IndusInd Bank Credit Card Payments through NEFT

Last Updated : May 23, 2025, 5:19 p.m.

Managing credit card payments efficiently is crucial for maintaining a healthy financial profile and a good CIBIL score . Among the various payment methods available to IndusInd Bank credit cardholders, NEFT (National Electronic Funds Transfer) stands out as one of the most reliable, secure, and convenient options. This comprehensive guide will walk you through everything you need to know about making IndusInd Bank credit card payments through NEFT, its benefits, and how to use this service effectively.

What is NEFT for Credit Card Payments?

NEFT is an electronic funds transfer system regulated by the Reserve Bank of India (RBI) that allows you to transfer money from any bank account to your IndusInd Bank credit card. This service provides a seamless way to clear your credit card dues without the need for physical visits to bank branches or ATMs, making it an ideal choice for busy professionals and digital-savvy consumers.

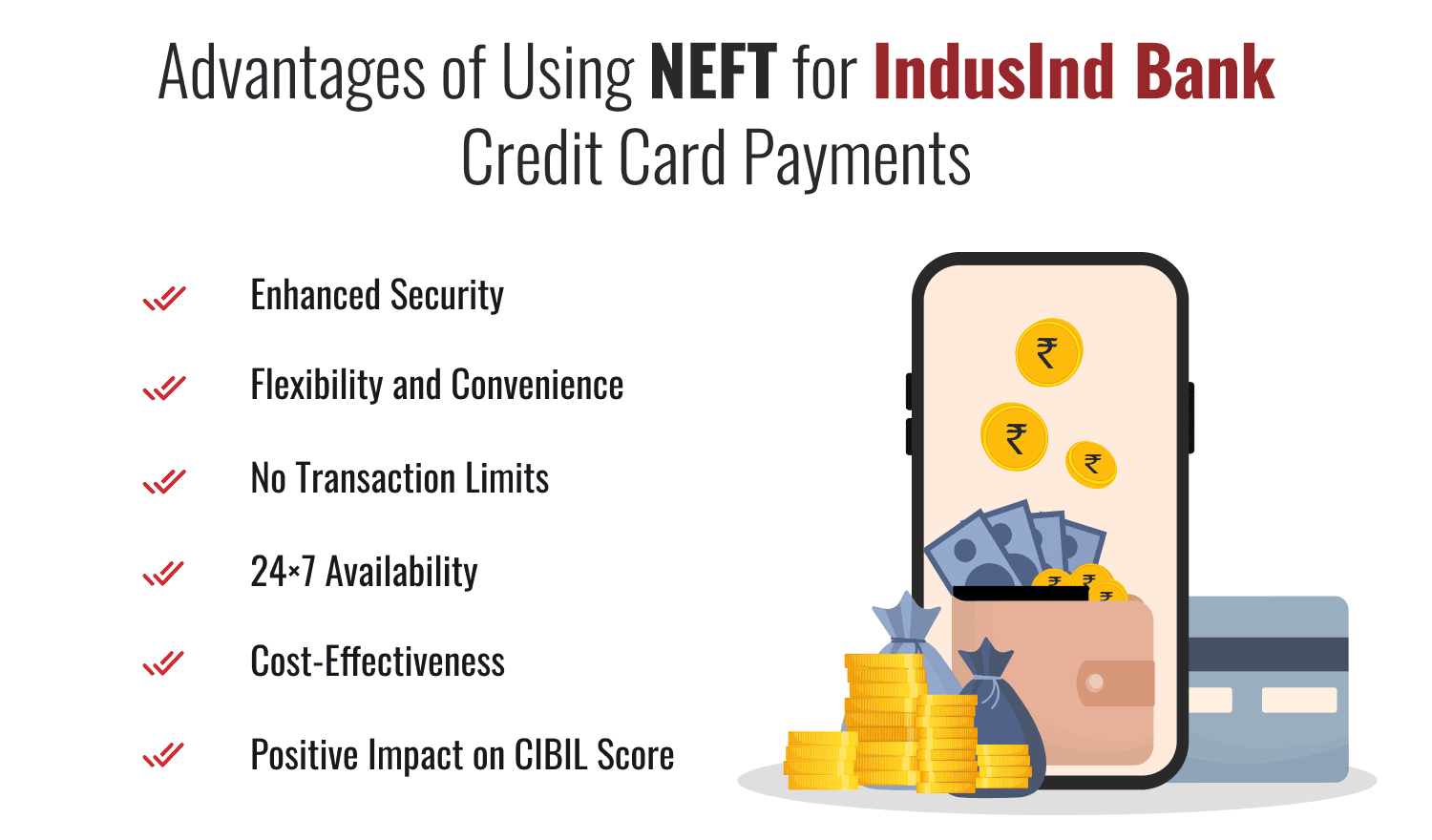

Advantages of Using NEFT for IndusInd Bank Credit Card Payments

1. Enhanced Security

NEFT transactions are processed through secure banking channels regulated by the RBI, ensuring that your payments are protected against fraud and unauthorized access. This makes NEFT one of the safest methods for credit card payments .

2. Flexibility and Convenience

With NEFT, you can pay your IndusInd Bank credit card bill from any bank account, not just an IndusInd Bank account. This cross-bank compatibility provides exceptional flexibility, especially if you maintain accounts with multiple banks.

3. No Transaction Limits

Unlike some other digital payment methods such as UPI, which may have daily transaction limits, NEFT allows you to transfer larger amounts, making it perfect for settling high credit card balances without worrying about payment restrictions.

4. 24×7 Availability

Most banks now offer round-the-clock NEFT services, allowing you to make payments at your convenience, including weekends and bank holidays. This ensures you never miss a payment deadline due to banking hours.

5. Cost-Effectiveness

Many banks offer NEFT services with minimal or zero transaction fees, making it an economical option compared to other payment methods that might involve service charges.

6. Positive Impact on CIBIL Score

Timely credit card payments are essential for maintaining a good CIBIL score. NEFT's reliability ensures your payments reach before the due date, helping you avoid late payment penalties and negative marks on your credit report.

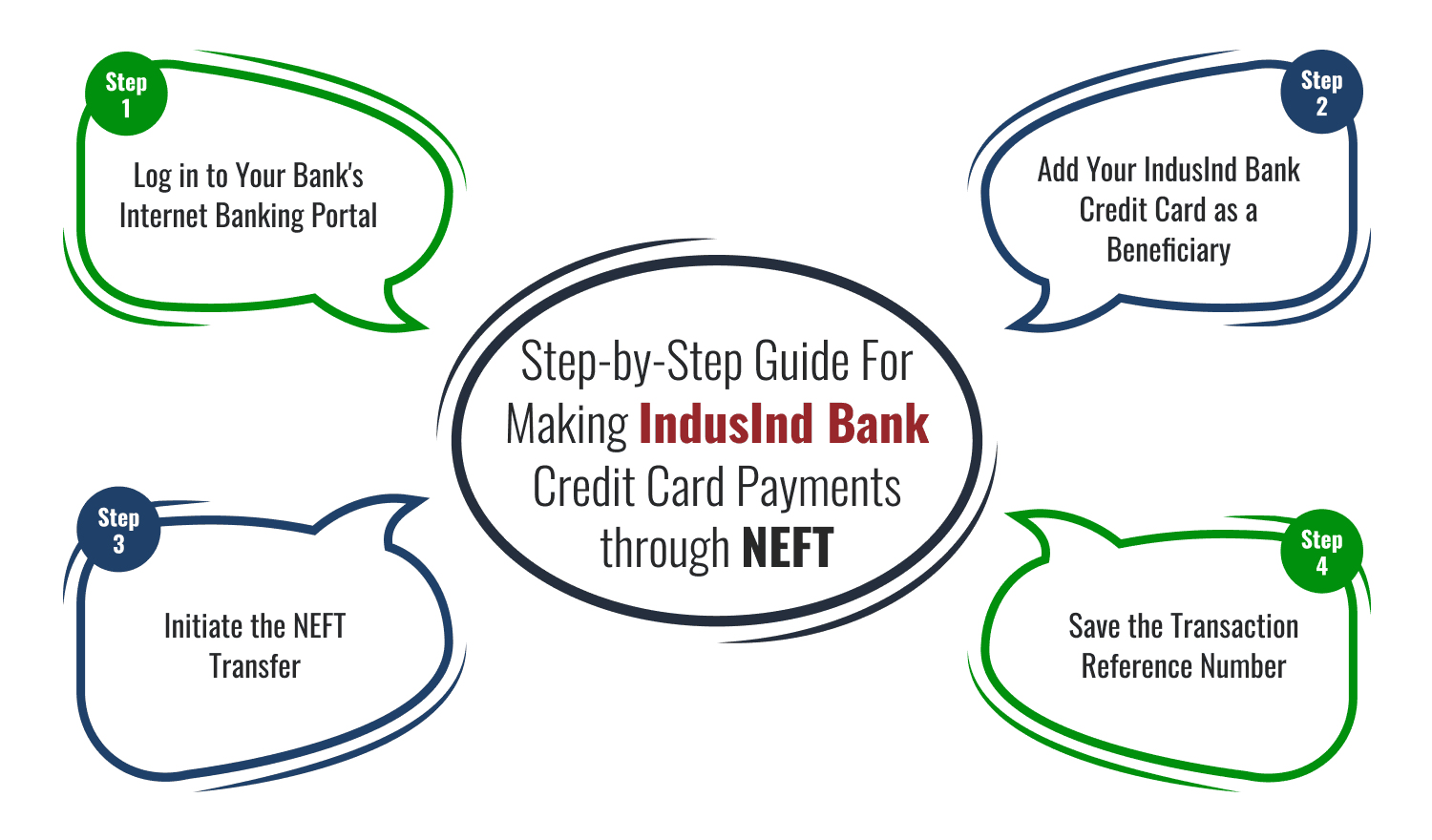

Step-by-Step Guide For Making IndusInd Bank Credit Card Payments through NEFT

Step 1: Log in to Your Bank's Internet Banking Portal

Access the internet banking facility of your bank (any bank that offers NEFT services) and navigate to the funds transfer or NEFT/RTGS section.

Step 2: Add Your IndusInd Bank Credit Card as a Beneficiary

- Go to the 'Add Beneficiary' page in your bank's internet banking portal

- Choose IndusInd Bank from the list of available banks

- Enter the correct IFSC code: INDB0000018 (this is specifically for credit card payments)

- In the 'Account Number' field, enter your 16-digit IndusInd Bank credit card number without any spaces or special characters (15 digits for IndusInd Bank Amex Credit Cards)

- Key in your name as it is seen on the credit card in the 'Beneficiary Name' field

- Save the beneficiary

Step 3: Initiate the NEFT Transfer

- Select the newly added IndusInd Bank credit card beneficiary

- Enter the payment amount

- Verify all details, especially the IFSC code and credit card number

- Confirm and authorize the transaction using your internet banking security credentials

Step 4: Save the Transaction Reference Number

After completing the transaction, save or note down the reference number for future reference and verification.

Important Points to Remember

- Correct IFSC Code: Always use INDB0000018 as the IFSC code specifically for IndusInd Bank credit card payments. Using an incorrect IFSC code can lead to transaction failures or delays.

- Processing Time: While NEFT is generally efficient, it's advisable to make your payment at least 2 working days before the due date to ensure timely processing and avoid late payment fees.

- No Spaces or Special Characters: When you key in your credit card number as the account number, Make sure that it has no spaces or special characters.

- Transaction Verification: Always verify transaction details before confirming to avoid errors in the payment process.

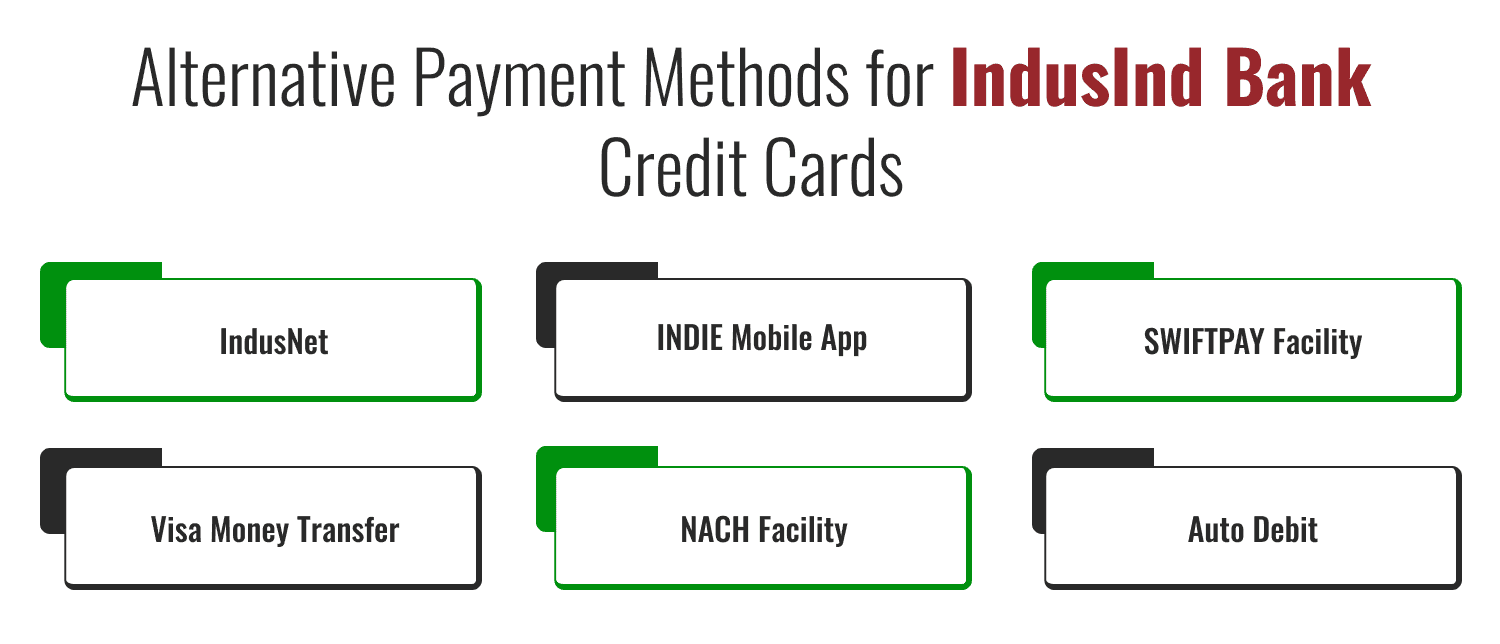

Alternative Payment Methods for IndusInd Bank Credit Cards

While NEFT is an excellent option for credit card payments, IndusInd Bank offers several other convenient payment methods:

- IndusNet: Direct payment through IndusInd Bank's net banking platform

- INDIE Mobile App: Payments via the bank's mobile application

- SWIFTPAY Facility: Online payment portal

- Visa Money Transfer: For Visa cardholders

- NACH Facility: Automated clearing house for recurring payments

- Auto Debit: Automatic payment from your linked account

How IndusInd Bank Credit Card Payments through NEFT Impacts Your CIBIL Score?

Your credit card payment history significantly impacts your CIBIL score, which in turn affects your eligibility for future loans and credit cards . Using NEFT for timely credit card payments helps maintain a positive payment history, one of the most crucial factors in determining your credit score.

Regular and on-time payments through NEFT can help:

- Prevent late payment penalties

- Demonstrate financial responsibility

- Build a strong credit history

- Improve your overall creditworthiness

Conclusion

IndusInd Bank credit card payments through NEFT offer a secure, convenient, and efficient way to manage your credit card bills. By following the simple steps outlined in this guide, you can ensure timely payments, avoid unnecessary charges, and maintain a healthy CIBIL score. The flexibility to make payments from any bank account, coupled with the security of RBI-regulated transactions, makes NEFT one of the most preferred methods for credit card payments in today's digital banking landscape.Whether you're a new IndusInd Bank credit cardholder or looking to optimize your payment methods, NEFT provides a reliable solution that combines convenience with security, helping you. Be on top of your financial commitments while enjoying the advantages of your IndusInd Bank credit card.

Frequently Asked Questions (FAQs)