using the Bob World app for quick, on-the-go payments

- UPI Payments : Via Bob e-Pay or third-party UPI apps

- AutoPay : Setting up standing instructions for automatic payments

- BillDesk : For non-Bank of Baroda account holders

- Cheque/Cash : Traditional payment methods at branches.

Improving Your CIBIL Score Through Credit Card Usage

Your credit card payment behavior significantly impacts your CIBIL score, which in turn affects your future loan eligibility and interest rates. Here are expert tips to boost your score:

Timely Payments and CIBIL Impact

- Always pay before the due date : Late payments can reduce your score by 50-100 points

- Set up payment reminders : Use calendar alerts or banking notifications

- Consider auto-payment : Set up auto-debit instructions for at least the minimum amount due

- Verify payment history : Monitor your payment status regularly through the Bob World app

Optimal Credit Utilization

- Maintain utilization below 30% : Maintain your expenditures within 30% of your credit limit

- Request for an increase in credit limit : A larger limit when spending is used for the same purpose enhances your utilization ratio.

- Distribute expenses : If you have multiple cards, spread purchases to keep credit utilization of every individual low

Long-term Credit Health Strategies

- Avoid multiple applications : Each credit inquiry can temporarily cause a dip in your score

- Maintain older accounts : Credit history length has a favorable impact on your score.

- Diversify credit mix : Having both credit cards and loans (managed responsibly) can improve score

- Regular monitoring : Check your CIBIL score quarterly to track improvements.

Unique Features and Benefits of Bank of Baroda Credit Cards

Bank of Baroda offers a varied portfolio of credit cards designed to cater to various customer segments and lifestyles:

Reward Programs

- BoB Rewardz : Earn points on every transaction, redeemable through the dedicated rewards portal

- Accelerated rewards : Select categories offer 2x-5x points based on card type

- Anniversary bonus : Premium cards provide bonus points on card anniversary

Insurance and Protection

- Purchase protection : Coverage against damage or theft of purchased items

- Travel insurance : Complimentary coverage on premium travel cards

- Fraud liability cover : Zero liability on unauthorized transactions reported within 24 hours

Lifestyle Benefits

- Airport lounge access : Complimentary visits to domestic and international lounges

- Golf privileges : Free rounds and discounted green fees at partner courses

- Dining programs : Discounts at partner restaurants and exclusive dining experiences

- Entertainment perks : Movie ticket discounts and priority booking for events.

Troubleshooting Bank of Baroda Credit Card Payments through NEFT

Common Issues and Solutions

- Payment not reflecting

- Allow 48 hours for processing before contacting customer service

- Keep transaction reference number handy for quicker resolution

- Check for any typographical mistakes in the card number during beneficiary registration

- Transaction declined

- Verify sufficient balance in your account

- Ensure the beneficiary details are correct

- Check if your bank has any NEFT transaction limits

- Wrong amount transferred

- If you’ve paid more than intended, the excess amount remains as credit in your card

- If you’ve paid less than the minimum due, make an additional payment immediately to prevent late fees

Customer Support Channels

- 24/7 Helpline : 1800-XXX-XXXX (Toll-free)

- Email Support : creditcards@bankofbaroda.com

- Branch Assistance : Visit any Bank of Baroda branch with your credit card and payment details.

Conclusion

Bank of Baroda Credit Card payments through NEFT is a seamless, secure, and efficient mode to manage your credit card bills, especially for customers who maintain accounts with other banks. Following the steps given above enables timely payments, thus helping you maintain and enhance your CIBIL score. Remember that consistent, timely payments not only help maintain a good credit score but also enable you to fully enjoy the benefits and rewards that come with your Bank of Baroda credit card. Whether you’re a new cardholder or an existing customer looking to optimize your payment process, NEFT offers a reliable solution that balances convenience with control over your finances.

Frequently Asked Questions (FAQs)