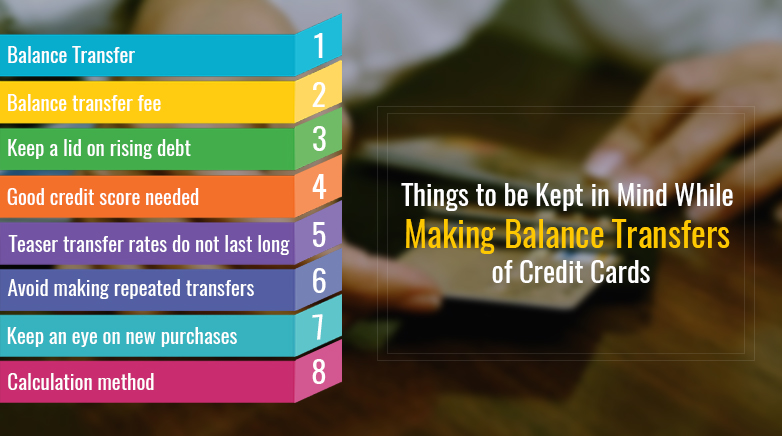

Things to be Kept in Mind While Making Balance Transfers of Credit Cards

Last Updated : March 25, 2016, 6:39 a.m.

There is no harm in having the credit card and buying necessary things using the cashless instrument. But getting carried away and not paying attention to the intricacies of credit cards can sink you financially. You can argue for the fact that you can transfer the balance on existing credit card to another one at low interest rate. But doing the same is not that easy as even a small mistake can cost you dearly. If you want to ensure a successful balance transfer of credit cards, then read the post carefully. First know what balance transfer is.

Balance Transfer

Balance Transfer (BT) is the process by which you can make payment for balances on existing loans or credit cards by transferring the amount to another credit card at low interest rate. Interest rate in credit card ranges within 30-40% per annum. So you can save money while transferring balance of your credit card to the one at low interest rate. Now read the following points that you need to keep in mind before making balance transfer of your existing credit cards.

Balance transfer fee

First thing that you need to be wary of is the fee on transferring the balance of your existing card. Fee is charged as a certain percentage of the overall transfer amount. The percentage may vary from card to card. So when you make BT, do ask about the fee amount that you need to pay. This will put you in a good stead to decide on BT.

Keep a lid on rising debt

BT allows you not only to make transfer of existing card balance but also the amount of personal loan, car loan and home loan, But if you have a huge pile of debt, you would not be able to save much even with BT. So it is necessary that you keep a tab on the debt and not let it go out of hand.

Good credit score needed

A good credit score is elementary to get the balance transfer request approved. If you have a bad credit score, then I am afraid you may get denied the facility. Bad credit score is a result of default in making payment, late fees, penalty, etc. So if you want to avail the privilege of BT, ensure you improve your credit score by paying the debt on time. If you have extra cash in a certain month, make payment before the due date to avoid penalty and hence bolster your credit score.

Teaser transfer rates do not last long

Don’t go blindly by the trigger of low interest rate on balance transfer of credit cards as such teaser rates do not last long. The rates will increase after a period of six months or a year, and it can happen that you will have to pay the interest on new cards equivalent to the earlier one. Moreover, if you missed out making payment on time, then the privilege of low rate may go out of sight.

Avoid making repeated transfers

Some people, with a view to avoid paying interest on credit card debt, make repeated balance transfers after the teaser rate expires. Don’t commit this mistake as it will dampen your credit score. Banks may view you as a risky option if you have new low-interest credit card accounts despite maintaining high levels of debt. You may get denied loan for buying home and car if you follow such practices.

Keep an eye on new purchases

You will get away with zero or low interest rate on balance transfer of credit cards. But interests will be accrued on new purchases and sometimes it can be much higher. So, it would be advisable for you to always keep an eye on your new purchases as it can lead to higher interest which is ultimately costly for you. Thus, you must be judicious while making new purchases so as to prevent your pocket from getting pinched.

Quick Facts about BT (Balance Transfer)

| Important Points | Applicability/Impact |

|---|---|

| BT | Only BT applies for low interest rate |

| Purchases | Purchases on new card will bear interest rate |

| Good credit score | Mandatory for BT |

| Repeated transfers | Repeated transfers will worsen your credit score |

| Teaser rates | Teaser rates on BT does not last long |

| BT fee | BT does bear a certain fee |

Credit Card Balance Transfer Offers

When it comes to credit card balance transfer, these days there are plenty of leading credit card companies available in the marketplace, which are known for offering this service to the customers. In fact, to grab the eyeballs of their customers, they give various kinds of lucrative deals and offers so that more and more people can avail this service. But, instead of getting trap in these offers, you should go ahead with a calculative decision while selecting a reliable credit card provider.

Credit Card Balance Transfer No Fee

Well, in order to make your journey more smooth and reliable, many of these credit card providers don’t even charge any kind of fee. Yes, you can avail the balance transfer facility with no fee. Through this way, it becomes easy for you to transfer your balance to another account, without even bothering about any sort of fee or charges. All in all, it is easy and hassle-free process, giving you a big relief from paying the extra money.

(Updated on: 10 September, 2016)