RBL Bank Credit Card Payments through UPI

Last Updated : June 9, 2025, 6:18 p.m.

India’s payment landscape has transformed with the rise of UPI , and credit card payments have become more accessible than ever. If you're an RBL Bank credit cardholder, you can now pay your credit card bill using UPI apps like Google Pay, PhonePe, Paytm, or BHIM in seconds—without logging into net banking or visiting a branch.

According to NPCI, UPI processed over 18.67 billion transactions worth Rs. 25.14 trillion in May 2025—a 33% YoY jump. UPI is at present the most effective way to pay your RBL Bank credit card bill. These payments incur nil charges and get immediate payment confirmation. The release of the credit limit also happens on the same day.

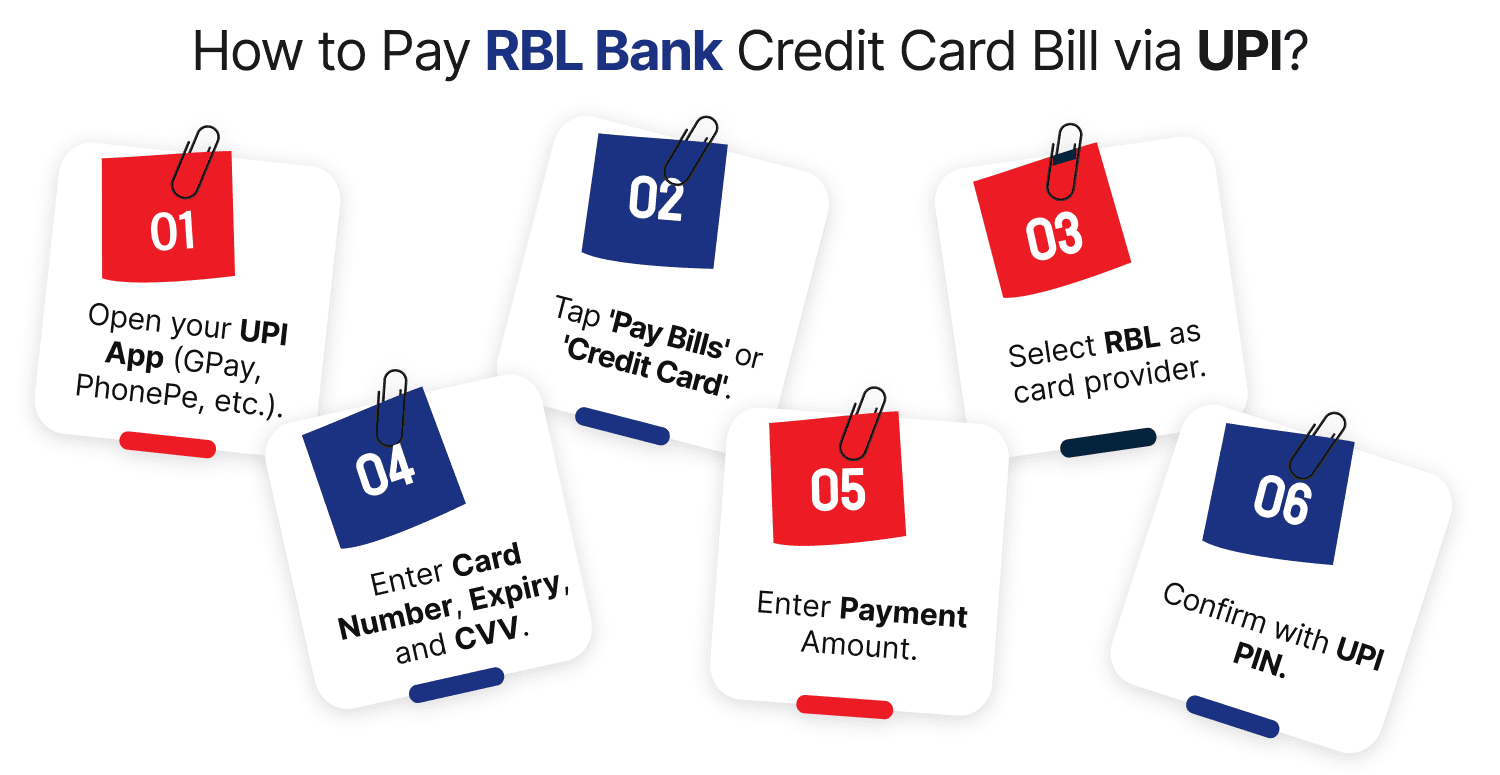

How to Pay RBL Bank Credit Card Bill via UPI – Steps

- Open UPI App: Launch Google Pay, PhonePe, Paytm, or BHIM.

- Tap on ‘Pay Bills’ or ‘Credit Card’ Option.

- Select RBL Bank as your credit card provider.

- Enter Card Details: 16-digit card number, expiry date, and CVV.

- Enter Amount: Type in the amount to be paid.

- Confirm with UPI PIN.

Pro Tip: You can also save your card in most apps for quicker repeat payments.

Make Credit Card with Instanly with Different Payment Modes

| Payment Method | Fees | Processing Time |

|---|---|---|

UPI | Re 0 | Instant; same-day limit release |

RBL Net Banking | Re 0 | Same-day |

Other Bank Net Banking | Re 0 | 1–3 days |

NEFT/RTGS | Re 0 | 24 hours |

Debit Card Payment | Re 0 | Up to 3 days |

Conclusion

If you’re still using conventional banking methods, it’s time to change over to UPI for paying your RBL Bank credit card bill. With instant processing, zero fees, and better credit management, UPI empowers you to stay financially ahead.

Whether you use Google Pay, PhonePe, Paytm, or BHIM, make UPI your go-to method for fast, secure RBL credit card payments—and take control of your credit health with ease.

Frequently Asked Questions (FAQs)