Standard Chartered Bank Credit Card Payments through Mobile Banking

Last Updated : May 20, 2025, 5:17 p.m.

In today’s digital-first world, managing financial transactions has become more convenient than ever before. Standard Chartered Bank, a leading global financial institution, offers comprehensive mobile banking solutions that enable customers to handle their banking needs from anywhere, at any time. One of the most utilized features of mobile banking is credit card management, particularly making timely payments. This article explores how Standard Chartered Bank’s mobile banking platform streamlines credit card payments , offering convenience, security, and flexibility to users worldwide. Let us now read in detail about Standard Chartered Bank Credit Card Payments through mobile banking.

Understanding Standard Chartered Mobile Banking App

Key Features for Credit Card Management

Standard Chartered’s mobile banking application is designed with user convenience in mind, offering a range of features specifically for credit card management:

- Real-time account access: Check credit card balances, available credit limits, and transaction history instantly

- Transaction monitoring: Track recent purchases and payments in real-time

- Statement access: View and download monthly statements directly from the app

- Payment reminders: Receive notifications about upcoming payment due dates

- Rewards point tracking: Monitor and redeem credit card reward points through the app.

Security Features

The Standard Chartered mobile banking app incorporates robust security measures to protect users’ financial information:

- Biometric authentication (facial recognition and fingerprint scanning)

- Multi-factor authentication

- End-to-end encryption for all transactions

- Automatic session timeouts

- Instant transaction notifications.

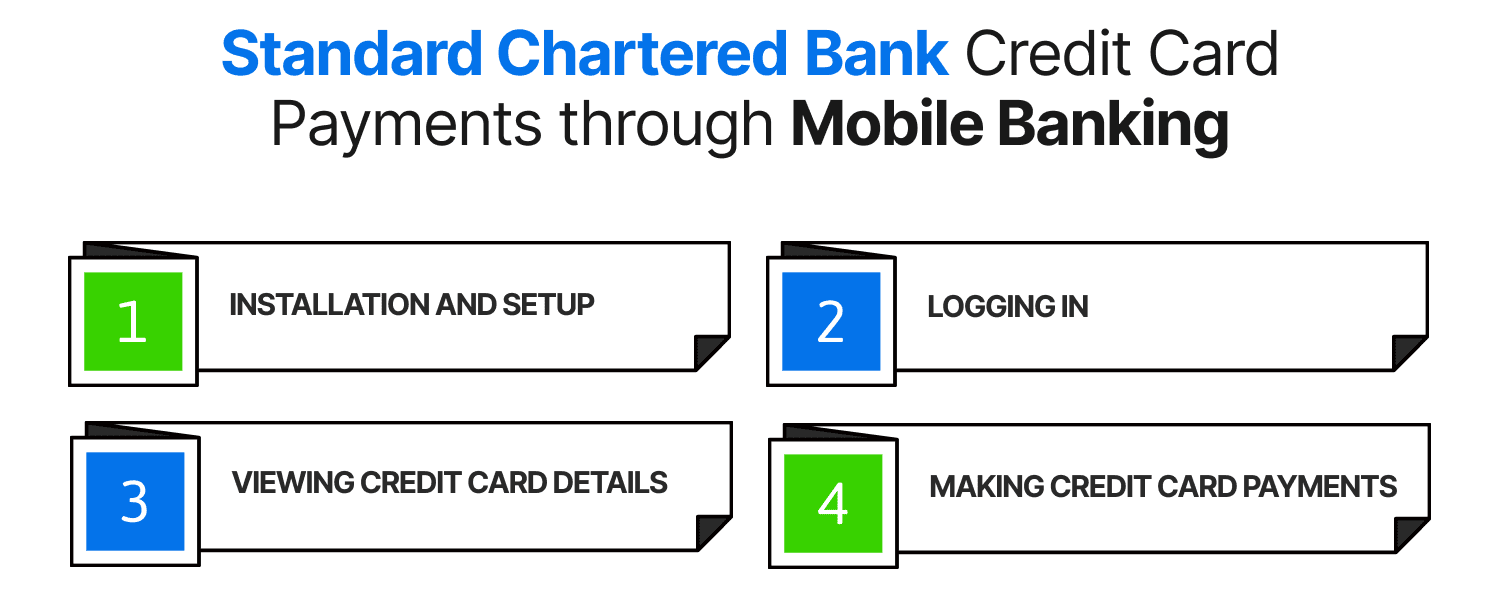

Standard Chartered Bank Credit Card Payments through Mobile Banking - Steps

Here is a step by step guide for making bill payments for Standard Chartered Bank credit cards .

Step-by-Step Guide

1. Installation and Setup

- Download the Standard Chartered mobile banking app from your device’s app store

- Complete the registration process using your credit card details

- Set up security credentials including username, password, and biometric authentication

2. Logging In

- Open the Standard Chartered mobile banking app

- Key in your username and password or use biometric authentication

- From the dashboard, go to the credit card section.

3. Viewing Credit Card Details

- Select the specific credit card account you wish to manage

- View your existing balance, available credit limit, and payment due date

- Access detailed transaction history by expanding the card information

4. Making Credit Card Payments

Option 1: Payment from Linked Standard Chartered Account

- Select “Pay & Transfer” or “Make Payment” option

- Choose the credit card you wish to pay

- Choose your Standard Chartered account as the origin of funds

- Enter the payment amount (minimum due, full amount, or custom amount)

- Review and confirm the payment details

- Complete authentication if required

- Receive confirmation of successful payment

Option 2: Payment from Other Bank Accounts

- Navigate to the credit card payment section

- Select the “Pay from other bank” option

- Add your external bank account details if not already saved

- Enter the payment amount

- Follow the authentication process

- Confirm the transaction

Option 3: Scheduled Payments

- Set up automatic monthly payments

- Choose payment frequency (monthly, bi-weekly)

- Select payment amount preference (minimum due, full amount, custom amount)

- Set the payment date preference

- Confirm the standing instruction setup

Benefits of Using Mobile Banking for Credit Card Payments

Convenience and Accessibility

- 24/7 access: Make payments at any time, regardless of bank operating hours

- Remote transactions: Eliminate the need to visit physical branches

- Quick processing: Payments are usually processed instantly or within 24 hours

- Multiple payment options: Select from different payment modes and sources

Financial Management Benefits

- Better budget control: Real-time visibility of credit card spending and balances

- Avoid late fees: Timely payment reminders help avoid late payment penalties

- Transaction tracking: Monitor all credit card activities in one place

- Paperless statements: Access digital statements, reducing paper waste

Enhanced Security

- Secure transactions: Multiple layers of security protection

- Transaction alerts: Immediate notifications for all account activities

- Fraud prevention: Quick detection of unauthorized transactions

- Secure communication: Encrypted channels for all communications with the bank.

How Timely Credit Card Payments Affect Your Credit Score?

Credit card payment behavior significantly impacts your CIBIL score , which influences your creditworthiness for future loans and credit facilities:

- Payment history: Timely payments through mobile banking contribute to a positive payment history, which accounts for 35% of your CIBIL score

- Credit utilization: The mobile app allows you to monitor and maintain healthy credit utilization ratios.

- Length of credit history: Regular payments help establish a longer, positive credit history.

- Credit mix: Managing multiple credit products effectively demonstrates financial responsibility.

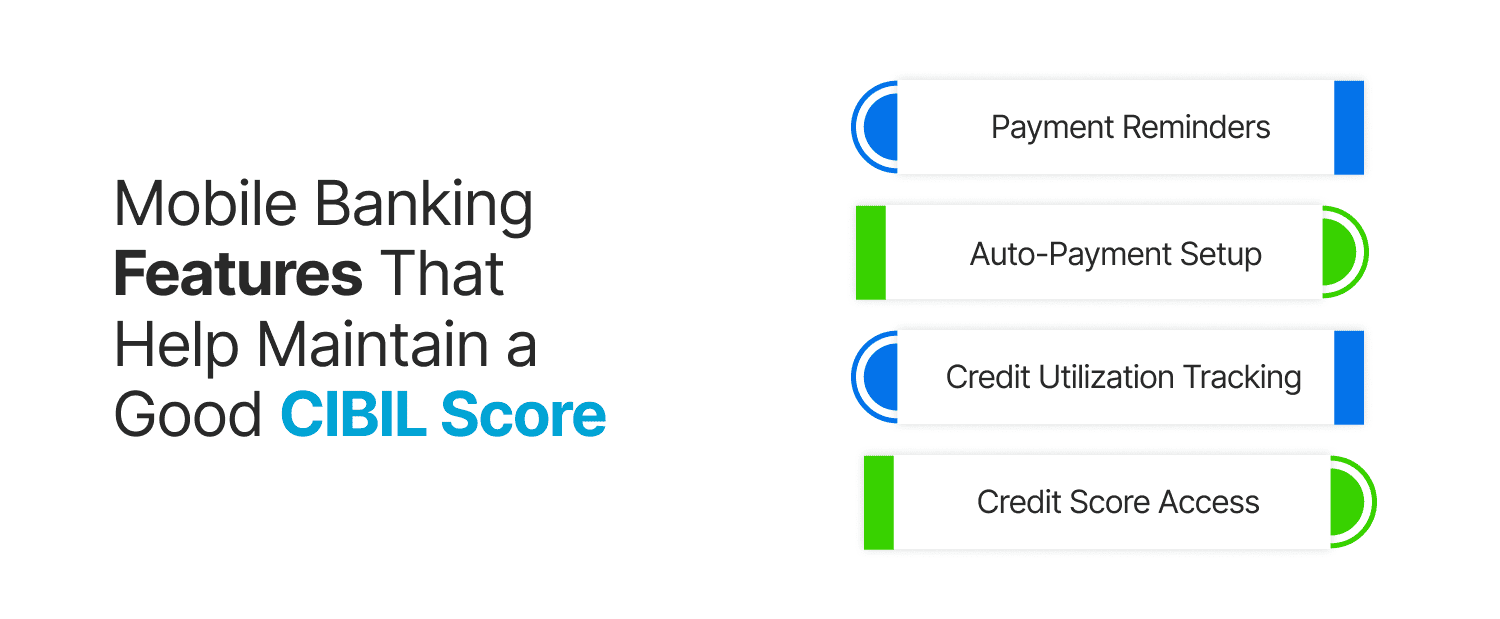

Mobile Banking Features That Help Maintain a Good CIBIL Score

Standard Chartered’s mobile banking app offers tools that directly or indirectly help maintain a healthy credit score:

- Payment reminders: Never default on a payment deadline with automated alerts

- Auto-payment setup: Ensure consistent timely payments through standing instructions

- Credit utilization tracking: Monitor spending relative to your credit limit

- Credit score access: Some versions of the app provide direct access to your credit score.

Practical Tips for Managing Standard Chartered Bank Credit Card Payments through Mobile Banking

Optimizing Your Mobile Banking Experience

- Enable notifications: Set up reminders for payment due dates and alerts for transactions

- Schedule recurring payments: Automate payments to ensure they’re never late

- Use spending categories: Track expenses by category to better manage your budget

- Regular monitoring: Check your credit card account frequently to spot unauthorized charges

Avoiding Common Pitfalls

- Verify payment confirmation: Always check for successful payment confirmation.

- Maintain sufficient funds: Ensure adequate balance in your payment source account

- Update contact information: Keep your mobile number and email current for important notifications

- Secure your device: Use device passwords and keep the banking app updated.

Recent Enhancements to Standard Chartered Bank Credit Card Payments through Mobile Banking

Standard Chartered continues to innovate its mobile banking platform with new features that enhance the credit card payment experience:

- QR code payments: Scan and pay functionality for quick transactions

- Bill splitting: Easily split bills among friends and family

- Customizable dashboards: Personalize your app interface for easier navigation

- Integrated financial insights: Receive personalized spending analysis and recommendations.

Comparison with Other Payment Methods

| Payment Method | Processing Time | Convenience | Record Keeping | Cost |

|---|---|---|---|---|

Mobile Banking | Instant/Same day | Very High | Automated | Free |

ATM Payments | 1-2 business days | Medium | Manual | Free |

Branch Payments | Same day | Low | Manual | May incur charges |

Cheque Payments | 3-5 business days | Low | Manual | May incur charges |

Third-party Apps | Varies | High | Varies | May incur charges |

Conclusion

Standard Chartered Bank’s mobile banking application provides a comprehensive, secure, and convenient platform for managing credit card payments. By utilizing this digital solution, customers can ensure timely payments, maintain healthy credit scores, and enjoy greater control over their financial management. The continuous enhancements to the mobile banking experience reflect Standard Chartered’s commitment to delivering customer-centric digital solutions that align with evolving financial needs and technological advancements. Whether you’re a new credit card user or looking to streamline your existing payment processes, Standard Chartered’s mobile banking platform offers the tools and features necessary for efficient credit card management. By making timely Standard Chartered Bank credit card payments through mobile banking, you not only avoid late fees and penalties but also contribute positively to your overall credit health, ensuring better financial opportunities in the future.

Frequently Asked Questions (FAQs)