YES Bank Credit Card Payment through ATMs

Last Updated : June 6, 2025, 3:26 p.m.

In India, ATMs continue to play a critical role for customers who prefer offline payment options. As per a 2023 Reserve Bank of India report, ATM transactions grew by 8% year-on-year, with a significant share dedicated to bill and credit card payments. If you’re a YES Bank credit cardholder and want an easy, offline route to clear your dues, paying through a YES Bank ATM is a reliable choice. In this detailed guide, we’ll walk you through YES Bank credit card payment through ATMs, from prerequisites to step-by-step instructions, charges, FAQs, and convenient tips so you can pay your bills without logging in online.

What Are YES Bank Credit Card Payment through ATMs?

YES Bank credit card payment through ATMs enable cardholders to settle their monthly dues directly at a YES Bank ATM using a linked bank account’s debit card. This offline option is particularly useful when:

- Internet connectivity is unavailable or unreliable.

- You prefer an immediate confirmation (since many NEFT/IMPS payments may take a few hours).

- You want to avoid logging into net banking or mobile apps.

By using this method, payments are usually credited to your credit card account immediately or within a few minutes, helping you avoid late fees, maintain a healthy credit score, and stay in control of your finances.

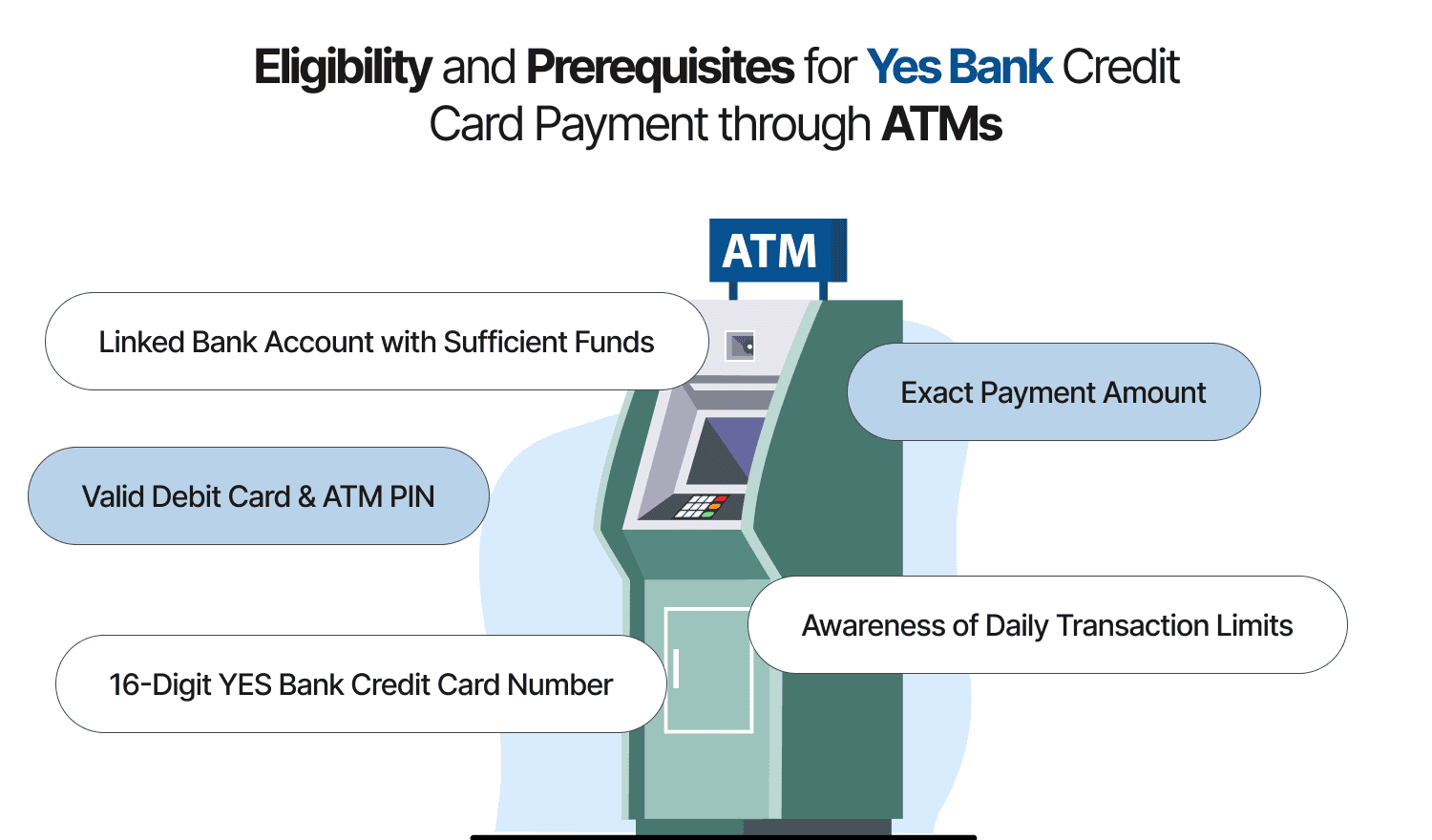

Eligibility and Prerequisites for Yes Bank Credit Card Payment through ATMs

Before going to a YES Bank ATM, ensure you have the following:

- Linked Bank Account with Sufficient Funds

- You can use any bank’s debit card (YES Bank or other bank) that supports fund transfers at ATMs.

- Make sure the account has at least the payment amount plus any convenience fees (if applicable).

- You can use any bank’s debit card (YES Bank or other bank) that supports fund transfers at ATMs.

- Valid Debit Card & ATM PIN

- A 4-digit PIN to authenticate transactions.

- If using a non-YES Bank debit card, check with your bank whether interbank fund transfers at YES Bank ATMs are permitted (some banks impose limits or fees).

- A 4-digit PIN to authenticate transactions.

- 16-Digit YES Bank Credit Card Number

- You’ll need the exact credit card number to ensure payment is applied to the correct account.

- You’ll need the exact credit card number to ensure payment is applied to the correct account.

- Exact Payment Amount

- Know the minimum due or full outstanding amount to avoid under-payment or partial payment confusion.

- Know the minimum due or full outstanding amount to avoid under-payment or partial payment confusion.

- Awareness of Daily Transaction Limits

- Most debit cards have daily ATM fund transfer limits (e.g., Rs. 25,000 or Rs. 50,000).

- If your credit card dues are more than that limit, you may need to split the payment across multiple transactions or days.

- Most debit cards have daily ATM fund transfer limits (e.g., Rs. 25,000 or Rs. 50,000).

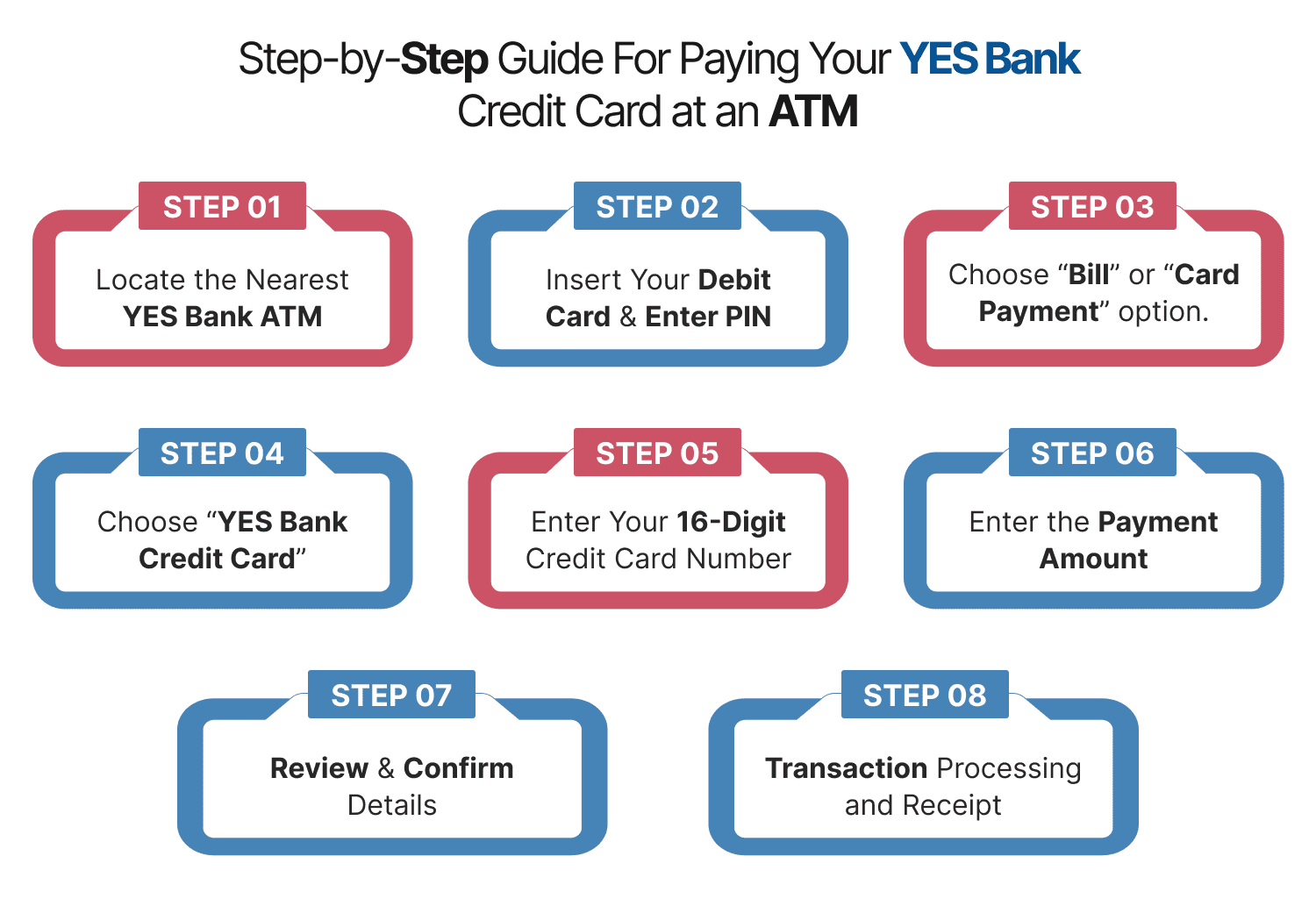

Step-by-Step Guide For Paying Your YES Bank Credit Card at an ATM

Follow these steps for a smooth YES Bank credit card payment through ATMs:

- Locate the Nearest YES Bank ATM

- Use the YES Bank portal to find out the closest YES Bank ATM.

- Choose ATMs in well-illuminated, safe locations—especially if transacting after sunset.

- Use the YES Bank portal to find out the closest YES Bank ATM.

- Insert Your Debit Card & Enter PIN

- Insert your authorized debit card (YES Bank or any other bank) into the ATM.

- Enter your 4-digit PIN when prompted.

- Insert your authorized debit card (YES Bank or any other bank) into the ATM.

- Select “Bill Payments”/“Credit Card Payment”

- On the main menu, scroll to Bill Payments or Other Transactions depending on the ATM interface.

- Choose Credit Card Payment.

- On the main menu, scroll to Bill Payments or Other Transactions depending on the ATM interface.

- Choose “YES Bank Credit Card”

- If prompted for the card issuer, select YES Bank.

- Some ATMs might display a merged option like “YES Bank Credit Cards & Other Card Issuers.” Always pick the exact YES Bank option.

- If prompted for the card issuer, select YES Bank.

- Enter Your 16-Digit Credit Card Number

- Carefully input your 16-digit YES Bank credit card number.

- Double-check each digit—an invalid number may credit someone else’s account.

- Carefully input your 16-digit YES Bank credit card number.

- Enter the Payment Amount

- Enter the amount that you want to pay accurately (Minimum outstanding or full bill amount).

- To avoid multiple small payments, pay at least the minimum amount outstanding.

- Enter the amount that you want to pay accurately (Minimum outstanding or full bill amount).

- Review & Confirm Details

- The ATM will display:

- Your debit account number (masked).

- The YES Bank credit card number (masked).

- The payment amount.

- Your debit account number (masked).

- Confirm if everything is correct. Press Yes/OK to proceed.

- The ATM will display:

- Transaction Processing and Receipt

- Wait for some time for the ATM to process the payment. The payments are usually processed immediately or within some minutes.

- Collect the transaction receipt; it displays:

- Transaction ID

- Date & Time

- Amount Debited

- Partially masked credit card number

- Transaction ID

- Wait for some time for the ATM to process the payment. The payments are usually processed immediately or within some minutes.

Keep this receipt until you see the payment credited in your credit card statement.

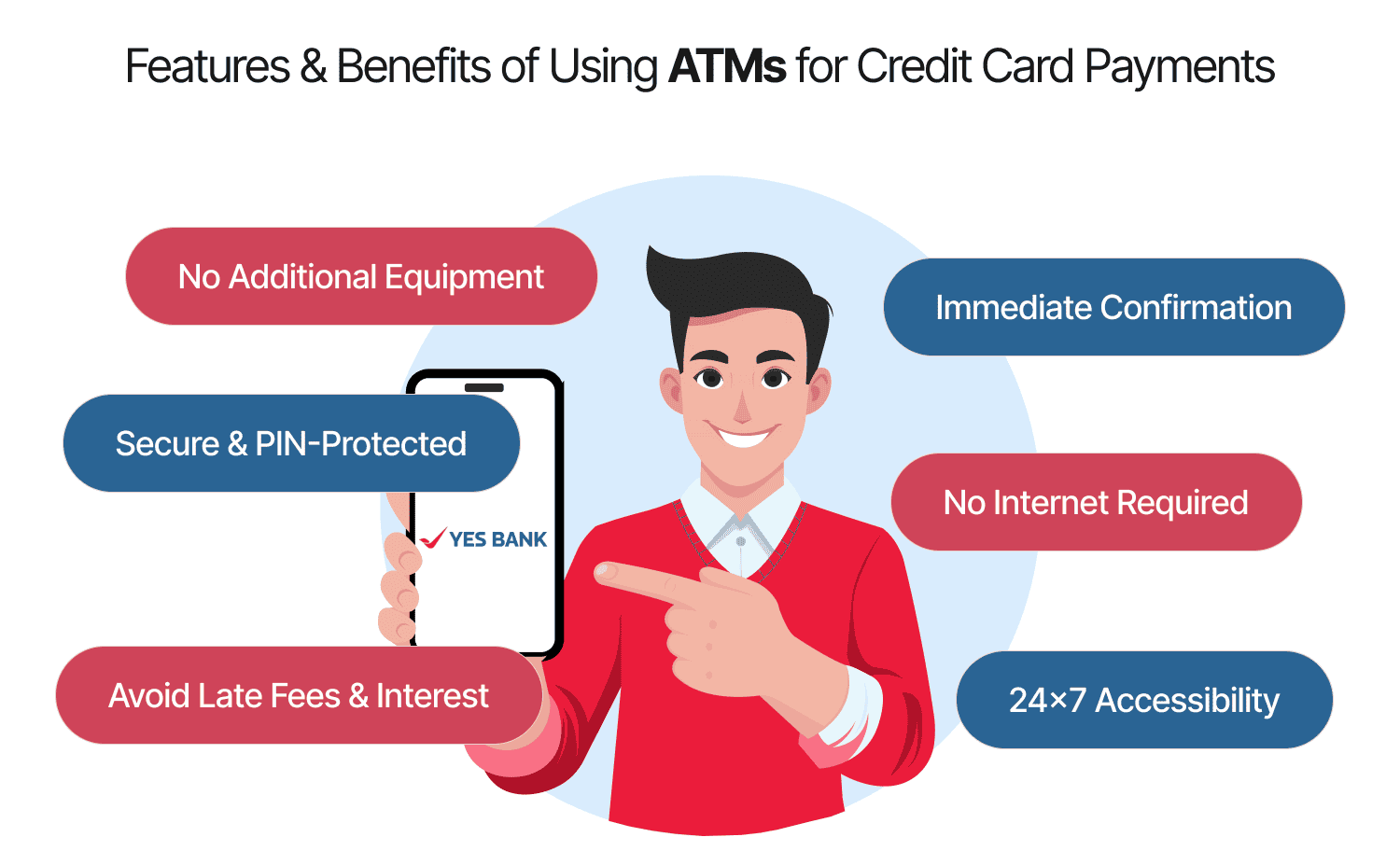

Features & Benefits of Using ATMs for Credit Card Payments

Choosing ATMs for YES Bank credit card payments provides multiple benefits:

- 24×7 Accessibility

Most YES Bank ATMs operate round the clock, allowing you to pay even when branches are closed. - Immediate Confirmation

In contrast to NEFT/IMPS transfers (which may take a few hours), ATM payments generally get credited instantly or within minutes. - Secure & PIN-Protected

Transactions require your debit card PIN, ensuring funds aren’t sent without your authorization. - No Internet Required

Ideal for users in low-connectivity areas or those uncomfortable with digital platforms. - Avoid Late Fees & Interest

Paying at an ATM just before the cut-off time can help you avoid late payment charges. - No Additional Equipment

Unlike cheque payments or challans, there’s no physical instrument to carry—just your debit card.

Charges & Limitations

While YES Bank credit card payments through ATMs are generally convenient, be aware of:

- Convenience Fees

- YES Bank Debit Card: No convenience fee for credit card payments at a YES Bank ATM.

- Other Bank Debit Cards: Some banks charge Rs. 10 - Rs. 25 per transaction for interbank fund transfers at non-home ATMs. Confirm with your issuing bank before transacting.

- YES Bank Debit Card: No convenience fee for credit card payments at a YES Bank ATM.

- Daily Fund Transfer Limits

- Your everyday ATM fund transfer limit is set by the issuer bank (e.g., Rs. 25,000 or Rs. 50,000).

- If your credit card bill exceeds this limit, split the payment into multiple transactions or days.

- Your everyday ATM fund transfer limit is set by the issuer bank (e.g., Rs. 25,000 or Rs. 50,000).

- Transaction Failure Reversals

- If a payment fails (e.g., due to network error), the debited amount usually gets reversed within 24–48 hours.

- Always retain the error/failure message and transaction reference for follow-up with your bank.

- If a payment fails (e.g., due to network error), the debited amount usually gets reversed within 24–48 hours.

- Balance & Account Verification

- Ensure your linked bank account has enough balance to cover the payment plus any interbank fee (if using another bank’s debit card).

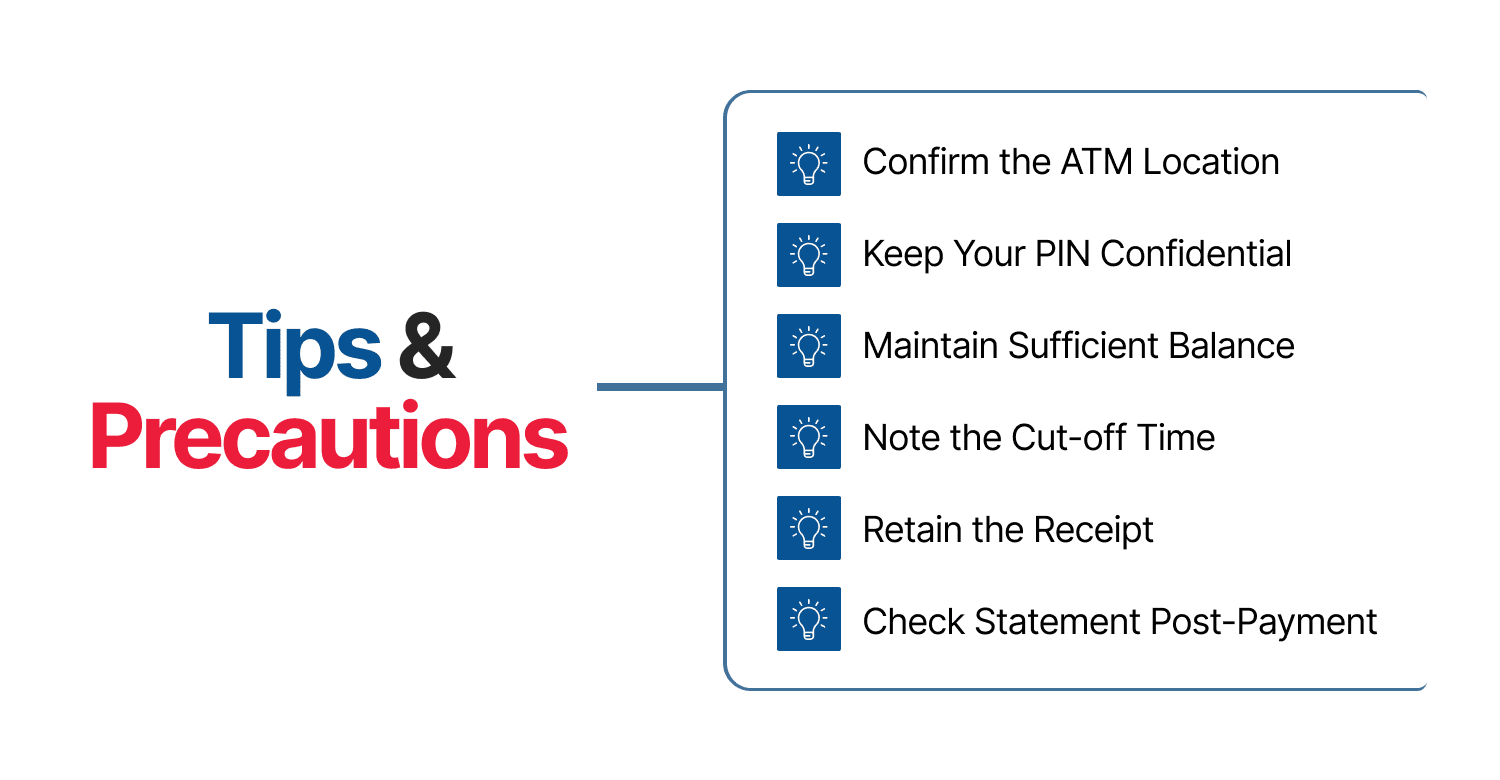

Tips & Precautions

To ensure a smooth YES Bank credit card payments through ATMs, follow these best practices:

- Confirm the ATM Location

Avoid unbranded or suspicious ATMs. Always use a secure, well-maintained YES Bank ATM. - Keep Your PIN Confidential

Cover the keypad while keying in your PIN to prevent shoulder surfing. - Maintain Sufficient Balance

If you plan to clear your full outstanding amount, check your bank balance before going to the ATM. - Note the Cut-off Time

ATM bill payments made after 11:00 PM may be credited the next day. Check YES Bank’s cut-off for instant credit. - Retain the Receipt

Keep the ATM receipt until you see the payment credited on your YES Bank credit card statement (usually within 24 hours). - Check Statement Post-Payment

Log in to YES Bank NetBanking or the YES Pay App the next day to confirm payment status.

Alternative Offline & Online Payment Methods

While ATM payments are quick, Yes Bank offers multiple alternatives to pay Yes Bank credit card dues. You can choose the method easiest and simplest for you:

- YES Bank NetBanking

- Log in to YES Bank NetBanking → Credit Card section → Pay Bill.

- Adds ease with scheduled payments and auto-debit options.

- Log in to YES Bank NetBanking → Credit Card section → Pay Bill.

- YES Pay Mobile App

- Download from Google Play / App Store.

- Under Credit Card , select Pay Bill → enter card details → proceed.

- Download from Google Play / App Store.

- Auto-Debit (SI Mandate)

- Authorize YES Bank to auto-debit the minimum or full due on your payment due date.

- Ideal for “set-and-forget” convenience—avoid late fees entirely.

- Authorize YES Bank to auto-debit the minimum or full due on your payment due date.

- NEFT/IMPS/RTGS

- From any other bank’s net banking, add your credit card as a beneficiary using the IFSC code YESB0CMSNOC.

- Payments may either get credited on the same day (IMPS/RTGS) or the subsequent working day (NEFT).

- From any other bank’s net banking, add your credit card as a beneficiary using the IFSC code YESB0CMSNOC.

- BillDesk (Other Bank NetBanking)

- Via BillDesk portal, choose YES Bank Credit Card → enter card number → pay.

- Funds transferred through BillDesk may take 2–3 days to reflect.

- Via BillDesk portal, choose YES Bank Credit Card → enter card number → pay.

- Cheque or Demand Draft

- Issue a cheque/DD payable to your credit card number → drop it at the nearest YES Bank branch or ATM dropbox.

- Processing time: 2–3 working days.

- Issue a cheque/DD payable to your credit card number → drop it at the nearest YES Bank branch or ATM dropbox.

- YES Robot (Chatbot)

- On Facebook Messenger, search for YES ROBOT → authenticate with OTP → use the “Pay Credit Card Bill” function.

- On Facebook Messenger, search for YES ROBOT → authenticate with OTP → use the “Pay Credit Card Bill” function.

- UPI Apps (PhonePe/Google Pay/Paytm/MobiKwik)

- Open your preferred UPI app → choose Credit Card Bill Payment → select YES Bank → enter card number → pay instantly.

Conclusion

Paying your YES Bank credit card bills through ATMs is a straightforward, offline solution—ideal when you want quick, secure payments without internet access. By following our step-by-step guide, you can leverage the convenience of YES Bank ATMs to avoid late fees, manage your cash flow, and safeguard your credit score. Remember to:

- Always verify your balance before going to the ATM.

- Keep your ATM PIN secure.

- Retain receipts until your payments show up on your statement.

- Compare alternative methods (NetBanking, UPI, auto-debit) if ATMs aren’t accessible.

Frequently Asked Questions (FAQs)