Wishfin Partners with CIBIL to Enable Easy Access to Credit Score Checks

Last Updated : Sept. 12, 2020, 12:40 p.m.

In a significant development aimed to redefine India’s credit space, Wishfin has now become an official partner of CIBIL, the country’s top credit information company, to let users check their credit scores free of cost. The move assumes enormous significance at a time when users seek in-depth knowledge regarding their credit score and its possible impacts on their credit journey by spending a decent amount of money.

Let’s check out some of the frequently asked questions (FAQs) pertaining to credit score checks at Wishfin.

FAQs for CIBIL Score Check

1. Is Wishin An Authentic Partner of CIBIL?

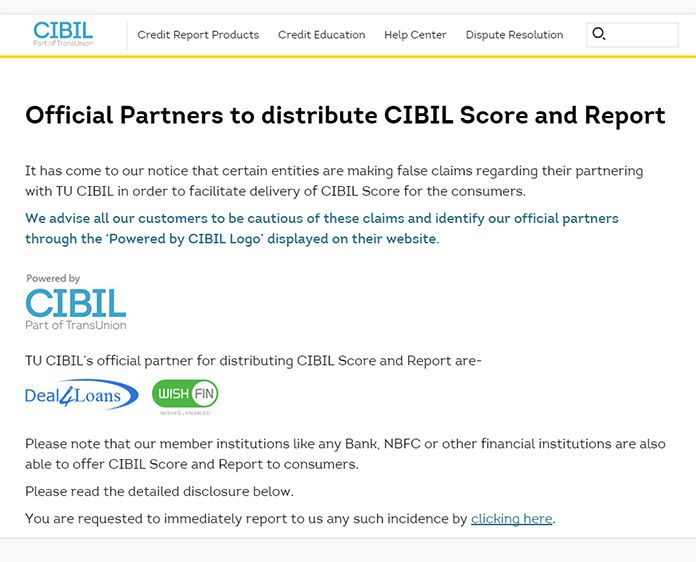

Wishfin is first official fintech partner of TransUnion CIBIL – the company that provides you your official CIBIL score. We are sharing below the screenshot of the partnership announcement by CIBIL. You can also check it on the CIBIL website through this url below.

https://www.cibil.com/official-partners

2. Does Wishfin Charge on Providing Credit Score?

No, the service is totally free. All you need to do is to furnish a few details. The details include PAN Number, name and date of birth (DOB) as per the PAN Card, along with your residence, email-ID and mobile number.

3. My score Is Not Coming Even After Filling All the Details, What can be the reason?

CIBIL and Wishfin take your privacy very seriously. So we do everything to ensure that there is proper authentication. Only then do we share the score and credit report.

Main reason is verification failure :

Main reason why the score does not come, even after filling the details is that your registered email id and contact number has to match the data in CIBIL report. If it does not match, then CIBIL does not share the score/credit report.

This is what you need to do to ensure that you pass verification:

Make sure that the email id and contact number that you use to register, is the same as the one on your CIBIL report.

What is the email id or coordinate that’s there on my CIBIL record?

- Either your PAN Card email id / phone number

- Or in case you have taken any kind of loan or financial product earlier, then that information will be there on your record.

4. If I am not able to get the CIBIL score/report due to verification failure or some other reason, What should I do?

To access your Free CIBIL Score and Report, you can upload your KYC details and wait for the login credentials that will be sent to your mailing address post successful verification of the documents submitted by you. It takes 7 working days post receipt of valid documents to complete the document verification process.

Upon successful verification of the documents, your Free CIBIL Score and Report will be sent to you in 30 calendar days. In case the KYC documents do not meet the requirements, you would receive an Email and SMS asking you to provide the requisite documents.

What This Partnership Means for the Credit Seekers?

Wishfin’s mission is to help its customers make responsible financial decisions. Our customer’s credit health is very important for them to make good financial decisions. Thus it’s important that our customers should check their CIBIL scores in evaluating their credit worthiness. We can advise our customers to improve their credit scores and credit health. Moreover, this helps users to know their eligibility for credits like personal loan, home loan, car loan, credit cards , etc. Factors like credit application, debt settlements, EMI and card repayment track, etc, will let users know their credit score better. So if your score comes higher, you can expect to receive a loan at lower rates. Wishfin will not only provide scores but also a detailed financial report by evaluating the data thoroughly. This will heighten the possibilities of loan or card approvals for those looking to apply via Wishfin, which has so far serviced 10 Million Customers.