Standard Chartered Bank Credit Card Payments through NEFT

Last Updated : May 22, 2025, 5:39 p.m.

Paying your Standard Chartered Bank credit card bill on time is crucial to maintain a healthy credit profile and avoid unnecessary interest charges. One of the most convenient and secure methods to make these payments is through the National Electronic Funds Transfer (NEFT) system. This guide provides a step-by-step process to help you complete your Standard Chartered Bank credit card payments through NEFT efficiently.

What Is NEFT and Why Use it for SCB Credit Card Payments?

The National Electronic Funds Transfer (NEFT) is an electronic payment system maintained by the Reserve Bank of India (RBI). It enables individuals to transmit funds between any two bank accounts supported by NEFt on a one-to-one basis. NEFT operates 24/7, ensuring that your credit card payments are processed promptly, even on weekends and holidays. Using NEFT for credit card payments offers several advantages:

- Convenience: Initiate payments from anywhere using online banking.

- Security: NEFT transactions are safe, since they are encrypted and regulated by the RBI, ensuring safe transmissions.

- Cost-Effective: Most banks do not levy charges for NEFT transactions made online.

- No Transaction Limits: There is no minimum or maximum limit on NEFT transactions, providing flexibility in payment amounts.

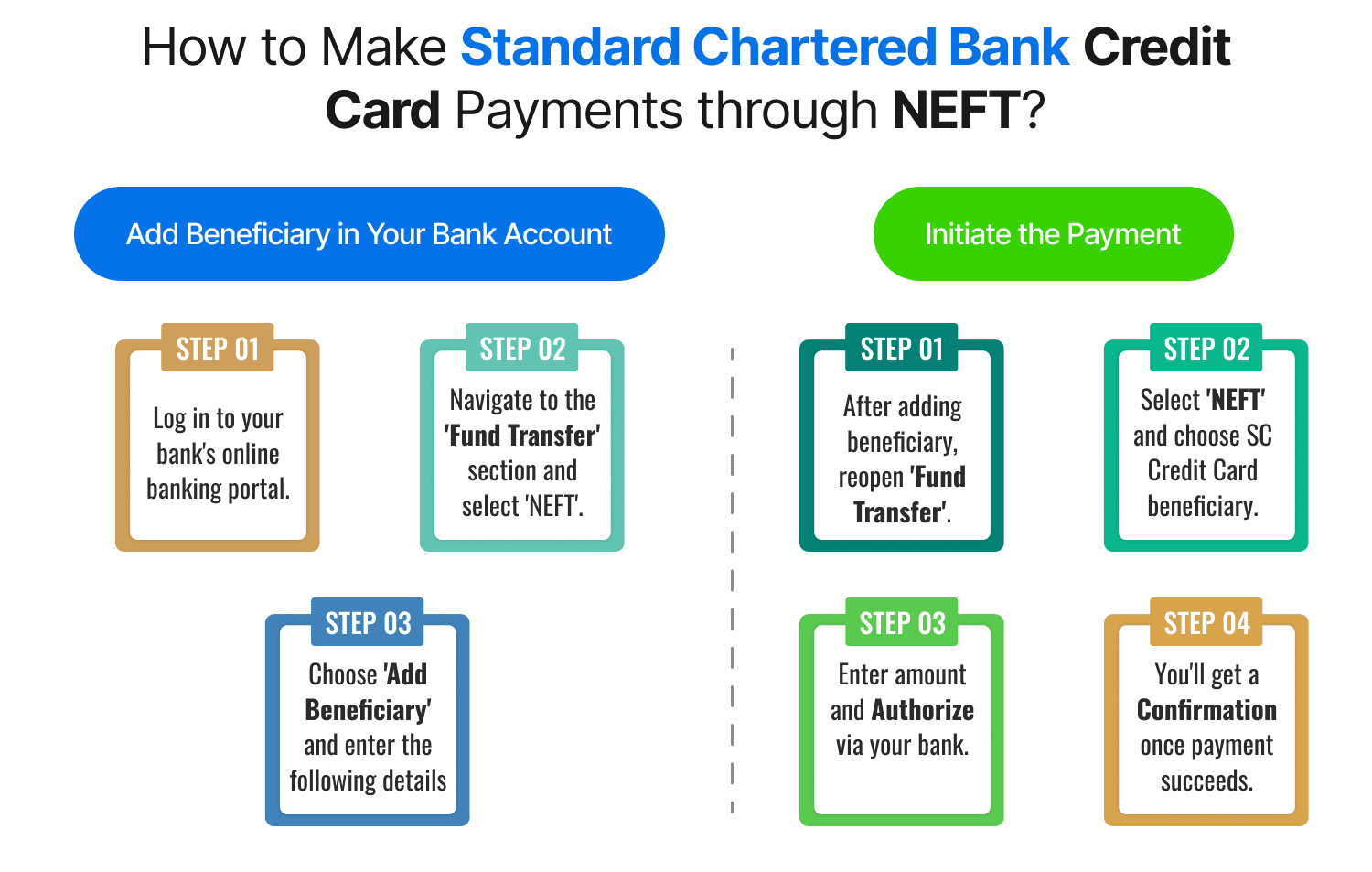

How to Make Standard Chartered Bank Credit Card Payments through NEFT?

Pursue these steps to pay your Standard Chartered credit card bills using NEFT:

Step 1: Add Beneficiary in Your Bank Account

- Log in to your bank's online banking portal.

- Navigate to the 'Fund Transfer' section and select 'NEFT'.

- Choose 'Add Beneficiary' and enter the following details:

- Beneficiary Name: Standard Chartered Bank

- Account Number: Your 16-digit Standard Chartered credit card number

- Account Type: Current

- IFSC Code: SCBL0036001

- Branch Address: MG Road, Mumbai

- Confirm the beneficiary details. For your bank to approve the new beneficiary, it may take up to 30 minutes.

Step 2: Initiate the Payment

- After the beneficiary is added, go to the 'Fund Transfer' section again.

- Select 'NEFT' and choose the Standard Chartered credit card as the beneficiary.

- Enter the payment amount and proceed to authorize the transaction using your bank's authentication method (e.g., OTP, transaction password).

- Once the payment is successful, you will receive a confirmation message or email from your bank.

Important Considerations

- Processing Time: NEFT transactions are processed in 48 half-hourly batches throughout the day. Payments initiated during non-business hours may take up to 1-2 working days to reflect in your credit card account.

- Payment Confirmation: After the payment is credited, you will receive an SMS or email confirmation from Standard Chartered Bank.

- Transaction Reference: Keep a record of the transaction reference number for future reference or for disputes.

Impact on CIBIL Score

Timely credit card payments positively influence your CIBIL score , reflecting responsible credit behavior. Consistently making payments through reliable methods like NEFT ensures that your credit history remains intact, aiding in future credit applications.

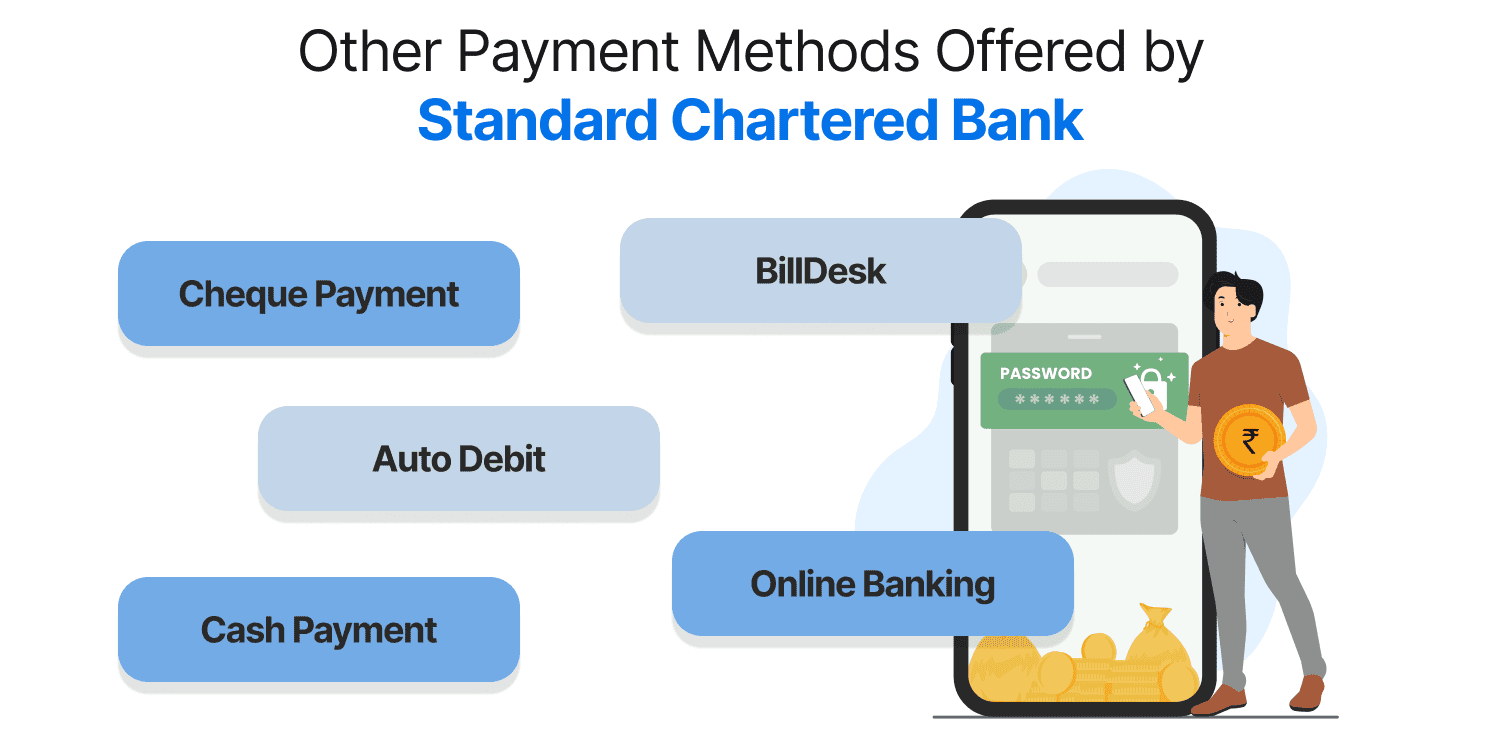

Other Payment Methods Offered by Standard Chartered Bank

In addition to NEFT, Standard Chartered Bank provides several other convenient payment options for credit card bills:

- BillDesk: Use the BillDesk platform to pay your credit card bill securely from any bank account

- Online Banking: Directly pay your credit card bill through Standard Chartered's online banking portal.

- Cheque Payment: Drop a cheque in favor of your credit card number at any Standard Chartered Bank branch or cheque collection box.

- Auto Debit: Set up an automatic payment instruction to pay your credit card bill on time every month.

- Cash Payment: Deposit cash at any Standard Chartered Bank branch using teller facilities.

Conclusion

Making your Standard Chartered Bank Credit Card Payments through NEFT is a secure, convenient, and cost-effective method. By following the outlined steps and considering the provided tips, you can ensure timely payments, maintain a healthy credit profile, and avoid unnecessary charges. Always remember to initiate payments well before the due date to account for processing times and ensure your payment is credited promptly.

Frequently Asked Questions (FAQs)