IFSC and MICR Code

Or Choose IFSC Code from list below

IFSC Code: Meaning, Examples, and How it Works

The IFSC code, short for Indian Financial System Code, is an essential part of digital banking in India. This eleven-character code helps make sure that when you transfer money, it goes exactly to the right bank branch quickly and safely.

It’s key to smooth and secure online payments, helping everyone from banks to customers ensure their transactions are accurate and secure.

In this blog post, we will learn more about this code, explore its benefits, main uses, and how it works. Let’s begin!

What is IFSC Code?

The Indian Financial System Code or IFSC is an 11-digit alphanumeric code that is unique for bank branches that offer online money transfer facilities.

This code is used to facilitate electronic money transfers between banks, specifically for wire transfers and other forms of electronic payments within India.

Each bank branch that participates in one of the major electronic funds transfer systems—such as Real Time Gross Settlement (RTGS), NEFT, and Centralised Funds Management System (CFMS)—has a unique IFSC code assigned to it. This code routes the funds to the correct bank during the transaction process.

Format of IFSC Code

As already mentioned above, IFSC code is an 11-digit identification code dedicated to a particular bank branch. The first four alphabetic characters represent the bank name, and the last six characters (usually numeric, but can be alphabetic) represent the bank branch. The fifth character is always zero (0) and is reserved for future use.

For instance, in the IFSC code HDFC0001015, the four letters HDFC represent the bank name. The fifth digit ‘0’ is kept aside for future use. The following six digits, ‘001015’ represent the bank branch. In this case, it is Dalhousie Branch, Kolkata, West Bengal.

Who Issues IFSC Codes in India?

IFSC codes are globally unique identifiers assigned by the Reserve Bank of India (RBI) to bank branches across India. These codes are essential for branches that wish to engage in major electronic payment and e-banking systems such as NEFT, RTGS, and IMPS.

The RBI also maintains an up-to-date database of all IFSC codes issued to various banks. The RBI IFSC Code database is a trustworthy and accurate source for finding IFSC Codes. It's a useful tool for looking up the code for any bank and branch in India.

Main Uses of IFSC Code

The IFSC code plays a major role in online money transfers in India and serves various purposes in banking transactions. Here are the main uses of the IFSC code:

- Facilitating electronic money transfers:The IFSC code is crucial for transferring money through methods like NEFT, RTGS, and IMPS. It ensures that the funds are sent to the correct bank branch.

- Online banking transactions:When setting up a new beneficiary for online transactions, the IFSC code must be provided to make sure the funds are transferred to the right account and branch.

- Cheque clearing:Used in the ECS (Electronic Clearing System), the IFSC code helps identify the originating and destination banks in transactions, thereby speeding up the cheque-clearing process.

- Loan EMIs:To set up auto-debit/ECS for loan EMI deductions from a bank account, the IFSC code is required to correctly link the bank accounts involved.

- Utility bill payment:Many utility companies in India require the IFSC code of the payer’s bank branch to process bill payments through online banking.

How Does the IFSC Code Operate?

When initiating an electronic fund transfer, the sender's bank uses the IFSC code to identify the recipient's bank and its specific branch. Upon receiving the transaction request, the beneficiary's bank verifies the IFSC code to confirm the transaction details.

Once verified, the funds are credited to the correct account. It's crucial to use the correct IFSC code, as an incorrect one can result in transaction failures or the misrouting of funds.

The IFSC code might seem like a small part of the electronic banking system, but it's really important. It matches each bank transaction to its correct branch, ensuring every transaction goes to the right place. This helps keep track of transactions easily and keeps the records accurate.

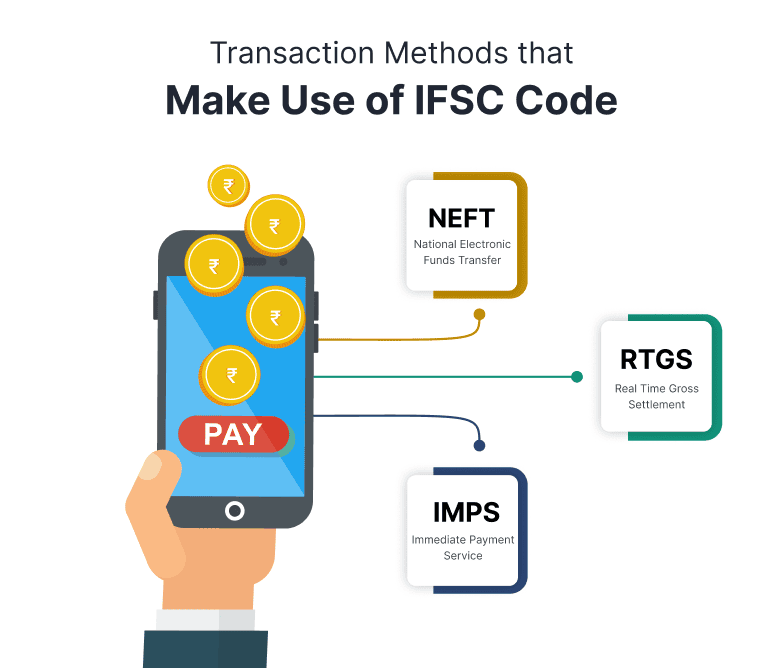

Methods to Transfer Money Using IFSC Code

IFSC is used to transfer money via three primary electronic fund transfer modes - NEFT, RTGS, and IMPS. These electronic fund transfer systems allow you to easily transfer money from one account to another.

They reduce the chances of errors in a transaction as fund transfers are authorized only if accurate details like bank account numbers and the bank-specific IFSC are validated.

- NEFT

NEFT, or National Electronic Fund Transfer, is a nationwide payment system that allows for the electronic transfer of funds across banks. The transactions made through NEFT are processed in batches and settled at hourly intervals throughout the day. It is a safe and hassle-free process as it is monitored by RBI. To initiate a fund transfer via NEFT, you would need the account number, name of the receiver, along with the name of the bank branch and IFSC. - RTGS

RTGS, or Real-time Gross Settlement, is a payment system that transfers money instantly and directly into the recipient's account. This system is generally used for large transactions that need to be cleared immediately and is vital for maintaining the liquidity of financial institutions. - IMPS

IMPS, or Immediate Payment Service is an instant interbank electronic fund transfer system in India that is governed by the National Payments Corporation of India (NPCI). It allows for quick, secure fund transfers between banks nationwide, available 24 hours a day. In this system, interbank fund transfers can be initiated via multiple channels like SMS, mobile banking, netbanking, etc.

How to Search for an IFSC Code?

If you are wondering how to find an IFSC code, below we have mentioned a few methods do so:

- Cheque leaf: To find the IFSC code of your branch, the simplest way is to refer to your cheque book. The full address of the branch is mentioned at the top left corner of the cheque leaf. You will find an 11-digit code (IFSC) at the end of the address.

- Passbook: The front sheet of your passbook mentions your account details as well as branch details. Look for the IFSC code there.

- RBI website: You can also refer to the official website of the Reserve Bank of India. Go to the tab for ‘IFSC codes’. Select your bank from the drop-down and write the name of your branch. The website will give you the IFSC code of your branch. In case you don’t know the name of your branch, just enter the name of your bank and you will get the list of all bank branches along with IFSC codes.

- Bank website: Almost all banks have branch locator services available on their website. You can visit the official website of your bank and look for the branch locator tool. Click on the tool and find the IFSC code of your branch.

How to Transfer Money with the IFSC Code?

For online fund transfers using NEFT, RTGS, or IMPS, the sender must input the recipient's bank name, branch, account number, and IFSC code. Before initiating a transfer, the beneficiary must be registered.

After this one-time setup, funds can be transferred to the same recipient regularly using electronic fund transfer methods. Once all required details are correctly entered, the funds are securely transferred to the recipient's account.

How to Transfer Money Through SMS Using IFSC Code?

Nowadays, it's possible to transfer funds via SMS on a mobile phone using an IFSC code. Here's how it works:

- To transfer money through SMS, you need to link your mobile number to your bank account by registering your phone number for mobile banking services.

- To start mobile banking, first, fill out an application to request the service.

- Once approved, you'll receive a unique 7-digit number known as MMID and a mPin.

- After registering for mobile services with your bank, create an SMS. Type "IMPS" followed by the recipient's details, such as their name, bank, branch, account number, and the IFSC code of their bank, along with the amount you wish to transfer.

- Confirm the transaction and send the SMS. You will then receive a confirmation message asking for your mPin.

- Enter your mPin, select 'OK', and the funds will be transferred to the recipient's account.

How IFSC Codes Help the RBI Keep Financial Transactions Safe

The use of the IFSC code helps RBI in several different ways. Some of them are listed below:

- Identifying bank and bank branches:The 11-digit IFSC code helps uniquely identify each bank participating in the RBI-regulated electronic fund transfer systems like NEFT and RTGS. The first 4 characters represent the bank, and the last 6 characters represent the bank branch.

- Enhancing security:The RBI enhances the financial security of transactions by using IFSC codes. These codes help verify the authenticity of the branches involved in fund transfers and reduce the risk of fraudulent activities.

- Routing transactions:The RBI uses the IFSC to route messages appropriately and facilitate electronic money transfers between banks. It helps identify the originating and destination banks/branches for each transaction.

- Maintaining transaction records:The RBI maintains all records related to bank transactions through IFSC codes. This helps the RBI to monitor, identify, and authenticate fund exchanges during banking transactions.

- Enabling faster processing:IFSC codes allow for faster processing and clearance of electronic transactions by accurately identifying the destination bank branch.

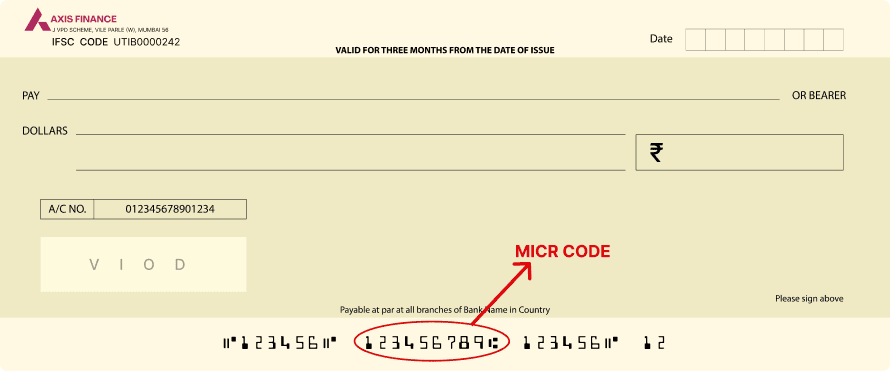

What is MICR Code?

MICR is an acronym for Magnetic Ink Character Recognition (MICR). It is a 9-digit code that facilitates faster processing of cheques. This code will help the bank verify the originality of the cheque and find out if it is counterfeit.

Format of MICR Code

The format of a MICR code is structured as follows:

- The first three digits are the city code.

- The middle three digits are the bank code.

- The last three digits signify the branch code.

For example, consider the MICR code 700002021 for the State Bank of India's main branch in Kolkata. Here, '700' is the city code for Kolkata, '002' is the code for the State Bank of India, and '021' identifies the specific branch.

Key Uses of MICR Code

MICR code is used specifically for the following reasons:

- Identifying banks and branches:The 9-digit MICR code uniquely identifies the bank and branch participating in the Electronic Clearing System (ECS).

- Speeding up cheque processing:MICR technology allows computers to accurately read and decode information like cheque numbers, account numbers, and routing numbers printed in magnetic ink. This enables faster clearance and processing of cheques by banks.

- Preventing cheque fraud:The use of magnetic ink in MICR codes makes cheques harder to duplicate or tamper with. MICR readers can precisely read characters even when obscured by stamps, marks, or other types of ink, which aids in identifying and preventing cheque fraud.

- Facilitating global transfers:While IFSC codes are used for domestic electronic transfers within India, MICR codes are also used for making fund transfers across international borders.

- Completing financial documents:MICR codes are frequently needed when filling out different financial forms like investment applications, SIP forms, or requests for transferring funds.

How Does MICR Code Work?

MICR code works by using special inks and fonts to print codes at the bottom of cheques. These codes contain essential information like bank and branch codes and are designed to be easily read by machines. When a cheque goes through a scanner, the machine activates the magnetic ink and reads the data.

This technology not only speeds up the processing of cheques by reducing manual input but also helps prevent errors and fraud. MICR codes are particularly useful in banking for quickly sorting and processing large volumes of cheques efficiently.

The Importance of MICR Code for RBI

Here’s why the MICR code is useful to RBI:

- Efficient cheque processing:MICR codes enable faster processing of cheques through automated systems. This efficiency is crucial for managing the high volume of cheque transactions processed daily across the country.

- Reduced fraud risks:The magnetic ink used in MICR codes is difficult to tamper with, which helps in reducing the risks of cheque fraud. This security feature is vital for maintaining the integrity of paper-based transactions.

- Enhanced accuracy:MICR technology ensures high accuracy in reading cheques, minimizing the possibility of errors during the clearing process. This reliability is important for maintaining trust in the banking system.

- Improved clearing system:MICR codes are integral to the cheque-clearing system, which is a critical component of the nation’s financial infrastructure. They ensure that cheques are quickly and correctly sorted and cleared, improving overall transaction speeds.

Difference Between IFSC and MICR Code

To make it easier to understand, we have highlighted the major differences between IFSC and MICR code:

| Feature | IFSC | MICR |

|---|---|---|

| Purpose | Facilitates electronic payments like NEFT, RTGS, and IMPS. | Used for cheque processing and clearance. |

| Structure | 11 characters (alphanumeric). The first four are the bank code, the fifth is '0', and the last six are the branch code. | 9 digits. The first three represent the city, the next three the bank, and the last three the branch. |

| Usage | Required for electronic or online fund transfers across banks in India. | Enhances security and speed of cheque processing via magnetic ink. |

| Example | SBIN0001707 (State Bank of India, branch code 1707) | 110229003 (For a specific branch in New Delhi) |

Where to Find IFSC and MICR Code on a Cheque?

You can easily find both IFSC and MICR code on the bank’s cheque book and passbook. The IFSC is printed on the top of the cheque leaf, while the MICR is printed on the bottom in the same leaf. You can also find both the codes on the first page of the bank passbook.

List of IFSC and MICR Code of Top Banks

Just to help you understand better, we have mentioned the IFSC and MICR code of a few top bank below:

| Bank Name | IFSC Code | MICR Code | Branch |

|---|---|---|---|

| State Bank of India | SBIN0000691 | 110002087 | New Delhi, Sansad Marg |

| ICICI Bank | ICIC0000002 | 560229002 | Bangalore, MG Road |

| Axis Bank | UTIB0000373 | 400211033 | Greater Mumbai, Goregaon East |

| HDFC | HDFC0002649 | 110240312 | Noida, Gautam Buddha Nagar |

Frequently Asked Questions (FAQs)

Can we find bank names with the IFSC code?

Yes, you can find the bank name using the IFSC code. Each IFSC code is unique to a specific bank branch, and the first four characters of the IFSC code represent the bank's name.