Why Should I Read My Credit Card Statement?

Last Updated : May 29, 2021, 2:51 p.m.

Credit card activities, if not checked regularly, can make you miss out on the opportunity to shop with reward points earned. At the same time, there can be erroneous transaction entries made to inflate the bill. The wrong entries can have a multiplier effect by raising the bill amount much higher than warranted. Plus, if the payment is made partly, the misery will mount further. The interest charged on the revolving credit due to part payment only raises the bill amount as shown on the statement. A regular glance at the statement is thus vital to get a track of your card shopping. So, stay unplugged with the article deliberating on the importance of several elements that make a credit card statement.

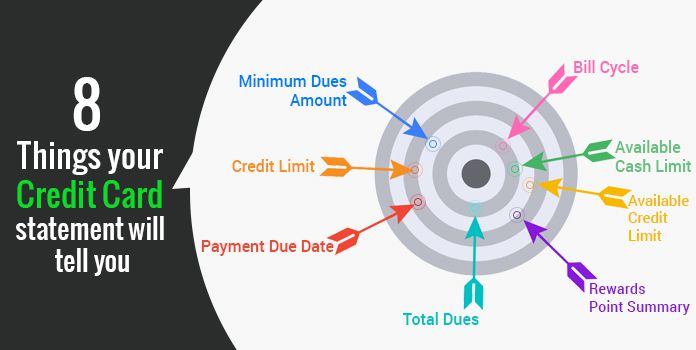

Constituents of a Credit Card Statement

The statement issued by a bank or any other financial institution can include the following elements in the horizontal order.

Credit Card Number and Cardholder Name – Both card number and name of the cardholder are stated in the very beginning. The card invariably comes with a 16-digit number, with only the initial and last four being shown. The rest in between would be viewed as XXXX XXXX. The number appears that way for security purposes.

Statement Date – It comes next to the vision. There would be a specific date mentioned in DD/MM/YY format.

Payment Due Date – Invariably, the due date of payment comes 20 days post the generation of the statement. The payment must be made on or before the due date to avoid late payment charges, interest as well as taxes in the next billing cycle.

Credit Limit – The limit denotes the total amount of credit that can be utilized for retail spends. You can shop for any of the needs, be it travel, fuel, grocery and get discounts and cashback as applicable. An interest-free credit period of 20-50 days can be provided by the card issuer from the date of retail purchase.

Ensure to keep a credit limit utilization of around 30% and not above to be able to pay off the dues with comfort while maintaining a strong credit score as sought by the lenders to approve a loan or any other credit application you make in the future.

Available Credit Limit – The amount left after spending on the card is termed as an available credit limit. It can increase with a regular payment of the card dues .

Available Cash Limit – This represents the amount of cash you can withdraw from the card via ATMs. But there’s a word of caution here. And that is either to avoid withdrawing cash or doing it very little. If you have a habit of withdrawing cash from the ATM on a regular basis, chances of statement with inflated bills become all the more prominent. Unlike in the case of a retail spend where a customer is entitled to an interest-free credit period of 20-50 days, availing cash limit can raise interest on the transaction amount from the moment you withdraw the cash from the ATM, making it an expensive affair.

Record of Transactions – This will have a complete detail of the shopping made in a billing cycle. It will have a date-by-date schedule of the transactions made via the card. It will show the number of transactions, as well as interest & taxes if applicable.

Total Dues – It is a combination of the credit amount availed in a billing cycle plus interest and tax charges, if any. The dues would also include the EMIs, including interest, running in for a retail purchase made before or much before the particular billing cycle.

Minimum Amount Due – The amount is calculated at about 5% of the outstanding balance in a particular billing cycle. This would most likely be an amount affordable to pay but would prove costly in the long run. By paying the minimum due , you are allowing the credit to revolve and adding the virus of interest to the card dues month-on-month. Along with the purchases made, the minimum due would only enlarge and make it a daunting task for you to overcome the debt trap.

Reward Points Summary – You must very well know that a card spend fetches rewards at the applicable rate. The summary would show the opening balance of the reward points earned till the previous billing cycle plus the points earned and adjusted this cycle to arrive at the total points that can be redeemed for shopping at online or offline stores. Most cards allow redemption for a maximum of 2 years from the accumulation of reward points.

How to Get a Credit Card Statement?

The card issuer can send the statement to your e-mail ID on a monthly basis. The statement may be password protected and so you need to type the credentials as per the instructions being shown on the e-mail. Besides, you can check the statement via net banking by navigating to the credit card section and then on to view statement.