IndusInd Bank Credit Card Payments Through Mobile Banking

Last Updated : May 23, 2025, 1:07 p.m.

Managing your credit card payments has become effortless with IndusInd Bank’s mobile banking services. If you’re looking for a seamless way to pay your IndusInd Bank credit card bills without visiting a branch, the official INDIE mobile app offers the perfect solution. This comprehensive guide covers everything you need to know about IndusInd Bank credit card payments through mobile banking, helping you maintain timely payments and a healthy CIBIL score.

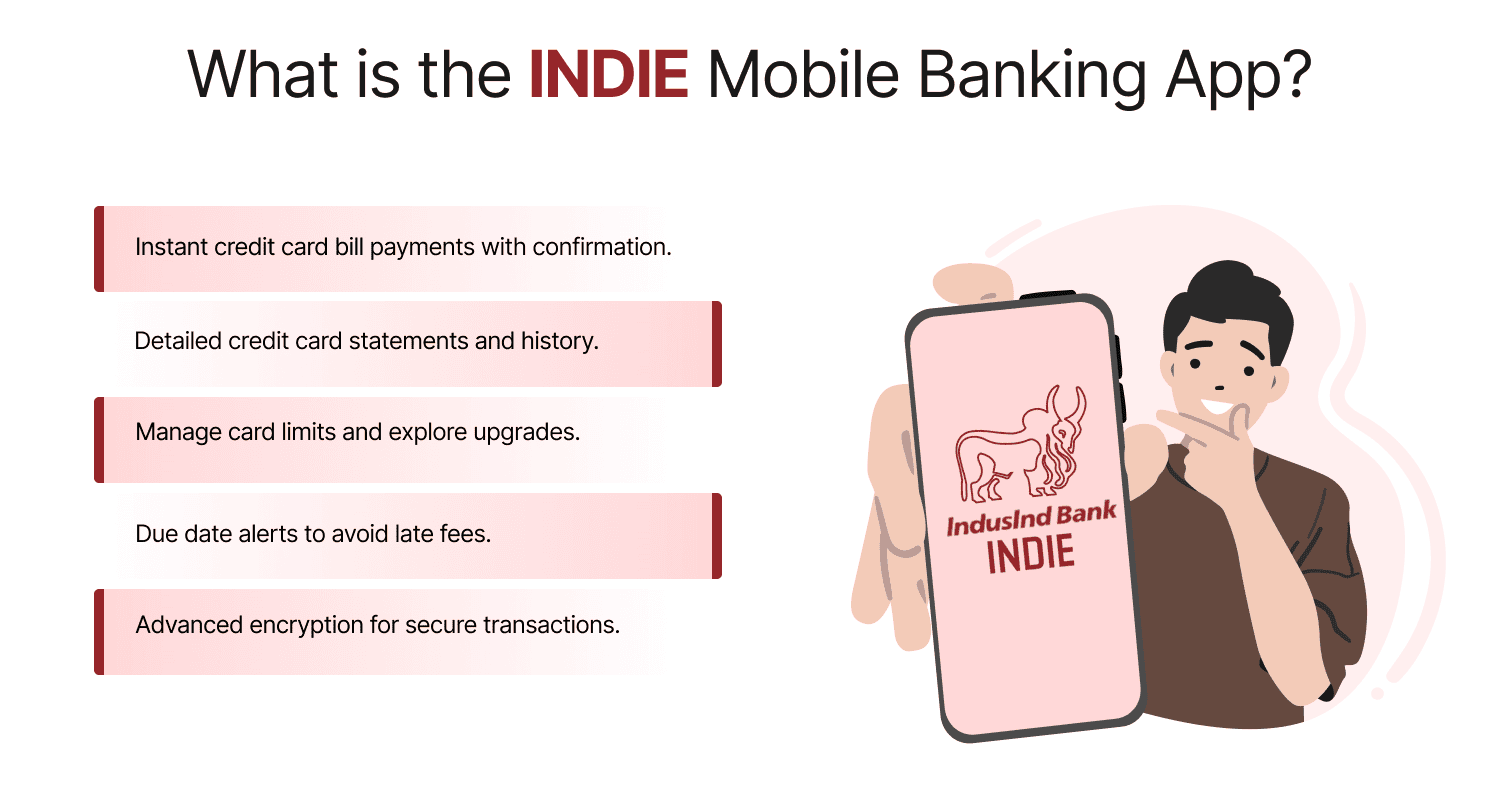

What is the INDIE Mobile Banking App?

Launched in October 2024, INDIE is IndusInd Bank’s flagship mobile banking platform designed to provide a modern, user-friendly banking experience. As of March 2025, INDIE has replaced older applications like IndusMobile and offers a range of features specifically optimized for credit card management:

- Quick credit card bill payments with instant confirmation

- Thorough view of credit card statements and transaction history

- Credit card limit management and upgrade options

- Payment due date reminders to avoid late fees that could affect your CIBIL score

- Secure transaction environment with advanced encryption

The app’s intuitive design makes it the preferred choice for IndusInd Bank credit card holders seeking convenient payment solutions.

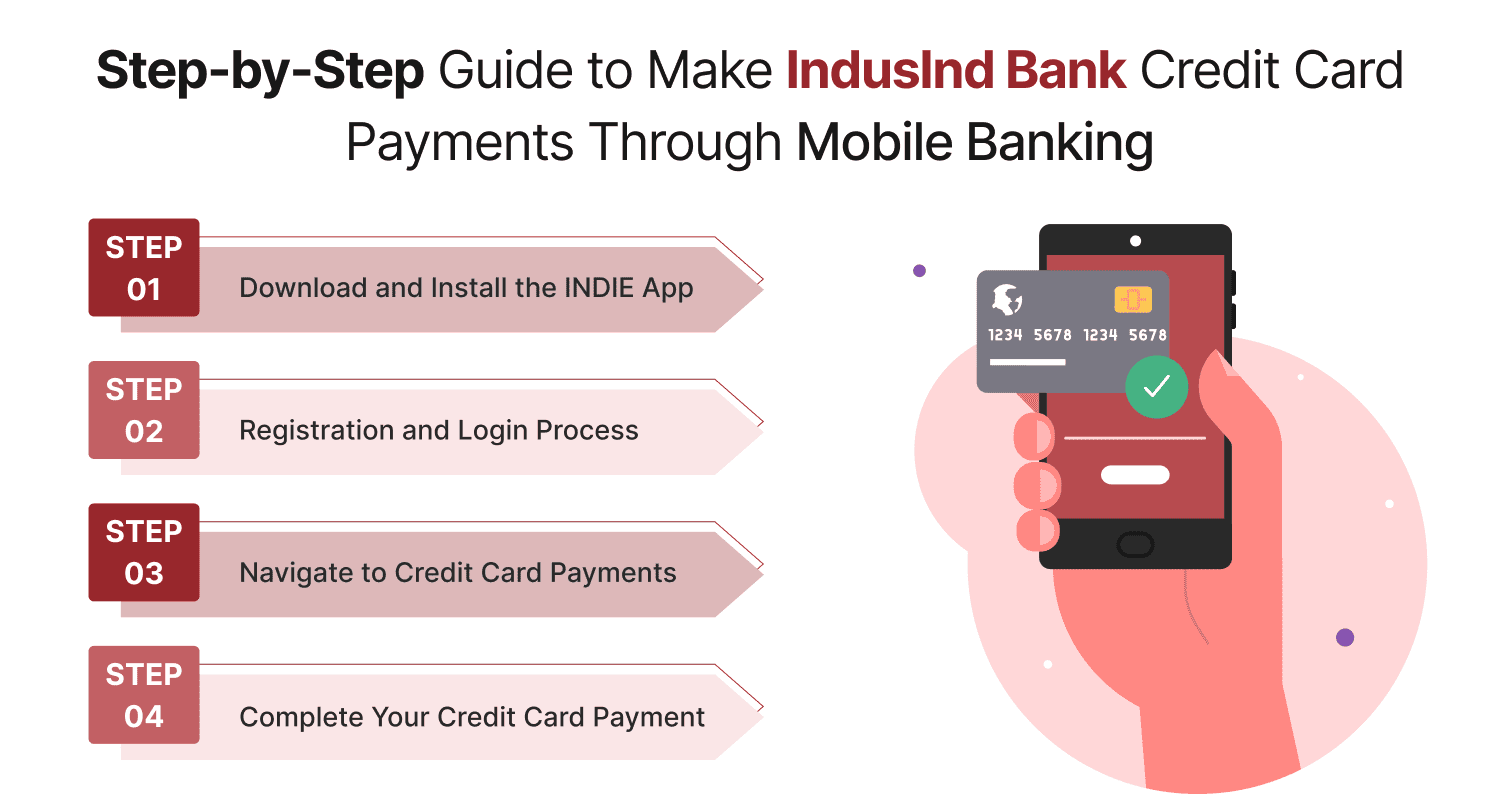

Step-by-Step Guide to Make IndusInd Bank Credit Card Payments Through Mobile Banking

1. Download and Install the INDIE App

- Visit the App Store (iOS) or Google Play Store (Android)

- Search for “INDIE by IndusInd Bank” (verify it’s published by IndusInd Bank Ltd)

- Download and install the application on your smartphone

2. Registration and Login Process

- Existing customers: Log in using your Customer ID and password, MPIN, or biometric authentication

- New users: Register by providing your registered mobile number, PAN, or Aadhaar for verification

- Complete the security setup as prompted by the app

3. Navigate to Credit Card Payments

- From the INDIE dashboard, locate the “Cards” or “Credit Cards” section

- Select the specific IndusInd Bank credit card you wish to make a payment for

- Tap on the “Pay Bill” or “Make Payment” option

4. Complete Your Credit Card Payment

- Select your payment source (IndusInd Bank savings account or other linked accounts)

- Choose payment amount:

- Minimum due amount

- Total outstanding balance

- Custom amount

- Review payment details for accuracy

- Authorize the transaction using PIN, biometric authentication, or OTP

- Save the confirmation receipt for your records

Your payment will be processed immediately, helping you maintain a good payment history and positive impact on your CIBIL score.

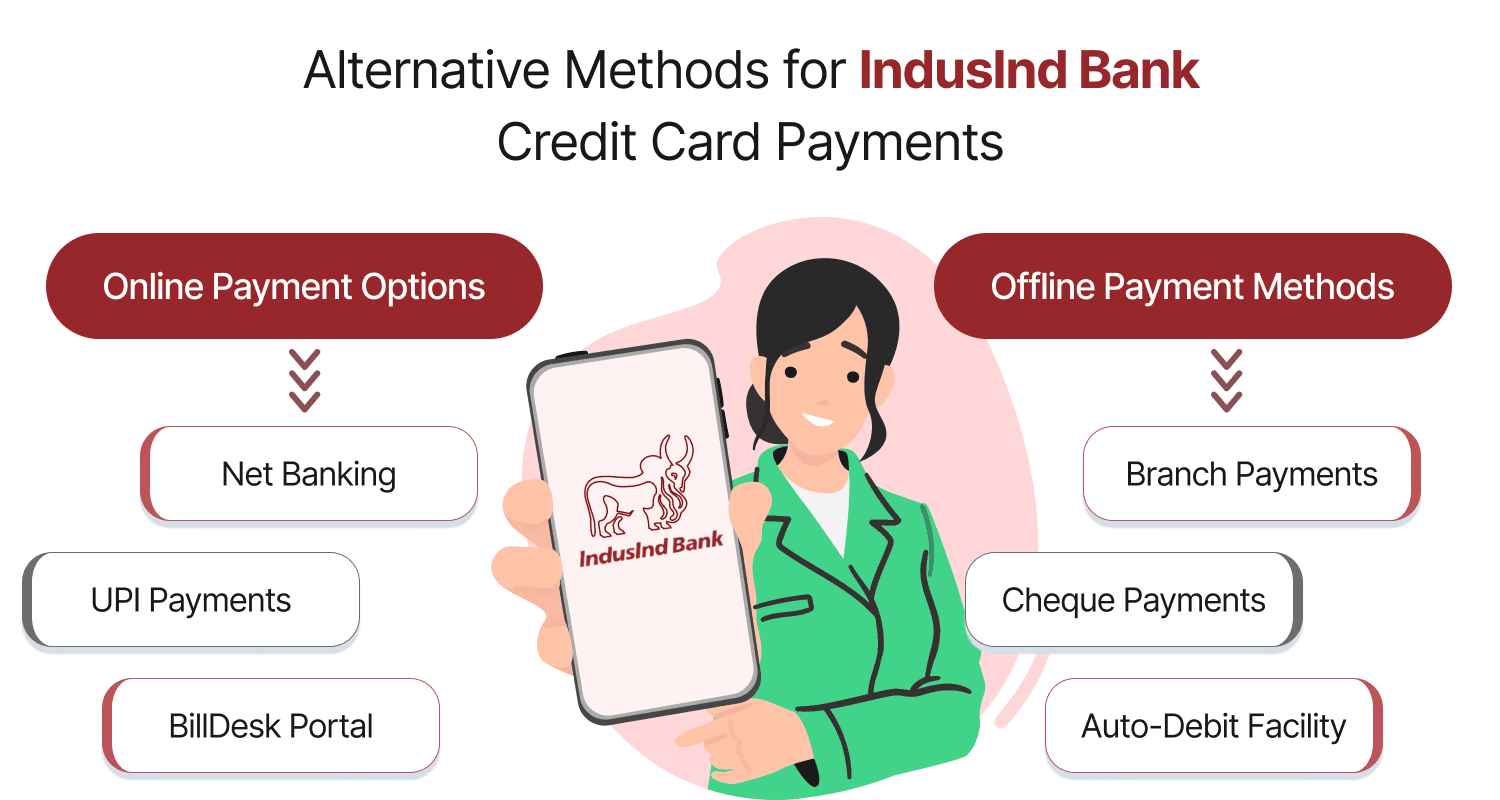

Alternative Methods for IndusInd Bank Credit Card Payments

While mobile banking offers the most convenient payment experience, IndusInd Bank provides multiple channels for credit card payments:

Online Payment Options

- Net Banking: Access IndusNet, choose “Funds Transfer,” and add your credit card as a beneficiary

- UPI Payments: Use any UPI-enabled app with your IndusInd Bank credit card number

- BillDesk Portal: Visit the BillDesk website to pay using another bank account

Offline Payment Methods

- Branch Payments: Visit any IndusInd Bank branch (note: ₹100 processing fee may apply)

- Cheque Payments: Drop a cheque at an ATM or designated drop box

- Auto-Debit Facility: Set up automatic payments through the INDIE app.

Advantages of Using Mobile Banking for Credit Card Payments

Managing your IndusInd Bank credit cards through the INDIE app provides several advantages:

Convenience and Accessibility

- 24/7 payment access from anywhere

- No need to visit branches or ATMs

- Real-time payment confirmation

Enhanced Financial Management

- Track all your credit card transactions in one place

- Monitor spending patterns across multiple credit cards

- Set up alerts for payment due dates

CIBIL Score Protection

- Timely payments help maintain a good CIBIL score

- Payment reminders prevent missed due dates

- Payment history tracking helps in credit score management

Advanced Security Features

- Numberless debit card integration

- Single-use virtual cards for online transactions

- Biometric authentication for transaction security

Security Best Practices for Mobile Credit Card Payments

Protect your financial information when managing credit card payments:

- Download the INDIE app only from official app stores

- Never share your login credentials, PIN, or OTP

- Use secure networks instead of public Wi-Fi for transactions

- Enable two-factor authentication for additional security

- Regularly update your mobile banking app to the most recent version.

Troubleshooting IndusInd Bank Credit Card Payment Issues

If you encounter challenges while making credit card payments through the INDIE app:

- Contact IndusInd Bank Customer Support:

- Email: indie@indusind.com

- Phone: 1860 267 2626

- Support Hours: 8 AM to 8 PM, all days

- Check your internet connection and app version

- Verify sufficient balance in your payment account

- Ensure your credit card isn’t blocked or expired.

Conclusion

The INDIE app by IndusInd Bank transforms the credit card payment experience, offering a secure, convenient, and efficient way to manage your credit card bills. By following the steps outlined in this guide, you can ensure timely payments, avoid late fees, and maintain a healthy CIBIL score . Download the INDIE app today to experience the benefits of digital credit card management and take control of your financial health by making timely IndusInd Bank credit card payments through mobile banking.

Frequently Asked Questions (FAQs)