Yes Bank Credit Card Late Payment Charges

Last Updated : June 14, 2025, 6:25 p.m.

Handling your finances responsibly includes making timely credit card payments. If you have a Yes Bank credit card , understanding the late payment charges and associated fees can help maintain a healthy financial profile and a good CIBIL score . Here's an in-depth guide to Yes Bank credit card late payment charges, including comparisons, additional fees, and essential tips.

What are Yes Bank Credit Card Late Payment Charges?

Yes Bank credit card late payment charges are penalties levied by the bank when cardholders do not pay at least the minimum amount due by the statement due date. The charges vary based on the outstanding balance at the end of the billing cycle. Paying at least the minimum amount by the due date will help you avoid these fees and maintain a good CIBIL score. Yes Bank computes late payment charges based on your outstanding bill amount:

| Statement Balance | Late payment charges |

|---|---|

Less than 101/- | Nil |

Rs. 101 to Rs. 500 | Rs. 150 |

Rs. 501 to Rs. 5000 | Rs. 500 |

Rs. 5001 to Rs. 20,000 | Rs. 750 |

Rs. 20,001 and above | Rs. 1000 |

These charges are applicable for each billing cycle if you miss the minimum payment due.

Yes Bank Credit Card Cash Withdrawal Charges

Using your Yes Bank credit card for cash withdrawals incurs additional charges:

- Domestic ATMs: 2.5% of the amount or Rs.300, whichever is higher

- International ATMs: 2.5% of the amount or Rs.300, whichever is higher

Interest collects instantly on cash advances from the date of withdrawal.

Yes Bank Credit Card Foreign Currency Charges

International transactions attract forex markup fees:

- Standard Yes Bank credit cards: 3.5% of the transaction amount

- Premium Yes Bank cards: 2.5% of the transaction amount.

Other Yes Bank Credit Card Fees

| Fee Type | Charges |

|---|---|

Card Replacement | Rs. 100 - Rs. 250 |

Over-limit Charges | Rs. 500 |

Returned Payment Charges | Rs. 350 per instance |

Duplicate Statement Request | Rs. 100 per request |

Cheque Bounce Charges | Rs. 350 per instance |

Balance Enquiry at ATMs | Rs. 25 per enquiry |

Outstation Cheque Charges | Rs. 50 - Rs. 100 per cheque |

Foreign Currency Transaction Decline Charges | Rs. 100 per instance |

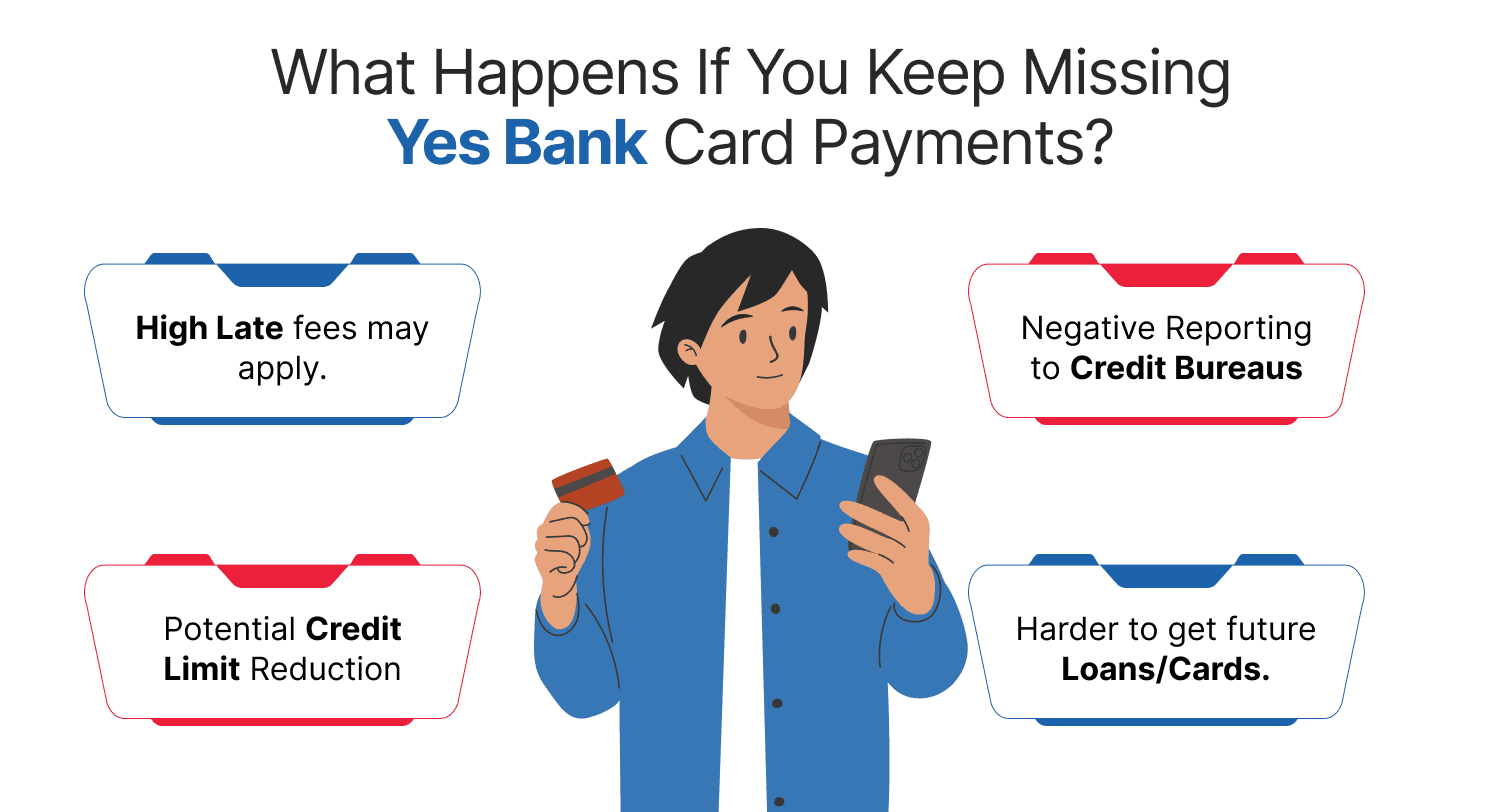

What Happens If You Keep Missing Yes Bank Card Payments?

Continuously missing Yes Bank credit card payments can result in:

- Accumulation of high late payment fees and compounded interest.

- Negative reporting to credit bureaus, considerably impacting your CIBIL score.

- Potential credit limit reduction or card cancellation.

- Difficulty in procuring future loans or new credit cards .

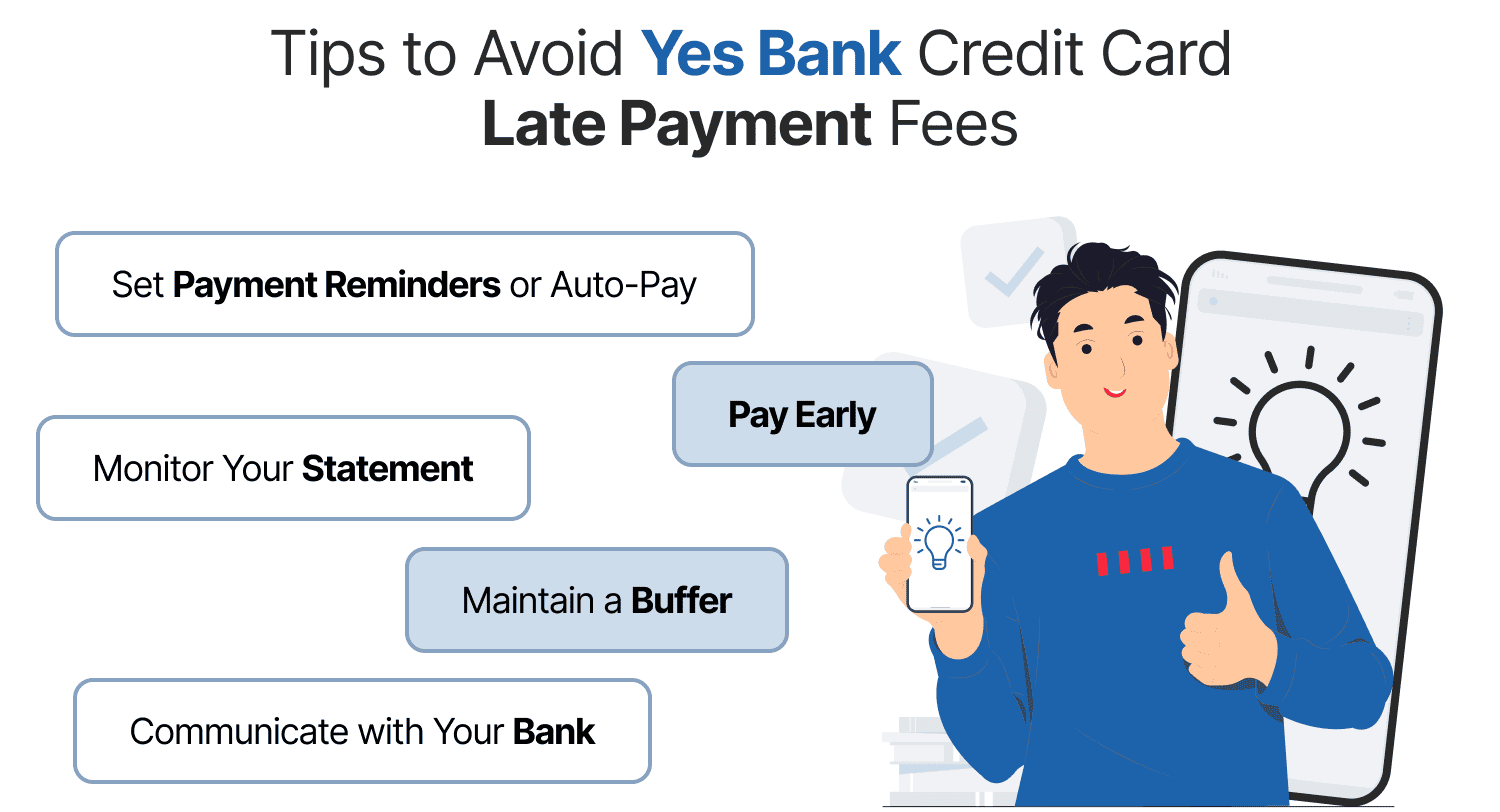

Tips to Avoid Yes Bank Credit Card Late Payment Fees

- Set Payment Reminders or Auto-Pay: Mark your due dates in a calendar or enable auto-debit for at least the minimum due. Paying even the least amount due on time prevents all late fees and interest on new charges.

- Pay Early: If possible, pay off the full statement balance a few days before the due date. This not only saves on late fees but also maximizes the interest-free period.

- Monitor Your Statement: Regularly check your Yes Bank credit card statement. Ensure transactions are correct and you’re aware of the due date and minimum due.

- Maintain a Buffer: Keep some funds in your account around payment day. This ensures a scheduled auto-debit or transfer clears without bouncing. (Bounced payments can incur additional charges.)

- Communicate with Your Bank: If you foresee trouble paying, contact Yes Bank customer care immediately. They may offer solutions like payment plans or one-time waivers, minimizing fee impact.

By being proactive, you can easily avoid the late payment fee altogether. In case of any oversight, many issuers will remove a one-time late fee if you request it politely and it’s a first incident.

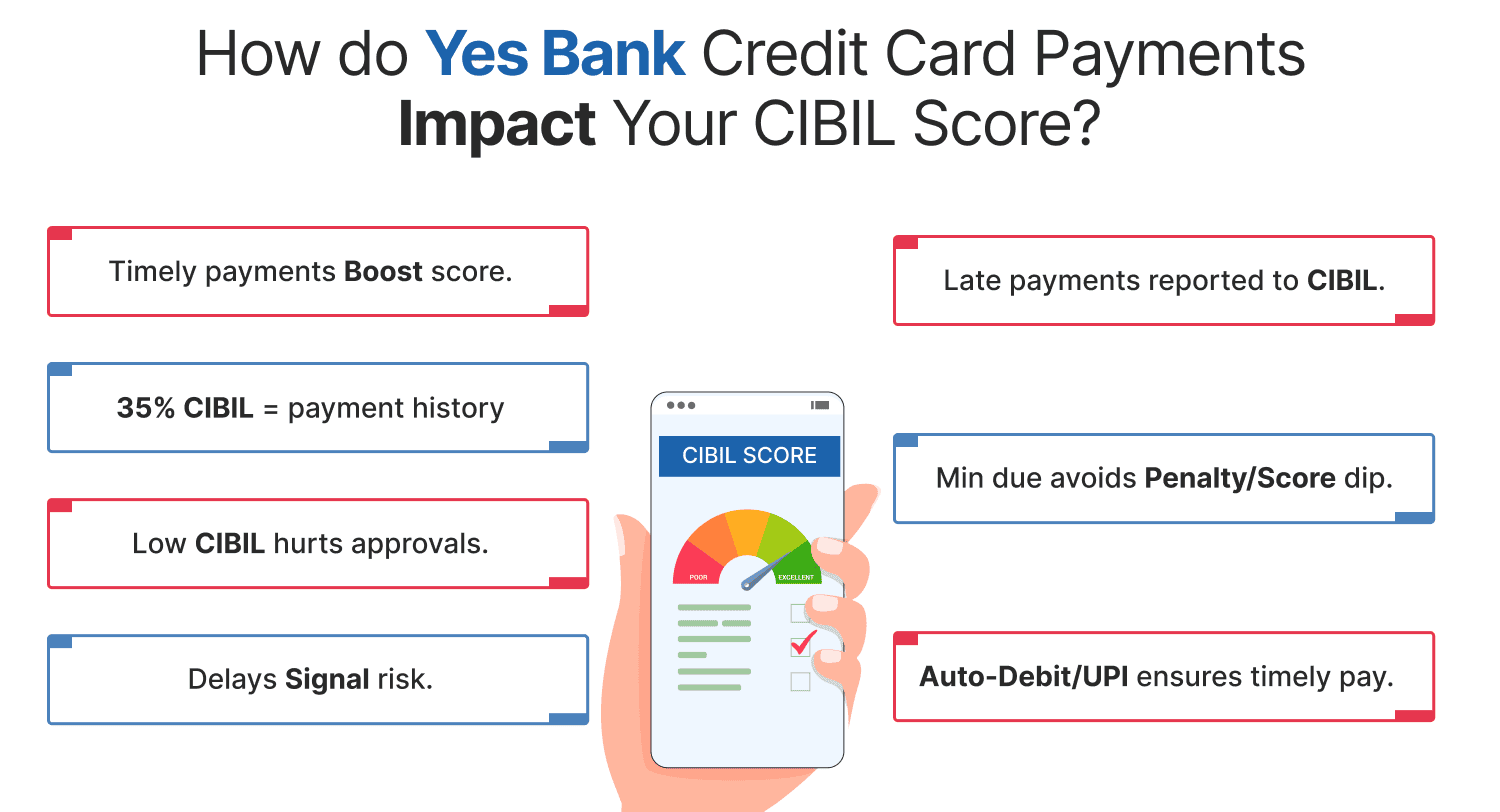

How do Yes Bank Credit Card Payments Impact Your CIBIL Score?

Timely or delayed Yes Bank credit card payments can directly influence your CIBIL score. Here’s how:

- Timely payments boost your credit score – Paying your Yes Bank credit card bill on or before the due date builds a positive credit history.

- Missed or late payments are reported to CIBIL – Even a single delay is flagged to credit bureaus and can reduce your score.

- CIBIL gives ~35% weightage to payment history – This means late payments significantly impact your overall credit health.

- Lower CIBIL score affects future approvals – Banks may reject your future credit card or loan applications, or offer higher interest rates.

- Repeated delays create a pattern of risk – Multiple late payments mark you as a high-risk borrower, which stays on your credit report for years.

- Minimum Amount Due helps avoid penalty & score drop – Paying at least the minimum due can prevent negative reporting.

- Using auto-debit or UPI autopay ensures timely payments – These tools reduce human error and improve credit discipline.

Tip: Always pay your Yes Bank credit card bill on or before the due date and maintain a high CIBIL score. Enjoy seamless access to credit.

How to Make Your Yes Bank Credit Card Bill Payments on Time?

To ensure timely payments:

- Auto-Pay Setup: Enable auto-debit through net banking.

- Payment Reminders: Set reminders via calendar apps or phone alerts.

- Early Payments: Pay bills a few days before the due date.

- Regular Monitoring: Regularly check your statements to avoid surprises.

- Maintain a Buffer: Ensure sufficient balance in your account around the payment date.

Comparison of Yes Bank Credit Card Late Payment With Other Banks

Here's how Yes Bank’s late payment fees compare with other leading banks:

| Total Amount | YES Bank | HDFC Bank | ICICI Bank | Axis Bank | SBI Card |

|---|---|---|---|---|---|

| ≤ ₹100 | ₹0 | ₹100 | ₹100 | ₹0 | ₹0 |

| ₹101–₹500 | ₹150 | ₹500 | ₹500 | ₹500 | ₹0 |

| ₹101–₹500 | ₹350 | ₹600 | ₹600 | ₹600 | ₹400 |

| ₹1,001–₹5,000 | ₹550 | ₹750 | ₹700 | ₹750 | ₹750 |

| ₹5,001–₹10,000 | ₹750 | ₹900 | ₹700 | ₹900 | ₹750 |

| ₹5,001–₹10,000 | ₹950 | ₹1000 | ₹900 | ₹1000 | ₹950 |

| ₹25,001–₹50,000 | ₹1150 | ₹1300 | ₹1000 | ₹1200 | ₹1100 |

| > ₹50,000 | ₹1300 | ₹1500 | ₹1200 | ₹1500 | ₹1300 |

Conclusion

Understanding Yes Bank credit card late payment charges and associated fees helps you manage your credit responsibly and avoid unnecessary financial stress. Regular, timely payments not only prevent costly penalties but also protect your CIBIL score, ensuring smooth financial interactions in the future. Leverage tools like auto-pay, reminders, and regular monitoring of your statements to stay financially disciplined. If you're considering applying for a Yes Bank credit card, explore options conveniently via Wishfin, and set yourself up for financial success.

Disclaimer: The charges given above are as of when this page was written. To ensure accuracy, always refer to Yes Bank’s site for the latest fee schedule or contact the bank.

Frequently Asked Questions (FAQs)