The Pros and Cons of Co-Branded Credit Cards

Last Updated : May 30, 2025, 3:19 p.m.

Co-branded credit cards, a collaboration between a bank and a brand, such as an airline, retailer, or hotel chain, have gained popularity for their tailored rewards and exclusive perks. These cards cater to specific consumer needs, offering benefits tied to particular brands or industries. However, they also come with limitations that may not suit everyone. In this Wishfin guide, we explore the pros and cons of co-branded credit cards to help you decide if they’re right for you.

What Are Co-Branded Credit Cards?

Co-branded credit cards are issued by financial institutions in partnership with companies like airlines, retail stores, or e-commerce platforms. They combine the convenience of a credit card with brand-specific rewards, such as airline miles, cashback on retail purchases, or exclusive discounts. For example, cards like the Amazon Pay ICICI Credit Card or Air India SBI Card offer rewards tailored to frequent shoppers or travelers. To explore the best credit card options, visit Wishfin’s Credit Card Comparison.

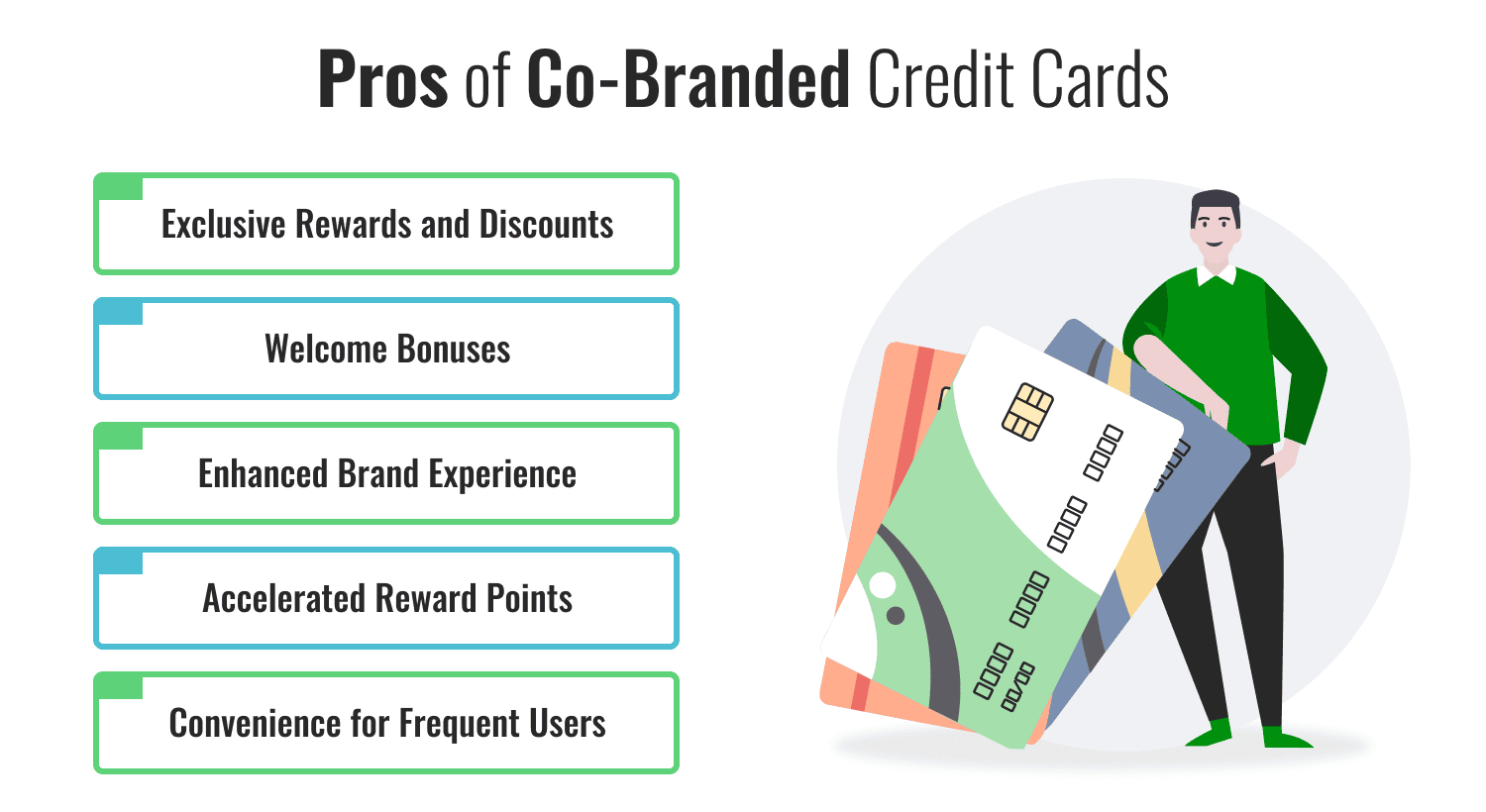

Pros of Co-Branded Credit Cards

- Exclusive Rewards and Discounts: Co-branded cards offer rewards tailored to specific brands, such as cashback on Amazon purchases or bonus miles with airlines. For instance, frequent shoppers can save significantly with retailer-specific cards.

- Welcome Bonuses: Many co-branded cards provide lucrative sign-up bonuses, such as free flight tickets or gift vouchers, upon meeting initial spending requirements.

- Enhanced Brand Experience: Cardholders often enjoy perks like priority boarding, free lounge access, or exclusive event invites, enhancing their experience with the partnered brand.

- Accelerated Reward Points: Purchases with the partner brand often earn higher reward points compared to general credit cards, maximizing savings for loyal customers.

- Convenience for Frequent Users: If you regularly shop or travel with a specific brand, a co-branded card streamlines rewards, making it easier to redeem points or miles.

Cons of Co-Branded Credit Cards

- Limited Usability: Rewards are often restricted to the partner brand, reducing flexibility. For example, airline co-branded cards may only offer miles redeemable with specific carriers.

- High Annual Fees: Many co-branded cards come with high annual fees, which may outweigh the benefits if you don’t use the card frequently.

- Higher Interest Rates: Co-branded cards may have higher interest rates than general-purpose credit cards , increasing costs if you carry a balance.

- Reward Redemption Restrictions: Some cards impose blackout dates, limited redemption options, or expiration dates on rewards, reducing their value.

- Brand Dependency: If the partnered brand faces issues, such as an airline going bankrupt, the card’s benefits may become obsolete.

Who Should Opt for a Co-Branded Credit Card?

Co-branded credit cards are ideal for consumers who frequently engage with a specific brand, such as frequent flyers, avid online shoppers, or loyal retail customers. However, they may not suit those who prefer flexibility or don’t align with a single brand. To check your eligibility for top co-branded cards, visit Wishfin’s Credit Score Tool to ensure your credit profile meets the requirements.

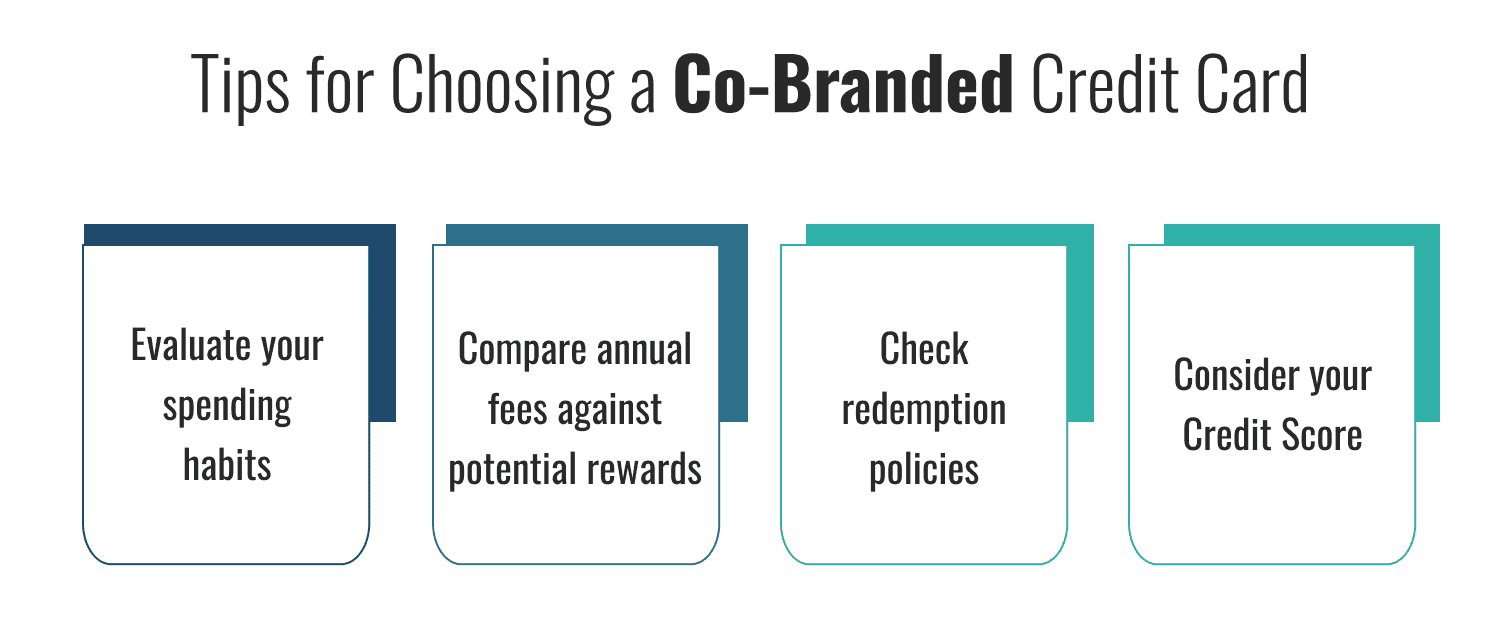

Tips for Choosing a Co-Branded Credit Card

- Evaluate your spending habits to ensure the card aligns with your lifestyle.

- Compare annual fees against potential rewards to determine cost-effectiveness.

- Check redemption policies to avoid restrictive terms.

- Consider your credit score, as premium co-branded cards often require a high score.

For a detailed comparison of credit card features, explore Wishfin’s Best Credit Cards Guide.

Conclusion

Co-branded credit cards offer a compelling mix of tailored rewards and exclusive perks for loyal customers, making them a great choice for frequent users of specific brands. However, their limitations, such as high fees and restricted usability, require careful consideration. By weighing the pros and cons and aligning the card with your spending habits, you can make an informed decision. Wishfin’s tools and resources can guide you in selecting the right card for your financial goals.

Frequently Asked Questions (FAQs)