Standard Chartered Credit Card Payments through BillDesk

Last Updated : May 21, 2025, 5:31 p.m.

Efficient credit card payment management is essential for maintaining financial wellness and protecting your CIBIL score in today’s digital banking environment. Among the various payment channels offered by Standard Chartered Bank to its cardholders, BillDesk emerges as a particularly effective solution. This comprehensive guide examines how to effectively make Standard Chartered credit card payments through BillDesk, offering strategies to streamline your financial obligations.

Understanding BillDesk as a Payment Solution

Established in Mumbai in 2000, BillDesk has evolved into a cornerstone of India’s digital payment infrastructure, facilitating approximately 50-60% of online bill transactions nationwide. This payment gateway excels in managing recurring payments and offers a secure environment for processing various financial transactions, including credit card bills. Operating as a business-to-business platform, BillDesk creates secure connections between financial institutions and service providers, ensuring the protection of sensitive customer information throughout the payment process. The company’s commitment to data security has established it as a trusted entity in India’s financial technology landscape.

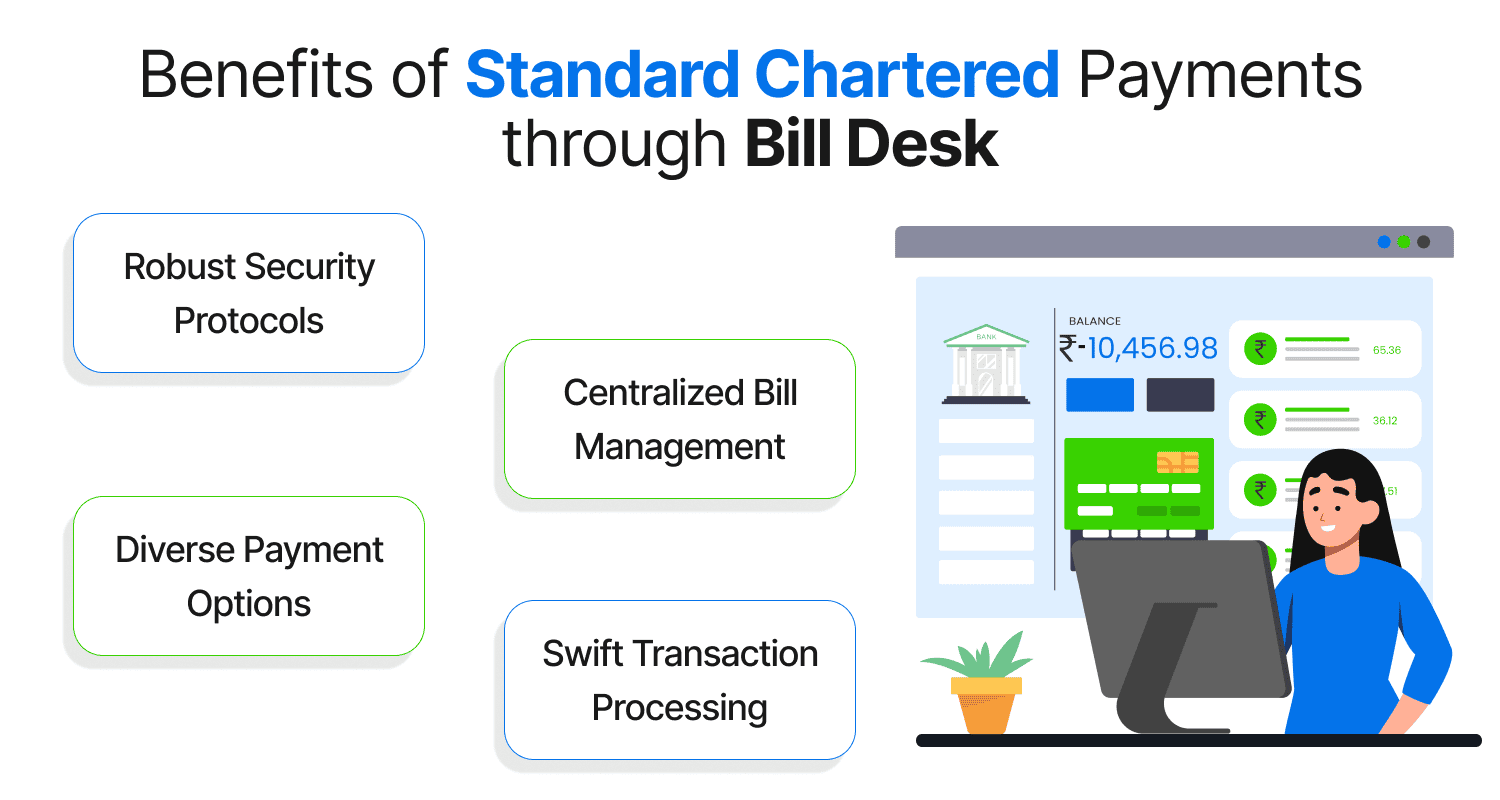

Benefits of Standard Chartered Payments through Bill Desk

Robust Security Protocols

When processing Standard Chartered credit card payments, BillDesk implements Secure Sockets Layer (SSL) encryption technology, establishing a protected channel for your financial information. This security framework is vital when transmitting sensitive payment data online.

Centralized Bill Management

The platform aggregates all your recurring payments in one accessible interface, enabling you to monitor and settle your Standard Chartered credit card obligations alongside other routine expenses without navigating multiple websites or applications.

Diverse Payment Options

BillDesk supports various transaction methods, including internet banking, UPI transfers, and additional digital payment solutions, providing flexibility in how you choose to settle your Standard Chartered credit card bills.

Swift Transaction Processing

Payments submitted through BillDesk typically register quickly, often within the same day, helping cardholders avoid late payment penalties and potential negative impacts on their credit history.

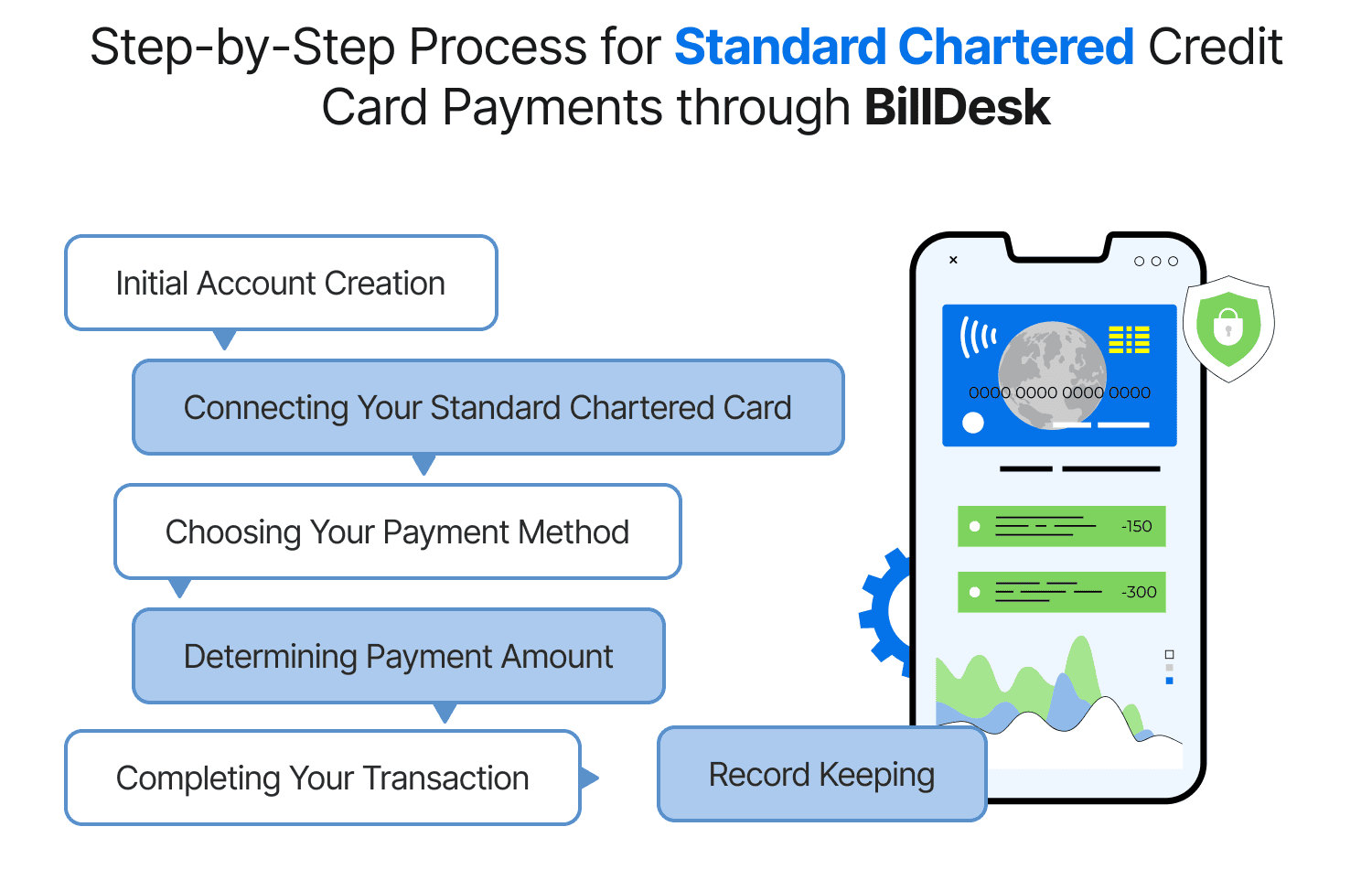

Step-by-Step Process for Standard Chartered Credit Card Payments through BillDesk

Initial Account Creation

First-time users must complete registration on the BillDesk platform by providing basic personal information and Standard Chartered credit card details. This one-time setup establishes your account foundation.

Connecting Your Standard Chartered Card

Following registration, add your Standard Chartered credit card as a payment recipient within the system. This requires entering your card number and completing verification steps.

Choosing Your Payment Method

The platform accommodates several payment options:

- Internet banking services

- Debit card transactions

- UPI transfers

- Digital wallet payments

Determining Payment Amount

When settling your bill, you can choose between:

- Minimum payment requirement (typically 5% of outstanding balance)

- Full balance settlement (recommended to eliminate interest charges)

- Custom payment amount based on your financial situation

Completing Your Transaction

Review the payment details thoroughly, confirm the transaction, and complete any required authentication steps. Upon completion, the system generates confirmation of your successful payment.

Record Keeping

Always preserve the transaction confirmation as payment evidence. BillDesk automatically sends verification details to your registered email address for record-keeping purposes.

Automated Payment Solutions

For those wishing to eliminate manual payment processes and due date concerns, BillDesk offers automated payment functionality:

- Access your BillDesk account dashboard

- Locate your registered Standard Chartered credit card

- Navigate to the recurring payment section

- Establish monthly payment frequency

- Specify payment preference (minimum due or complete balance)

- Select a processing date (preferably several days before the actual due date)

- Confirm your automated payment arrangement

This automation ensures consistent monthly payments, supporting regular payment patterns and potentially enhancing your credit assessment.

Impact on Your Credit Profile

Your payment reliability directly influences your CIBIL score calculation. Regular Standard Chartered credit card payments through BillDesk can make your financial profile stronger through:

Enhanced Payment Records

Timely payments make up for approximately 35% of your CIBIL score. BillDesk’s automated payment features help maintain consistent payment timing.

Improved Credit Utilization

Paying your credit card bill in full rather than the minimum amount due helps maintain lower credit utilization percentages, positively impacting your credit evaluation metrics.

Sustained Positive Credit History

Consistent payments through reliable platforms like BillDesk contribute to building a solid credit history foundation, enhancing your overall financial credibility.

Troubleshooting Common Issues for Standard Chartered Credit Card Payments through BillDesk

Despite BillDesk’s reliability, occasional challenges may arise. Here are solutions for typical scenarios:

Transaction Failures

If your payment doesn’t process successfully, verify:

- Available funds in your payment account

- Accuracy of entered card information

- Internet connection stability

- Bank system availability

Try again after a brief waiting period or contact BillDesk support if problems persist.

Processing Delays

Most payments appear within 24-48 hours. For transactions not reflected on your Standard Chartered statement after this timeframe, contact Standard Chartered customer service with your BillDesk reference information.

Accidental Duplicate Payments

If you accidentally submit multiple payments, promptly notify Standard Chartered Bank. The excess amount typically applies to future billing cycles or returns to your account.

Payment Method Comparison

| Payment Channel | Processing Timeframe | User Experience | Transaction Tracking | Associated Fees |

|---|---|---|---|---|

BillDesk | Same day processing | Exceptional | Digital tracking | No charge |

Standard Chartered Mobile Banking | Immediate | Exceptional | Digital tracking | No charge |

ATM Deposits | 1-2 business days | Moderate | Manual record-keeping | No charge |

In-Branch Payments | Same day | Basic | Manual record-keeping | Possible fees |

Check Payments | 3-5 business days | Basic | Manual record-keeping | Possible fees |

Alternative Payment Applications | Variable | Good | Varies by platform | Possible fees |

Conclusion

In an increasingly digital financial ecosystem, making Standard Chartered credit card payments through Bill Desk is easy. By leveraging this platform’s security features, payment flexibility, and automation capabilities, cardholders can significantly simplify their financial management routines while simultaneously strengthening their credit profiles. The seamless integration between Standard Chartered Bank and BillDesk represents the future of smart personal finance management—where security, efficiency, and user experience converge to offer cardholders greater control over their financial obligations. As digital payment solutions continue to evolve, embracing tools like BillDesk not only streamlines your current payment processes but also positions you advantageously within India’s rapidly advancing financial technology landscape.

Frequently Asked Questions (FAQs)