YES Bank Credit Card Payment through Net Banking

Last Updated : June 3, 2025, 3:14 p.m.

Making YES Bank credit card payment through net banking is one of the quickest, safest, and most convenient ways to clear your dues online. Whether you're a YES Bank account holder or using another bank, internet banking ensures on-time payments, helps you avoid late fees, and improves your CIBIL score . This guide walks you through detailed steps, compares all available methods, highlights best practices, and answers frequently asked questions to help you manage your YES Bank credit card payment effortlessly.

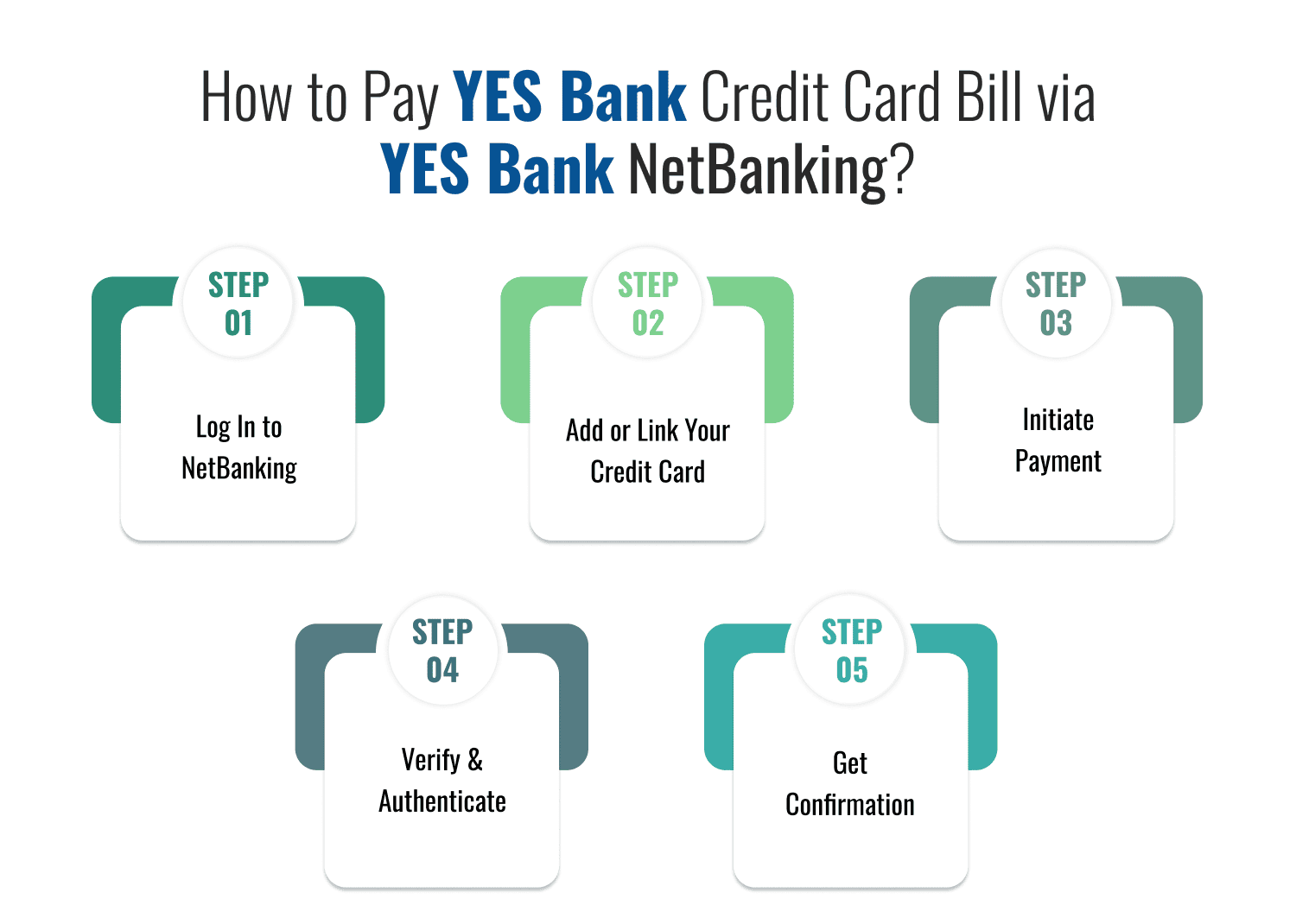

How to Pay YES Bank Credit Card Bill via YES Bank NetBanking? (YES Online)

If you hold a YES Bank savings or current account, you can use YES Bank’s own net banking portal (YES ONLINE) to pay your credit card bill in a few simple steps. This method is fast, free, and typically updates your available credit limit instantly.

Step-by-Step Instructions:

- Log In to NetBanking: Visit the YES Bank NetBanking portal @ https://www.yesbank.in/ and log in using your Customer ID and password. If you haven’t registered, click on “Register Now” and complete the one-time setup.

- Add or Link Your Credit Card: If your credit card is not visible in your dashboard, go to the “Bill Payments” or “Credit Cards” section, then select “Add Biller.” Enter your 16-digit YES Bank credit card number, validate via OTP, and save the card.

- Initiate Payment: Navigate to “Credit Card Bill Payment” → Select your linked YES Bank credit card → Choose the payment amount (minimum due, total due, or custom amount).

- Verify & Authenticate: Confirm the details. Authenticate the transaction using OTP sent to your registered mobile or email. Alternatively, you may use your transaction password.

- Get Confirmation: Once the payment is successfully processed, you will see a success screen and receive confirmation via SMS/email. The amount is usually credited instantly.

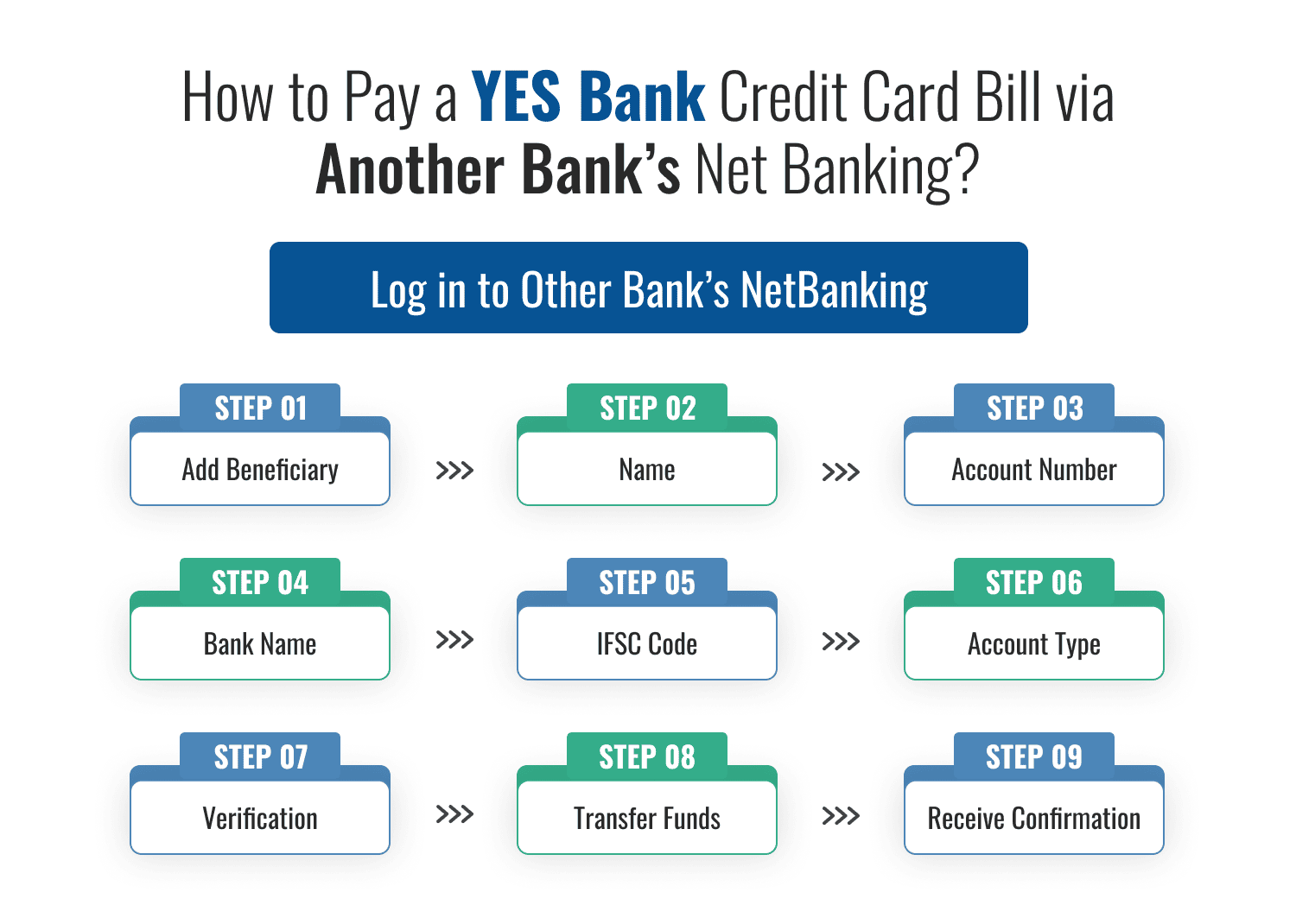

How to Pay YES Bank Credit Card Bill via Another Bank’s Net Banking? (NEFT/IMPS)

If you do not have a YES Bank account, you can still pay your YES Bank credit card bill through any other bank’s internet banking platform using NEFT or IMPS.

Step-by-Step Instructions:

- Log in to Other Bank’s NetBanking: Use your login credentials to access your existing bank’s internet banking portal.

- Add Beneficiary: Go to “Funds Transfer” → “Add New Beneficiary” or “Manage Payees.” Enter:

- Name: Your full name (as it appears on your credit card)

- Account Number: Your 16-digit YES Bank credit card number

- Bank Name: YES BANK

- IFSC Code: YESB0CMSNOC (specific for credit card payments)

- Account Type: Select "Current Account"

- Verification: You will receive an OTP on your registered mobile number for beneficiary activation. Some banks take up to 30 minutes to activate new payees.

- Transfer Funds: Go to the NEFT or IMPS section. Select the YES Bank credit card beneficiary, enter the bill amount, add an optional remark (e.g., “Card Payment”), and complete the transaction.

- Receive Confirmation: After the transaction is successful, your bank will display a confirmation screen and send you a receipt via email/SMS. YES Bank will also notify you once the payment reflects.

RTGS for High-Value Credit Card Payments

For payments above Rs. 2 lakh, you can use RTGS (Real Time Gross Settlement) from your bank’s net banking portal. RTGS transactions are processed immediately during business hours and are ideal for high-value payments that exceed the IMPS/UPI daily limit. Steps remain the same as NEFT, except you must choose "RTGS" as the transfer type.

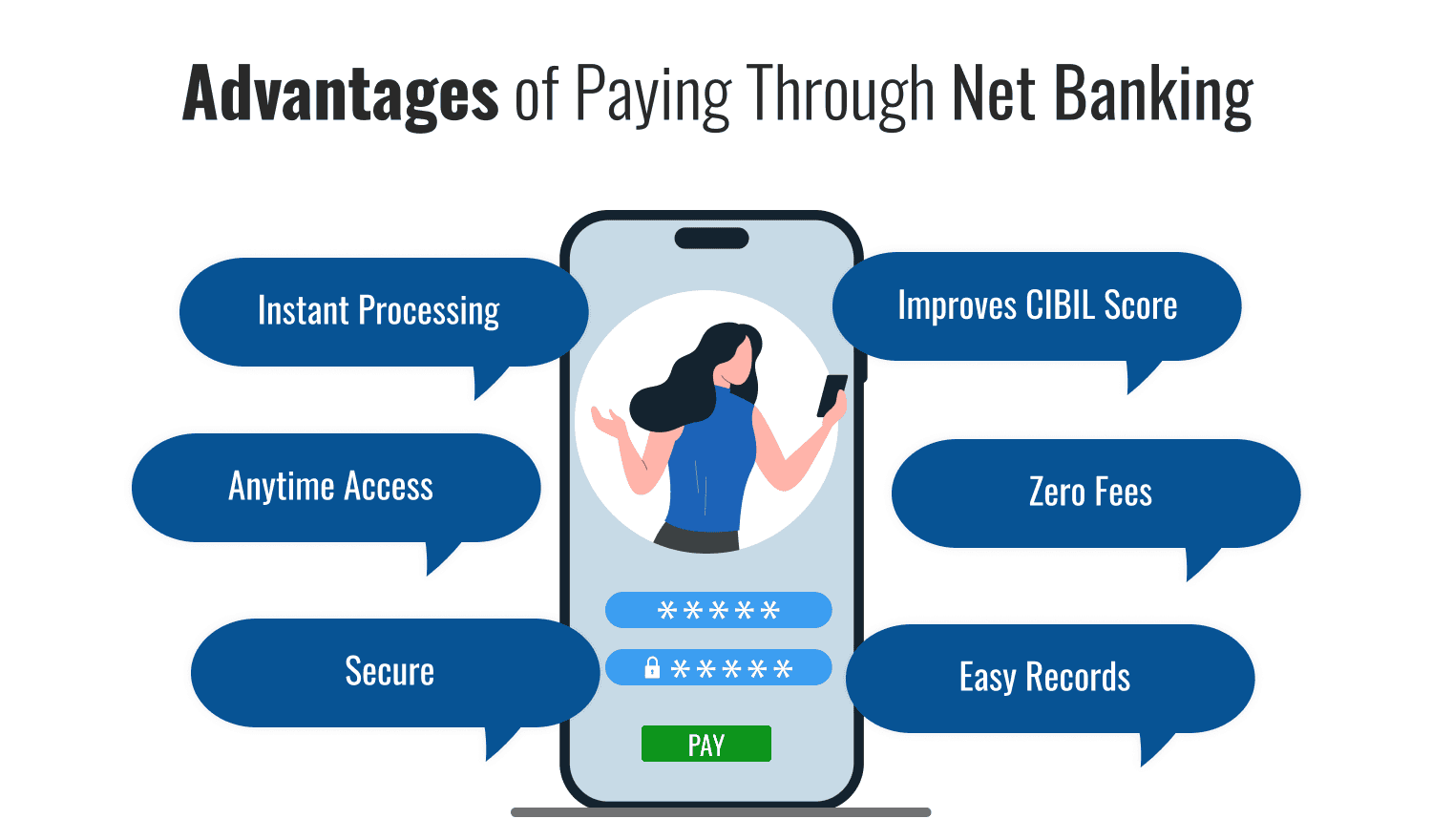

Advantages of Paying Through Net Banking

- Instant Processing: Most payments reflect on the same day; YES Bank NetBanking and IMPS are typically instant.

- Anytime Access: Make payments 24x7, even on Sundays and bank holidays.

- Secure: Encrypted sessions, OTP authentication, and transaction passwords ensure safety.

- Improves CIBIL Score: Consistently paying on time via net banking keeps your credit profile healthy.

- Zero Fees: YES Bank does not charge for NetBanking credit card payments; NEFT/IMPS are free with most banks.

- Easy Records: You receive digital confirmation and can track the transaction in your bank statement.

YES Bank NetBanking vs Other Payment Methods

| Payment Method | Processing Time | Suitability |

|---|---|---|

YES Bank Net Banking | Same day (instant) | Recommended for YES Bank account holders |

YES Bank Mobile App (Iris) | Same day (real-time) | Ideal for mobile banking users |

NEFT from Other Bank | 1 working day | For non-YES Bank users |

IMPS | Instant | Best for urgent payments |

UPI | Instant | Quick but may have daily limits |

BillDesk | 2–3 working days | Not ideal for last-minute payments |

Auto-Debit | On due date | Great for automation |

Cash at Branch | Same day (charges apply) | Slower and less secure |

Cheque | 2–5 days | Least preferred |

Should You Use Auto-Debit?

Setting up auto-debit ensures that your bill is paid on time every month without manual intervention. You can choose to auto-pay the minimum amount due or total outstanding. However, always maintain sufficient balance in your account to avoid failed debits.

Auto-debit can be set up:

- From YES Bank account (via NetBanking or branch)

- From another bank using NACH mandate

Tips for Secure and Hassle-Free Credit Card Payments

- Always use the official YES Bank website or app to avoid phishing.

- Never share your OTP, passwords, or CVV with anyone.

- Avoid transacting over public Wi-Fi or shared networks.

- Double verify your credit card number and IFSC code while setting up a new beneficiary.

- Set up payment at least 48 hours before the due date if you use NEFT or BillDesk.

- Retain payment confirmation and transaction reference number until it reflects in your card statement.

- Regularly monitor your credit card balance and statements to spot discrepancies.

Conclusion

Making your YES Bank credit card payments through net banking is not just convenient—it’s also the most efficient and secure method to ensure on-time payments. Whether you use YES Bank’s own NetBanking portal or another bank’s NEFT/IMPS facility, the flexibility and speed offered by digital payments can help you avoid penalties, maintain a healthy credit utilization ratio, and improve your CIBIL score. Net banking comes up as the most ideal option for responsible credit card handling with round-the-clock access, nil transaction fees, and fast processing. Use the correct payment method for your needs and take control of your finances with confidence.

Frequently Asked Questions (FAQs)