Bank of Baroda Credit Card Payments through UPI

Last Updated : May 20, 2025, 12:57 p.m.

In today’s digital banking landscape, the integration of Unified Payment Interface (UPI) with credit card payments has revolutionized how customers manage their finances. Bank of Baroda, one of India’s leading public sector banks, has been at the forefront of this technological advancement by enabling credit card payments through UPI. This comprehensive guide explores the process, benefits, features, and impact of Bank of Baroda Credit Card Payments through UPI on customer experience and financial management.

Understanding Bank of Baroda Credit Card Payments through UPI

What is UPI Integration with Credit Cards?

The Reserve Bank of India (RBI) enabled the linking of RuPay credit cards with UPI platforms to expand digital payment options for consumers. Bank of Baroda, leveraging this regulatory change, has implemented a seamless system for customers to make credit card payments using UPI, significantly enhancing convenience and transaction speed.

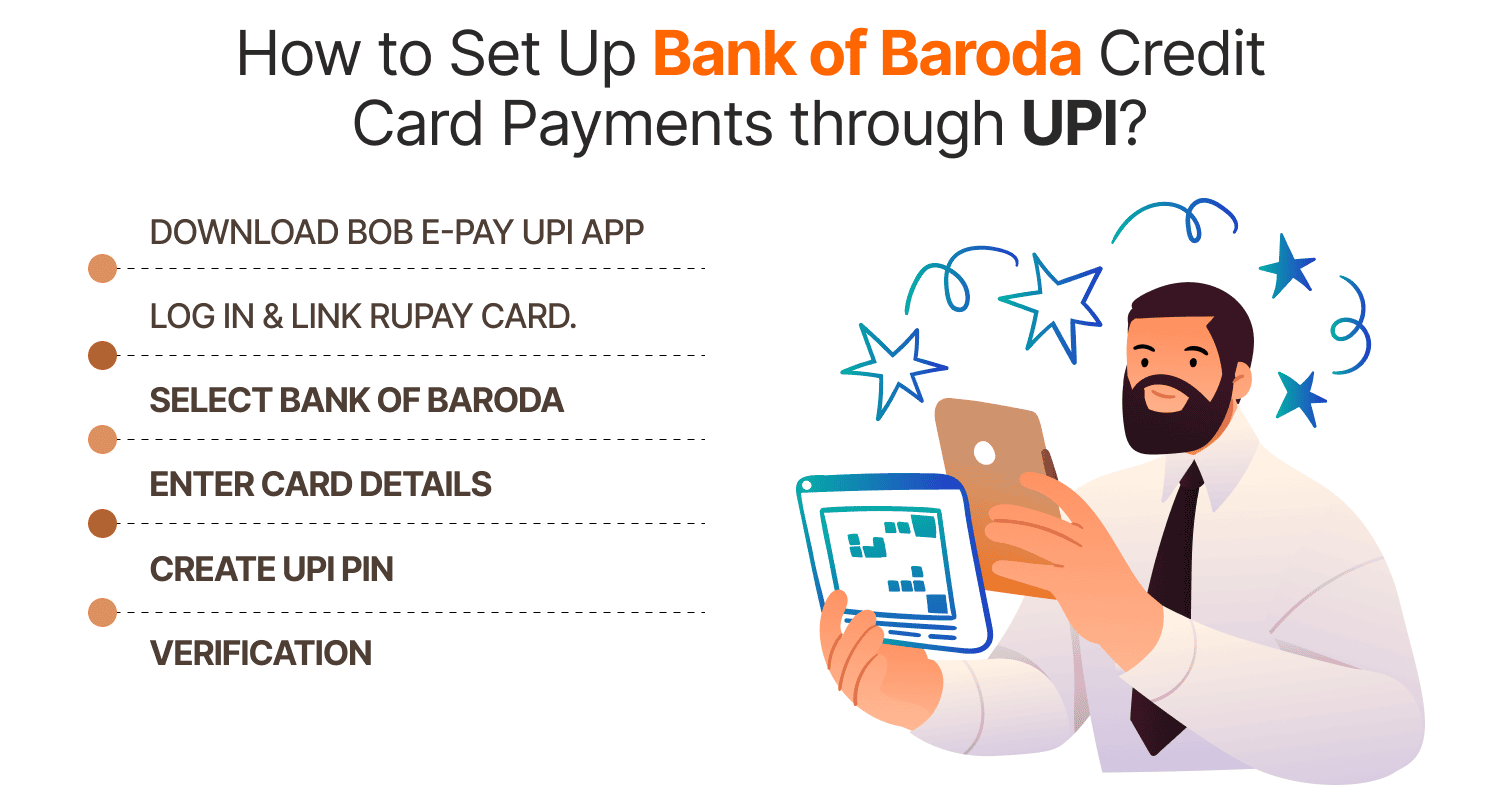

How to Set Up Bank of Baroda Credit Card Payments through UPI?

Linking Your Bank of Baroda Credit Card with UPI

- Download Bob e-Pay UPI App : Bank of Baroda’s dedicated UPI application

- Log in and Select “Link RuPay Credit Card” : Navigate to the credit card linking section

- Select Bank of Baroda : Choose from the list of available banks

- Enter Card Details : Provide the last six digits of your credit card and the expiry date

- Create UPI PIN : Set up a security PIN for authenticating transactions

- Verification : Complete the process of verification via the OTP sent to your registered mobile number

Once linked, your Bank of Baroda credit card becomes available as a payment option on your UPI app, enabling quick and secure transactions.

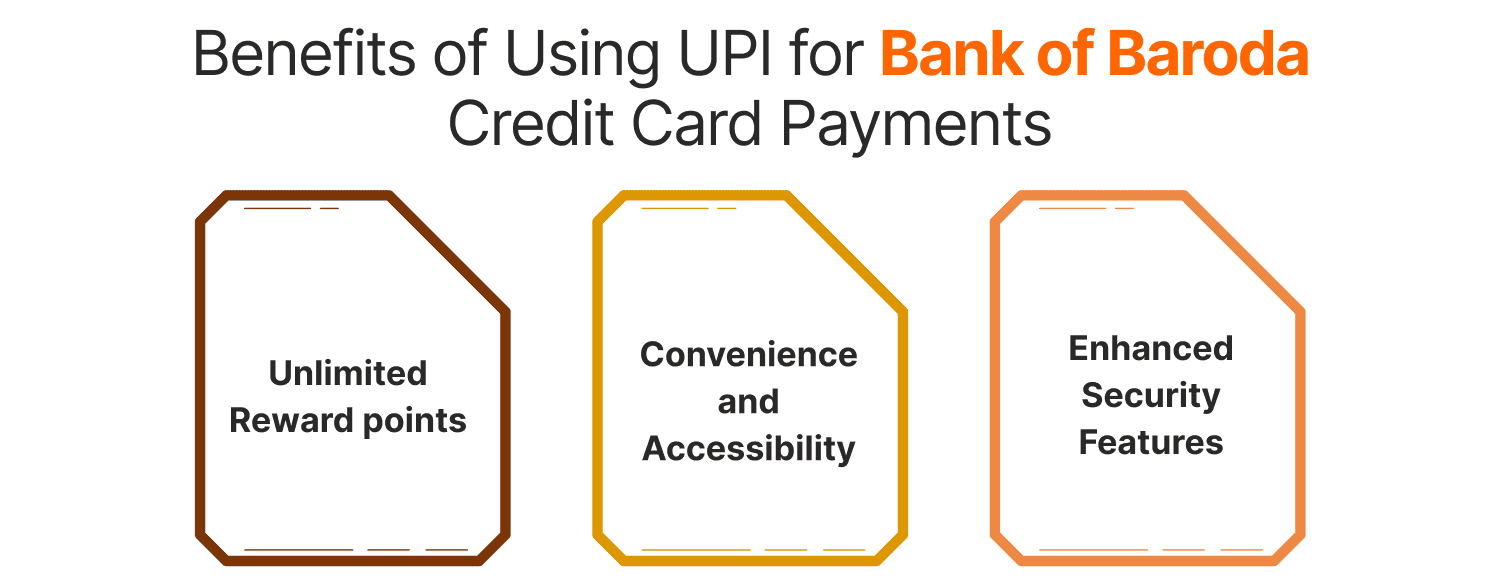

Benefits of Using UPI for Bank of Baroda Credit Card Payments

Unlimited Reward points

As of January 1, 2025, Bank of Baroda has removed the capping on reward points earned through UPI transactions. Previously limited to 500 reward points per statement cycle, cardholders can now earn unlimited reward points when using their credit cards for UPI payments. This significant enhancement rewards frequent users and encourages digital transactions.

Convenience and Accessibility

UPI integration offers unparalleled convenience:

- 24/7 Payment Access : Make payments anytime, anywhere

- Quick Transaction Processing : Payments are processed almost instantly

- No Physical Card Required : Eliminate the need to carry your physical credit card

- Simplified User Experience : Easy-to-navigate interface requires minimal technical knowledge

- Multiple Device Compatibility : Access from smartphones, tablets, or other compatible devices.

Enhanced Security Features

Bank of Baroda prioritizes security for UPI credit card transactions via:

- Two-Factor Authentication : Ensures only authorized users can make payments

- End-to-End Encryption : Protects data from unauthorized access

- UPI PIN Protection : Unique PIN required for each transaction

- Immediate Transaction Alerts : Instant notifications for all transactions

- Fraud Detection Systems : Advanced algorithms to detect unusual activities.

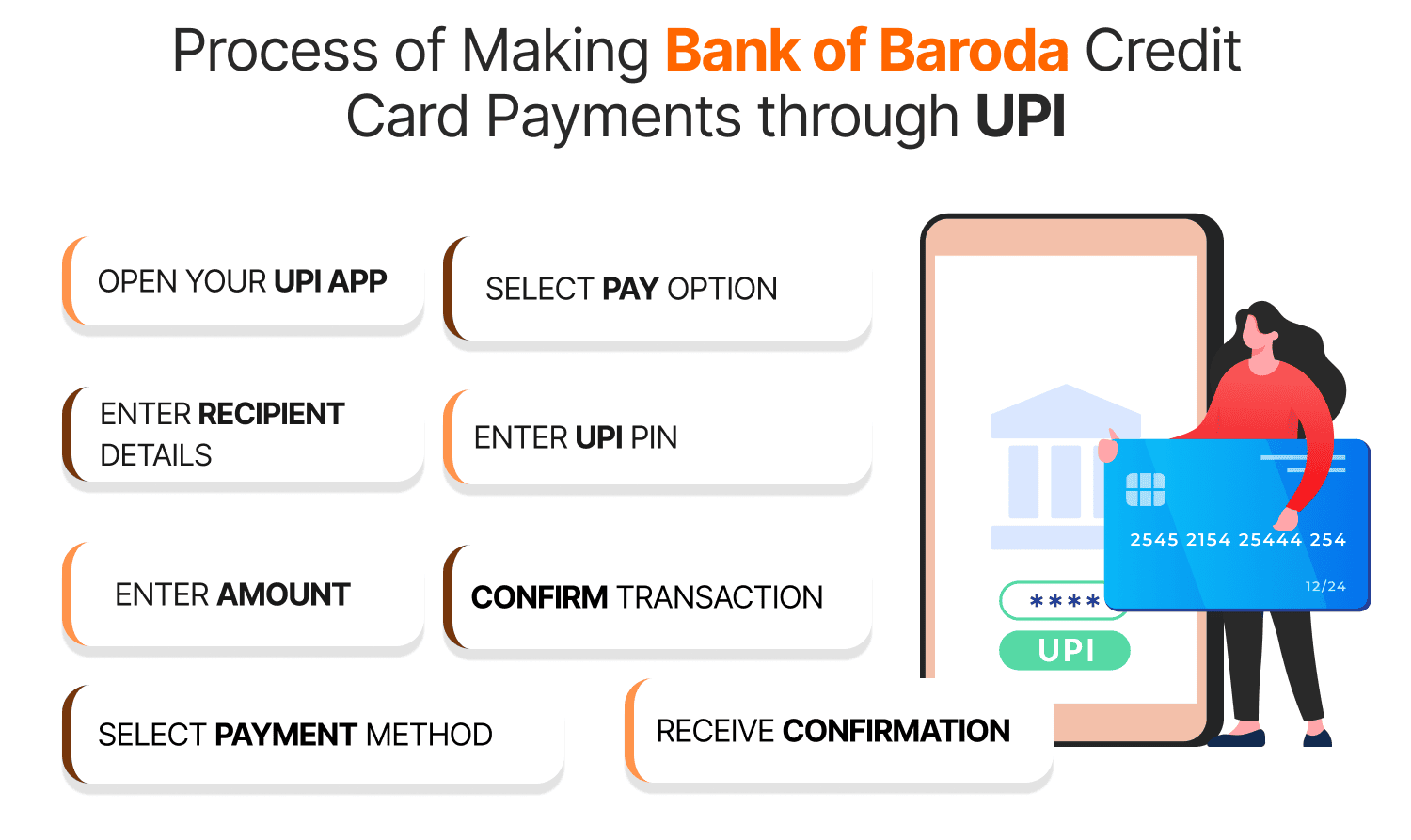

Process of Making Bank of Baroda Credit Card Payments through UPI

Step-by-Step Guide

- Open Your UPI App : Launch Bob e-Pay or any UPI-enabled payment app

- Select Pay Option : Choose the payment option in the app

- Enter Recipient Details : Input the UPI ID or scan the QR code of the recipient

- Select Payment Method : Choose your linked Bank of Baroda credit card as the payment source

- Enter Amount : Specify the payment amount

- Confirm Transaction : Monitor the details and confirm the payment

- Enter UPI PIN : Authenticate the transaction with your UPI PIN

- Receive Confirmation : Get instant confirmation of the successful payment.

Merchant Payments vs. Peer-to-Peer Transfers

It’s important to note that while Bank of Baroda allows credit card payments to merchants through UPI, peer-to-peer money transfers using credit cards via UPI may have restrictions or additional charges. Always check the latest terms and conditions before making such transactions.

Impact on CIBIL Score and Credit Management

Building Credit History through UPI Payments

Regular and timely payments of your Bank of Baroda credit card bills through UPI can positively impact your CIBIL score . Here’s how:

- Payment Timeliness : On-time payments contribute positively to your credit score

- Credit Utilization : Monitoring and managing your credit utilization becomes easier with instant payment options

- Transaction Record : Maintains a clear digital record of all payments for better financial management.

Tips to Improve CIBIL Score Using Credit Cards

- Pay Full Outstanding Amount : Avoid carrying a balance by paying the full amount due

- Meet Payment Deadlines : Set up payment reminders or auto-payments through UPI

- Maintain Low Credit Utilization : Keep credit usage below 30% of your total limit

- Regular Checking : Verify your credit card statements and CIBIL report periodically

- Strategic Credit Use : Use your credit card for planned expenses, which you can repay easily and surely.

Bank of Baroda Credit Cards: Unique Features and Benefits

Bank of Baroda offers a diverse range of credit cards catering to different customer segments. When linked with UPI, these cards provide enhanced value:

Premium Card Options

- Eterna : Unrestricted domestic lounge access with quarterly expenditures of Rs. 40,000

- Tiara : Premium lifestyle benefits with travel and dining privileges

- Varunah Premium : Exclusive rewards and premium services for high-value customers

Specialized and Co-branded Cards

- HPCL Energie : Fuel surcharge waiver and accelerated reward points on fuel transactions

- Corporate : Business-focused benefits with expense management features

- Professional Cards (ICAI, ICMAI, ICSI): Tailored benefits for professional bodies’ members

Core Benefits Across All Cards

- Reward Programs : Accelerated points on specific spending categories

- Insurance Coverage : Purchase protection and travel insurance

- EMI Conversion : Flexibility to convert large purchases into easy monthly installments

- Global Acceptance : Worldwide recognition at merchant establishments.

Troubleshooting Common Issues with UPI Credit Card Payments

Technical Challenges and Solutions

- Transaction Failures : Ensure stable internet connection and sufficient credit limit

- App Functionality Issues : Keep your UPI app upgraded to the latest version

- Card Linking Problems : Verify card eligibility and contact customer support if issues persist

- Payment Delays : Allow processing time and check for confirmation before retrying

Customer Support Channels

Bank of Baroda offers several support options for UPI credit card payment issues:

- 24/7 Helpline : Dedicated credit card customer service

- In-App Support : Direct assistance through the Bob e-Pay application

- Email Support : Documented communication for complex issues

- Branch Assistance : In-person help at any Bank of Baroda branch.

What is the Future of UPI and Credit Card Integration at Bank of Baroda?

Upcoming Enhancements

Based on current industry trends and Bank of Baroda’s innovation trajectory, customers can expect:

- Expanded Card Compatibility : More credit card variants becoming eligible for UPI linkage

- Enhanced Reward Structures : Additional benefits for UPI-based credit card transactions

- Advanced Security Protocols : Further strengthening of authentication and verification processes

- Cross-Platform Integration : Seamless functionality across multiple payment platforms.

Conclusion

Bank of Baroda Credit Card Payments through UPI represents a significant advancement in digital banking, combining the convenience of UPI with the benefits of credit card usage. By removing reward points capping on UPI transactions and offering a user-friendly interface, Bank of Baroda has positioned itself as a leader in digital payment innovation.

For customers looking to optimize their financial management, improve their CIBIL score , and enhance their banking experience, utilizing UPI for credit card payments offers a compelling solution. As digital payment systems continue to evolve, Bank of Baroda’s commitment to technological integration ensures customers receive the most advanced, secure, and convenient banking services available.

By making timely payments through UPI and using credit cards responsibly, customers can build a healthy credit profile while enjoying the rewards and benefits offered by Bank of Baroda’s diverse credit card portfolio.

Disclaimer: The information provided is based on Bank of Baroda policies as of May 2025. Features, benefits, and processes may change. Please refer to the official Bank of Baroda website or contact customer service for the most current information.

Frequently Asked Questions (FAQs)