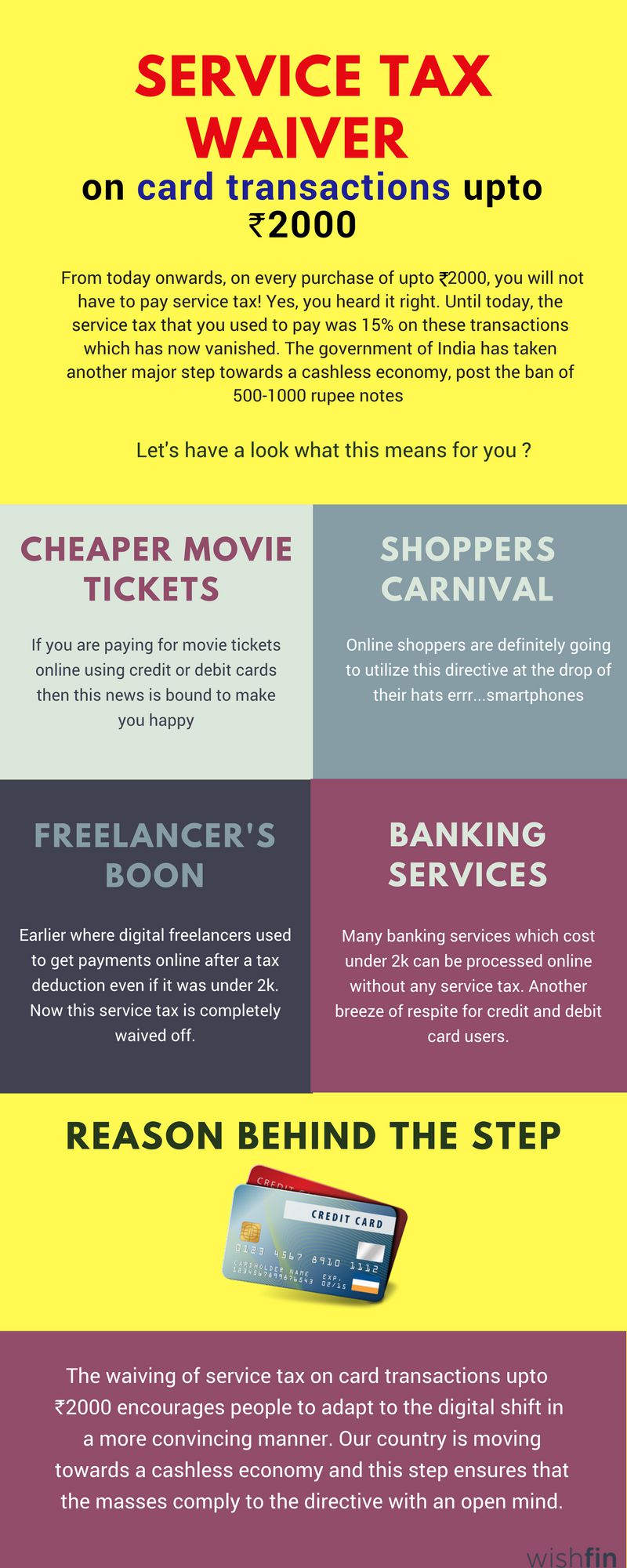

No Service Tax on Credit & Debit Card Transactions up to ₹2000

Last Updated : Nov. 28, 2019, 3:37 p.m.

A good news for all the shopping freaks is here. From today onwards, on every purchase of upto 2000 Rupees, you will not have to pay service tax! Yes, you heard it right. Until today, the service tax that you used to pay was 15% on these online transactions by cards upto 2000 Rupees, which has now vanished. The government of India has taken another major step towards a cashless economy, post the ban of 500-1000 rupee notes still the currency is yet to come into circulation properly.

Post 8 November 2016, everyone’s focus is on the demonetization which continues to be a topic of discussion and is taking its due course of time. However, the new decision of making the card transactions up to Rs. 2000 service tax-free, is for sure a good news for all the people who prefer card transactions and also the ones who don’t.

Following are the sectors exempted from paying service tax through card payments are as follows:

- Banking and other financial services

- Insurance sector

- Travel agencies (road, air, and railway services)

- Telecommunication management

- Tourist services

- Braodcasting services (Television and Radio)

- Stock-brokers

- Hospitals and healthcare

- Retail stores

- Passport services

- Immigration services

- Automobile service stations

- Human resource services

- Credit rating agencies

- Real estate agents

Even though, the ban of higher currency notes is still posing a question that when the general public can freely get back to their routine, this new transition can surely create a sigh of relief for all.