IndusInd Bank Credit Card Payment through an ATM

Last Updated : May 30, 2025, 12:31 p.m.

Paying your IndusInd Bank credit card bill has never been easier. Among the many convenient methods available, IndusInd Bank credit card payments through ATMs stand out for their accessibility and real-time processing. Whether you're on the go or prefer an offline method, this ATM facility ensures that your credit card dues are paid promptly, helping you maintain a good CIBIL score and avoid penalties. In this guide, we’ll explore how to make IndusInd Bank credit card payment through ATMs , step-by-step instructions, benefits, precautions, and answers to the most frequently asked questions.

Why Choose IndusInd Bank Credit Card Payment through ATMs?

Using an ATM to make your IndusInd credit card payment offers multiple benefits:

- 24x7 Availability : Pay your credit card dues anytime.

- Instant Processing : Real-time credit to your IndusInd Bank credit card .

- No Internet Required : Ideal for those who prefer offline methods.

- Secure Transactions : ATM payments are encrypted and secure.

- Avoid Late Fees : Payments reflect quickly, reducing chances of delay.

This feature is especially beneficial for those who already hold a savings or current account with IndusInd Bank, making it a seamless and integrated payment method.

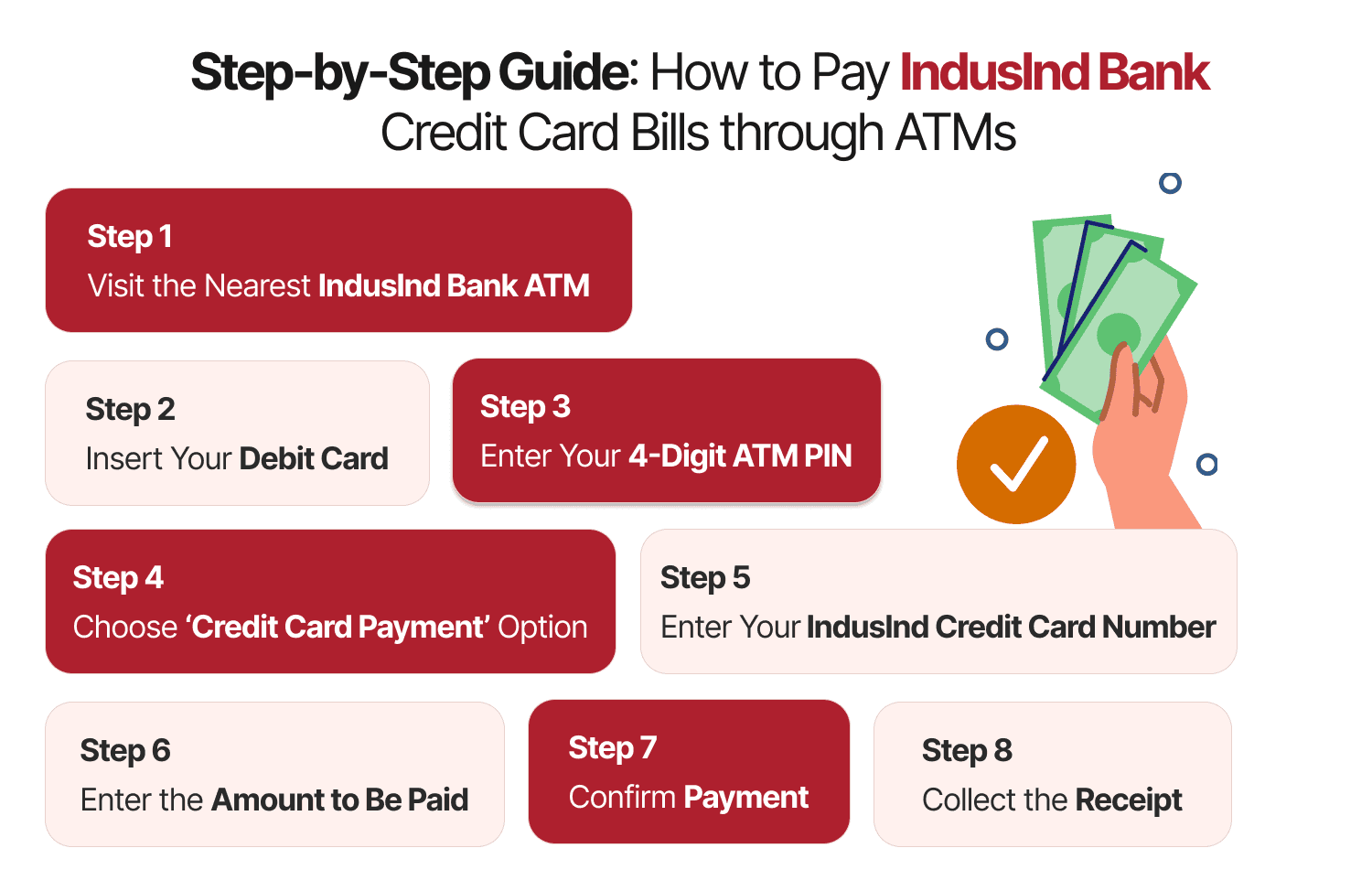

Step-by-Step Guide: How to Pay IndusInd Bank Credit Card Bills through ATMs

To pay your IndusInd Bank credit card bill through an ATM, visit the nearest IndusInd Bank ATM, insert your debit card, enter your PIN, select 'Credit Card Payment', enter your 16-digit credit card number, input the bill amount, and confirm the transaction. The payment is processed instantly and a receipt is generated. Here’s a simple step-by-step process to make your IndusInd Bank credit card payment through ATMs:

Step 1: Visit the Nearest IndusInd Bank ATM

Come across an IndusInd Bank ATM near you using the bank’s ATM locator or mobile app.

Step 2: Insert Your Debit Card

Insert your IndusInd Bank debit card into the ATM machine.

Step 3: Enter Your 4-Digit ATM PIN

Authenticate using your Personal Identification Number (PIN).

Step 4: Choose ‘Credit Card Payment’ Option

From the main menu, choose 'Bill Pay' or ‘Credit Card Payment’, depending on the ATM interface.

Step 5: Enter Your IndusInd Credit Card Number

Carefully enter the 16-digit IndusInd Bank credit card number.

Step 6: Enter the Amount to Be Paid

Input the amount you wish to pay toward your credit card bill.

Step 7: Confirm Payment

Review the entered details and confirm the payment.

Step 8: Collect the Receipt

The ATM will generate a printed receipt confirming your transaction.

Pro Tip : Always double-check your credit card number and payment amount before confirming the transaction to avoid errors.

Key Things to Remember When Using ATMs for Credit Card Payments

- Only IndusInd Bank debit cards can be used for this payment method.

- Payments made via ATM are instantly shown in your credit card account.

- Payments are accepted only for IndusInd Bank credit cards.

- No service charges are levied for credit card payments via ATMs.

- The facility may not be present at ATMs which are not part of the network.

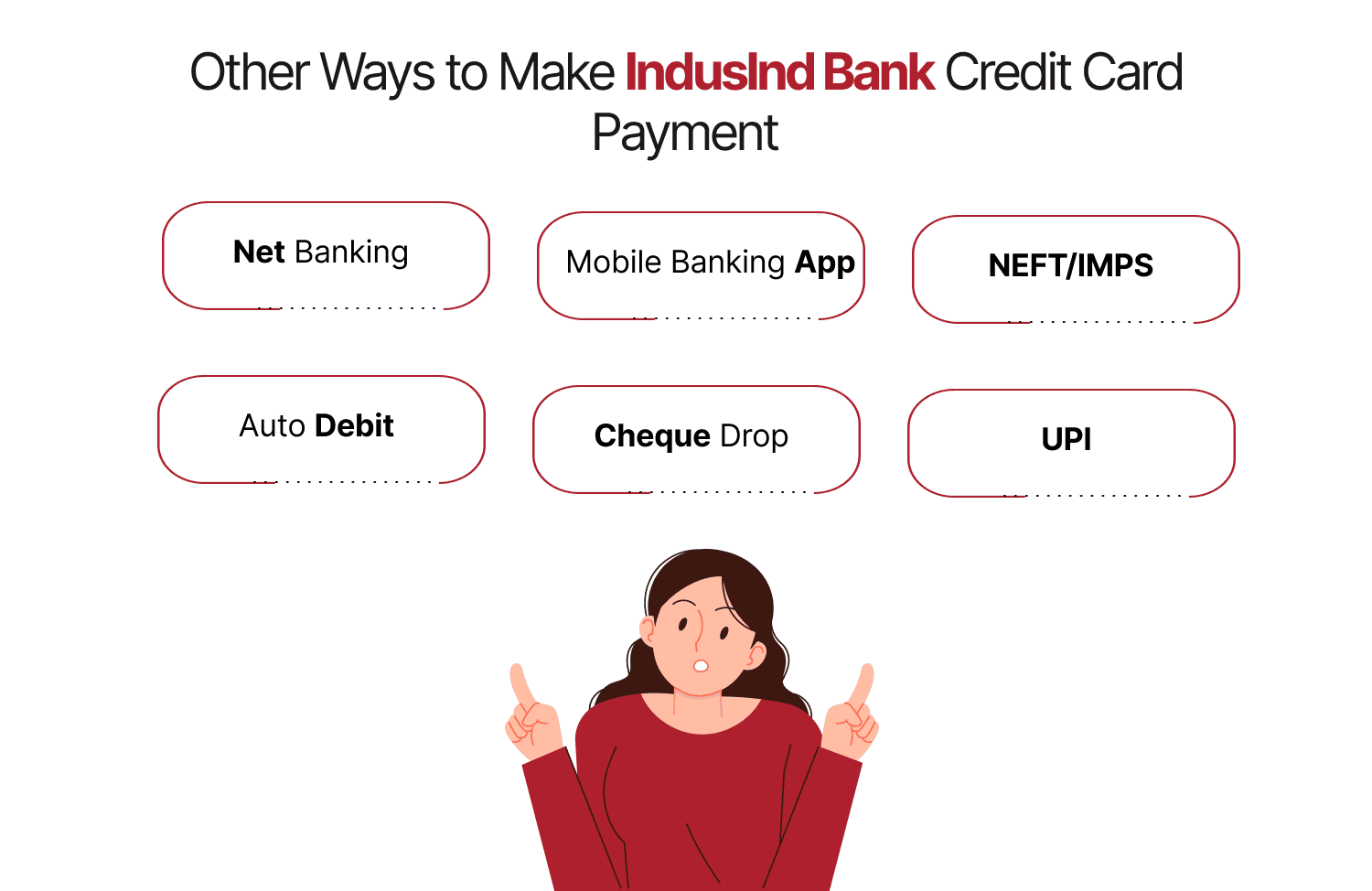

Other Ways to Make IndusInd Bank Credit Card Payment

While ATMs offer a convenient way to pay, IndusInd Bank also offers several other methods:

| Mode | Online/Offline | Processing Time |

|---|---|---|

Net Banking | Online | Same-day |

Mobile Banking App | Online | Same-day |

NEFT/IMPS | Online | Real-time |

Auto Debit | Online | On Due Date |

Cheque Drop | Offline | 3-5 Business Days |

Online | Instant |

Exploring multiple credit card payment options can help you pick one that suits your lifestyle best.

How Timely Payments Help Your CIBIL Score?

Your CIBIL score is an important metric that displays your creditworthiness. Timely payments of your IndusInd Bank credit card bills contribute considerably to a healthy score. Here's how:

- 35% of your CIBIL score is based on payment history.

- Late or missed payments can reduce your score by up to 100 points.

- Regular use and timely repayments create a strong credit profile.

Why Use IndusInd Bank Credit Cards?

IndusInd Bank offers a wide range of credit cards that cater to varied financial needs—Be it shopping, travel, dining, or lifestyle. Key features include:

- Attractive rewards programs

- Fuel surcharge waivers

- Airport lounge access

- EMI conversion options

- Contactless payments

Owning an IndusInd Bank credit card not only enhances purchasing power but also helps in building a strong financial foundation when managed responsibly.

Comparison: ATM Payments vs Other Payment Methods

| Feature | ATM Payment | Net Banking | UPI | Cheque |

|---|---|---|---|---|

Speed | Instant | Same-day | Instant | 3-5 Days |

Accessibility | High | Medium | High | Low |

Internet Required | No | Yes | Yes | No |

Charges | Free | Free | Free | Free |

Risk of Delay | Low | Low | Low | High |

For quick and safe credit card bill payments , an ATM remains a trusted option, especially in emergency situations.

Conclusion

Making IndusInd Bank credit card payments through ATMs is a smart, safe, and convenient option—especially for those who prefer offline methods or need to make a quick payment without internet access. By ensuring timely bill payments, you not only avoid late fees but also boost your CIBIL score, keeping your credit health in top shape.

Explore the full range of IndusInd Bank credit cards today and manage your payments effortlessly through multiple channels including ATMs, net banking, UPI, and mobile apps.

Wishfin Tip : Automate your payments or set reminders to avoid missing your due dates and protect your credit profile.

Frequently Asked Questions (FAQs)