Standard Chartered Bank Credit Card Payments through Net Banking

Last Updated : May 21, 2025, 12:49 p.m.

In today's digital banking landscape, managing credit card payments efficiently is essential for maintaining financial health. Standard Chartered Bank offers various convenient methods for customers to pay their credit card bills, with net banking being one of the most popular options. This comprehensive guide explores everything you need to know about making Standard Chartered Bank credit card payments through net banking, the benefits of this payment method, and how timely payments can positively impact your CIBIL score .

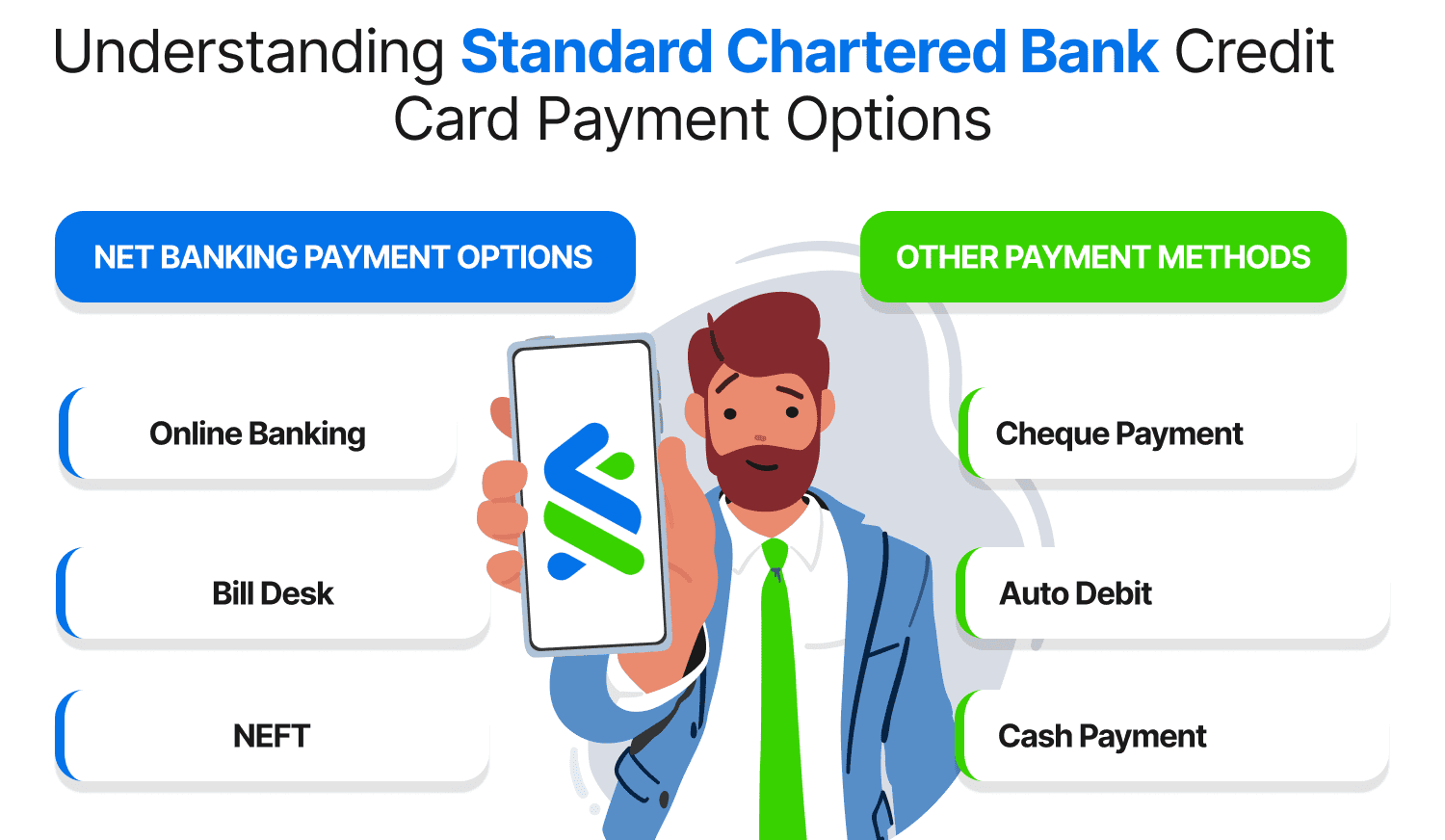

Understanding Standard Chartered Bank Credit Card Payment Options

Standard Chartered Bank provides multiple payment channels to ensure customers can conveniently manage their credit card bills. These include:

Net Banking Payment Options

- Online Banking: Standard Chartered's online banking platform gives customers complete control over their finances, allowing them to make credit card payments anytime, anywhere.

- Bill Desk: This secure platform enables payments from any bank account through Standard Chartered's payment portal.

- NEFT/IBFT: Customers can add their credit card as a beneficiary using the IFSC code SCBL0036001 and transfer funds directly from their bank account.

Other Payment Methods

- Cheque Payment: Dropping a cheque or draft at collection boxes

- Auto Debit: Setting up automatic payments for minimum or full payment amounts

- Cash Payment: Available at Standard Chartered branches through teller facilities.

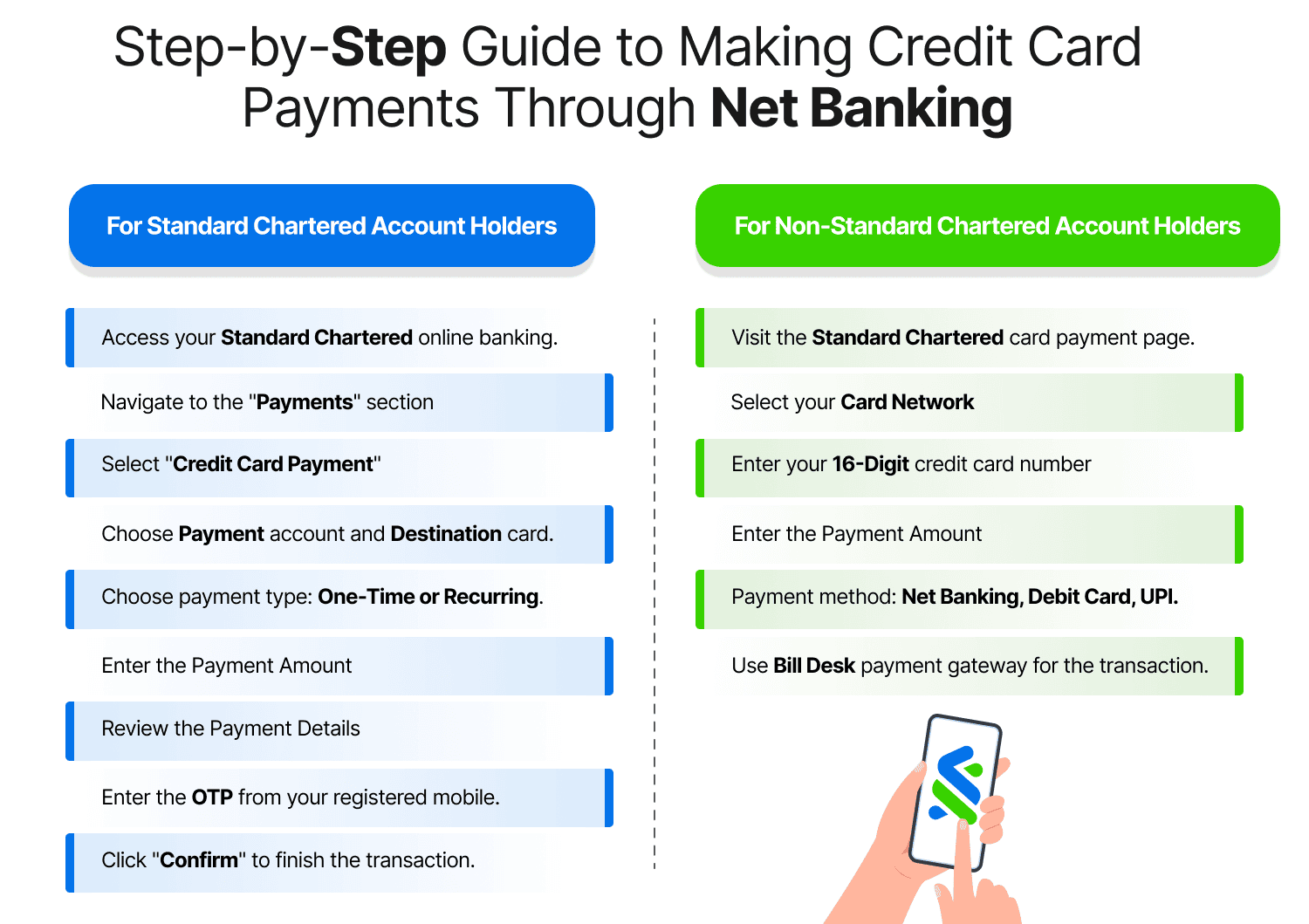

Step-by-Step Guide to Making Credit Card Payments Through Net Banking

Making Standard Chartered Bank credit card payments through net banking is a straightforward process that can be completed in a few simple steps.

For Standard Chartered Account Holders

- Access your Standard Chartered online banking account

- Navigate to the "Payments" section

- Select "Credit Card Payment"

- Choose the account you want to pay from and the credit card you're paying to

- Select payment type (one-time or recurring)

- Enter the payment amount

- Review the payment details

- Key in the One-Time Password (OTP) obtained on your registered mobile number

- Click "Confirm" to complete the transaction

For Non-Standard Chartered Account Holders

If you don't have a Standard Chartered Bank account, you can still make credit card payments through their online portal:

- Visit the Standard Chartered credit card payment page

- Select your card network

- Enter your 16-digit credit card number

- Enter the payment amount

- Choose your preferred payment method (net banking, debit card, UPI, or QR code)

- Complete the transaction through the BillDesk payment gateway.

Recent Changes in Standard Chartered Credit Card Payment Systems

Standard Chartered has recently updated the policies related to credit card payments. As of 2024, the bank has shown that credit card payments via third-party platforms may no longer be supported.

Cardholders are now encouraged to use:

- Standard Chartered's online portal

- NEFT payments

- NACH (National Automated Clearing House)

- Traditional methods like cheque, DD, or cash

For Standard Chartered account holders, the bank's net banking platform or SC mobile app remains the most convenient option.

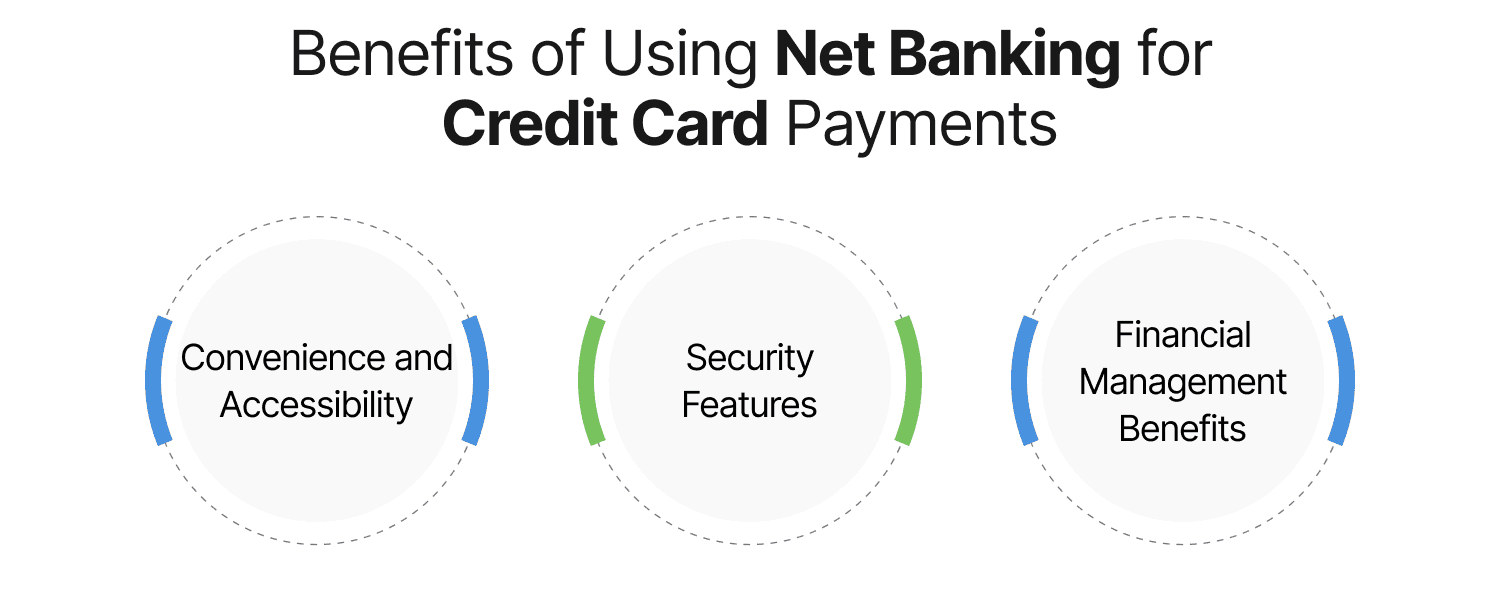

Benefits of Using Net Banking for Credit Card Payments

Making Standard Chartered Bank credit card payments through net banking offers multiple benefits:

Convenience and Accessibility

- 24/7 payment facility without time constraints

- No need to visit branches or ATMs

- Transaction history available for reference

- Immediate confirmation of payment

Security Features

- Secure encrypted transactions

- Two-factor authentication

- OTP verification for added security

- Digital receipts and transaction records

Financial Management Benefits

- Option to schedule payments in advance

- Ability to set up automatic payments

- Real-time status updates

- Better tracking of payment history

How Credit Card Payments Impact Your CIBIL Score?

Your payment habits significantly influence your credit profile. Understanding this relationship is crucial for maintaining a healthy credit score.

Positive Impact of Timely Payments

Regular and on-time Standard Chartered Bank credit card payments through net banking can positively impact your CIBIL score in several ways:

- Building a positive payment history

- Demonstrating financial responsibility

- Improving your credit utilization ratio

- Enhancing your overall creditworthiness

Consequences of Missed Payments

Missing even a single credit card payment can have serious implications:

- A significant drop in your CIBIL score (as much as 50-75 points for a single missed payment)

- Recording of late payment in your credit history

- Potential difficulty in obtaining future loans or credit cards

- Higher interest rates on future credit applications

One user reported that missing a Standard Chartered Bank credit card payment by just 15 days caused their CIBIL score to drop from 780 to 705, illustrating the importance of timely payments.

Best Practices for Managing Credit Card Payments

Here are some tips to get the maximum benefits from using net banking for Standard Chartered Bank credit card payments and thus maintain a healthy credit profile:

Payment Strategies

- Pay before the due date: Schedule payments at least 2-3 days before the due date to account for processing time

- Pay more than the minimum amount: Aim to pay the full balance or significantly more than the minimum amount due

- Set up reminders for payments: Use calendar alerts or banking notifications.

- Consider auto-payment: Set up standing instructions for at least the minimum amount due

CIBIL Score Management

- Check your credit report periodically: Check for any discrepancies or unauthorized activities

- Maintain low credit utilization: Keep credit card balances below 30% of your total credit limit

- Avoid multiple payment skips: Even a single missed payment can significantly impact your score

- Have a varied portfolio for your credit: Having various types of credit accounts can positively influence your score.

Alternative Payment Options in Case of Emergencies

If you're unable to access net banking, consider these alternatives:

- Mobile Banking App: Use the SC Mobile app for immediate payments

- UPI Payments: Quick and convenient digital transfers

- ATM Payments: Deposit cash or cheques at Standard Chartered ATMs

- Branch Payments: Visit a Standard Chartered branch for assistance.

Conclusion

Standard Chartered Bank credit card payments through net banking offer a convenient, secure, and efficient way to manage your credit obligations. By understanding the payment process, utilizing the available features, and maintaining timely payments, you can not only avoid penalties and interest charges but also build a strong credit profile with a healthy CIBIL score.

Regular verification of your payment history and credit report will enable you to stay informed about your financial standing and make the required adjustments to your payment strategies. Remember, a strong credit score opens doors to better financial opportunities, including favorable interest rates and higher credit limits in the future. By leveraging Standard Chartered's net banking platform for credit card payments, you're taking a significant step toward effective financial management and long-term credit health.

Frequently Asked Questions (FAQs)