Yes Bank Credit Card Bill Payment Through UPI

Last Updated : June 6, 2025, 3:02 p.m.

Paying your credit card bill on time is important for maintaining a healthy credit profile. For Yes Bank credit cardholders in India, UPI offers one of the fastest, most convenient ways to settle dues. In this guide, we’ll show you how to make Yes Bank credit card bill payment through UPI, compare UPI with other payment methods, and highlight the benefits for your credit score.

What Is UPI (Unified Payments Interface)?

- Instant transfers : UPI lets you transfer money between bank accounts in real time, 24×7.

- Supported by major apps : Google Pay, PhonePe, Paytm, BHIM, and others – now also enable RuPay credit card linkage.

- Secure & free : End-to-end encryption, with no added fees for UPI transfers (subject to daily RBI limit).

Recently, RBI/NPCI allowed RuPay credit cards to be added to UPI wallets. This means you can use your Yes Bank RuPay credit card as a funding source. Once linked, paying your bill becomes as simple as sending money to any UPI recipient.

Pro tip: Timely UPI bill payments help maintain or improve your CIBIL score. Monitor your score for free on Wishfin .

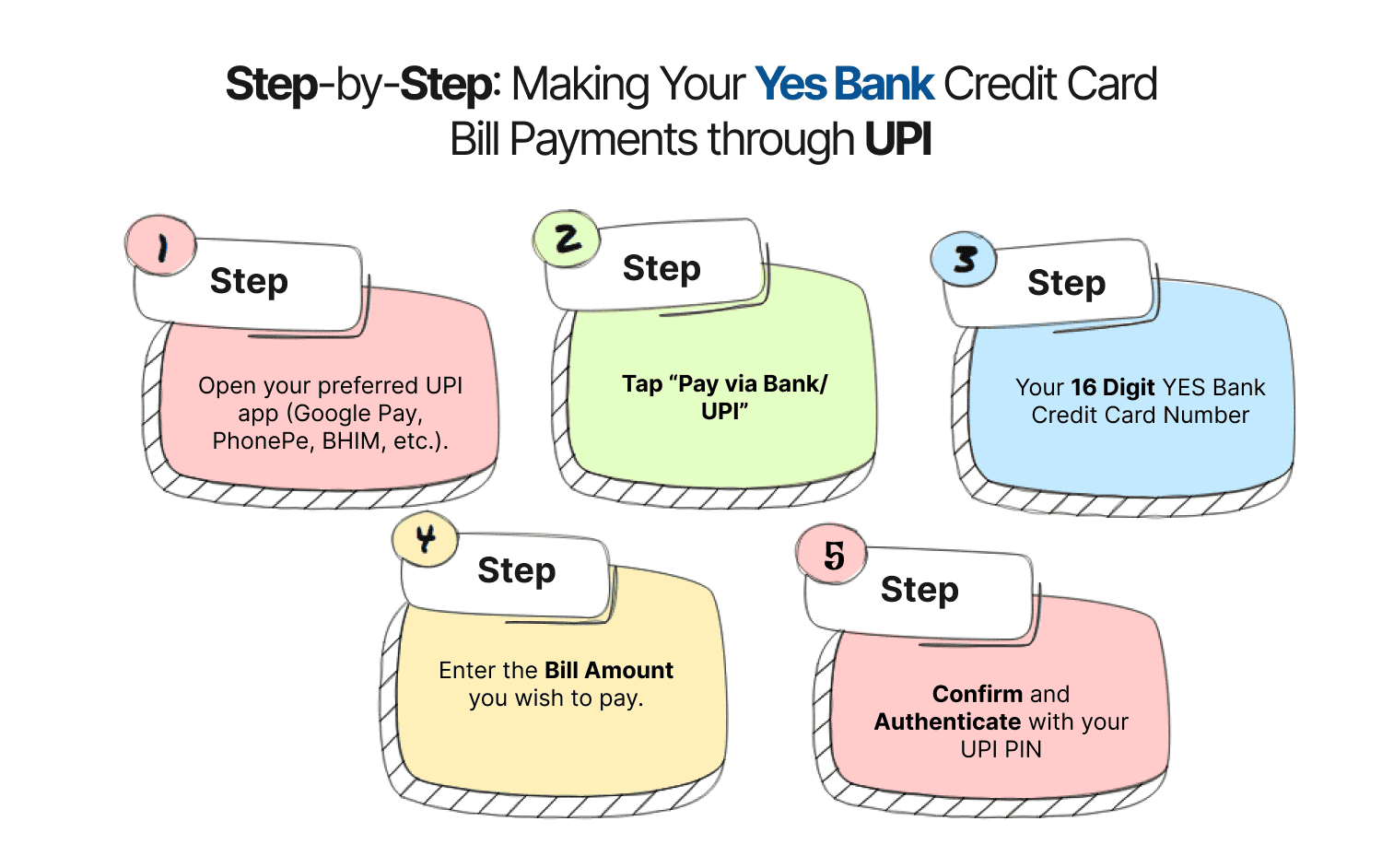

Step-by-Step: Making Your Yes Bank Credit Card Bill Payments through UPI

- Open your preferred UPI app (Google Pay, PhonePe, BHIM, etc.).

- Tap “Pay via Bank/UPI” (or similar).

- Enter Beneficiary Details :

- Account number : Your Yes Bank credit card number of length 16 digits.

- IFSC code : YESB0CMSNOC

- Account number : Your Yes Bank credit card number of length 16 digits.

- Enter the bill amount you wish to pay.

- Confirm and authenticate with your UPI PIN.

Post doing this, the amount is instantly debited from your linked bank/credit source and credited to your credit card account. UPI transfers are typically credited on the same day. This ensures timely payments.

Note : There’s a Rs. 1,00,000 daily upper limit on UPI transfers (RBI mandate). If you are required to pay above this, use IMPS or net banking.

UPI vs. Other Payment Methods

| Payment Mode | Speed | Cost | Availability |

UPI | Instant (real-time) | Free | 24×7 |

IMPS | Instant | Nominal fee (if any) | 24×7 |

Net Banking (NEFT/RTGS) | NEFT: Same/next working day RTGS: Same day (high-value) | Generally free or minimal | Bank hours (NEFT) / 24×7 (RTGS) |

BillDesk (Payment Gateway) | 2–3 working days | Usually free | 24×7 (but processing slower) |

Auto-Debit | Scheduled on due date | Free | Requires sufficient balance |

Cash/Cheque at Branch | Same day (cash) / 2–5 days (cheque) | Possible bank charges | Branch hours |

- UPI & IMPS are fastest.

- Net banking is reliable; NEFT can take a few hours on working days.

- BillDesk and branch visits are slower—avoid these if your due date is near.

- Auto-debit is convenient but needs enough funds in advance.

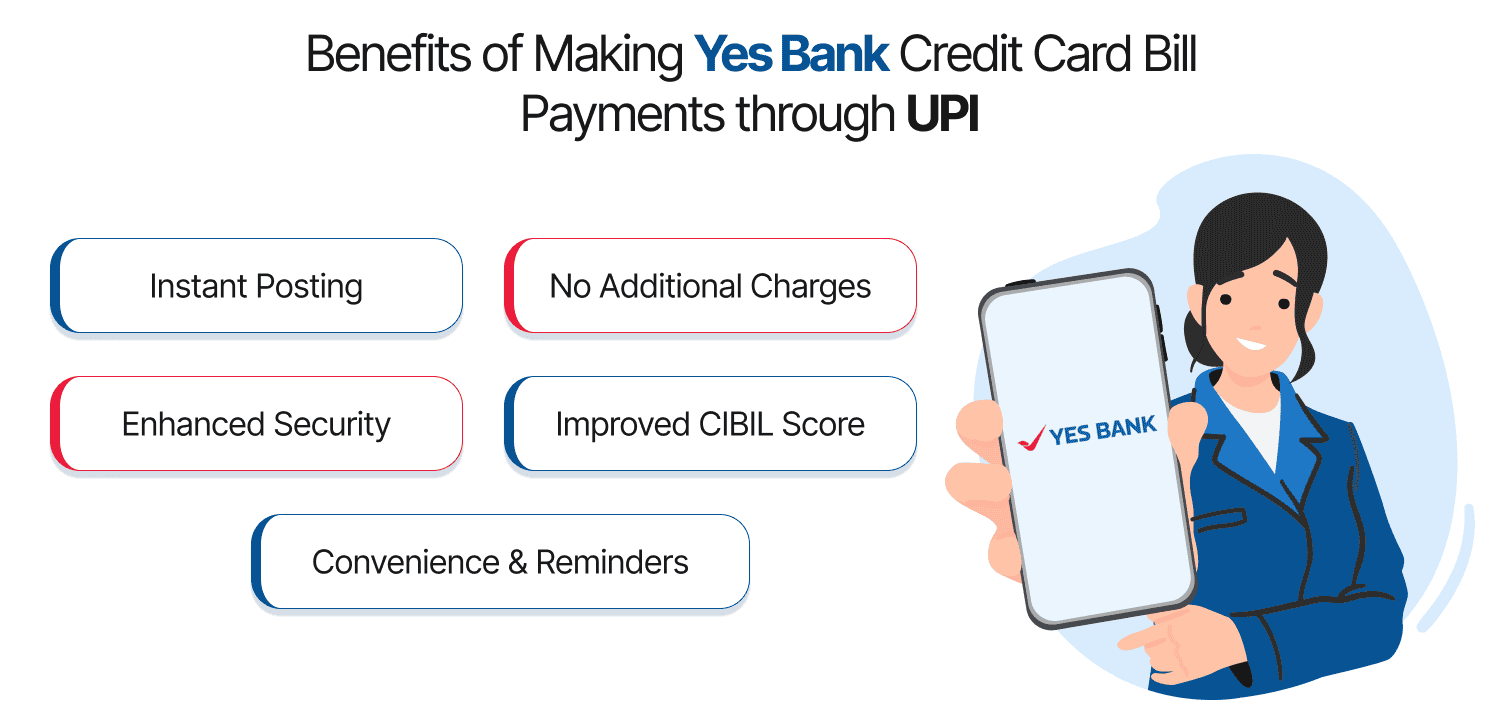

Benefits of Making Yes Bank Credit Card Bill Payments through UPI

- Instant Posting

- UPI and IMPS payments reflect immediately (within minutes).

- Eliminates worry about late fees if you pay well before the due date.

- UPI and IMPS payments reflect immediately (within minutes).

- No Additional Charges

- Most UPI apps do not levy extra fees for credit card bill settlement.

- Compare that to certain net banking or third-party gateways which might charge nominal fees.

- Most UPI apps do not levy extra fees for credit card bill settlement.

- Enhanced Security

- UPI transactions are end-to-end encrypted.

- You use a UPI PIN—you don’t have to share bank login details.

- UPI transactions are end-to-end encrypted.

- Improved CIBIL Score

- Timely payments strengthen your repayment history.

- Consistently paying via UPI (or any on-time method) helps push your CIBIL score higher.

- Track your score easily on Wishfin’s CIBIL Score Check page.

- Timely payments strengthen your repayment history.

- Convenience & Reminders

- UPI apps often send notifications before bill due dates.

- No need to remember multiple login credentials.

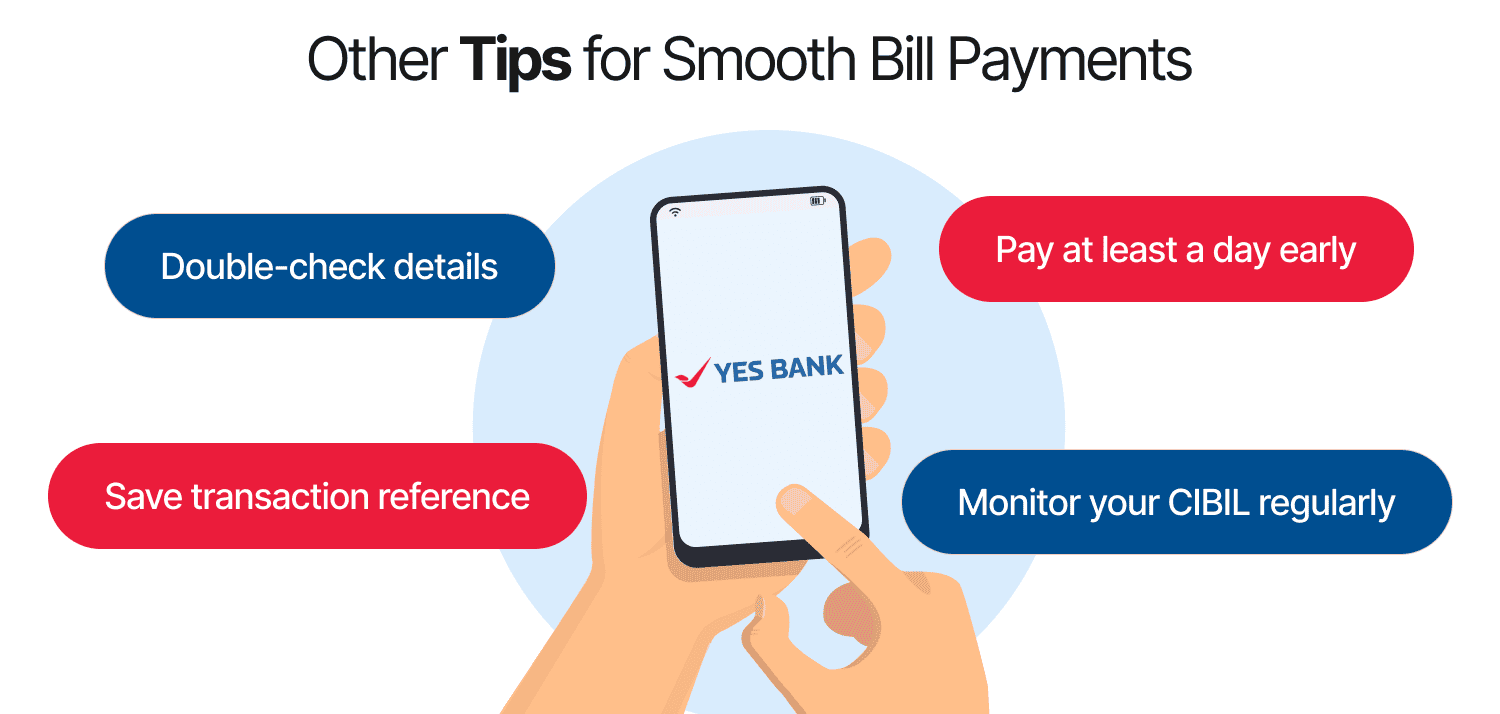

Other Tips for Smooth Bill Payments

- Double-check details before authenticating: Always verify the 16-digit credit card number and IFSC (YESB0CMSNOC).

- Pay at least a day early : Even though UPI is instant, unexpected network issues can occur.

- Save transaction reference : Keep the UPI reference ID until you see the credit on your account statement.

- Monitor your CIBIL regularly : Use Wishfin’s free CIBIL Score tool to ensure your credit health stays on track.

Comparing YES Bank UPI to Other Banks

| Bank | UPI Support for Credit Card Bill Payment | Charges | Limits |

Yes Bank | Yes (RuPay credit cards) | Free | Rs. 1 lakh/day |

HDFC Bank | Yes (RuPay & Visa/Mastercard) | Free or minimal | Rs. 1 lakh/day (varies by app) |

ICICI Bank | Yes (RuPay & Visa/Mastercard) | Free or minimal | Rs. 1 lakh/day |

SBI | Yes (RuPay & Visa/Mastercard) | Free or minimal | Rs. 1 lakh/day |

Most major banks now allow UPI payments for credit cards, but charges and app-specific policies may vary. Always check your UPI app’s “Add RuPay” or “Add Card” feature to link and pay smoothly.

Conclusion

Making your Yes Bank Credit Card Bill Payments Through UPI is fast, secure, and helps you maintain a healthy credit score. By following the steps above, you can:

- Settle your bill instantly

- Avoid late fees and interest

- Strengthen your CIBIL score

Frequently Asked Questions (FAQs)