HDFC Credit Card Late Payment Charges

Last Updated : June 11, 2025, 4:24 p.m.

Managing your credit card payments effectively is essential for maintaining financial health and a strong credit score. HDFC Bank, one of India’s leading private sector banks, offers a variety of HDFC credit cards tailored to different needs, from shopping to travel. However, failing to pay on time can lead to Late Payment Charges, along with other fees like cash withdrawal and forex charges. These charges can add up quickly, impacting your finances and CIBIL score . This article provides a detailed guide to HDFC Credit Card Late Payment Charges, covering what they are, when they’re charged, related fees, and their impact on your credit profile. We also share practical tips to ensure timely HDFC credit card payments and avoid unnecessary costs, based on the latest information as of June 2025.

What are HDFC Credit Card Late Payment Charges?

HDFC Credit Card Late Payment Charges are fees imposed when you fail to pay at least the minimum amount due on your credit card bill by the due date. These late payment fees encourage timely payments and compensate the bank for the risk of delayed repayments. As of August 1, 2024, HDFC Bank has updated its late payment fee structure, which is tiered based on the outstanding balance. The following table outlines the charges:

| Outstanding Amount Slab | Late Payment Fee (Rs.) |

|---|---|

≤ ₹100 | Nil |

₹101 - ₹500 | ₹100 |

₹501 - ₹1,000 | ₹500 |

₹1,001 - ₹5,000 | ₹600 |

₹5,001 - ₹10,000 | ₹750 |

₹10,001 - ₹25,000 | ₹900 |

₹25,001 - ₹50,000 | ₹1,100 |

> ₹50,000 | ₹1,300 |

These late payment fees are subject to Goods and Services Tax (GST) as per government regulations. Notably, these charges do not apply to Pixel Credit Cards, and for commercial credit cards, only the Rental Transaction Charge is applicable. HDFC credit card late fees are not just a financial penalty; they can signal to the bank that you may be a higher-risk borrower, potentially affecting your credit limit or interest rates.

When are HDFC Credit Card Late Fees Charged?

HDFC Bank imposes HDFC credit card late payment charges when you do not pay the minimum amount outstanding—Typically 5% of the statement balance - By the due date mentioned on your credit card bill. The due date is clearly mentioned in your monthly statement, accessible via the HDFC Bank mobile app or netbanking. If the minimum payment is not made by this date, the late fee is automatically applied based on the outstanding balance, as shown in the table above. HDFC Bank may offer a short grace period (typically a few days) before reporting a late payment to credit bureaus like CIBIL, but the late fee is charged immediately after the due date passes. It’s critical to check your due date regularly, as missing it even by a day can trigger these charges and additional interest on the unpaid balance, impacting your HDFC credit card payments management.

HDFC Credit Card Withdrawal Charges

Using your HDFC credit card to withdraw cash from an ATM or other sources incurs cash advance fees. The cash withdrawal fee is typically 2.5% of the withdrawn amount or ₹500, whichever is higher. Additionally, interest is charged on cash advances at a rate of 1.99% to 3.75% per month (23.88% to 45% per annum), depending on the card type. Interest on cash advances starts accruing immediately, with no grace period, making it an expensive option.

For specific cards:

- Premium cards like Infinia, Infinia (Metal Edition), BizBlack Metal Card, H.O.G Diners Club, Diners Black, and Diners Black (Metal Edition) have an interest rate of 1.99% per month (23.88% per annum).

- Other card variants have an interest rate of 3.75% per month (45% per annum).

The following table summarizes the withdrawal charges:

| Charge Type | Details |

|---|---|

Cash Withdrawal Fee | 2.5% of the amount or ₹500, whichever is higher |

Interest Rate | 1.99% to 3.75% monthly (23.88% to 45% p.a.) |

Specific Card Rates | Infinia, Infinia (Metal Edition), etc.: 1.99% p.m. (23.88% p.a.) |

Cash Withdrawal Limit | Up to 40% of the total credit card limit |

For precise details, refer to your card’s terms and conditions on the HDFC Bank website.

HDFC Credit Card Forex Markup Fees

When using your HDFC credit card for overseas transactions or cross-currency purchases, a forex markup fee is levied to cover currency conversion costs. This fee varies based on the type of credit card you possess. The following table summarizes the forex markup fees for different HDFC credit cards as of June 10, 2025:

| Card Type | Forex Markup Fee |

|---|---|

Diners ClubMiles, Signature, Bharat CashBack, Doctor's Superior, Business Bharat CashBack, Freedom Card, Business Freedom Card | 3.5% of the transaction amount |

Regalia, Business Regalia, Doctor's Regalia, Diners Club Premium, Regalia First, Business Regalia First, Infinia, Diners Black | 2% of the transaction amount |

Times Platinum Card, Solitaire, Platinum Edge, MoneyBack, Business MoneyBack, Select, Times Titanium Card, Teacher's Platinum, Business Platinum | 3.5% of the transaction amount |

Diners Club Rewardz | 3% of the transaction amount |

These fees will incur GST, and additional charges may be applied by payment networks like Visa or MasterCard. Cardholders must verify their card type to understand the applicable fee, especially for frequent international travelers.

Also Read: Best Forex Credit Cards in India for 2025

Other HDFC Credit Card Fees

Apart from HDFC credit card late payment charges, cash withdrawal, and forex charges, HDFC credit cards may incur additional fees, based on usage and type of the card. The following table summarizes common fees:

| Fee Type | Details |

|---|---|

Annual Fees | Varies by card; some waived if spending thresholds are met (e.g., ₹50,000/year for MoneyBack+) |

Over-Limit Fees | Charged if credit limit is exceeded; typically ₹500 or a percentage of the over-limit amount |

Balance Transfer Fees | 1.10% of the transferred amount |

Reward Redemption Fees | Rs. 50 for redeeming reward points as statement credits |

Rental Transaction Fees | 1% of the transaction amount, capped at ₹3,000, for rent payments via third-party apps (e.g., CRED, Paytm) |

Fuel Transaction Fees | No fee for transactions under Rs. 15,000; 1% fee, capped at Rs. 3,000, for transactions above Rs. 15,000 |

Utility Transaction Fees | No fee for transactions below ₹50,000; 1% fee, capped at ₹3,000, for transactions above ₹50,000 |

These fees vary by card type, so review your card’s schedule of charges on the HDFC Bank website. For example, lifetime free cards like BizFirst or Tata Neu may have no annual fees but still incur other charges based on usage.

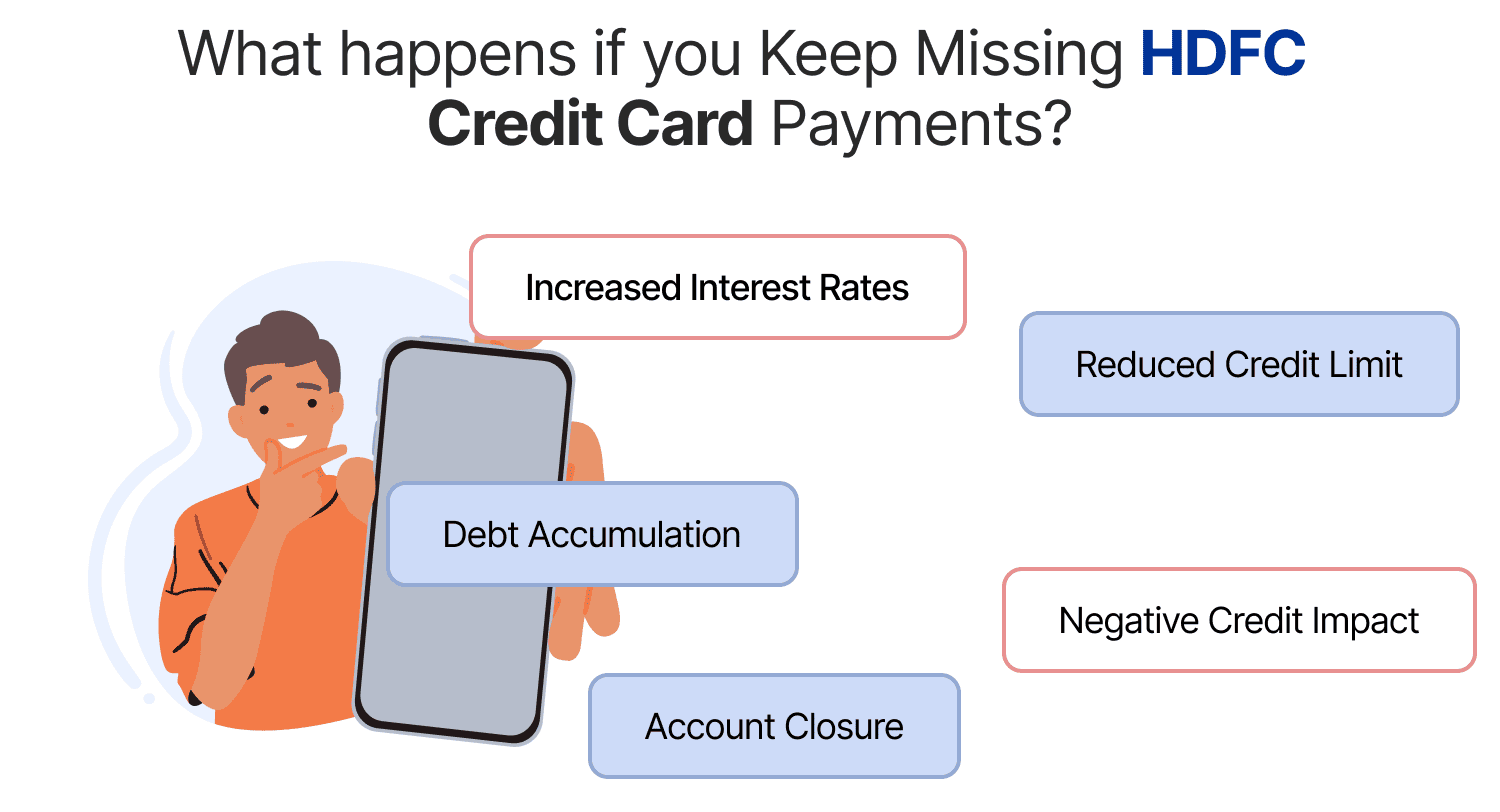

What Happens If You Keep Missing HDFC Card Payments?

Repeatedly missing HDFC credit card payments can lead to serious financial consequences, affecting both your wallet and credit profile:

- Increased Interest Rates : HDFC Bank may raise your interest rate, potentially up to 3.75% per month (45% per annum), increasing the cost of carrying a balance.

- Reduced Credit Limit : Your available credit may be lowered, limiting your spending capacity.

- Debt Accumulation : Unpaid balances accrue high interest. Besides, the bank charges a late payment fee which will get added up to your existing debt. Thus, your debt gets compounded, making repayment harder.

- Negative Credit Impact : Late payments are reported to credit bureaus like CIBIL, lowering your CIBIL score and affecting future loan or card approvals.

- Account Closure : In extreme cases, HDFC Bank may close your account, further damaging your credit profile.

Prompt action, such as paying overdue amounts and contacting HDFC Bank’s customer service, can help mitigate these issues. For support, visit the HDFC Bank contact page.

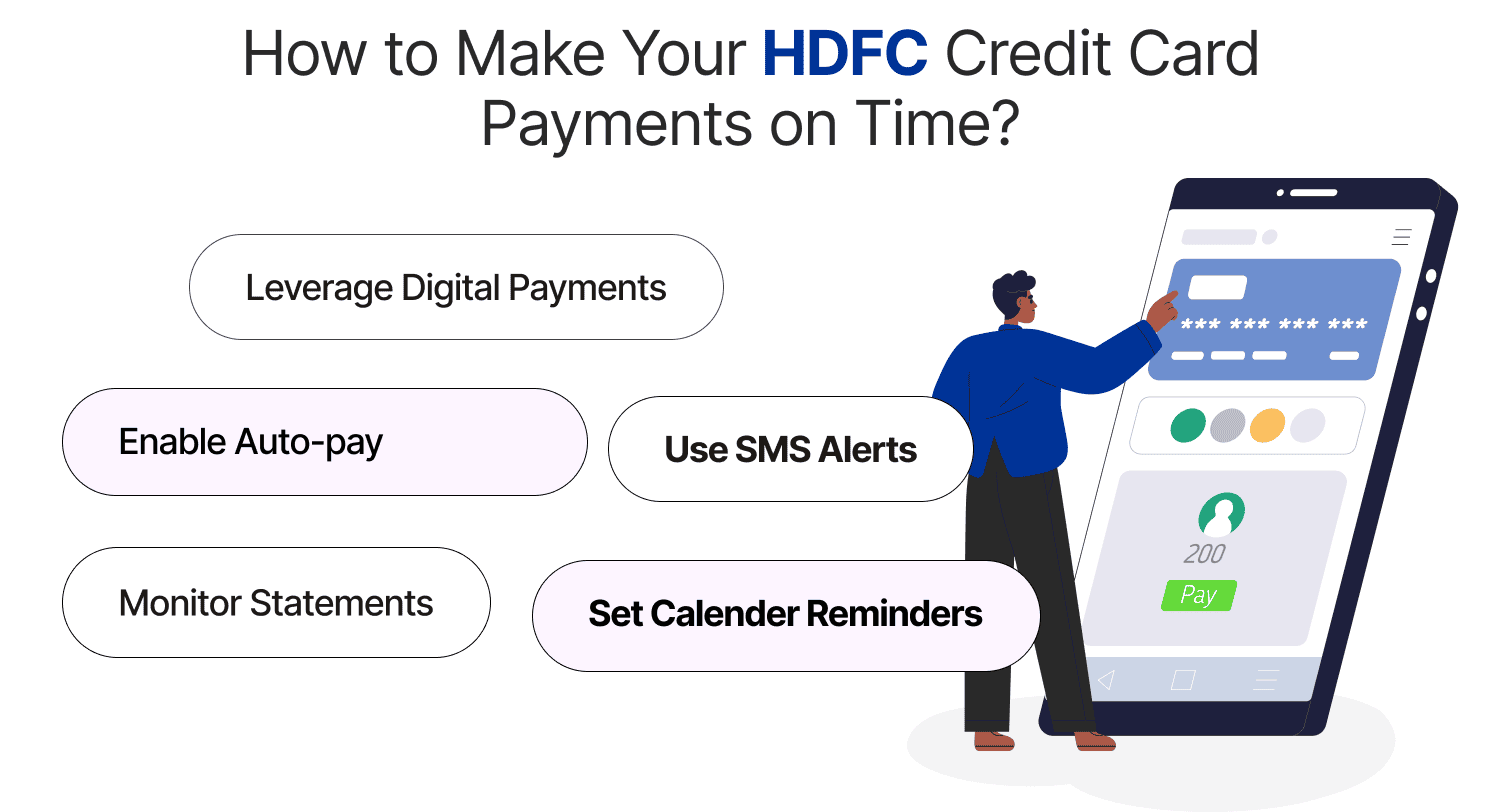

How to Make Your HDFC Credit Card Payments on Time?

Avoiding HDFC Credit Card Late Payment Charges is straightforward with these strategies:

- Set Calendar Reminders: Use your phone or email calendar to track due dates.

- Enable Auto-Pay: Set up automatic payments for the minimum amount or full balance via HDFC’s netbanking or mobile app.

- Monitor Statements: Regularly check your credit card statement through the HDFC Bank mobile app or netbanking.

- Use SMS Alerts: Ensure your contact details are updated to receive payment reminders.

- Pay Early: Make payments a few days before the due date to account for processing delays.

- Leverage Digital Payments: Use UPI, netbanking, or mobile apps for quick and convenient HDFC credit card payments.

These habits can help you stay on top of your payments, avoid HDFC credit card late fees, and maintain a healthy credit profile.

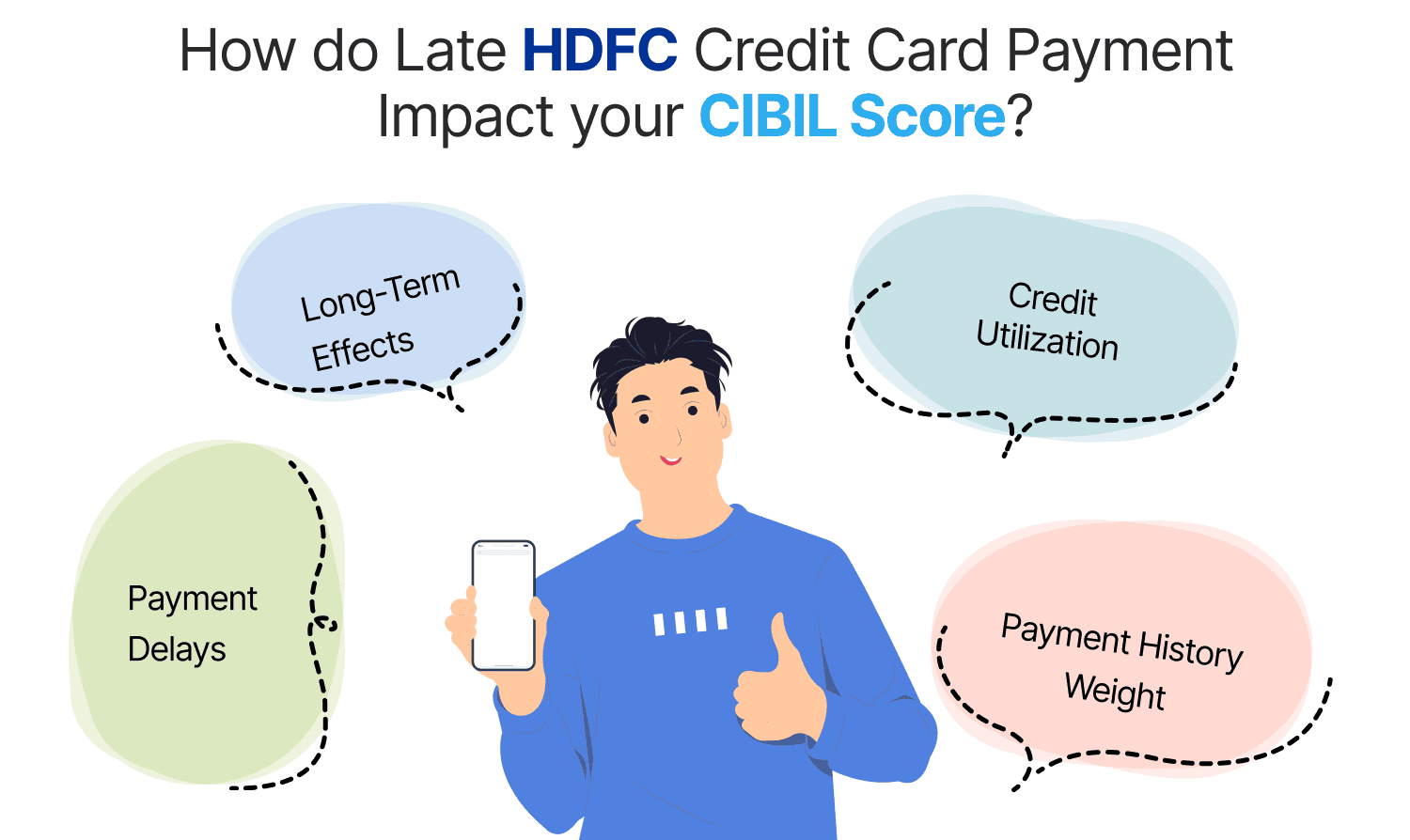

How Do Late HDFC Credit Card Payments Impact Your CIBIL Score?

Your CIBIL score, a three-digit number showing your creditworthiness, is highly influenced by your payment history. Late HDFC credit card payments can have the following impacts:

- Payment Delays : Payments delayed by more than 30 days are reported as defaults to CIBIL, potentially lowering your score by 100 points or more, depending on your credit history.

- Payment History Weight : Payment history constitutes a significant portion of your CIBIL score. Even a single late payment can have a visible effect, especially if you have a short credit history.

- Credit Utilization : Late payments can increase your credit utilization ratio (the percentage of your credit limit used), further harming your score.

- Long-Term Effects : A lower CIBIL score can make it harder to secure loans, credit cards, or favorable interest rates.

To minimize damage, pay overdue amounts as soon as possible. Payments delayed by less than 30 days may have a minimal impact if settled promptly. Consistently paying on time can help rebuild your score over time. For more details, see CIBIL’s guide on failed payments.

Conclusion

HDFC Credit Card Late Payment Charges are a critical aspect of credit card management that can affect your finances and credit health. With fees ranging from Nil to ₹1,300 based on your outstanding balance, timely HDFC credit card payments are essential to avoid penalties. Beyond late fees, missing payments can lead to higher interest rates, reduced credit limits, and a damaged CIBIL score, impacting your ability to access credit in the future. Additional charges, such as HDFC credit card withdrawal charges and HDFC forex charges, can further increase costs if not managed properly. By understanding these charges, adopting proactive payment habits, and staying informed about all fees, you can manage your HDFC credit card effectively. Prioritize timely payments to maintain a strong credit profile and financial peace of mind.

Disclaimer: The charges given above are as of when this page was written. To ensure accuracy, always refer to HDFC Bank’s site for the latest fee schedule.

Frequently Asked Questions (FAQs)