Canara Bank Mini Statement

Last Updated : May 30, 2024, 1:03 p.m.

It is not possible every time to visit the bank and update the passbook to get the statement of the last transactions. Therefore, people prefer a mini-statement that tells the history of the last 10 transactions. So, in this article, we have discussed some easy methods to get the Canara Bank Mini Statement. You can have the statement on your mobile phone through a missed call and even through the Canara Bank Net Banking. All the methods are free of cost and you will not have to spend a single penny. On the other hand, the bank also has a mobile application that allows you to download the statement of your Canara Bank Account into your mobile phone.

Techniques to Get Mini Statement of Canara Bank

You can explore all the techniques to get the Mini Statement of the Canara Bank and you can use the missed call service if you don’t have a smartphone or internet connection.

Canara Bank Mini Statement through Missed Call

The Canara Bank has a toll-free number through which you can download the mini statement on your mobile phone. You will just have to give a missed call on 09015734734 and get a mini statement in English of your Canara Bank savings to account on your mobile phone. On the other hand, this service is available 24×7 and free of cost. You can get the Canara Bank mini statement in Hindi through a missed call on 09015613613. But remember, you should give a missed call on the toll-free number from your registered mobile number.

Canara Bank Mini Statement through Internet Banking

You can make use of the official website of Canara Bank and log in to download the mini statement of the Canara Bank savings account . You can make a successful login through your credentials after which in the statement option you can see the history of various transactions.

Canara Bank Mini Statement through ATM

You can get a hard copy of your Canara Bank mini statement by visiting the nearest Canara Bank ATM and print the Statement. Make use of the Canara debit and in the banking option choose the Mini Statement Option to get the printout of your statement. The ATM machine will give you a printed receipt of the mini statement that consists of the last 10 debit and credit transactions.

Canara Bank Mini Statement through Mobile Application

If you have a smartphone then you can download the CANMOBILE application from the Android or IOS store. Once you download the application, log in using your ID and password. After logging in successfully, you can see and download the statement of the Canara Bank savings account.

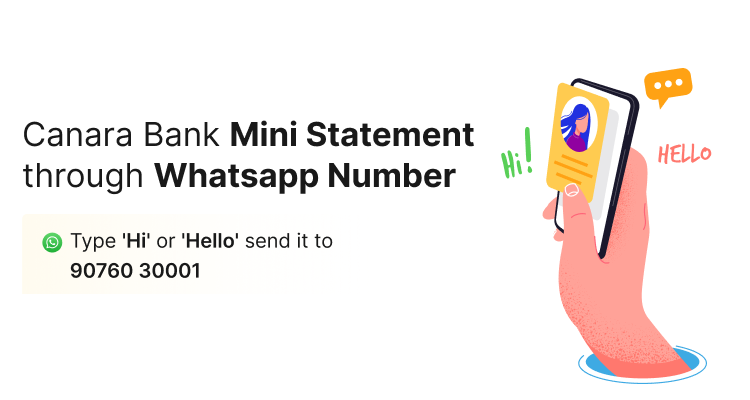

Canara Bank Mini Statement through Whatsapp Number

To get a mini statement from Canara Bank using WhatsApp, you can save the Canara Bank WhatsApp Banking number 90760 30001 on your phone and then send a message saying "Hi" or "Hello" to the saved number. After that, you will need to accept the Terms & Conditions to proceed.

Canara Bank Mini Statement by Visiting Bank

To get a Canara Bank mini statement by visiting the bank, you can follow these steps:

- Visit your nearest Canara Bank branch during working hours.

- Approach the bank teller or customer service desk.

- Request a mini statement of your account.

- Provide your account details or any required identification to the bank staff.

- The bank staff will print out your mini statement, which will typically show your recent transactions and account balance.

- Review the printed mini statement to ensure it reflects the transactions you were expecting.

- If you have any questions or concerns about the transactions listed, you can discuss them with the bank staff at this time.

Canara Bank Mini Statement through Customer Care Number

Please take note of the following details: Dial 1800 1030 to speak with a bank representative and receive your mini statement.

Canara Bank Mini Statement PDF Download

To download the Canara Bank Mini Statement in PDF format, you would typically need to follow these steps:

- Visit the official website of Canara Bank and navigate to the internet banking portal.

- Log in to your internet banking account using your user ID and password.

- Once logged in, look for the "Mini Statement" or "Account Statement" option in the menu.

- Select the account for which you want to generate the mini statement.

- Look for the option to download the statement in PDF format and click on it.

- After clicking on the download option, the system will generate the mini statement in PDF format and prompt you to save the file to your device.

- Choose the location where you want to save the PDF file and click "Save."

Advantage of Using Canara Bank Mini Statement

Quick access to recent transactions without visiting the bank: The Canara Bank Mini Statement provides a convenient way to access the latest transactions without the need to visit a bank branch. This saves time and effort for customers.

Helps monitor account activity and detect unauthorised transactions: By regularly checking the mini statement, customers can keep track of their account activity. This helps in identifying any unauthorised or suspicious transactions, allowing for timely action to be taken.

Convenient for keeping track of balance and expenses: The mini statement allows customers to monitor their account balance and track their expenses. This helps in managing finances effectively and staying within budget.

Can be accessed through mobile banking, internet banking, or ATMs: Customers can obtain their Canara Bank Mini Statement through various channels such as mobile banking, internet banking, or ATMs, providing flexibility and convenience based on their preference and availability of resources.

Conclusion

You have seen all the possible methods to get the Canara mini statement on your mobile phone. The best thing about all the methods is that all of them are free of cost and you can also have the Canara Bank Balance Check through the CANMOBILE Application. You can make use of any method to download the statement of the Canara Bank. Therefore, it will be easy for you to make a good financial decision once you monitor your previous transactions.

Frequently Asked Questions (FAQs)