How to Choose the Right Credit Card for Your Lifestyle?

Last Updated : May 30, 2025, 3:31 p.m.

Selecting the right credit card can enhance your financial flexibility, reward your spending, and align with your lifestyle. With countless options available in India, from travel and shopping to fuel and business cards, choosing the perfect one requires understanding your spending habits and goals. This Wishfin guide breaks down the steps to find the ideal credit card for you. Start by exploring options at Wishfin’s Credit Card Comparison.

Why Choosing the Right Credit Card Matters?

A credit card tailored to your lifestyle can save money through rewards, cashback, or discounts while helping you manage expenses effectively. However, picking the wrong card can lead to high fees, unused benefits, or debt. By aligning a card with your spending patterns—whether you’re a frequent traveler, online shopper, or business owner—you maximize value and avoid pitfalls.

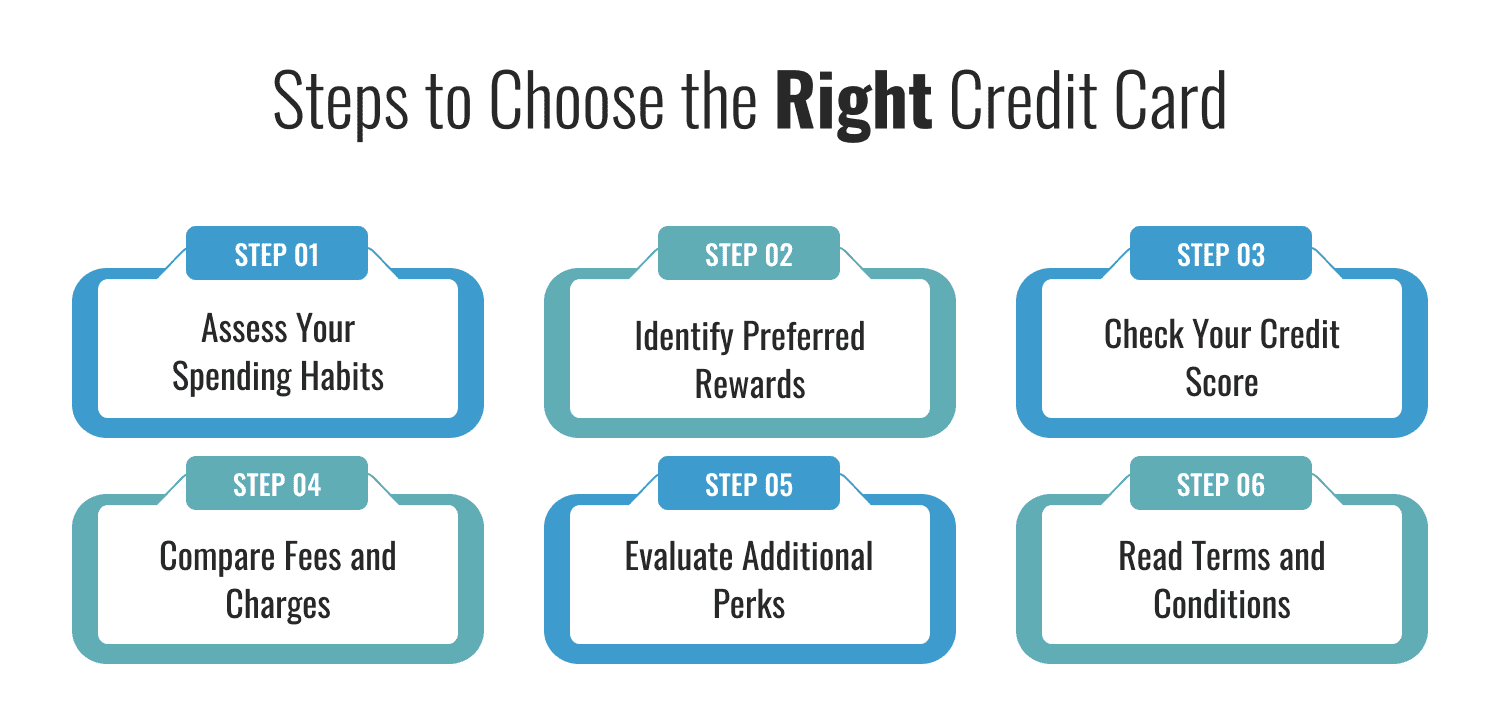

Steps to Choose the Right Credit Card

- Assess Your Spending Habits: Analyze where you spend most—travel, dining, fuel, groceries, or online shopping. For example, frequent travelers benefit from cards offering air miles, while shoppers may prefer cashback cards.

- Identify Preferred Rewards: Decide if you value cashback, reward points, travel miles, or discounts. Cards like the HDFC Regalia are great for travel perks, while the Amazon Pay ICICI Card suits online shoppers.

- Check Your Credit Score: A strong credit score (above 750) qualifies you for premium cards with better rewards. Check your score at Wishfin’s Credit Score Tool before applying.

- Compare Fees and Charges: Look at annual fees, interest rates, and foreign transaction fees. Some cards waive fees for high spenders, but ensure the benefits outweigh costs.

- Evaluate Additional Perks: Consider benefits like lounge access, insurance, or EMI options that align with your needs.

- Read Terms and Conditions: Understand reward redemption rules, blackout dates, or expiration policies to avoid surprises.

For a curated list of top cards, visit Wishfin’s Best Credit Cards Guide.

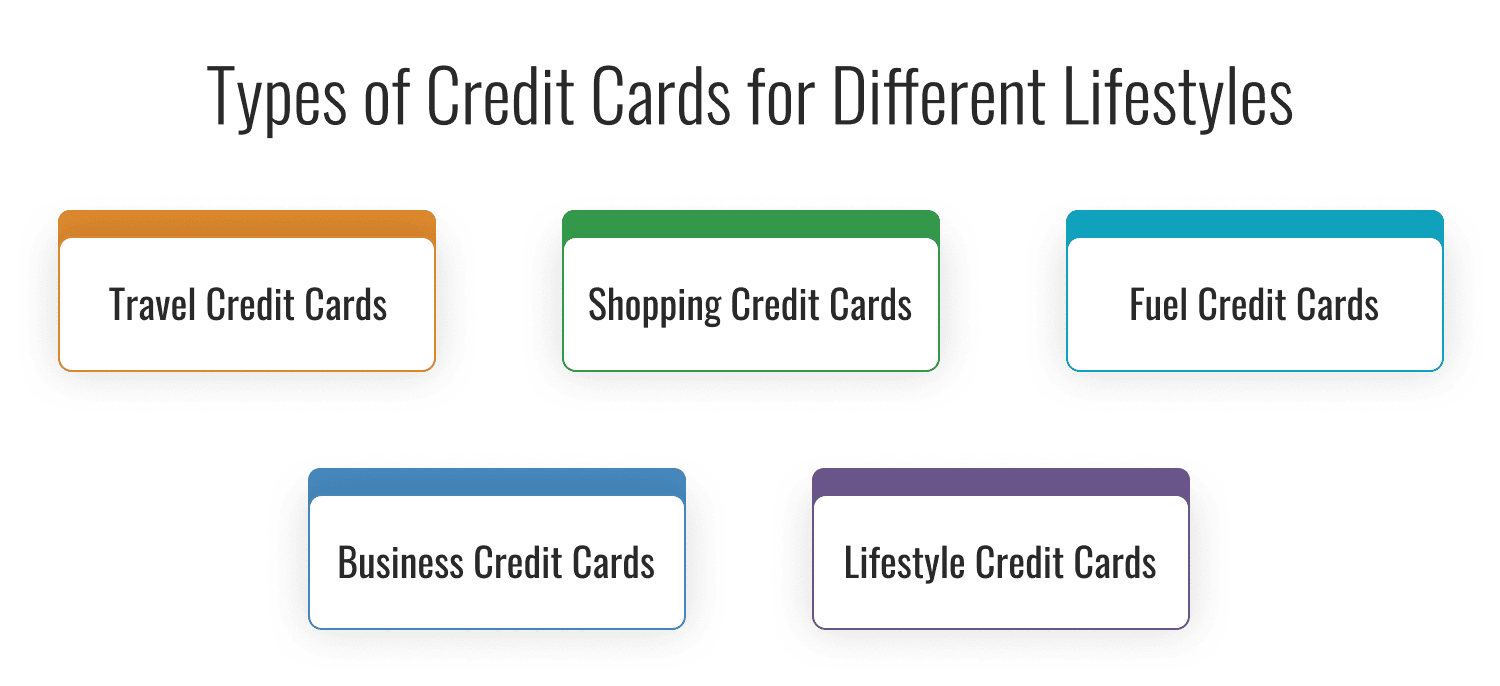

Types of Credit Cards for Different Lifestyles

- Travel Credit Cards: Ideal for frequent flyers, offering air miles, lounge access, and travel insurance (e.g., SBI Elite Card ).

- Shopping Credit Cards: Perfect for online or retail shoppers, with cashback or discounts (e.g., Flipkart Axis Bank Card ).

- Fuel Credit Cards: Suited for commuters, offering fuel surcharge waivers (e.g., IndianOil Citi Card).

- Business Credit Cards: Designed for entrepreneurs, with expense tracking and high credit limits (e.g., HDFC Business MoneyBack Card).

- Lifestyle Credit Cards: Versatile cards for dining, entertainment, and general spending (e.g., Axis Bank Vistara Card).

Common Mistakes to Avoid

- Choosing a card based solely on welcome bonuses without considering long-term benefits.

- Ignoring annual fees or high interest rates that could offset rewards.

- Applying for multiple cards at once, which can hurt your credit score .

- Not reviewing redemption terms, leading to expired or unusable rewards.

Conclusion

Choosing the right credit card involves understanding your spending habits, reward preferences, and financial profile. By following the steps outlined—assessing spending, checking your credit score, and comparing options—you can find a card that complements your lifestyle. Wishfin’s tools make it easy to compare cards, check eligibility, and make informed decisions for financial success.

Frequently Asked Questions (FAQs)