IndusInd Bank Credit Card Payments through Net Banking

Last Updated : May 24, 2025, 6:11 p.m.

Maintaining financial health requires prompt credit card bill payments, which help preserve both fiscal discipline and a positive credit profile. IndusInd Bank cardholders can leverage the convenience of net banking solutions to efficiently manage their monthly payment obligations. This detailed guide explores the various methods for processing IndusInd Bank credit card payments through net banking, while also highlighting additional payment options to ensure you consistently meet your payment deadlines.

The Importance of Managing Your IndusInd Bank Credit Card Payments

IndusInd Bank provides various options for credit cards . Each of them is curated to accommodate different spending patterns and lifestyle needs. Regardless of which specific IndusInd Bank credit card variant you possess, prompt payment is crucial to prevent unnecessary late payment charges, exorbitant interest fees, and detrimental effects on your CIBIL score.

Comprehensive Instructions: Making Your IndusInd Bank Credit Card Payments through Net Banking

Option 1: Through IndusNet Online Banking

For customers who maintain a savings or current account with IndusInd Bank, this represents the most streamlined approach:

- Access your IndusNet account by entering your login credentials

- Select the “Funds Transfer” option and proceed to “Add a Beneficiary for Visa Credit Card Bill Payment”

- Enter the necessary card information, including cardholder name and the complete card number

- Proceed to the “Transfer Funds” area and choose the “To any Visa Card” selection

- Identify which IndusInd account you wish to use for the transfer

- Indicate which credit card should receive the payment

- Specify the amount you wish to pay and confirm your preferred transaction date

- Complete the security verification by providing your transaction password or the OTP received.

Option 2: Via Other Banks’ Online Banking Platforms (NEFT Transfer)

If your primary banking relationship is with another financial institution, you can utilize NEFT functionality to settle your IndusInd Bank credit card obligation:

- Key in your credentials to access your bank’s online portal

- Navigate to the “Funds Transfer” or “NEFT” functionality

- Choose the option to “Add/Manage Beneficiary”

- Register your IndusInd credit card with these details:

- Beneficiary name: Input your name as it is given on the credit card

- Beneficiary account number: Input all 16 digits of your IndusInd credit card

- IFSC code: Use INDB0000018

- Complete the beneficiary registration (Give approximately 30 minutes for activation)

- Navigate to the “Fund Transfer” or “NEFT” section

- Choose your registered IndusInd credit card from your beneficiary roster

- Enter your intended payment amount and proceed with the transaction

- Validate the payment by entering the required OTP or transaction password.

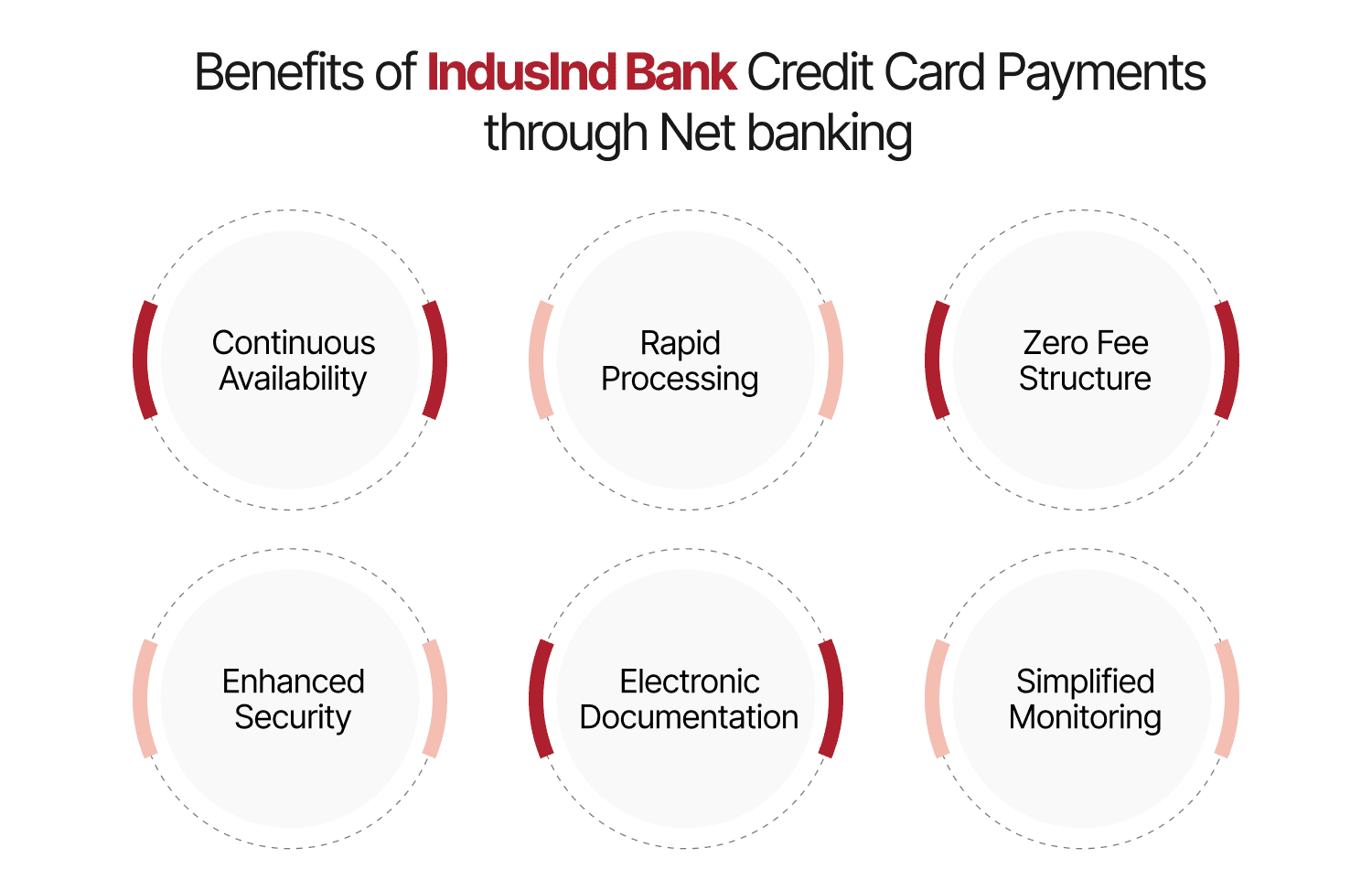

Benefits of IndusInd Bank Credit Card Payments through Net banking

- Continuous Availability : Execute payments at any time, No matter what location you are paying from.

- Rapid Processing : Enjoy faster transaction completion compared to alternative methods

- Zero Fee Structure : The majority of online banking transactions incur no charges

- Enhanced Security : State-of-the-art encryption technology safeguards your financial information

- Electronic Documentation : Easily retrieve payment history and electronic receipts

- Simplified Monitoring : Track payment status through text notifications and digital statements.

Additional Payment Solutions for IndusInd Bank Credit Cards

While net banking offers substantial convenience, IndusInd Bank supports multiple payment channels to accommodate various customer preferences:

Mobile Banking via the INDIE Application

- Install the IndusMobile application (INDIE) from your device’s app marketplace

- Authenticate using your MPIN or online banking credentials

- From the main screen, choose the option ‘Credit Card’

- Tap ‘Pay Now’ to continue

- Select either ‘IndusInd Bank account’ or ‘Swift Pay’

- Input the payment amount and verify with your MPIN

Automated NACH Payment System

For recurring monthly payments, establish a NACH arrangement by completing and submitting the appropriate mandate form. This permits IndusInd Bank to automatically withdraw funds from your designated account on the statement due date.

Supplementary Payment Channels

- RTGS Transfers : Similar to NEFT but with real-time processing

- UPI Transactions : Swift payments through various UPI-enabled applications

- Paper Instruments : Submit checks or demand drafts at designated collection points

- In-Branch Payments : Visit any IndusInd Bank location for in-person payments

- Paytm Wallet : Utilize this popular digital payment platform.

Credit Card Payment Practices and Their CIBIL Score Implications

Your approach to managing payments substantially affects your CIBIL score , which influences future credit eligibility:

- Payment Timeliness (35% weight) : Missed or delayed payments can significantly reduce your score

- Credit Utilization (30% weight) : Maintaining this ratio below 30% contributes to a healthier score

- Credit Diversity (10% weight) : A balanced mix of secured and unsecured credit improves your profile

- Credit History Duration (15% weight) : Established credit histories generally yield superior scores

- Recent Credit Inquiries (10% weight) : Multiple applications within a brief period may diminish your score.

Strategic Recommendations for IndusInd Bank Credit Card Payment Management

- Implement Payment Alerts : Establish notifications for upcoming payment deadlines

- Exceed Minimum Payment Requirements : This strategy reduces interest expenses and bolsters your credit profile

- Configure Automatic Payments : Leverage NACH or auto-debit functionality to ensure timely payments

- Process Payments Ahead of Schedule : Allow 1-2 days for processing by paying before the due date

- Conduct Regular Statement Reviews : Examine statements for unauthorized charges and billing discrepancies

- Maintain Payment Records : Preserve payment confirmations and acknowledgment messages

Conclusion

Making IndusInd Bank credit card payments through net banking represents an intelligent approach to maintaining financial order and protecting your credit standing. By implementing the methodical procedures outlined in this guide, you can ensure consistent on-time payments. Remember that regular, punctual payments not only help avoid financial penalties but also contribute substantially to establishing a robust credit history—an invaluable asset for your long-term financial objectives.

Whether you opt for IndusNet, third-party banking platforms, or any alternative payment method, IndusInd Bank delivers multiple secure options designed to transform credit card payment management into a straightforward process.

Frequently Asked Questions (FAQs)