UAN Activation

Last Updated : March 23, 2021, 5:26 p.m.

EPFO is the Employee Provident Fund Organization where the employee and the employer register themselves to make contributions. On the other hand, they need a Universal Account Number also known as UAN to access their EPF account. EPFO UAN is a 12 digit number issued by EPFO so that the employee can access their previous and present PF accounts. You must know the UAN Activation Process so that you can easily access your EPFO accounts. The process to activate the UAN is simple. Either you can visit the official website of EPFO to activate UAN or download the Umang app. We will tell you both the methods that will help you in EPFO UAN activation.

Process of UAN Activation

As we have told you that you can activate UAN through the Umang App and EPFO website, so you must explore both methods of activation. There are simple steps involved that will help you to activate the EPFO UAN.

Activate UAN through Umang App

- Download and Install Umang Application from Android Play Store or IOS App Store.

- Launch the Application and in the All Services option touch on the EPFO option.

- You will find the UAN Activation option in the EPFO services.

- The EPFO UAN Activation page will appear on the mobile app.

- In the Category option, you will have to choose the UAN option.

- Then enter the UAN number that has to be activated.

- Enter your Full Name and the Date of Birth in the next options.

- Now provide your Mobile Number and Email ID in the next boxes.

- Then touch the Get OTP button present at the bottom of the screen.

- Now enter the OTP in the Enter OTP Box that you have received on your registered mobile number.

- Finally, accept the Declaration box and then touch the Submit button on your mobile screen.

You have done Umang UAN Activation and you will receive a confirmation message “Your UAN is Activated. The password is sent to your registered mobile number”. So, by using the UAN and Password, you can make the UAN Login and manage your EPFO account.

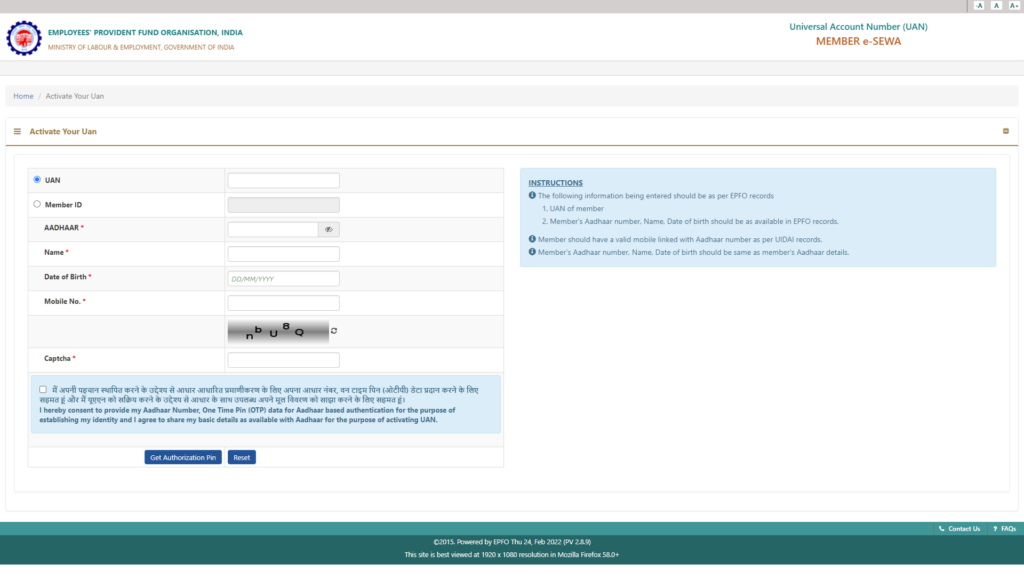

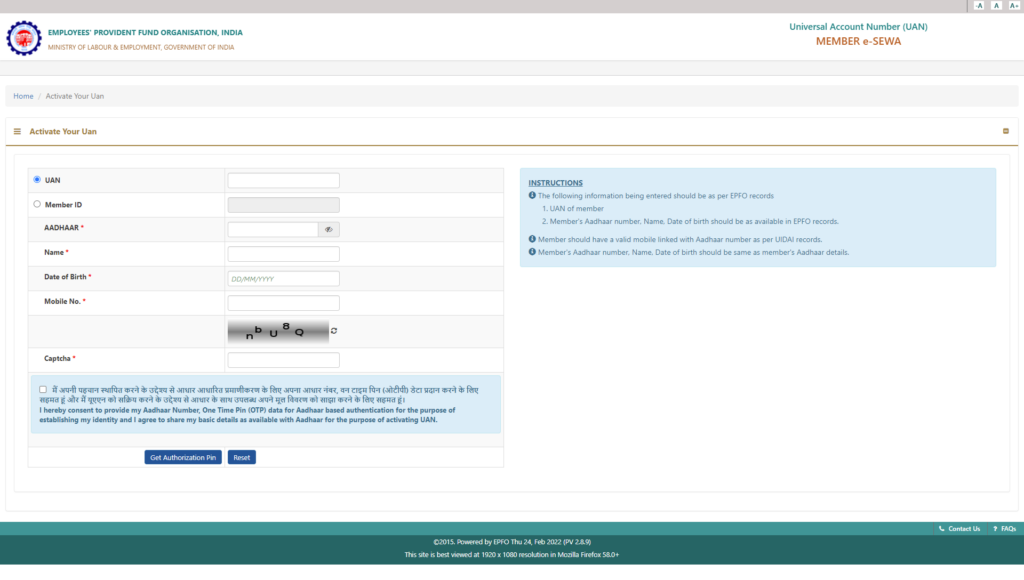

Activate UAN through EPFO Official Website

- Open the official website of EPFO on your PC or Laptop.

- Then expand the Service Tab among different tabs present at the top left side, and then click on the ‘For Employees’ option.

- Now, click on the ‘Member UAN/Online service (OCS/OTCP)’ that will appear under Service Head.

- Then the Employee Login Portal will appear in front of you.

- Click on the ‘Activate UAN’ option in the Important links column on the right side of the page.

- Then you will be redirected to the page where you have to enter your UAN in order to activate it.

- Enter your Name, Date of Birth, Mobile Number, and Email ID on that page.

- Enter the given Captcha as shown in the box.

- Now click on the ‘Get Authorization PIN’ link.

- An OTP will be sent to your registered mobile number that you will have to enter in the box.

- Click on the ‘I Agree’ Checkbox and enter the OTP you have received on your mobile phone.

- Finally, click on the Validate OTP and Activate UAN button and your UAN will be activated.

You will receive a confirmation message on the screen that says “Your UAN is activated. The Password is sent to your registered mobile number”. You can easily manage your EPFO account using the UAN and the password you have received on your mobile phone.

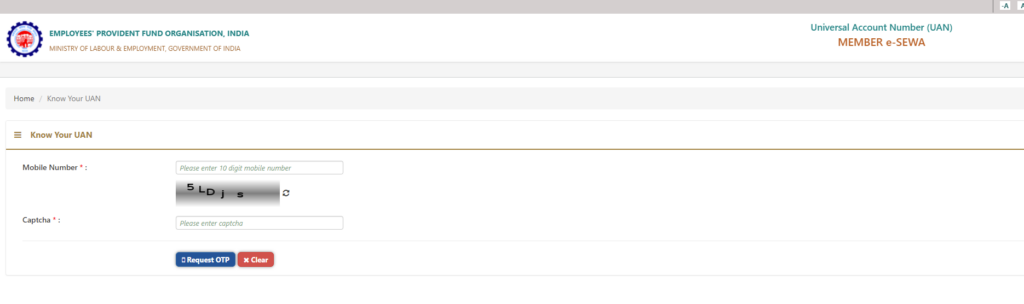

How to Know Your UAN?

If you don’t know your Universal Account Number then you can follow the steps given below to generate the number:-

- Open the EPFO Official website and expand the Services Tab.

- Then click on the For Employees option.

- A new page will open where you will have to click on the Member UAN/Online Service Link.

- Now you will reach the UAN Member Portal.

- On the button-right corner, click on the Know Your UAN in the Important Links head.

- Now enter your Member ID, Aadhar Number, PAN, Date of Birth, Mobile Number, and Captcha Code.

- Then click on the Get Authorization Pin link and enter the OTP that you will receive on your Mobile.

- Finally, click on the Validate OTP and get the UAN button and you will receive the UAN on your mobile phone.

Once you have the UAN, you can activate it by following the steps given above.

Documents Needed for UAN Activation

You will have to enter the details of the following documents at the time of registering and activating UAN.

- Aadhaar Card

- PAN Card

- Bank Account Details with IFSC

- Other Address or Identity Proofs if needed

Need for a UAN

Earlier, employees used to get only the PF account number and it became difficult for them to calculate the exact value of their funds. But after the introduction of Universal Account Number, all the PF accounts associated with multiple IDs of different corporate organizations were assembled in one place. Now, an employee can easily withdraw or transfer funds with the help of a Universal Account Number. Therefore it is necessary for every employee to activate the UAN in order to manage his EPFO account.

Advantages of Activating UAN for Employer and Employee

- The employee can view and download the passbook with the help of EPFO UAN.

- You will have to enter UAN and Password while making an Employee or Employer Login.

- Employers’ involvement has decreased after the introduction of a UAN.

- Employees can easily transfer their old PF to the new PF account with the help of a UAN and KYC.

- After registering at the UAN portal you can easily receive the contribution alerts on your mobile phones through an SMS.

- The UAN helps the EPFO to track the change in the job of the employee.

- Whenever you change your job, you will have to link a new PF account to the UAN and the EPFO will update the same in the records.

- EPFO UAN helps to withdraw and transfer funds online when you change your job.

- UAN also ensures the authenticity of the employees who are registered in EPFO.

Frequently Asked Questions

1. What is UAN?

UAN stands for Universal Account Number and it is a 12 digit number that is used to make an EPFO login. You will always need UAN to manage your EPF accounts.

2. How to Activate UAN through SMS?

There is no way to activate UAN offline through an SMS. You can either activate UAN through the Umang app or EPFO official website.

3. Can I activate UAN through Mobile?

Yes, you can activate UAN through a smartphone by downloading the Umang App. This app is available at the Play Store and App Store from where you can activate the UAN.

4. What are documents needed for UAN registration?

You will need an Aadhar Card Number, PAN Card Number, and Bank Account Details to make a UAN registration and activation.

5. Will I have to activate UAN again if I switch my job?

No, UAN is activated only once. You will not have to activate UAN again if you switch the job.

6. What is the UAN activation link?

The UAN Activation Link is “https://unifiedportal-mem.epfindia.gov.in/memberinterface/no-auth/uanActivation/activationForm?_HDIV_STATE_=19-10-C4A30F4E6D48A47751CE6F28FE10F61D” and you can copy it to any URL and start the process of EPFO UAN Activation.

7. Do I need an Aadhar to activate UAN?

Yes, it is mandatory to enter the Aadhar Number at the time of UAN registration. You cannot activate UAN without the UAN number and you cannot generate the UAN without Aadhar Number. Therefore, you will need an Aadhar to activate UAN.

Conclusion

Now you know the whole process of EPFO UAN activation. You have two options to activate UAN either through the Umang app or EPFO official website. If it is feasible for you to activate UAN through the Umang app then you can easily do the same if you have a smartphone. On the other hand, you can activate the EPFO UAN through the official website and manage your funds online.

Best Offers For You!

Personal Loan Rates by Top Banks

- HDFC Personal Loan Interest Rates

- ICICI Personal Loan Interest Rates

- Kotak Personal Loan Interest Rates

- IndusInd Bank Personal Loan Interest Rates

- RBL Bank Personal Loan Interest Rates

- YES BANK Personal Loan Interest Rates

- IDFC First Bank Personal Loan

- Tata Capital Personal Loan

- SMFG India Credit Personal Loan

- Standard Chartered Personal Loan Interest Rates

- SBFC Personal Loan Interest Rates

- SBI Personal Loan Interest Rates

- Axis Bank Personal Loan Interest Rates