CERSAI Portal 2022-23

Last Updated : Oct. 14, 2022, 6:12 p.m.

CERSAI is an internet security interest registry in India. The Central Registry of Securitization Asset Reconstruction and Security Interest of India (CERSAI) forbids utilizing the same property as collateral for loans from various banks.

What is CERSAI?

According to the Companies Act of 2013, CERSAI was established as a government-owned corporation. The head office of CERSAI is located in New Delhi. The purpose of CERSAI is to stop mortgage-related fraud. Scammers can obtain multiple loans from different banks on the same piece of property in various situations. These instances are checked using the CERSAI registry.

Even authentic buyers were uninformed of the loans and liabilities associated with property without CERSAI (Cersai Login). Thereby causing legal difficulties and problems for those who purchased such houses.

The public and financial institutions can both use the CERSAI Portal. Though, the general populace can only view information about equitable mortgages.

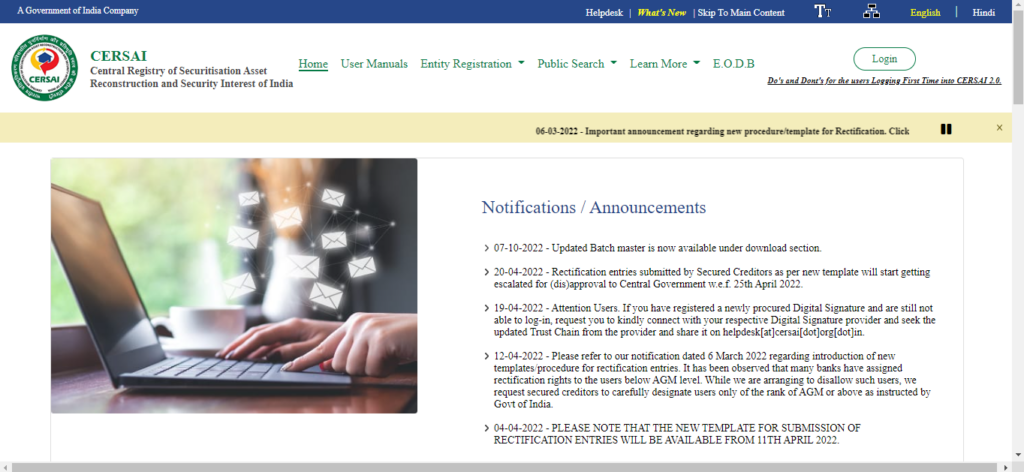

CERSAI Login

The CERSAI Login feature allows users to access the Indian portal for the Central Registry of Securitization of Asset Reconstruction and Security Interest. A user can access the CERSAI database using the CERSAI Login, which has been updated by organisations and authorities, including banks. The general populace can use CERSAI Login to conduct an asset-based check in the central register for a small cost. Additionally, by paying the necessary cost, an average person may conduct a debtor-based check in the central registry using CERSAI Login.

Both members of the general public and financial or banking institutions officials can use a CERSAI Login to access the database.

Follow these directions to log in to CERSAI:

- Step 1: Visit the CERSAI website at cersai.org.in.

- Step 2: Choose the CERSAI Login button in the top-right corner of the website.

- Step 3: A refreshed CERSAI Login window will now be displayed.

- Step 4: Enter your Login Id (CERSAI Login), Password, and Captcha Code if you have already registered as a user on the CERSAI portal.

- Step 5: Select the Login button (CERSAI Login).

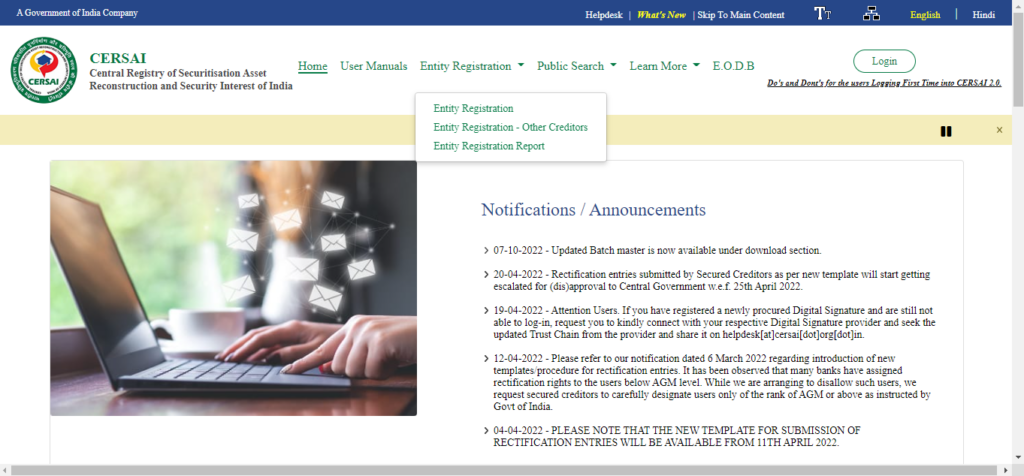

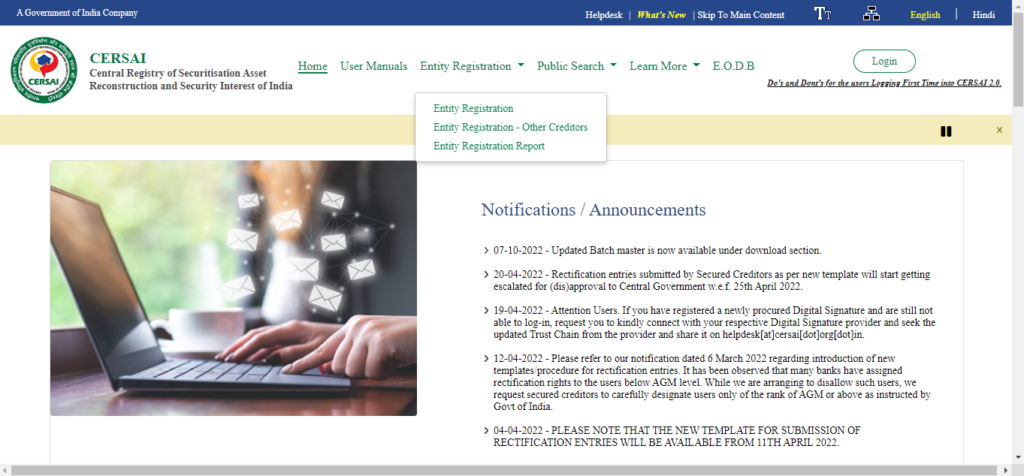

CERSAI Entity Registration

Entity registration is very easy and simple on CERSAI. The user must possess the “Digital Signature Certificate” to use the CERSAI Portal.

Follow the steps below to sign up on the CERSAI portal:

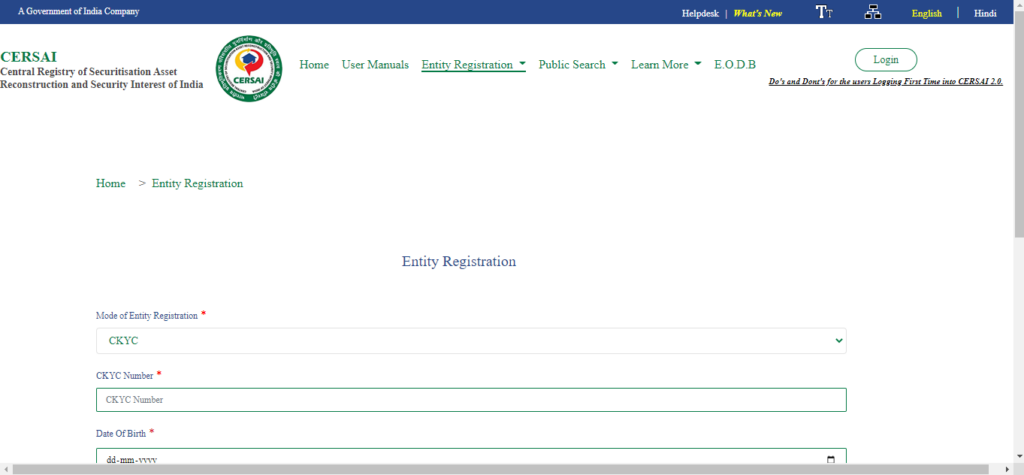

Step 1: Go to cersai.org.in. And click on the “Entity Registration” link for CERSAI registration.

Step 2: A refreshed CERSAI entity registration window will now be displayed.

Step 3: From the drop-down list, choose Entity Registration Mode. The window below will appear if you choose “CKYC.” Before clicking ” Submit, ” you must enter information such as your CKYC number, birth date, and captcha code here before clicking “Submit.”

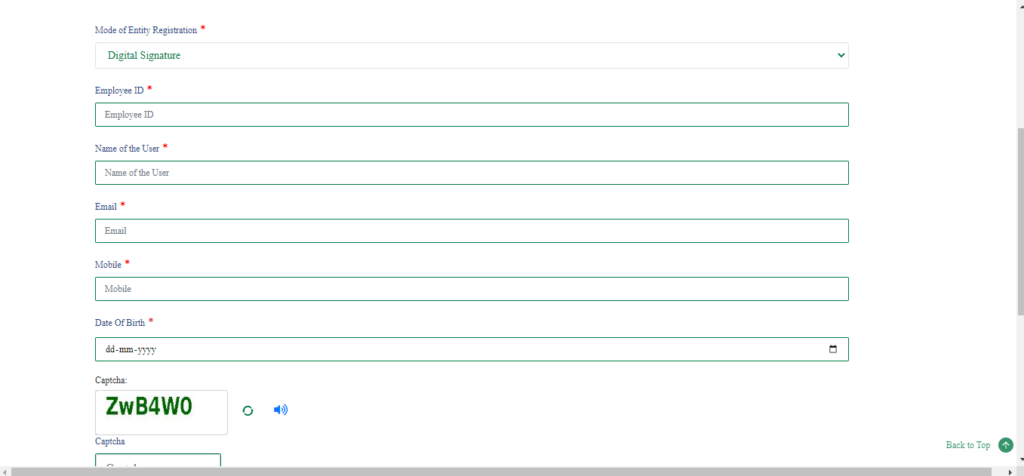

Step 4: If you choose “Digital Signature” in step 3, you must enter the information below.

- Employee ID

- Username

- Date Of Birth

- Email ID

- Mobile Number

- Captcha

Step 5: Press the “Submit” button.

CERSAI Search

A prospective buyer can conduct a CERSAI Search to be extra assured, given the increasing incidence of utilizing the same property as collateral for loans from many institutions. A CERSAI Search will include the property’s specifics and reveal whether it has been refinanced against a loan.

You can log into the CERSAI Portal and select the “Public Search” tab from the home page to conduct a CERSAI search.

You can use the following methods to carry out CERSAI Search.

- Debtor-Based Research

- Asset-Based Research

- AOR Based Research

How is the CERSAI database updated and maintained?

The CERSAI database is updated and maintained with the assistance of Indian banks and other financial organisations. Each time the bank approves and disburses a loan, it is required to update the CERSAI database with new information. The database update is known as “Registration of Charges.”

The “Registration of Charges” aims to keep an open database of encumbrances on properties. f Banks are required by law to give information regarding a disbursed loan within 30 days of the loan’s completion.

If the CERSAI database is not updated, the Reserve Bank of India (RBI) will impose financial penalties on the banking institutions.

CERSAI Registration Charges

The CERSAI charges a fixed price for the registration of security interests. The registration cost on CERSAI ranges from Rs 50 to Rs 100. These charges are based on how much money has been borrowed and applied to the property.

| S.No | Intent of the Transaction | Payable Charge (Excl. Tax) |

|---|---|---|

| 1 | Adding or changing a security interest to benefit secured creditors or other creditors | The fees are Rs. 50 and Rs. 100, for loans up to and over Rs. 5 lakh, respectively. |

| 2 | Satisfaction of any security interest that already exists | NIL |

| 3 | Financial asset securitization or reconstruction. | Rs. 500 |

| 4 | Securitization or rebuilding of financial assets satisfaction | Rs. 50 |

| 5 | Obtain information using CERSAI | Rs. 10 |

| 6 | Transfer of Accounts Receivable | For receivables less than Rs. 5 lakh, the assignment fee is Rs. 10, and for receivables over Rs. 5 lakh, the assignment fee is Rs. 100. |

| 7 | Registration satisfaction upon the realisation of the receivables | NIL |

| 8 | Remission of up to a 30-day delay for the assignment of receivables | Depending on the situation, ten times the base price. |

Following the Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest Act of 2002, the main goal of CERSAI is to maintain and run a Registration System to register securitisation, asset reconstruction, and creation of security interests over real estate transactions (SARFAESI Act).