Can you always make money by investing in a falling market?

Last Updated : April 10, 2020, 5:25 p.m.

Falling markets lead to a lot of fear and anxiety among investors. Usually, people take irrational decisions during these times leading to unfavourable outcomes. No one likes to see markets fall or portfolios in red but then that’s the nature of markets. They never move in a linear direction both on the upside and downside. However, when markets fall severely, people give up all hope of a reversal and there is capitulation. This capitulation is the beginning of the next phase for markets to rise and give outsized returns. Falling markets have a silver lining-you accumulate more units since NAVs or prices are lower, thereby leading to fabulous returns when the markets rise again. Therefore, we would recommend you to buy into falling markets. History gives us the best answer validating this point; let’s look at some previous market falls.

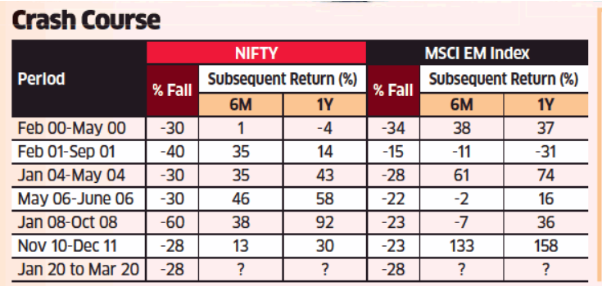

PAST PANDEMICS AND RETURNS IN SENSEX

| Period of outbreak | Virus name | Returns during outbreak | 1 year return post outbreak | 3 years return post outbreak |

|---|---|---|---|---|

| Jan-March,2003 | Sars | -10.07% | 77.68% | 269.99% |

| Jan-August,2004 | Evin Influenza | -12.23% | 47.42% | 195.04% |

| Dec,13-Feb,2014 | Ebola | 1.06% | 44.44% | 36.09% |

| Nov,15-Feb,2016 | Zika | -13.39% | 13.36% | 55.93% |

| Jan,15-May,2015 | Swine Flu | -6.91% | -4.24% | 26.83% |

Source-Times Of India

As we can see from this set of data after every pandemic the returns in the markets in the succeeding years have been great. This suggests that investing in falling markets does make a lot of sense.

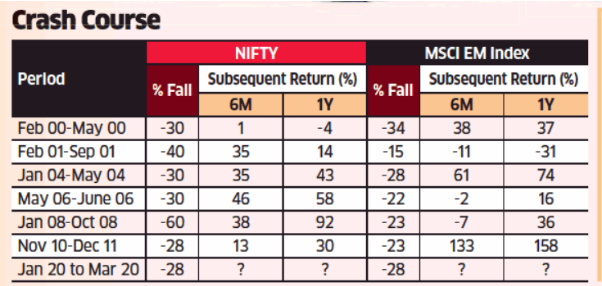

Let’s also look at the previous major crashes and returns post those market falls in Nifty:

Source-Quora

As we can see from this set of data, all major market crashes in history have been followed by high double-digit returns in the subsequent year. The current fall in markets owing to Coronavirus also presents a similar opportunity. However, at this juncture, it is hard to predict the extent of the fall or whether we have made a bottom in the market or not. Therefore, we would recommend a calibrated approach to investing-putting money to work in a staggered way over the next 3-6 months would be an optimum strategy. Every market fall gives a great opportunity to make handsome returns and this one is no different.