YES Bank Credit Card Payment through Mobile Banking

Last Updated : May 31, 2025, 3:56 p.m.

Missing your credit card payment can be detrimental to your CIBIL score quickly. Here’s how to stay ahead using YES Bank’s mobile app — quickly and securely. YES Bank credit card payment through mobile banking offer unmatched convenience. With the YES Bank IRIS mobile app, you can securely pay your credit card bills anytime, anywhere. Whether you're managing finances or improving your CIBIL score, the IRIS app makes it all seamless.

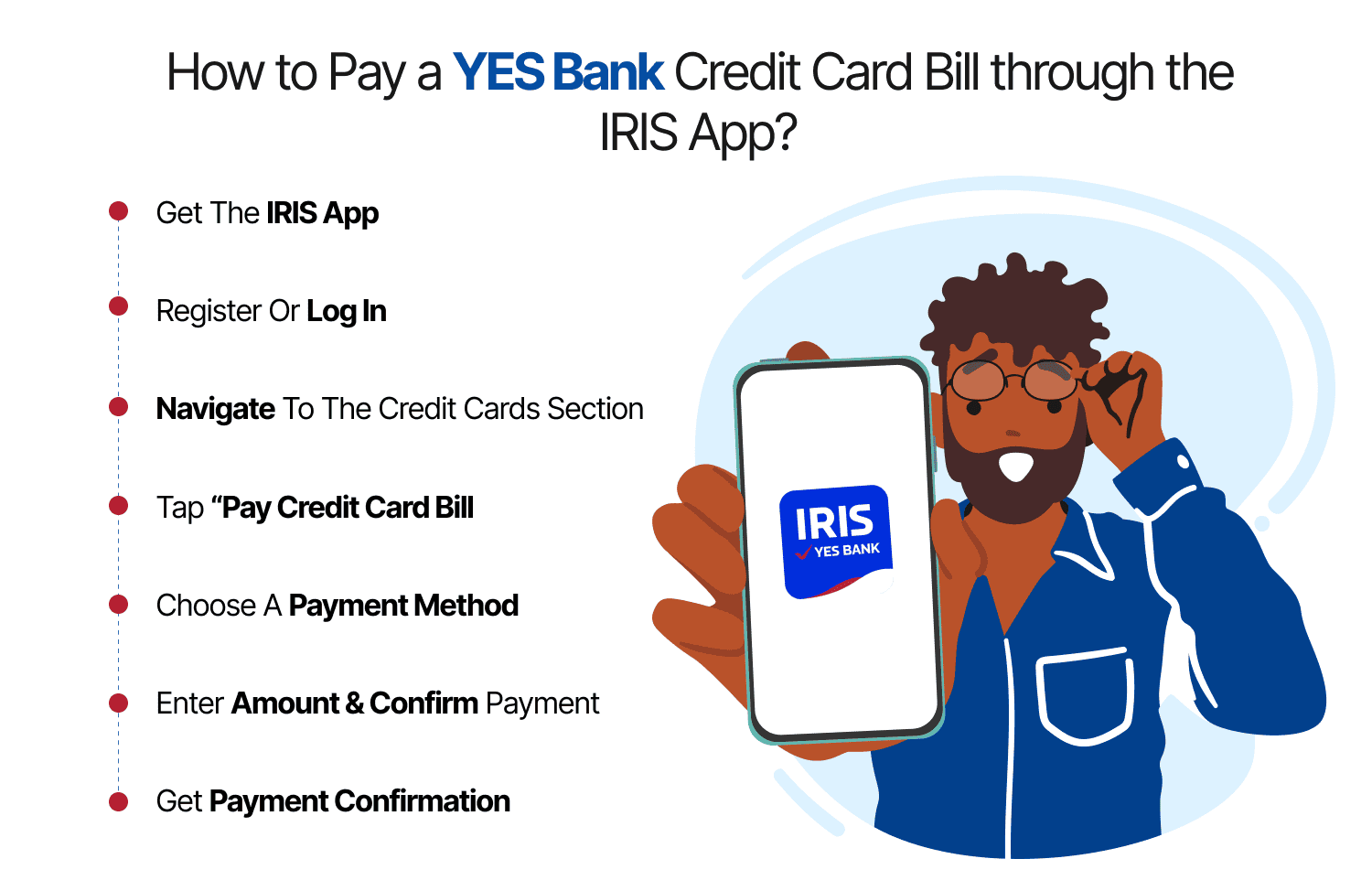

How to Pay a YES Bank Credit Card Bill through the IRIS App?

Adhere to these simple steps to make your YES Bank credit card bill payment through mobile banking:

Step 1: Get the IRIS App: You can install the YES Bank IRIS app directly from the Google Play Store (Android) or Apple App Store (iOS) to get started.

Step 2: Register or Log in: Sign up by entering the following details:

- Your customer ID

- Debit card, or credit card number.

Set your MPIN for secure access.

Step 3: Navigate to the Credit Cards Section: After logging in, tap on the “ Credit Cards ” option on the dashboard.

Step 4: Tap “Pay Credit Card Bill”: Select the specific YES Bank credit card you want to pay for.

Step 5: Choose a Payment Method

- YES Bank Account : Direct and instant transfer from your linked YES Bank savings/current account.

- Other Bank Accounts (NEFT/IMPS) : Add your YES Bank credit card as a beneficiary using your IFSC code YESB0CMSNOC.

- UPI Payments : Use a UPI ID linked to another bank for quick transactions.

Step 6: Enter Amount & Confirm Payment: Fill in the payment amount, review the details, and authenticate using MPIN or OTP.

Step 7: Get Payment Confirmation: Get instant confirmation via SMS, email, and in-app notification.

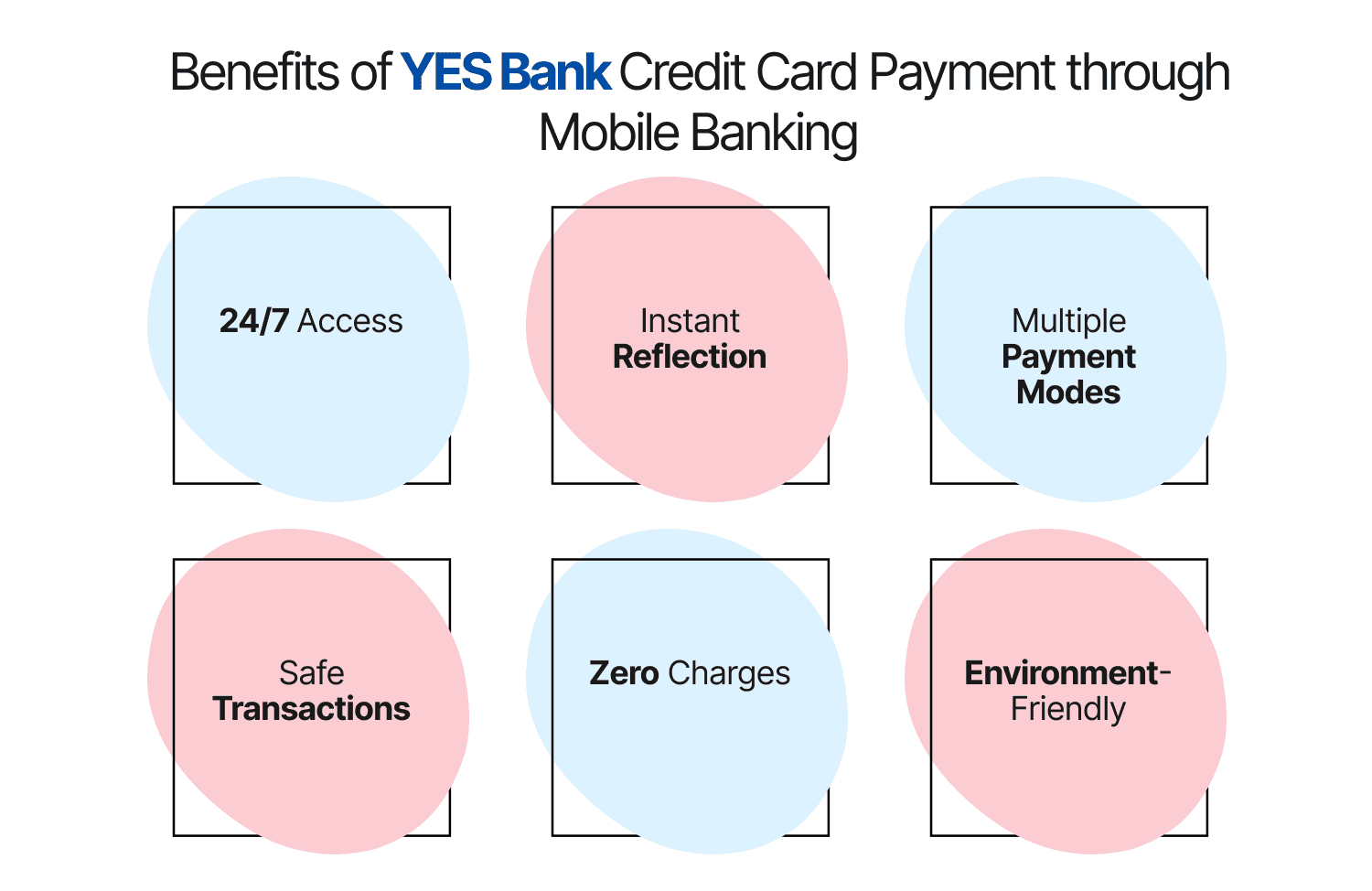

Benefits of YES Bank Credit Card Payment through Mobile Banking

- 24/7 Access : Make payments from anywhere, at any time.

- Instant Reflection : Payments reflect immediately when done via YES Bank account.

- Multiple Payment Modes : UPI, NEFT, or in-app payments provide flexibility.

- Safe Transactions : Uses multi-layered encryption and secure login.

- Zero Charges : No hidden fees for mobile app transactions.

- Environment-Friendly : Encourages digital, paperless banking.

How This Affects Your CIBIL Score?

Your credit card payment behavior directly influences your CIBIL score. Mobile banking makes it easier to stay on top of payments:

- On-Time Payments : Prevents late payments, the #1 factor in credit score.

- Lower Credit Utilization : Paying in full reduces your balance and improves utilization ratio.

- Automated Tracking : Avoids missed due dates by setting reminders or automatic payments.

Understanding Credit Utilization

Credit utilization is the percentage of your total credit limit in use. Keeping it below 30% boosts your creditworthiness.

Example :

If your limit is ₹50,000, your monthly balance should ideally not exceed ₹15,000. Paying the full credit card bill via mobile banking helps you maintain this ratio.

Troubleshooting Common Issues

Login Issues

- Ensure a stable internet connection.

- Use “Forgot MPIN” to reset credentials securely.

Payment Not Going Through

- Check your account balance and daily transfer limits.

- Wait a few minutes and retry.

Payment Delayed or Not Reflected

- In-app payments via YES Bank are instant.

- NEFT or IMPS may take 24 hours. Contact YES Bank customer care if delays persist.

App Crashing or Freezing

- Update to the latest version.

- Clear cache or reinstall the IRIS app.

YES Bank IRIS App vs. Other Bank Apps

| Feature | YES Bank IRIS | Other Banks |

|---|---|---|

Access for non-account holders | Yes | Not always |

Integrated UPI payments | Seamless | External apps needed |

Unified dashboard | Yes | Often limited |

This makes IRIS particularly useful for users managing multiple financial products.

Real-World Example

Rahul, a frequent traveler, uses the IRIS app to pay his credit card bills from any location — airports, hotels, or cafes. He never misses a due date and enjoys a strong CIBIL score, thanks to real-time payments and alerts.

Secure Mobile Banking Best Practices

- Only download the official IRIS app from trusted stores.

- Use strong, unique passwords and avoid reusing across accounts.

- Avoid using public Wi-Fi for transactions.

- Turn on SMS and email alerts for every transaction.

- Report suspicious activity immediately.

Importance of Financial Discipline

Managing your credit card payments effectively is important for:

- Long-term credit health

- Financial planning

- Avoiding debt traps

Use Wishfin’s free CIBIL Score Check and Credit Card Comparison facilities to make informed financial decisions.

Conclusion

YES Bank credit card payments through mobile banking provide a secure, fast, and flexible way to manage your bills. With multiple payment options, instant confirmation, and tools to maintain a strong CIBIL score, the IRIS app ensures that you're always in control of your credit health.

Use Wishfin’s Credit Card Tools and CIBIL Score Checker to stay on top of your financial game.

Frequently Asked Questions (FAQs)