IndusInd Bank Credit Card Payment through Debit Card

Last Updated : May 30, 2025, 12:51 p.m.

Can I pay IndusInd Bank credit card bills using a debit card? Yes – you can clear your IndusInd Bank credit card dues using a debit card by leveraging various online payment methods. For example, you can use UPI-enabled apps (like Paytm or Google Pay) to pay your IndusInd credit card bill using any bank’s debit card. You can also transfer funds from your savings account via IMPS or NEFT (Linked to your debit card) directly to your IndusInd credit card.

How to Pay IndusInd Credit Card Bills with a Debit Card?

- Use a UPI/payment app: Open a UPI app such as Paytm or Google Pay. Select “Credit Card Payment” and add your 16-digit IndusInd Bank credit card details. When prompted for payment method, choose to pay from your debit card–linked savings account or UPI wallet. Once you enter the bill amount and authenticate (OTP or PIN), the payment clears almost instantly. You’ll receive a confirmation via SMS or email.

- Transfer via IMPS/NEFT from another bank: If your debit card is linked to a different bank’s account, log in to that bank’s net banking or mobile banking. Go to the fund transfer (NEFT/IMPS) section and add a beneficiary . Select IndusInd Bank and enter the 16-digit IndusInd credit card number as the account number (Use IFSC code INDB0000018). Once the beneficiary is added, initiate a transfer for the bill amount. IMPS payments are instant, while NEFT usually clears within a few hours. This is a reliable way to pay any IndusInd credit card using a debit-card-linked account.

- At an IndusInd ATM (if available): Some banks allow you to pay credit card bills at ATMs by swiping your debit card. While IndusInd’s official options focus on online payments, Wishfin notes that some banks offer ATM credit card payment using a debit If IndusInd ATMs support this, you’d insert your debit card, select “Credit Card Payment,” and enter your credit card details to complete the transaction on the spot. (Check with your local IndusInd branch or ATM.)

Each of these methods uses your debit card as the payment source, so you’re effectively paying from your savings account. For convenience and security, always keep receipts or transaction IDs, and check your credit score on Wishfin to monitor your credit health after payments. If you are exploring credit cards, you can evaluate different IndusInd Bank credit cards here and find one with the rewards you prefer.

Figure: Paying IndusInd credit card bills via your debit-card-linked bank account or payment app is quick and secure. By using digital modes like IMPS/NEFT or UPI (Through apps), the funds transfer almost instantly without interest charges.

Benefits of Paying Credit Card Bills with a Debit Card

Paying with a debit card (i.e. directly from your bank account) offers several benefits:

- Immediate funds transfer: Digital payments like IMPS or UPI clear quickly (Often instantly). This means the payment posts almost immediately, helping ensure you never miss the due date.

- Avoid interest and fees: Since the money comes from your own account, you’re not taking on new credit. You can eliminate any chance of interest accrual on unpaid dues. Many banks offer these online payments free of charge, unlike cash payments (which can incur a fee).

- Better budgeting: Using a debit card enforces discipline; you pay only what you have. It’s harder to overspend since the payment clears only if sufficient funds are in your account.

- Rewards and convenience: Some apps and banks offer cashback or rewards when you use digital methods. Plus, you can set up or schedule payments easily. For example, IndusInd’s online channels or apps allow you to schedule future payments from your account. Using Wishfin’s portal or UPI means you can also make payments anytime, without visiting a branch or ATM.

- Record and security: Every transaction gives an immediate digital receipt. You can save or screenshot it, and most apps send an SMS/Email confirmation. This provides proof of payment and helps in record-keeping. As Wishfin notes, automated payment methods and reminders via mobile apps can alert you about upcoming dues, reducing the risk of forgetfulness.

By contrast, traditional methods like cheques can take days to process and incur drop-box fees. In summary, paying via your debit card (through IMPS/UPI) is a secure, efficient way to settle your IndusInd credit card bills promptly.

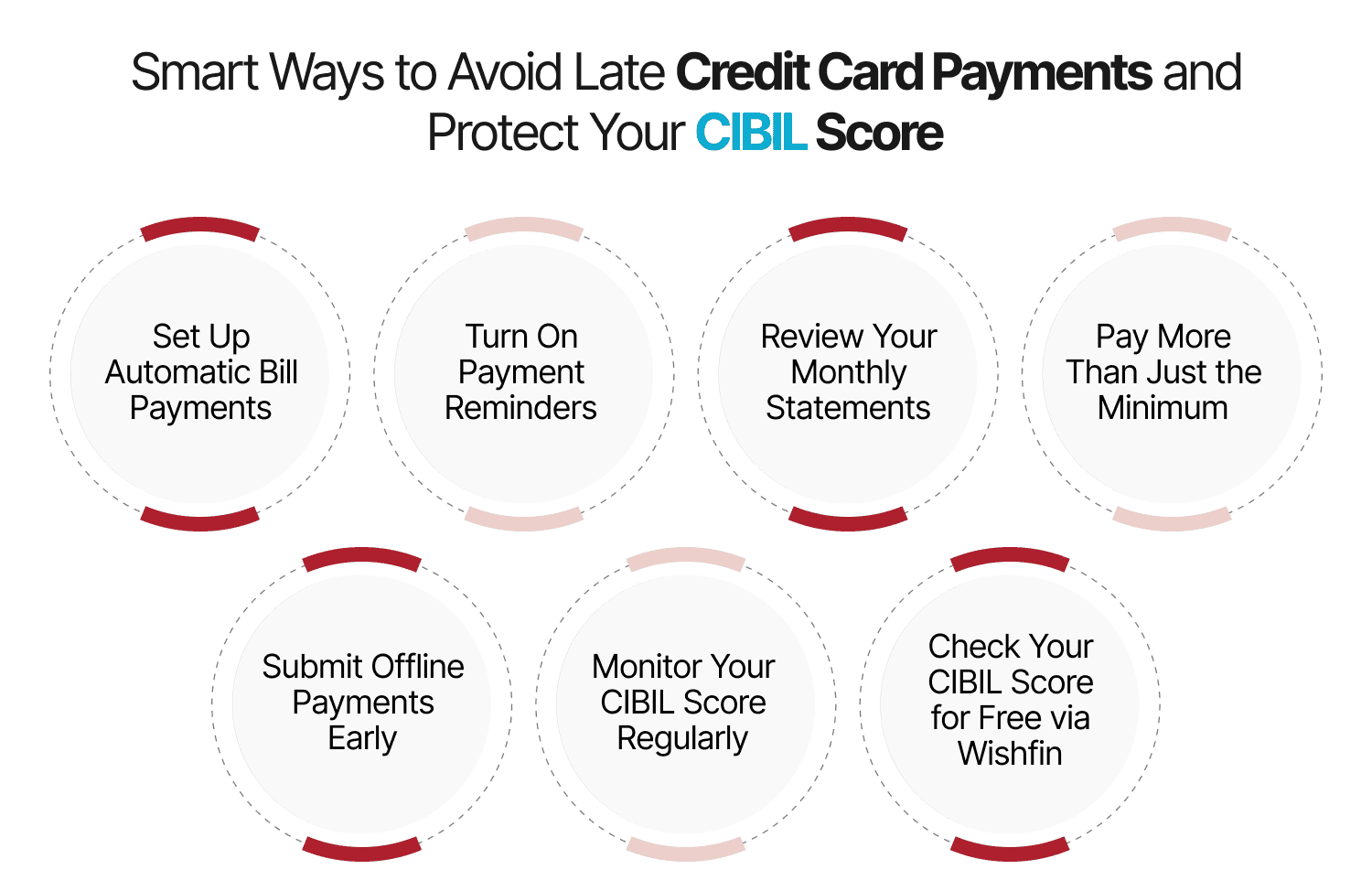

Smart Ways to Avoid Late Credit Card Payments and Protect Your CIBIL Score

Maintaining a healthy credit profile starts with timely credit card payments. Here are effective strategies to help you stay on top of your dues and improve your CIBIL score .

1. Set Up Automatic Bill Payments

Activate AutoPay or use a NACH mandate linked to your savings account to automatically clear your credit card dues before the due date. This not only prevents missed payments but also helps develop a strong repayment routine.

2. Turn On Payment Reminders

Enable SMS and email alerts via the INDIE app or IndusNet portal. You can also use reputed UPI apps to customize reminders. These timely alerts reduce the chances of missing your payment due date.

3. Review Your Monthly Statements

Go through your monthly statements carefully using the INDIE mobile app or through IndusNet. Verify all charges, track the outstanding balance, and ensure you’re aware of the due date. This habit helps avoid billing errors and surprises.

4. Pay More Than Just the Minimum

Always aim to pay off the entire outstanding amount. If that’s not feasible, pay more than the minimum amount due. Making only minimum payments leads to higher interest charges and can prolong debt, negatively affecting your credit score.

5. Submit Offline Payments Early

If you're paying by cheque or cash, do so at least 4–5 working days before the due date to account for processing time. Note down your 16-digit credit card number on the back of the check to ensure accurate posting.

6. Monitor Your CIBIL Score Regularly

Your payment history significantly influences your CIBIL score—nearly 35% of it depends on how timely your repayments are. Staying consistent in your payments boosts your credit rating and builds financial trust.

7. Check Your CIBIL Score for Free via Wishfin

Use platforms like Wishfin to access your CIBIL score at no cost. Regular checks help you stay informed about your credit health and spot any negative trends before they impact your financial reputation.

Final Thoughts

Staying proactive with your credit card management—through automation, alerts, and regular score monitoring—can safeguard you from late fees and help maintain a strong credit profile. Responsible financial behavior increases your eligibility for top-tier cards and better loan terms.

Frequently Asked Questions (FAQs)